Prepare all Adjusting Journal Entries Needed

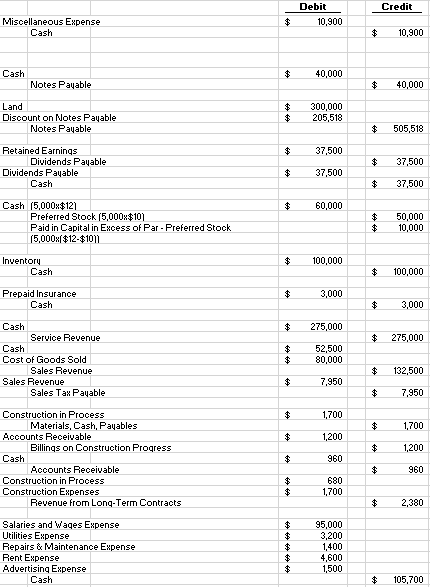

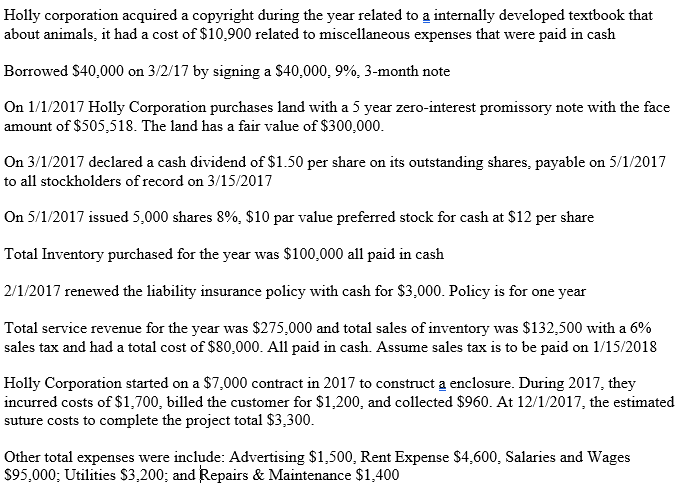

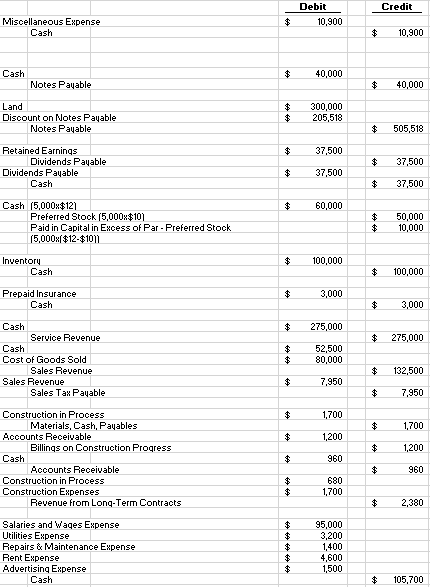

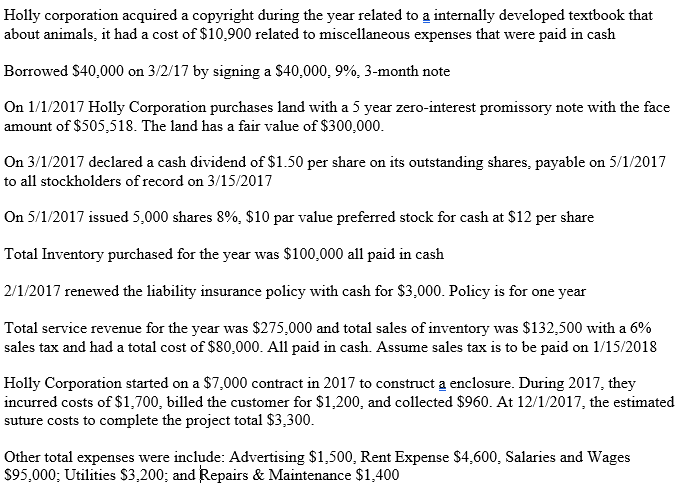

Credit Debit 10,900 $ Miscellaneous Expense Cash $ 10,900 Cash Notes Payable 40,000 $ 40,000 Land Discount on Notes Payable Notes Payable 300,000 205,518 $ 505,518 37,500 $ 37,500 Retained Earnings Dividends Payable Dividends Payable Cash 37,500 $ 37,500 $ 60,000 Cash (5,000x$12) Preferred Stock (5,000x$10) Paid in Capital in Excess of Par - Preferred Stock 15,000x($12-$100 $ $ 50,000 10,000 $ 100,000 Inventory Cash $ 100,000 $ 3,000 Prepaid Insurance Cash $ 3,000 $ 275,000 $ 275,000 Cash Service Revenue Cash Cost of Goods Sold Sales Revenue Sales Revenue Sales Tax Payable 52,500 80,000 $ 132,500 7,950 $ 7,950 1,700 1,200 Construction in Process Materials, Cash, Payables Accounts Receivable Billings on Construction Progress Cash Accounts Receivable Construction in Process Construction Expenses Revenue from Long-Term Contracts 1,700 1200 960 960 680 1,700 2,380 Salaries and Vages Expense Utilities Expense Repairs & Maintenance Expense Rent Expense Advertising Expense Cash 95,000 3,200 1400 4.600 1,500 $ 105,700 Holly corporation acquired a copyright during the year related to a internally developed textbook that about animals, it had a cost of $10.900 related to miscellaneous expenses that were paid in cash Borrowed $40,000 on 3/2/17 by signing a $40,000, 9%, 3-month note On 1/1/2017 Holly Corporation purchases land with a 5 year zero-interest promissory note with the face amount of $505,518. The land has a fair value of $300,000. On 3/1/2017 declared a cash dividend of $1.50 per share on its outstanding shares, payable on 5/1/2017 to all stockholders of record on 3/15/2017 On 5/1/2017 issued 5,000 shares 8%, $10 par value preferred stock for cash at $12 per share Total Inventory purchased for the year was $100.000 all paid in cash 2/1/2017 renewed the liability insurance policy with cash for $3,000. Policy is for one year Total service revenue for the year was $275,000 and total sales of inventory was $132,500 with a 6% sales tax and had a total cost of $80,000. All paid in cash. Assume sales tax is to be paid on 1/15/2018 Holly Corporation started on a $7,000 contract in 2017 to construct a enclosure. During 2017, they incurred costs of $1,700, billed the customer for $1,200, and collected $960. At 12/1/2017, the estimated suture costs to complete the project total $3,300. Other total expenses were include: Advertising $1,500, Rent Expense $4.600, Salaries and Wages $95,000; Utilities $3,200; and Repairs & Maintenance $1,400 Credit Debit 10,900 $ Miscellaneous Expense Cash $ 10,900 Cash Notes Payable 40,000 $ 40,000 Land Discount on Notes Payable Notes Payable 300,000 205,518 $ 505,518 37,500 $ 37,500 Retained Earnings Dividends Payable Dividends Payable Cash 37,500 $ 37,500 $ 60,000 Cash (5,000x$12) Preferred Stock (5,000x$10) Paid in Capital in Excess of Par - Preferred Stock 15,000x($12-$100 $ $ 50,000 10,000 $ 100,000 Inventory Cash $ 100,000 $ 3,000 Prepaid Insurance Cash $ 3,000 $ 275,000 $ 275,000 Cash Service Revenue Cash Cost of Goods Sold Sales Revenue Sales Revenue Sales Tax Payable 52,500 80,000 $ 132,500 7,950 $ 7,950 1,700 1,200 Construction in Process Materials, Cash, Payables Accounts Receivable Billings on Construction Progress Cash Accounts Receivable Construction in Process Construction Expenses Revenue from Long-Term Contracts 1,700 1200 960 960 680 1,700 2,380 Salaries and Vages Expense Utilities Expense Repairs & Maintenance Expense Rent Expense Advertising Expense Cash 95,000 3,200 1400 4.600 1,500 $ 105,700 Holly corporation acquired a copyright during the year related to a internally developed textbook that about animals, it had a cost of $10.900 related to miscellaneous expenses that were paid in cash Borrowed $40,000 on 3/2/17 by signing a $40,000, 9%, 3-month note On 1/1/2017 Holly Corporation purchases land with a 5 year zero-interest promissory note with the face amount of $505,518. The land has a fair value of $300,000. On 3/1/2017 declared a cash dividend of $1.50 per share on its outstanding shares, payable on 5/1/2017 to all stockholders of record on 3/15/2017 On 5/1/2017 issued 5,000 shares 8%, $10 par value preferred stock for cash at $12 per share Total Inventory purchased for the year was $100.000 all paid in cash 2/1/2017 renewed the liability insurance policy with cash for $3,000. Policy is for one year Total service revenue for the year was $275,000 and total sales of inventory was $132,500 with a 6% sales tax and had a total cost of $80,000. All paid in cash. Assume sales tax is to be paid on 1/15/2018 Holly Corporation started on a $7,000 contract in 2017 to construct a enclosure. During 2017, they incurred costs of $1,700, billed the customer for $1,200, and collected $960. At 12/1/2017, the estimated suture costs to complete the project total $3,300. Other total expenses were include: Advertising $1,500, Rent Expense $4.600, Salaries and Wages $95,000; Utilities $3,200; and Repairs & Maintenance $1,400