Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare all required entries for Y4 and Y5 for the above transactions with a step-by-step guide on calculating. Thanks! Belmont Inc issued $10,000,00010 year, 9%

Prepare all required entries for Y4 and Y5 for the above transactions with a step-by-step guide on calculating. Thanks!

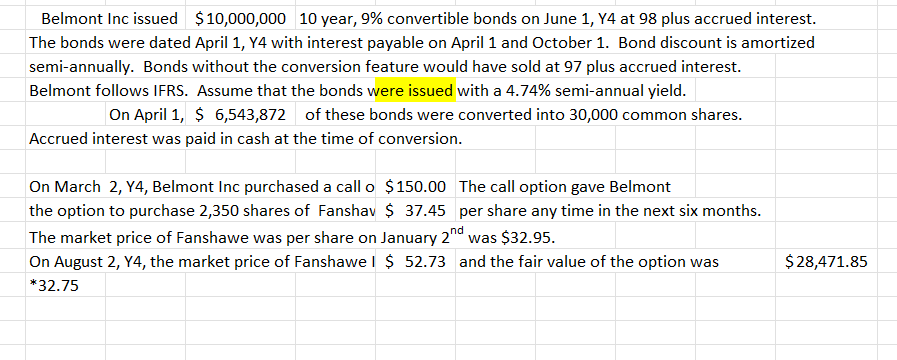

Belmont Inc issued $10,000,00010 year, 9% convertible bonds on June 1, Y4 at 98 plus accrued interest. The bonds were dated April 1, Y4 with interest payable on April 1 and October 1. Bond discount is amortized semi-annually. Bonds without the conversion feature would have sold at 97 plus accrued interest. Belmont follows IFRS. Assume that the bonds were issued with a 4.74% semi-annual yield. On April 1, \$6,543,872 of these bonds were converted into 30,000 common shares. Accrued interest was paid in cash at the time of conversion. On March 2, Y4, Belmont Inc purchased a call o \$150.00 The call option gave Belmont the option to purchase 2,350 shares of Fanshav $37.45 per share any time in the next six months. The market price of Fanshawe was per share on January 2nd was $32.95. On August 2, Y4, the market price of Fanshawe I \$52.73 and the fair value of the option was $28,471.85 32.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started