Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare adjusting entries for the following transactions (use the worksheet on next page), assuming all normal journal entries during the year has already been

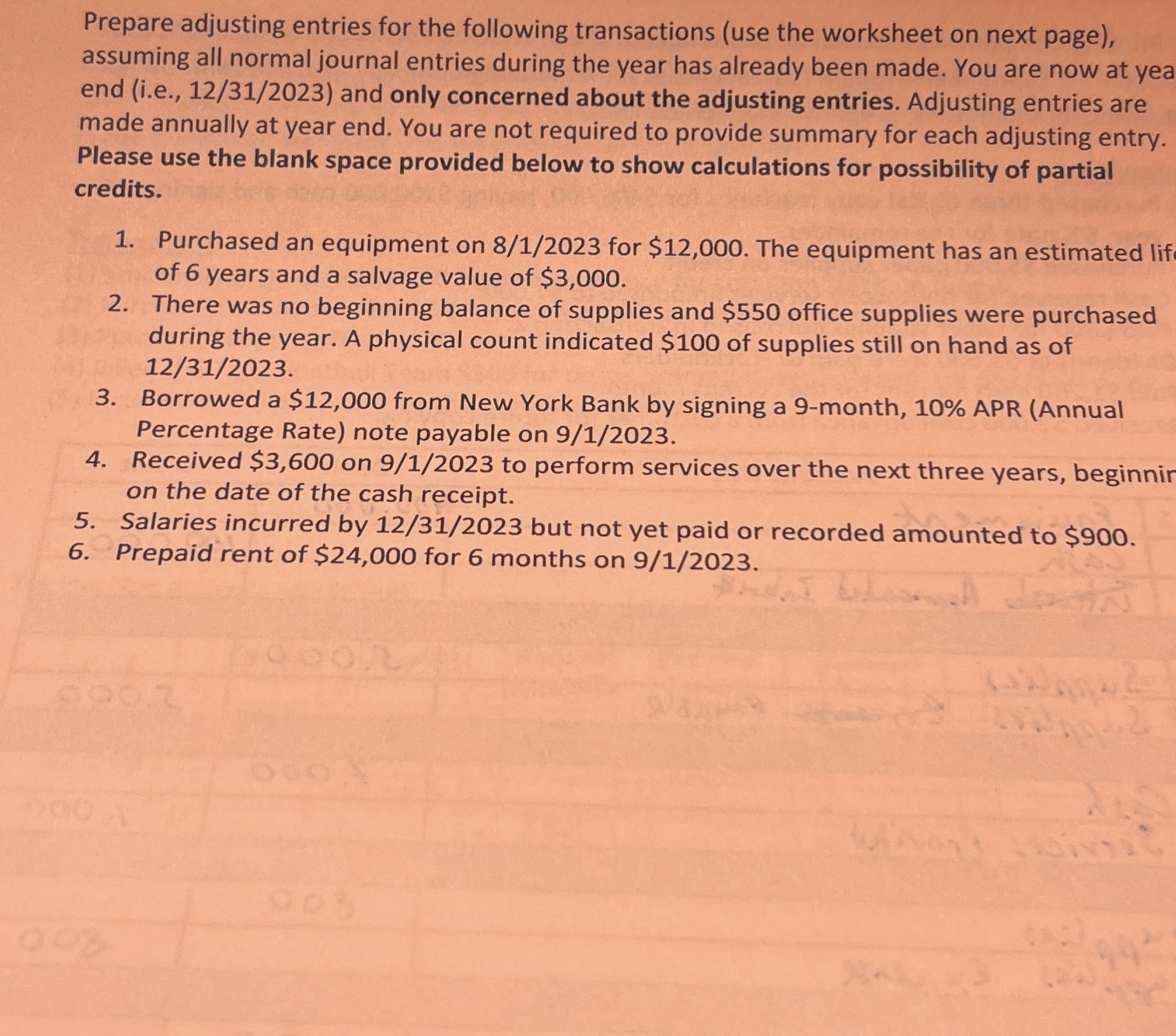

Prepare adjusting entries for the following transactions (use the worksheet on next page), assuming all normal journal entries during the year has already been made. You are now at yea end (i.e., 12/31/2023) and only concerned about the adjusting entries. Adjusting entries are made annually at year end. You are not required to provide summary for each adjusting entry. Please use the blank space provided below to show calculations for possibility of partial credits. 1. Purchased an equipment on 8/1/2023 for $12,000. The equipment has an estimated lif of 6 years and a salvage value of $3,000. 2. There was no beginning balance of supplies and $550 office supplies were purchased during the year. A physical count indicated $100 of supplies still on hand as of 12/31/2023. 3. Borrowed a $12,000 from New York Bank by signing a 9-month, 10% APR (Annual Percentage Rate) note payable on 9/1/2023. 4. Received $3,600 on 9/1/2023 to perform services over the next three years, beginnin on the date of the cash receipt. 5. Salaries incurred by 12/31/2023 but not yet paid or recorded amounted to $900. 6. Prepaid rent of $24,000 for 6 months on 9/1/2023. 500 005

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you with preparing the adjusting entries for the transactions listed in the image Transaction 1 Depreciation of Equipment This transaction adjusts the equipment account and accumulated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started