Prepare a vertical analysis of the income statement through net income for the four most recent years using Sales as the base amount.

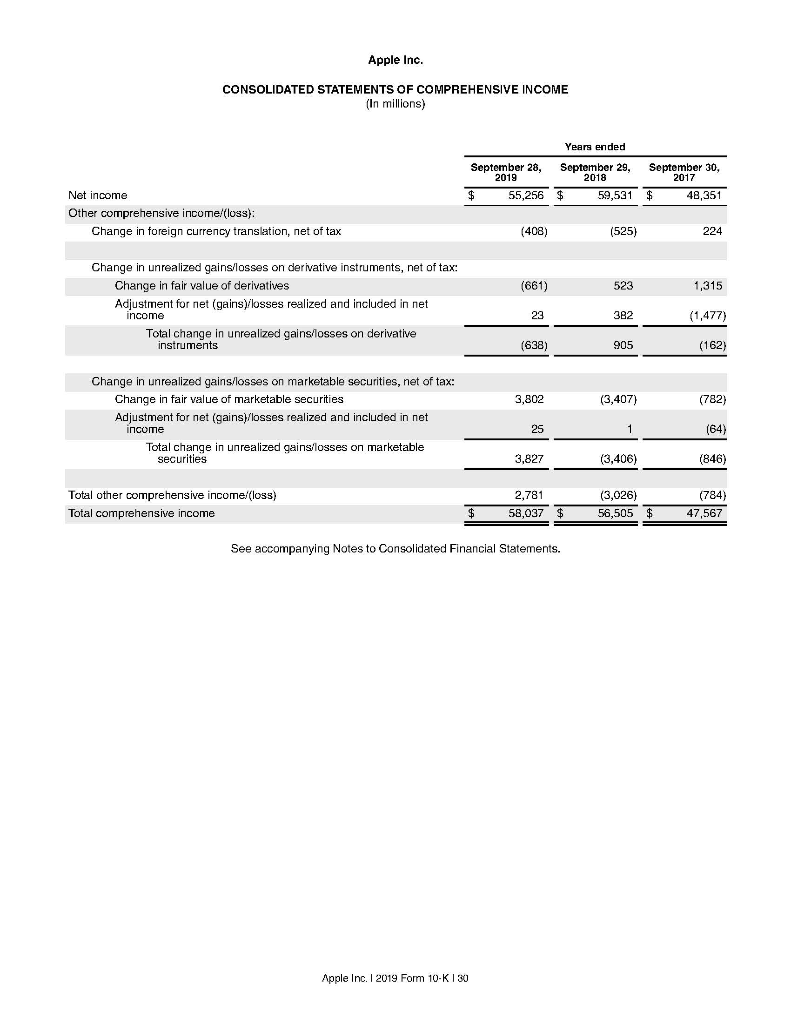

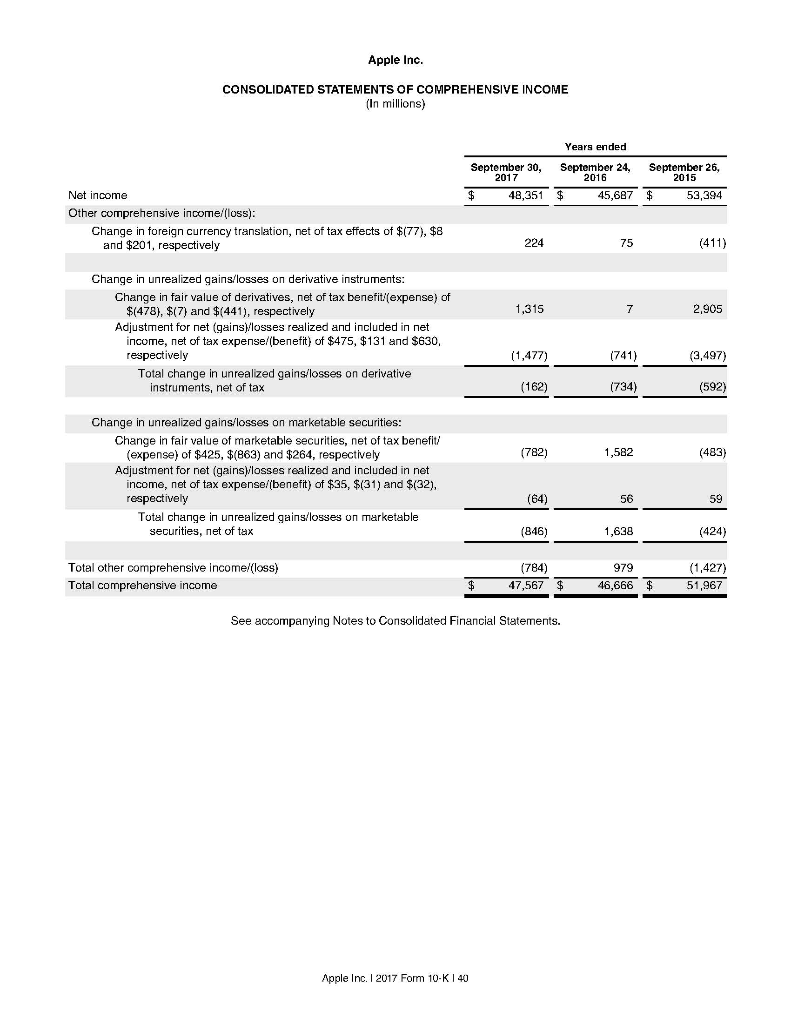

Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 28, September 29. September 30, 2019 2018 2017 $ 55,256 $ 59,531 $ 48,351 Net income Other comprehensive income/(loss): Change in foreign currency translation, net of tax (408) (525) 224 (661) 523 1,315 Change in unrealized gainslosses on derivative instruments, net of tax: Change in fair value of derivatives Adjustment for net (gainsy/losses realized and included in net income Total change in unrealized gains/losses on derivative instruments 23 3B2 (1,477) (638) 905 (162) 3,802 (3,407) (782) Change in unrealized gains/losses on marketable securities, net of tax: Change in fair value of marketable securities Adjustment for net (gainsy/losses realized and included in net income Total change in unrealized gains losses on marketable securities 25 1 (64) 3,827 (3,406) (846) Total other comprehensive income (loss) Total comprehensive income 2,781 58,037 $ (3,026) 56,505 $ (784) 47,567 $ See accompanying Notes to Consolidated Financial Statements. Apple Inc. I 2019 Form 10-K 130 Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 30, September 24, September 26, 2017 2016 2015 $ 48,351 $ 45,687 $ 53,394 Net income Other comprehensive income/(loss): Change in foreign currency translation, net of tax effects of $(77), $8 and $201, respectively 224 75 (411) 1,315 7 2,905 Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit:(expense) of $(478), $(7) and $(441), respectively Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $475, $131 and $630, respectively Total change in unrealized gains/losses on derivative instruments, net of tax (1,477) (741) (3,497) (162) (734) (592) (782) 1,582 (483) Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/ (expense) of $425, $(863) and $264, respectively Adjustment for net (gainsw'losses realized and included in net income, net of tax expense/(benefit) of $35, $(31) and $(32), respectively Total change in unrealized gains/losses on marketable securities, net of tax (64) 56 59 (846) 1,638 (424) Total other comprehensive income/(loss) Total comprehensive income (784) 47,567 $ 979 46,666 $ (1,427) 51,967 $ See accompanying Notes to Consolidated Financial Statements. Apple Inc. I 2017 Form 10-K 140