Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a worksheet to consolidate the financial information for these two companies. Compute the following amounts that would appear on Pinnacles 2021 separate (nonconsolidated) financial

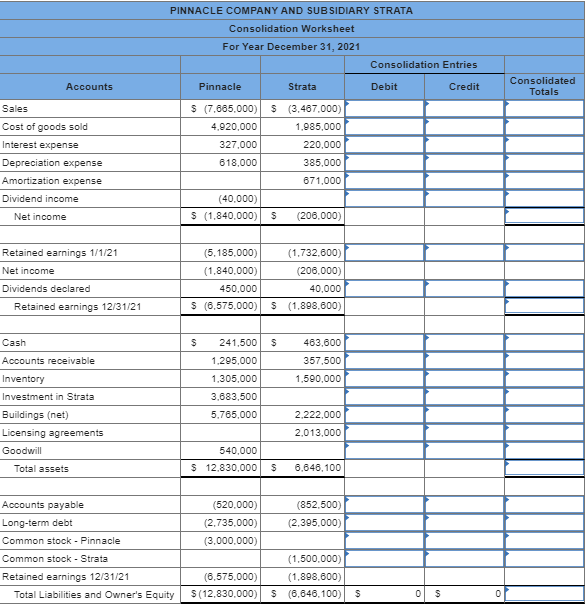

- Prepare a worksheet to consolidate the financial information for these two companies.

- Compute the following amounts that would appear on Pinnacles 2021 separate (nonconsolidated) financial records if Pinnacles investment accounting was based on the equity method.

- Subsidiary income.

- Retained earnings, 1/1/21.

- Investment in Strata.

- What effect does the parents internal investment accounting method have on its consolidated financial statements?

Please !!:

1. Highlight the answers

2. Upload if you're 100% positive! I only get 1 chance :(

3. Answer ALL questions!

Thank you.

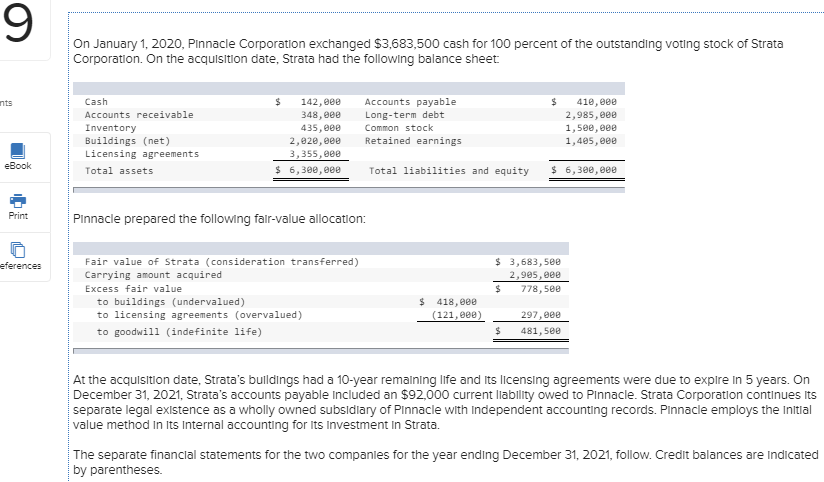

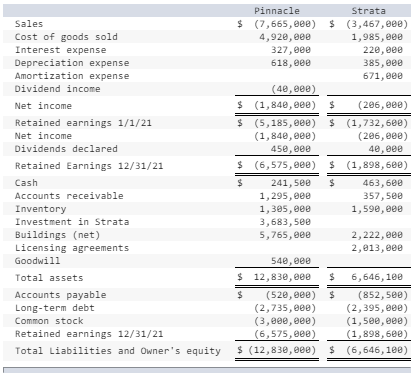

9 On January 1, 2020, Pinnacle Corporation exchanged $3,683,500 cash for 100 percent of the outstanding voting stock of Strata Corporation. On the acquisition date, Strata had the following balance sheet: nts $ Cash Accounts receivable Inventory Buildings (net) Licensing agreements Total assets $ 142, eee 348,00 435,000 2,920, eee 3,355, eee $ 6,300,000 Accounts payable Long-term debt Common stock Retained earnings 410, eee 2,985, eee 1,500,eee 1,485, eee eBook Total liabilities and equity $ 6,300,000 Print Pinnacle prepared the following falr-value allocation: eferences $ 3,683,500 2,905,000 $ 778,500 Fair value of Strata (consideration transferred) Carrying amount acquired Excess fair value to buildings (undervalued) to licensing agreements (overvalued) to goodwill (indefinite life) $ 418, eee (121,000) 297,000 481,500 $ At the acquisition date, Strata's buildings had a 10-year remaining life and its licensing agreements were due to expire in 5 years. On December 31, 2021, Strata's accounts payable Included an $92,000 current liability owed to Pinnacle. Strata Corporation continues its separate legal existence as a wholly owned subsidiary of Pinnacle with Independent accounting records. Pinnacle employs the initial value method in its Internal accounting for its Investment in Strata. The separate financial statements for the two companies for the year ending December 31, 2021, follow. Credit balances are indicated by parentheses Sales Cost of goods sold Interest expense Depreciation expense Amortization expense Dividend income Net income Retained earnings 1/1/21 Net income Dividends declared Retained Earnings 12/31/21 Cash Accounts receivable Inventory Investment in Strata Buildings (net) Licensing agreements Goodwill Total assets Accounts payable Long-term debt Common stock Retained earnings 12/31/21 Total Liabilities and Owner's equity Pinnacle Strata $ (7,665,000) $ (3,467, eee) 4,920, eee 1,985, cee 327,00 220, eee 618, eee 385, eee 671,080 (40,000) $ (1,840,000) $ (206,000) $ (5,185, eee) $ (1,732,600) (1,840,000) (206, eee) 450,000 40,00 $ (6,575,000) $ (1,898,620) $ 241, 500 $ 463,600 1,295,000 357,500 1,305,000 1,590, eee 3,683,500 5,765, eee 2,222, eee 2,013, eee 540,000 $ 12,830,000 6,646,1ee $ (520,000) $ (852,500) (2,735,000) (2,395, eee) (3,800,000) (1,500,000) (6,575, eee) (1,898, 680) $ (12,830,eee) $ (6,646,100) $ PINNACLE COMPANY AND SUBSIDIARY STRATA Consolidation Worksheet For Year December 31, 2021 Consolidation Entries Accounts Pinnacle Strata Debit Credit Consolidated Totals Sales Cost of goods sold Interest expense Depreciation expense Amortization expense Dividend income Net income $ (7.665.000) 4.920,000 327,000 618.000 $ (3,467.000) 1.985,000 220,000 385,000 671.000 (40.000) S (1.840,000) (206,000) Retained earnings 1/1/21 Net income Dividends declared Retained earnings 12/31/21 (5.185.000) (1.840,000) 450.000 $ (6,575,000) (1.732,600) (206,000) 40.000 $ (1,898,800) Cash $ $ Accounts receivable 241.500 1.295.000 1.305,000 3.683,500 483.600 357.500 1.590.000 Inventory Investment in Strata Buildings (net) Licensing agreements Goodwill 5.765,000 2.222.000 2.013,000 540.000 $ 12.830,000 Total assets 6,646,100 (520,000) (2.735.000) (3.000.000) (852.500) (2.395,000) Accounts payable Long-term debt Common stock - Pinnacle Common stock - Strata Retained earnings 12/31/21 Total Liabilities and Owner's Equity (6,575.000) $(12.830.000) (1.500.000) (1.898.600) (6,646,100) S $ 0 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started