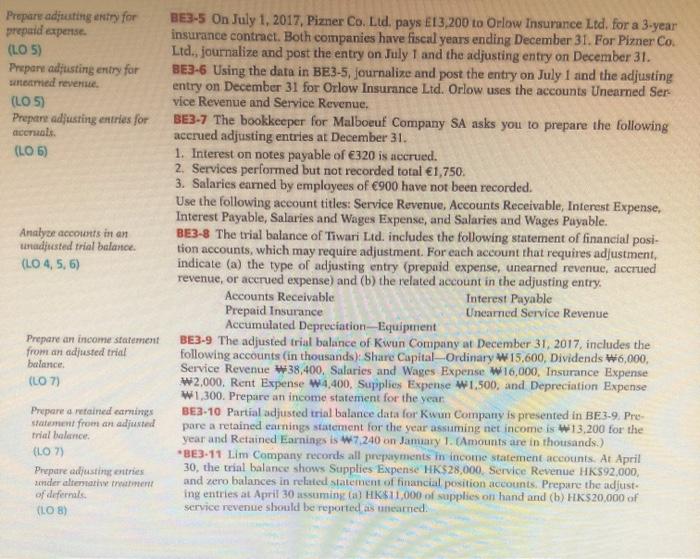

Prepare adjusting entry for prepaid expense. (LO 5) Prepare adjusting entry for med revenue (LO 5) Prepare adjusting entries for accruals, (LO 6) Analye accounts in an uradjusted trial balance (LO 4,5,6) BE3-5 On July 1, 2017, Pizner Co. Ltd, pays E13,200 to Orlow Insurance Ltd. for a 3-year insurance contract. Both companies have fiscal years ending December 31. For Pimer Co. Ltd., journalize and post the entry on July 1 and the adjusting entry on December 31. BE3-6 Using the data in BE3-5, journalize and post the entry on July 1 and the adjusting entry on December 31 for Orlow Insurance Ltd. Orlow uses the accounts Unearned Ser- vice Revenue and Service Revenue. BE3-7 The bookkeeper for Malboeuf Company SA asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of 320 is accrued. 2. Services performed but not recorded total 1,750. 3. Salaries earned by employees of 900 have not been recorded. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and Wages Puyable. BE3-8 The trial balance of Tiwari Ltd. includes the following statement of financial posi- tion accounts, which may require adjustment. For each account that requires adjustment, indicate (a) the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or accrued expense) and (b) the related account in the adjusting entry, Accounts Receivable Interest Payable Prepaid Insurance Uncated Service Revenue Accumulated Depreciation Equipment BE3-9 The adjusted trial balance of Kwun Company at December 31, 2017, includes the following accounts (in thousands): Share Capital-Ordinary W15,600, Dividends 6,000, Service Revenue W38,400, Salaries and Wages Expense W16,000, Insurance Expense W2,000, Rent Expense w4,400, Supplies Expense W1.500, and Depreciation Expense W1,300. Prepare an income statement for the year. BE2-10 Partial adjusted trial balance data for Kwun Company is presented in BE3-9. Pre- pare a retained earnings statement for the year assuming net income is W13,200 for the year and Retained Earnings is W7,240 on Jamuary 1. Amounts are in thousands) *BE3-11 Lim Company records all prepayments in income statement accounts. At April 30, the trial balance shows Supplies Expense HK$28,000, Service Revenue HK$92.000, and zero balances in related statement of financial position accounts. Prepare the adjust ing entries at April 30 assuming HK$11,000 of supplies on hand and (b) HK$20,000 of service revenue should be reported as unearted. Prepare an income statement from an adjusted trial balance (107) Prepare a retained earnings statement from an adjusted trial balance (107) Prepare adjusting entries ander alternative of defernale (L08)