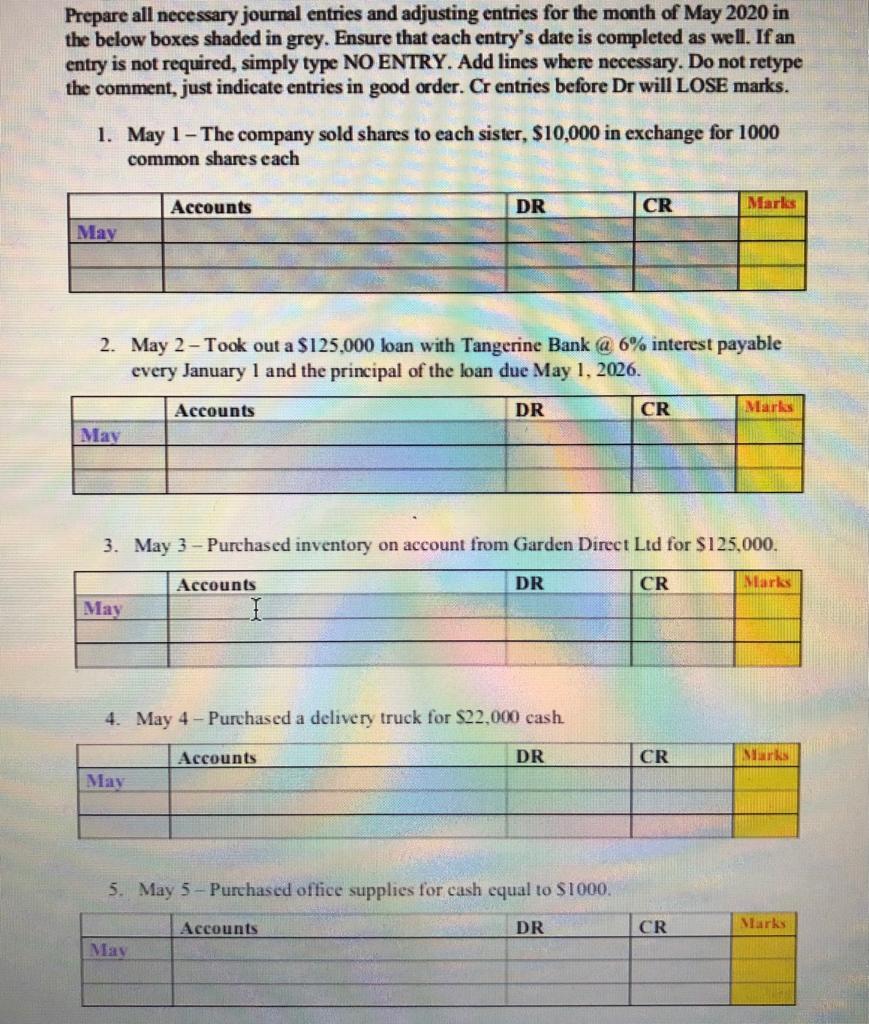

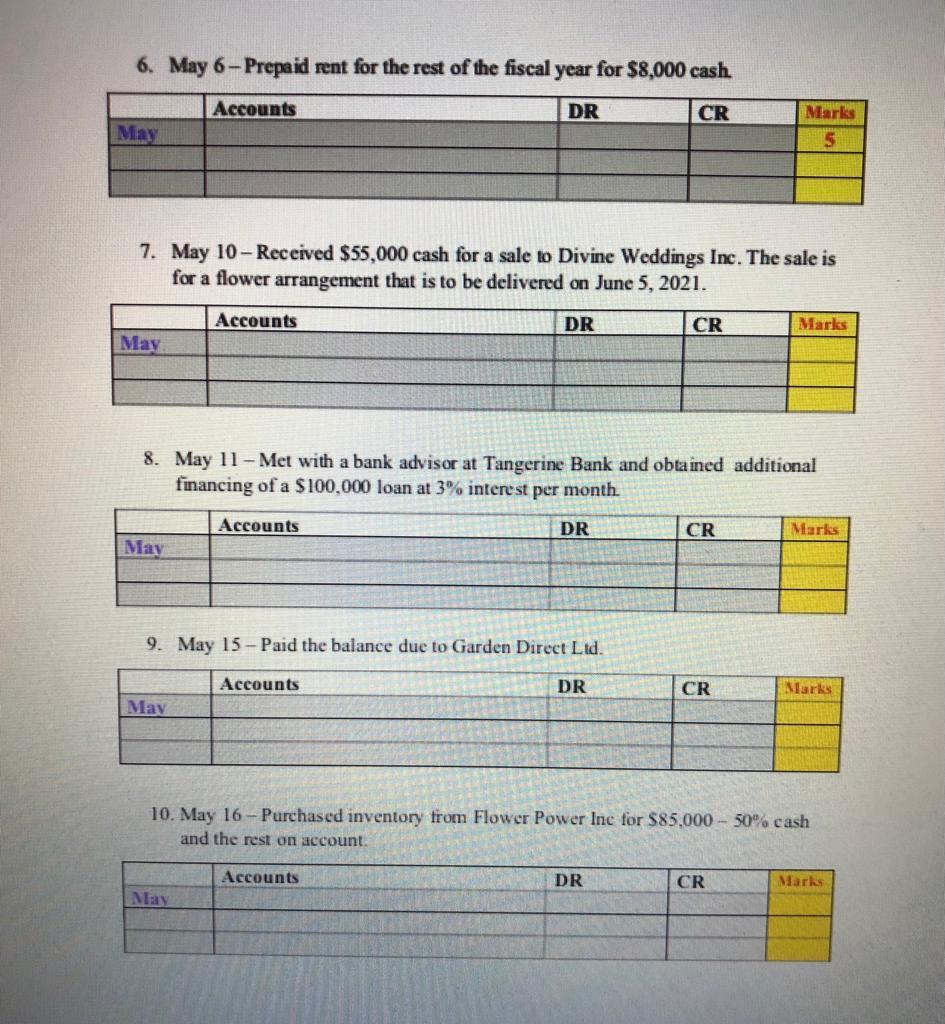

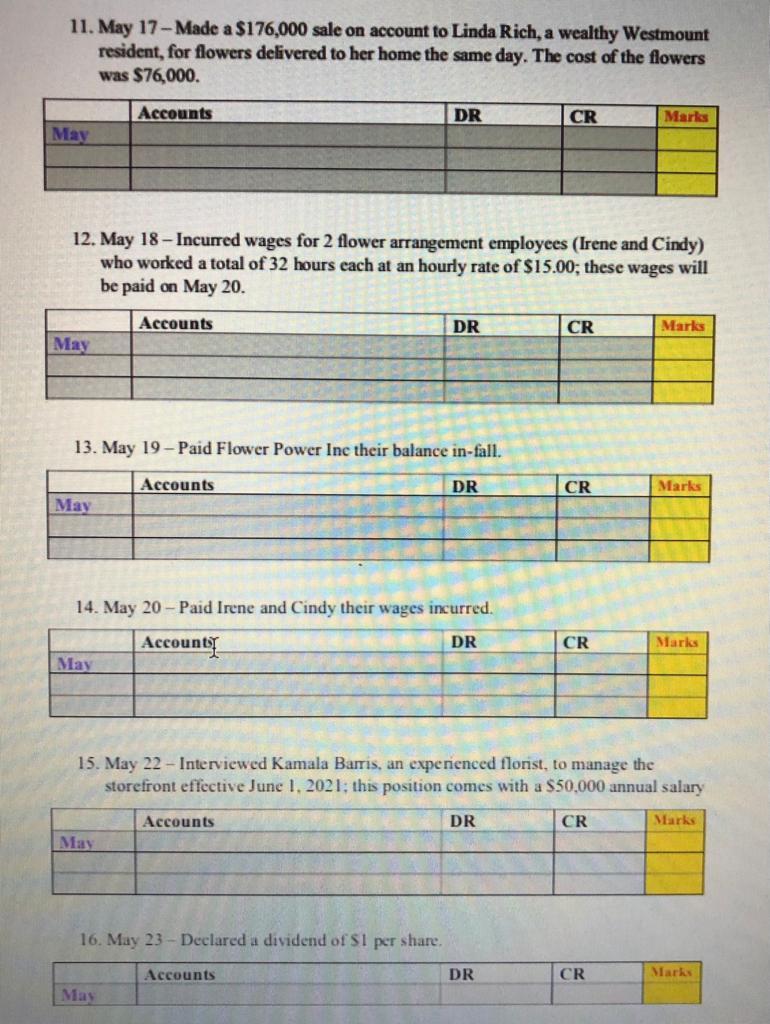

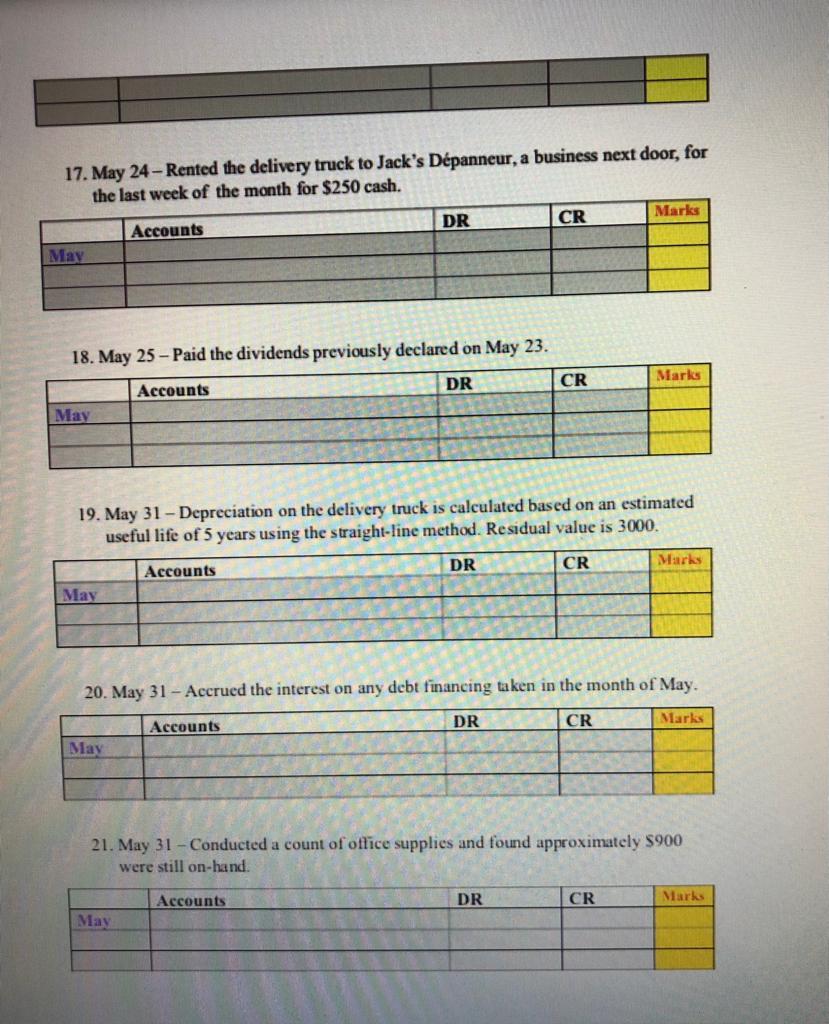

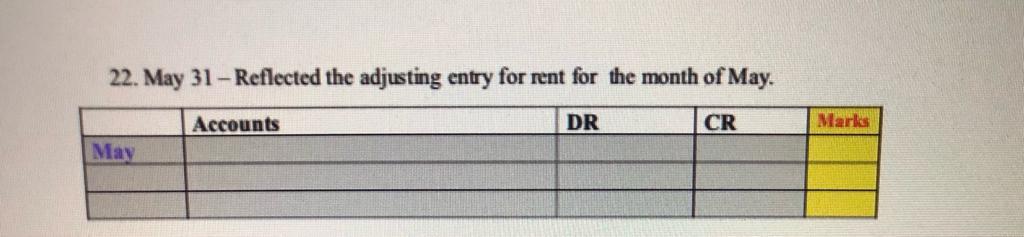

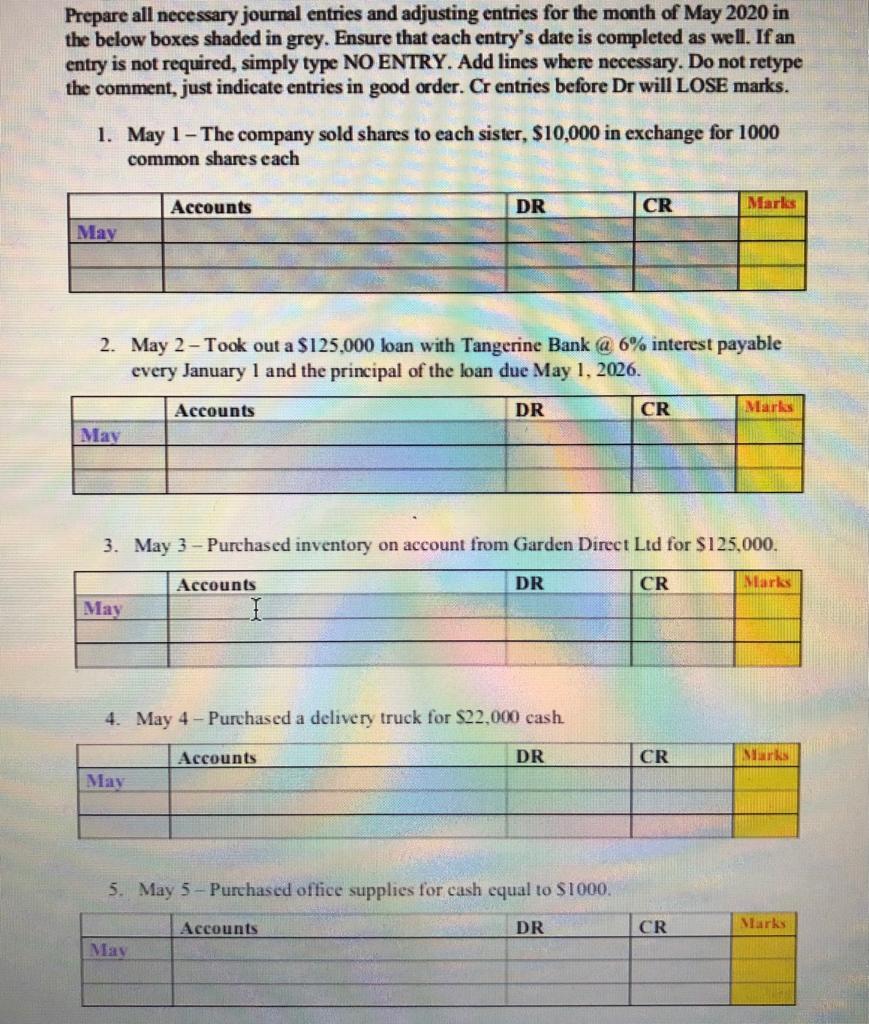

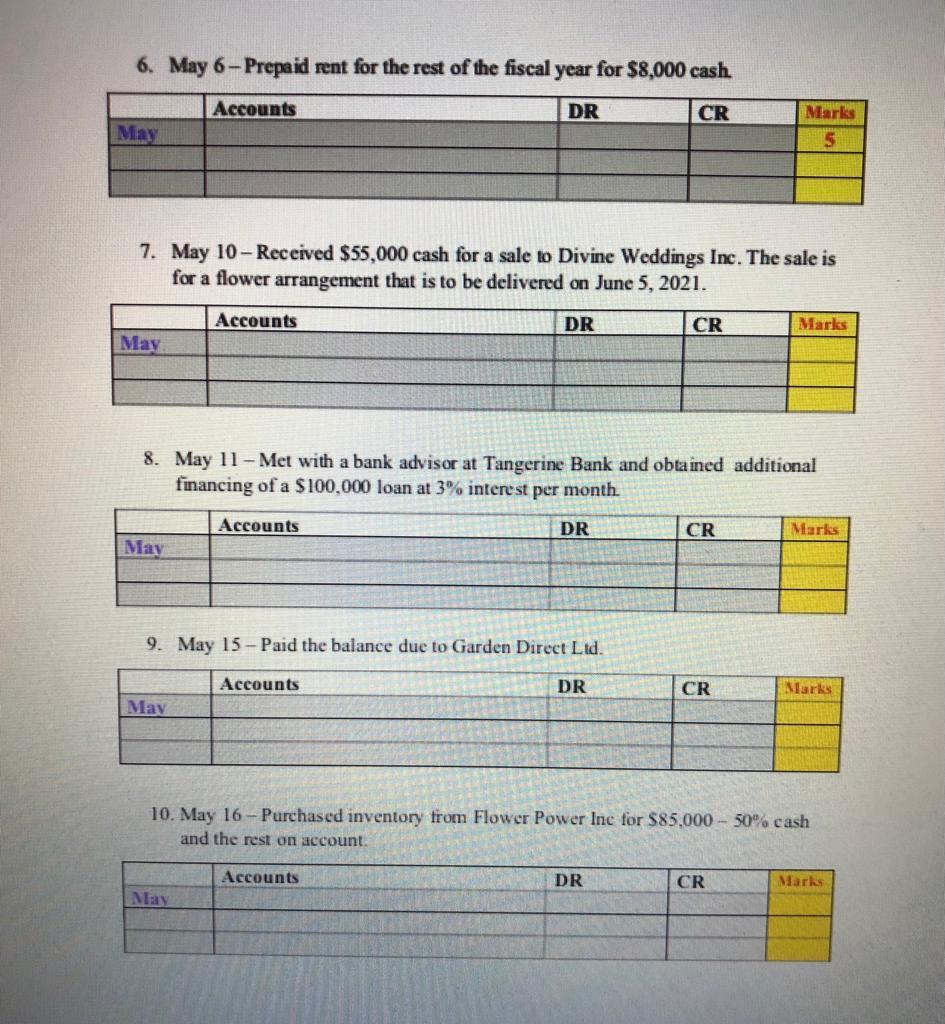

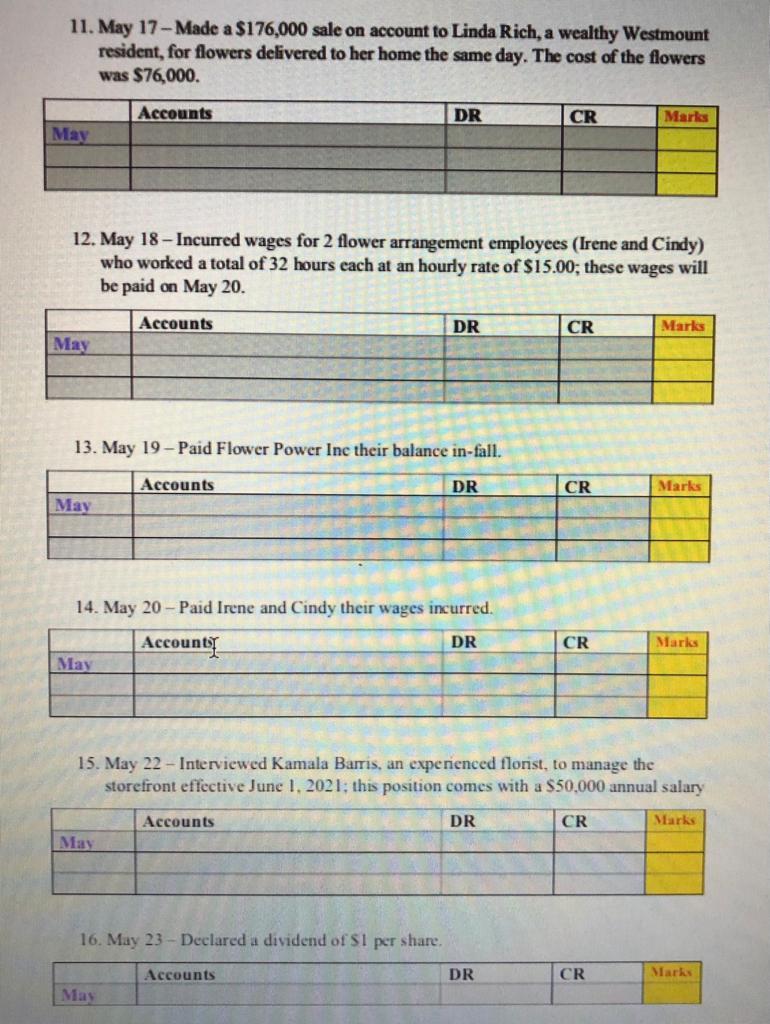

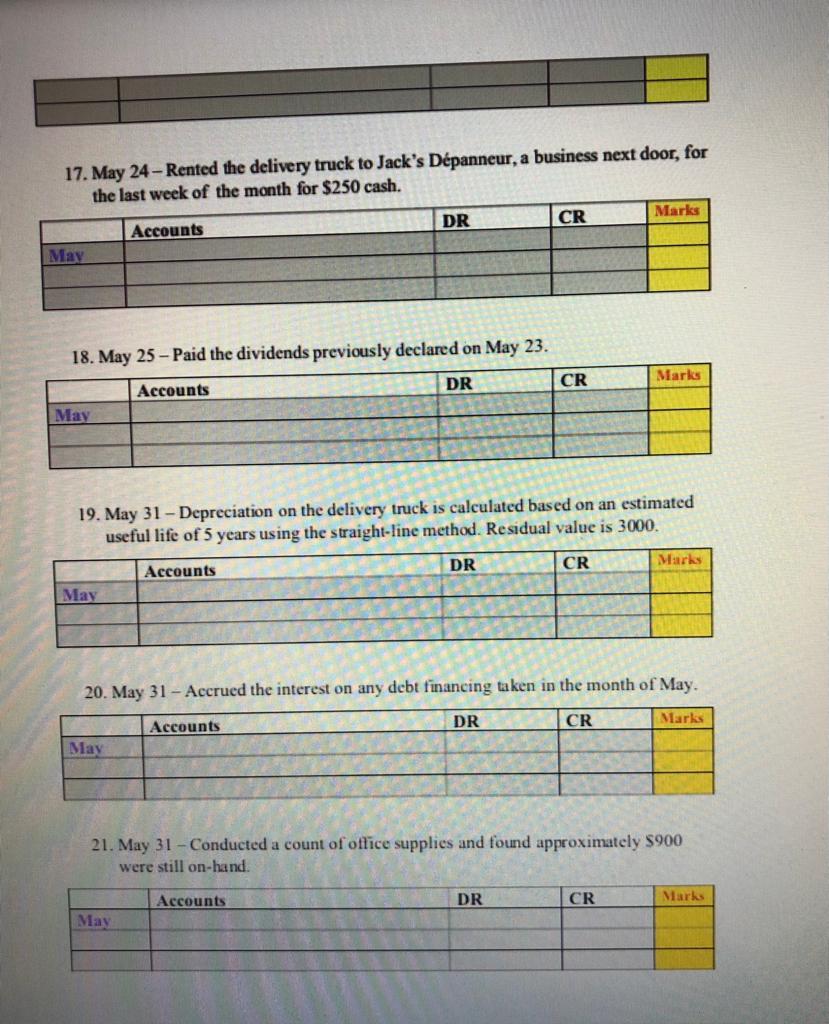

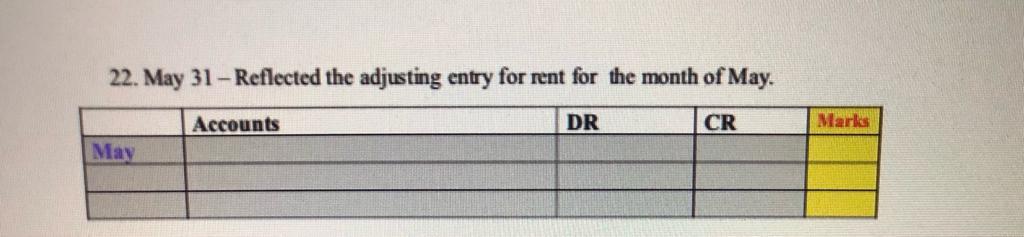

Prepare all necessary journal entries and adjusting entries for the month of May 2020 in the below boxes shaded in grey. Ensure that each entry's date is completed as well. If an entry is not required, simply type NO ENTRY. Add lines where necessary. Do not retype the comment, just indicate entries in good order. Cr entries before Dr will LOSE marks. 1. May 1 - The company sold shares to each sister, $10,000 in exchange for 1000 common shares each Accounts DR CR Marks May 2. May 2 - Took out a $125,000 loan with Tangerine Bank @ 6% interest payable every January 1 and the principal of the loan due May 1, 2026. Accounts DR CR Marks May 3. May 3 - Purchased inventory on account from Garden Direct Ltd for $125,000. Accounts DR CR Marks May 4. May 4 - Purchased a delivery truck for $22.000 cash Accounts DR CR Mark May 5. May 5 - Purchased office supplies for cash equal to S1000. Accounts DR CR Marks May 6. May 6 - Prepaid rent for the rest of the fiscal year for $8,000 cash. Accounts DR CR May Marks 5 7. May 10 - Received $55,000 cash for a sale to Divine Weddings Inc. The sale is for a flower arrangement that is to be delivered on June 5, 2021. Accounts DR CR Marks May 8. May 11 - Met with a bank advisor at Tangerine Bank and obtained additional financing of a $100,000 loan at 3% interest per month. Accounts DR CR Marks May 9. May 15 - Paid the balance due to Garden Direct Ltd. Accounts DR CR Marks May 10. May 16 - Purchased inventory from Flower Power Inc for $85.000 - 50% cash and the rest on account. Accounts DR CR Marks May 11. May 17 - Made a $176,000 sale on account to Linda Rich, a wealthy Westmount resident, for flowers delivered to her home the same day. The cost of the flowers was $76,000. Accounts DR CR Marks May 12. May 18 - Incurred wages for 2 flower arrangement employees (Irene and Cindy) who worked a total of 32 hours each at an hourly rate of $15.00; these wages will be paid on May 20. Accounts DR CR Marks May 13. May 19 - Paid Flower Power Inc their balance in-fall. Accounts DR CR Marks May 14. May 20 - Paid Irene and Cindy their wages incurred. Account DR CR Marks May 15. May 22 - Interviewed Kamala Barris, an experienced flonst, to manage the storefront effective June 1, 2021; this position comes with a $50,000 annual salary Accounts DR CR Marks May 16. May 23 - Declared a dividend of Si per share. Accounts DR CR Marks May 17. May 24 - Rented the delivery truck to Jack's Dpanneur, a business next door, for the last week of the month for $250 cash. Marks DR CR Accounts May 18. May 25 - Paid the dividends previously declared on May 23. CR Marks Accounts DR May 19. May 31 - Depreciation on the delivery truck is calculated based on an estimated useful life of 5 years using the straight-line method. Residual value is 3000. DR CR Accounts Marks May 20. May 31 - Accrued the interest on any debt financing taken in the month of May. DR CR Accounts Marks May 21. May 31 - Conducted a count of office supplies and found approximately $900 were still on-hand. Accounts DR CR Marks May 22. May 31 - Reflected the adjusting entry for rent for the month of May. Accounts DR CR Marlo May