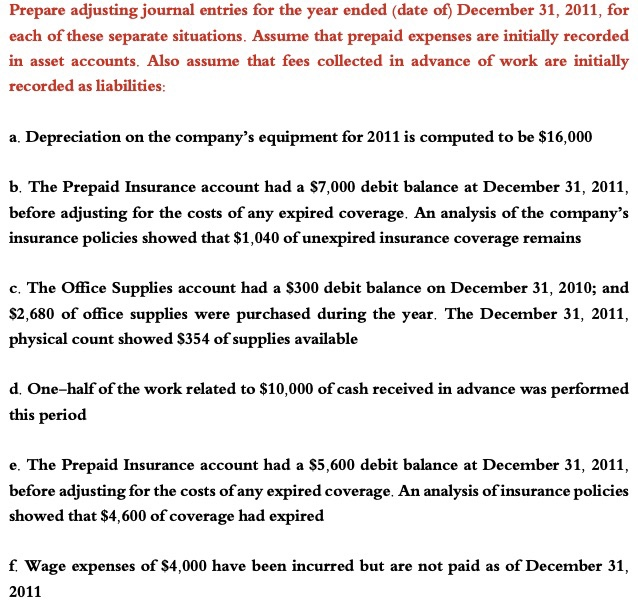

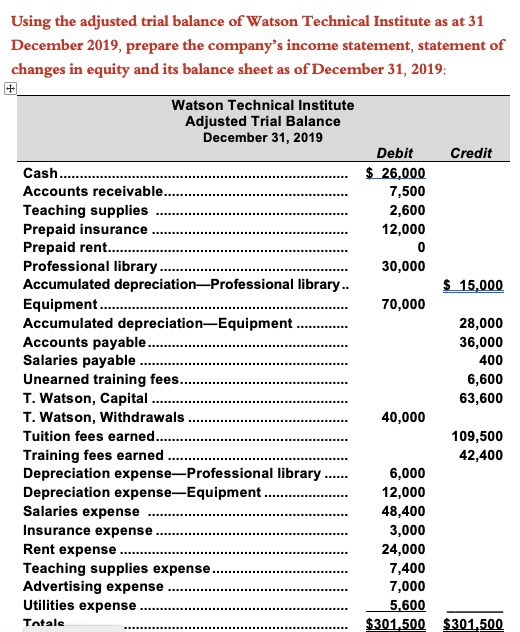

Prepare adjusting journal entries for the year ended (date of) December 31, 2011, for each of these separate situations. Assume that prepaid expenses are initially recorded in asset accounts. Also assume that fees collected in advance of work are initially recorded as liabilities: a. Depreciation on the company's equipment for 2011 is computed to be $16,000 b. The Prepaid Insurance account had a $7,000 debit balance at December 31, 2011, before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $1,040 of unexpired insurance coverage remains c. The Office Supplies account had a $300 debit balance on December 31, 2010; and $2,680 of office supplies were purchased during the year. The December 31, 2011, physical count showed $354 of supplies available d. One-half of the work related to $10,000 of cash received in advance was performed this period e. The Prepaid Insurance account had a $5,600 debit balance at December 31, 2011, before adjusting for the costs of any expired coverage. An analysis of insurance policies showed that $4,600 of coverage had expired f. Wage expenses of $4,000 have been incurred but are not paid as of December 31, 2011 Using the adjusted trial balance of Watson Technical Institute as at 31 December 2019, prepare the company's income statement, statement of changes in equity and its balance sheet as of December 31, 2019: Watson Technical Institute Adjusted Trial Balance December 31, 2019 Cash......... Accounts receivable. Teaching supplies Prepaid insurance Prepaid rent........... Professional library. Accumulated depreciation Professional library.. Equipment.... Accumulated depreciation Equipment Accounts payable. Salaries payable Unearned training fees.. T. Watson, Capital T. Watson, Withdrawals Tuition fees earned... Training fees earned Depreciation expenseProfessional library ...... Depreciation expense-Equipment. Salaries expense Insurance expense Rent expense Teaching supplies expense. Advertising expense Utilities expense Debit Credit $ 26,000 7,500 2,600 12,000 0 30,000 $ 15,000 70,000 28,000 36,000 400 6,600 63,600 40,000 109,500 42,400 6,000 12,000 48,400 3,000 24,000 7,400 7,000 5,600 $301,500 $301.500 Totale