Answered step by step

Verified Expert Solution

Question

1 Approved Answer

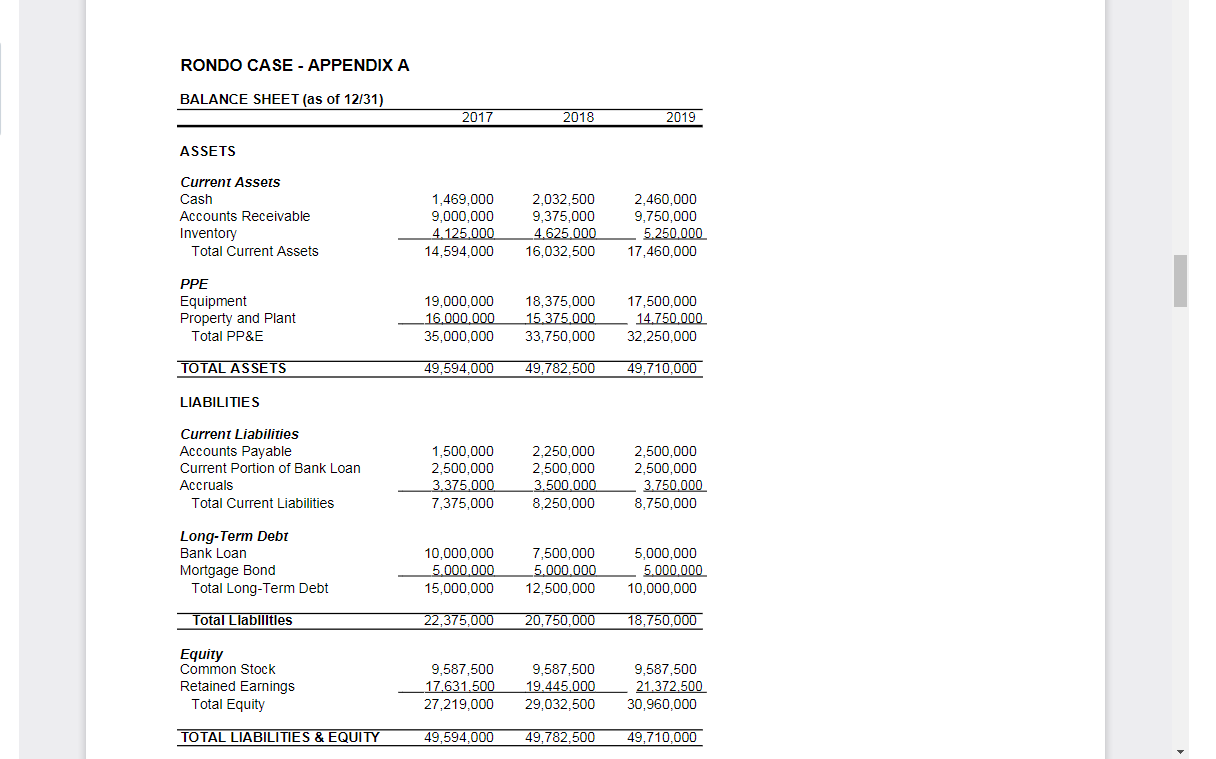

Prepare a three-year financial analysis of the Rondo Company based on the three years of Income Statement and Balance Sheet information provided in the case.

Prepare a three-year financial analysis of the Rondo Company based on the

three years of Income Statement and Balance Sheet information provided in the

case. Include (i) common size financial statements, (ii) key ratio analysis, (iii) trend analysis, and (iv) benchmarking analysis (identify a comparable industry to Rondo and compare Rondo's key ratios to the industry ratios). Summarize your analysis in an Executive Summary

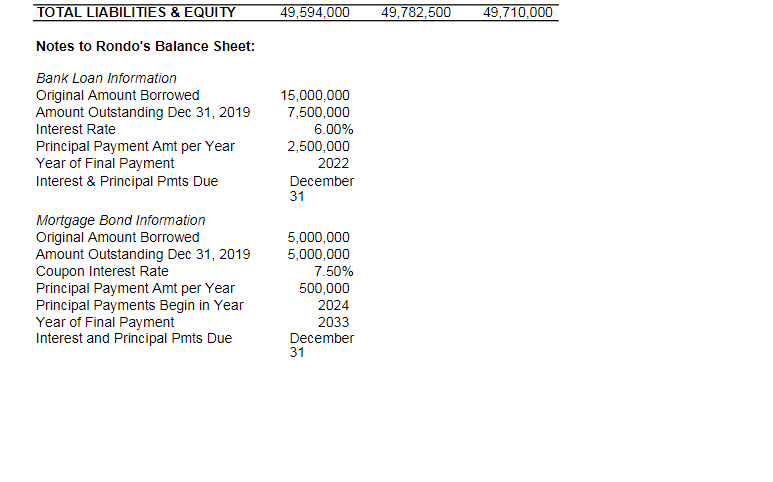

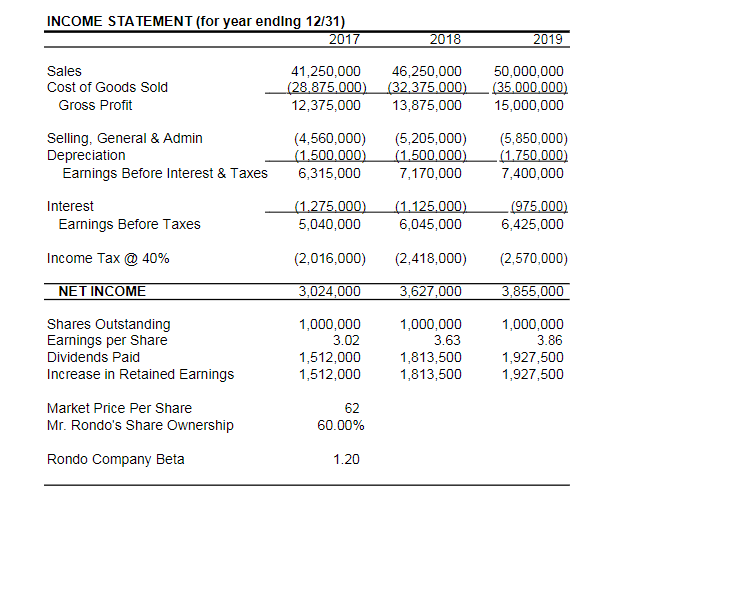

below are the income statement and balance sheet

RONDO CASE - APPENDIX A BALANCE SHEET (as of 12/31) LIABILITIES Current Liabilities \begin{tabular}{lrrr} Accounts Payable & 1,500,000 & 2,250,000 & 2,500,000 \\ Current Portion of Bank Loan & 2,500,000 & 2,500,000 & 2,500,000 \\ Accruals & 3,375,000 & 3,500,000 & 3,750,000 \\ \cline { 2 - 4 } Total Current Liabilities & 7,375,000 & 8,250,000 & 8,750,000 \end{tabular} \begin{tabular}{lrrc} Long-Term Debt & & & \\ Bank Loan & 10,000,000 & 7,500,000 & 5,000,000 \\ Mortgage Bond & 5,000,000 & 5,000,000 & 5 \\ \cline { 2 - 4 } Total Long-Term Debt & 15,000,000 & 12,500,000 & 10,000,000 \\ \hline & 22,375,000 & 20,750,000 & 18,750,000 \\ \hline Total Llabllltles & & \end{tabular} \begin{tabular}{lrrr} \hline Total Llabilltles & 22,375,000 & 20,750,000 & 18,750,000 \\ \hline & & & \\ Equity & 9,587,500 & 9,587,500 & 9,587,500 \\ Common Stock & 17,631,500 & 19,445,000 & 21,372,500 \\ \cline { 2 - 3 } Retained Earnings Total Equity & 27,219,000 & 29,032,500 & 30,960,000 \\ \hline & & & \\ \hline TOTAL LIABILITIES \& EQUITY & 49,594,000 & 49,782,500 & 49,710,000 \\ \hline \end{tabular} Notes to Rondo's Balance Sheet: INCOME STATEMENT (for year endlng 12/31) RONDO CASE - APPENDIX A BALANCE SHEET (as of 12/31) LIABILITIES Current Liabilities \begin{tabular}{lrrr} Accounts Payable & 1,500,000 & 2,250,000 & 2,500,000 \\ Current Portion of Bank Loan & 2,500,000 & 2,500,000 & 2,500,000 \\ Accruals & 3,375,000 & 3,500,000 & 3,750,000 \\ \cline { 2 - 4 } Total Current Liabilities & 7,375,000 & 8,250,000 & 8,750,000 \end{tabular} \begin{tabular}{lrrc} Long-Term Debt & & & \\ Bank Loan & 10,000,000 & 7,500,000 & 5,000,000 \\ Mortgage Bond & 5,000,000 & 5,000,000 & 5 \\ \cline { 2 - 4 } Total Long-Term Debt & 15,000,000 & 12,500,000 & 10,000,000 \\ \hline & 22,375,000 & 20,750,000 & 18,750,000 \\ \hline Total Llabllltles & & \end{tabular} \begin{tabular}{lrrr} \hline Total Llabilltles & 22,375,000 & 20,750,000 & 18,750,000 \\ \hline & & & \\ Equity & 9,587,500 & 9,587,500 & 9,587,500 \\ Common Stock & 17,631,500 & 19,445,000 & 21,372,500 \\ \cline { 2 - 3 } Retained Earnings Total Equity & 27,219,000 & 29,032,500 & 30,960,000 \\ \hline & & & \\ \hline TOTAL LIABILITIES \& EQUITY & 49,594,000 & 49,782,500 & 49,710,000 \\ \hline \end{tabular} Notes to Rondo's Balance Sheet: INCOME STATEMENT (for year endlng 12/31)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started