Prepare a table based on the information available in the 2017 Qantas segment disclosure which presents total segment revenue and other income and underlying EBIT for each segment. For each segment, provide a calculation in that table of how those two line items have changed from the year ended 2016, to the year ended 2017.

Please refer to Qantas 2017 annual report for futher information required.

http://investor.qantas.com/FormBuilder/_Resource/_module/doLLG5ufYkCyEPjF1tpgyw/file/annual-reports/2017AnnualReport.pdf

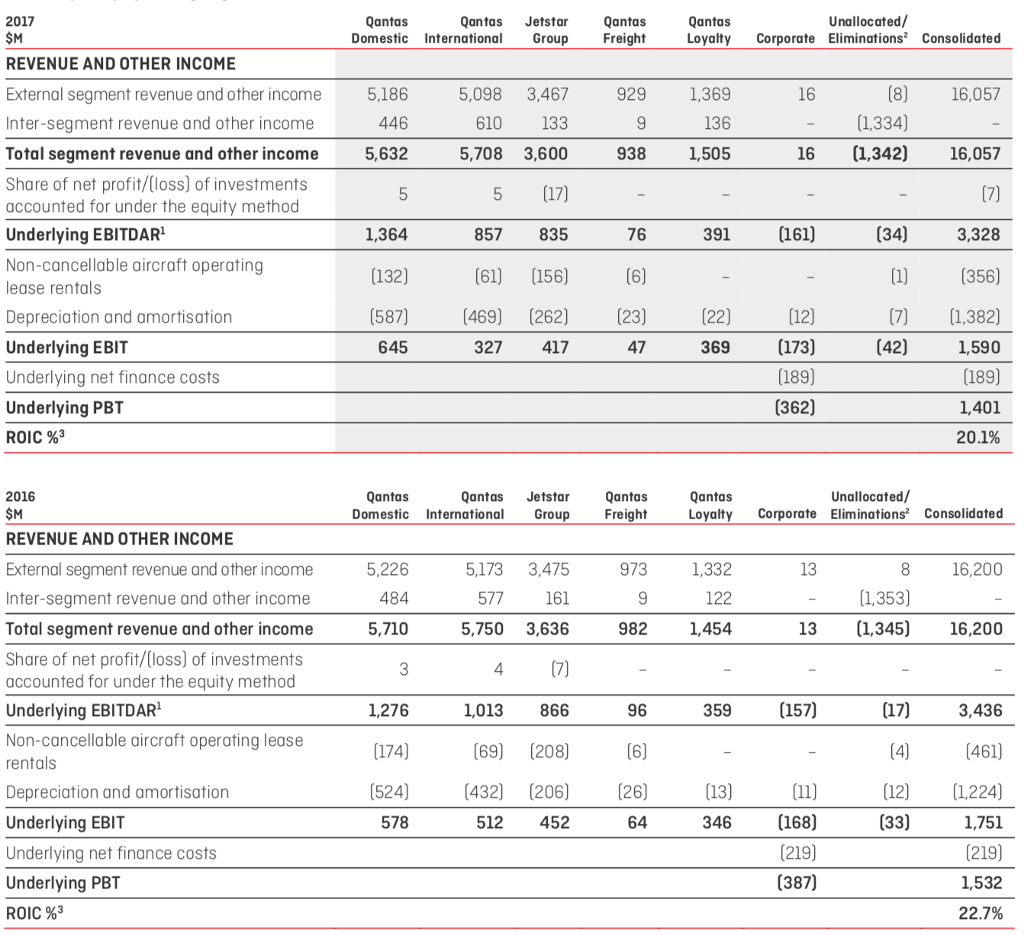

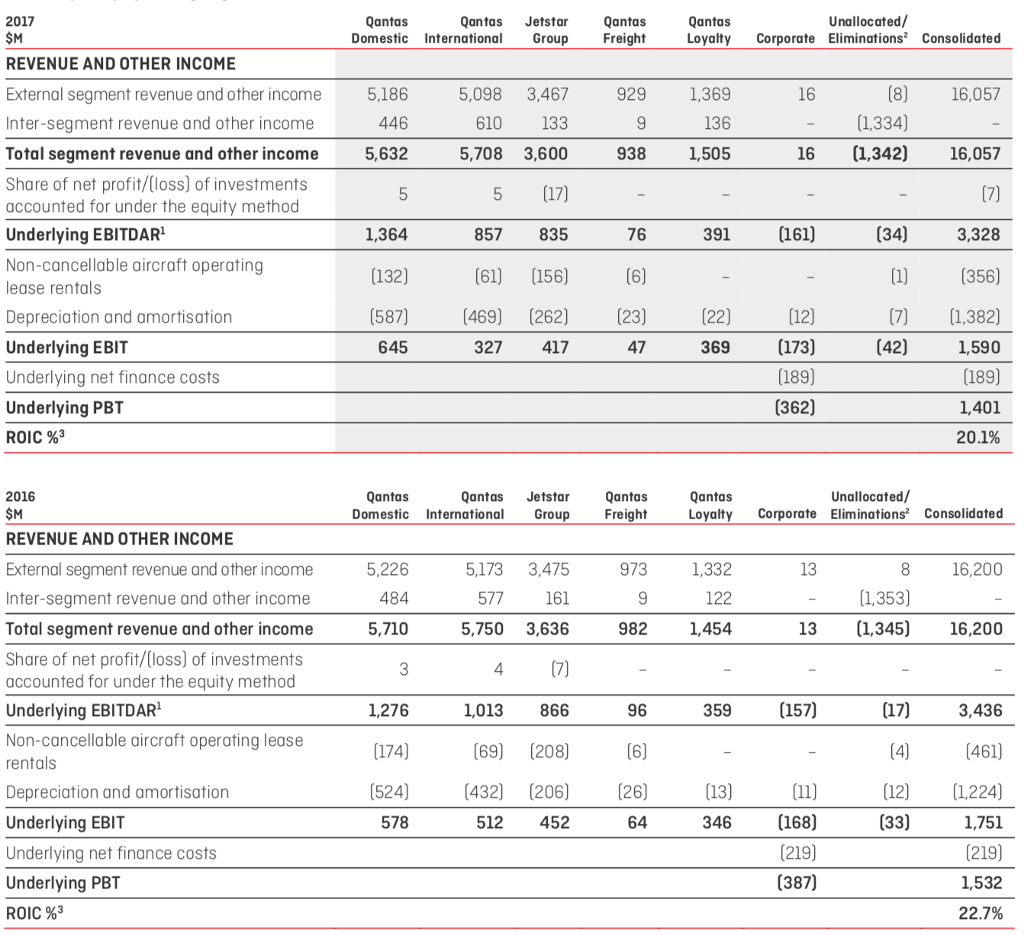

Unallocated/ Qantas Jetstar Qantas Freight Qantas Loyalty Corporate Eliminations2 Consolidated 2017 Qantas Domestic Internation Group REVENUE AND OTHER INCOME External segment revenue and other income Inter-segment revenue and other income Total segment revenue and other income Share of net profit/(loss) of investments accounted for under the equity method Underlying EBITDAR Non-cancellable aircraft operating lease rentals Depreciation and amortisation Underlying EBIT Underlying net finance costs Underlying PBT ROIC %3 (8) 16,057 5,186 446 5,632 1,369 5,098 3,467 610 133 5,708 3,600 929 16 1,334 938 1,505 16 (1,342) 16,057 1,364 857 835 391 161) (34) 3,328 (61) 156) 7) 1,382) (42) 1,590 587) (469) (262) (23) 645 327 417 369 (173) (362) 1,401 20.1% 2016 Qantas Unallocated Qantas Loyalty Corporate Eliminations Consolidated Qantas Qantas Jetstar Domestic InternationalGroup REVENUE AND OTHER INCOME External segment revenue and other income Inter-segment revenue and other income Total segment revenue and other income Share of net profit/(loss) of investments accounted for under the equity method Underlying EBITDAR Non-cancellable aircraft operating lease rentals Depreciation and amortisation Underlying EBIT Underlying net finance costs Underlying PBT ROIC %3 5,226 484 5,710 173 3,475 577 161 5,750 3,636 973 8 16,200 1,332 122 9821,454 13 1,353) 13 (1,345) 16,200 4 359(157) (17) 3,436 (4611 (12) 1.224) 1,751 219) 1,532 22.7% 1,276 1,013866 (69) (208) 432) (206) 26) 524) 578 512 452 346 (168) (33) (387) Unallocated/ Qantas Jetstar Qantas Freight Qantas Loyalty Corporate Eliminations2 Consolidated 2017 Qantas Domestic Internation Group REVENUE AND OTHER INCOME External segment revenue and other income Inter-segment revenue and other income Total segment revenue and other income Share of net profit/(loss) of investments accounted for under the equity method Underlying EBITDAR Non-cancellable aircraft operating lease rentals Depreciation and amortisation Underlying EBIT Underlying net finance costs Underlying PBT ROIC %3 (8) 16,057 5,186 446 5,632 1,369 5,098 3,467 610 133 5,708 3,600 929 16 1,334 938 1,505 16 (1,342) 16,057 1,364 857 835 391 161) (34) 3,328 (61) 156) 7) 1,382) (42) 1,590 587) (469) (262) (23) 645 327 417 369 (173) (362) 1,401 20.1% 2016 Qantas Unallocated Qantas Loyalty Corporate Eliminations Consolidated Qantas Qantas Jetstar Domestic InternationalGroup REVENUE AND OTHER INCOME External segment revenue and other income Inter-segment revenue and other income Total segment revenue and other income Share of net profit/(loss) of investments accounted for under the equity method Underlying EBITDAR Non-cancellable aircraft operating lease rentals Depreciation and amortisation Underlying EBIT Underlying net finance costs Underlying PBT ROIC %3 5,226 484 5,710 173 3,475 577 161 5,750 3,636 973 8 16,200 1,332 122 9821,454 13 1,353) 13 (1,345) 16,200 4 359(157) (17) 3,436 (4611 (12) 1.224) 1,751 219) 1,532 22.7% 1,276 1,013866 (69) (208) 432) (206) 26) 524) 578 512 452 346 (168) (33) (387)