Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare all the reuired journal entries to affect the consolidation of Patterson Limited and Stanley Corporation at June 30, 2022. On July 1, 2019 Patterson

Prepare all the reuired journal entries to affect the consolidation of Patterson Limited and Stanley Corporation at June 30, 2022.

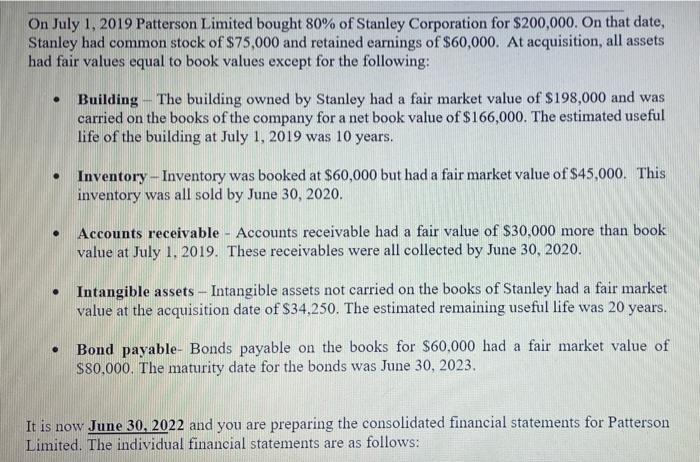

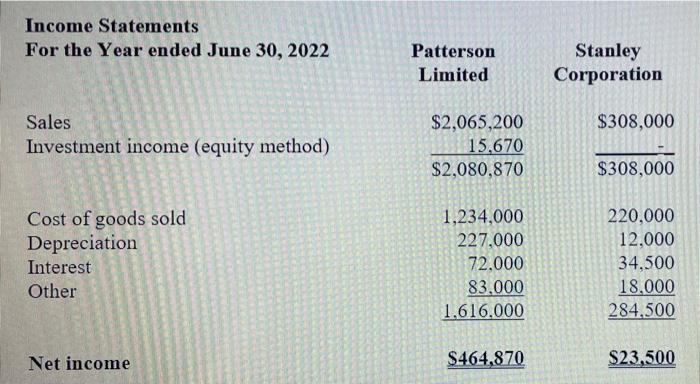

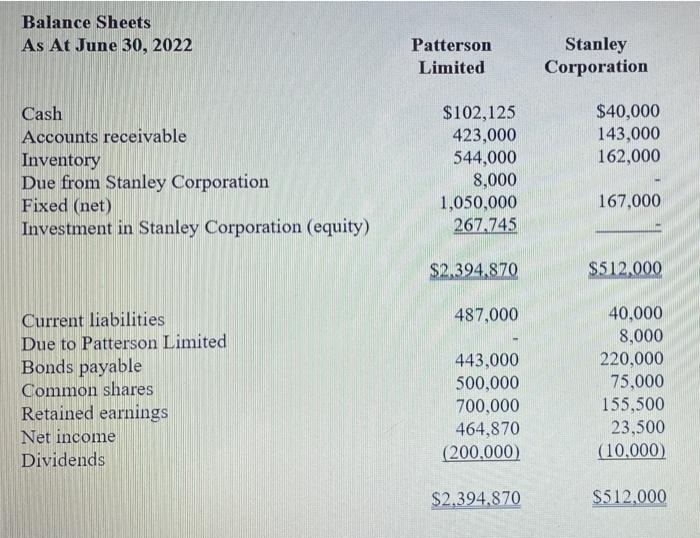

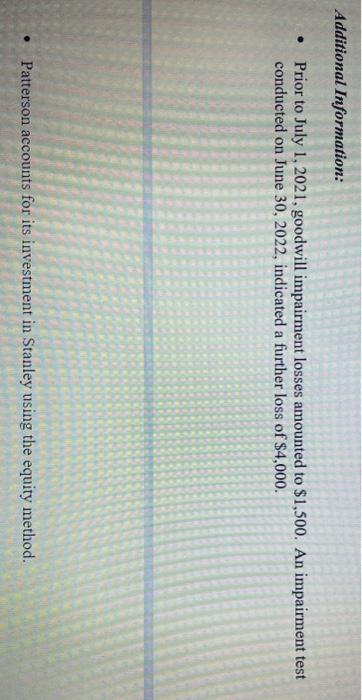

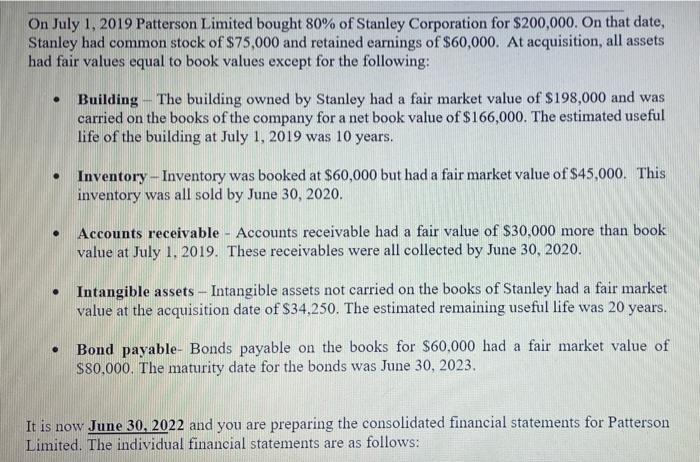

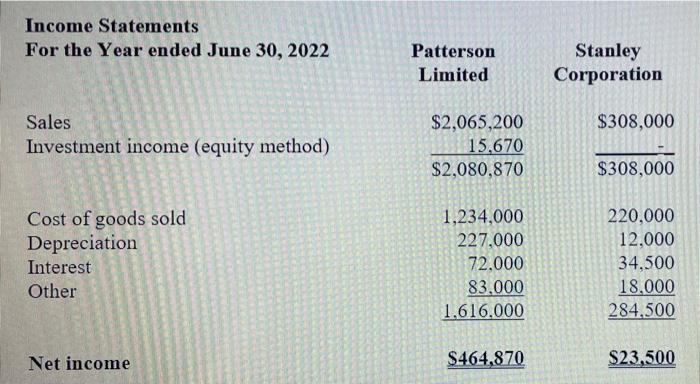

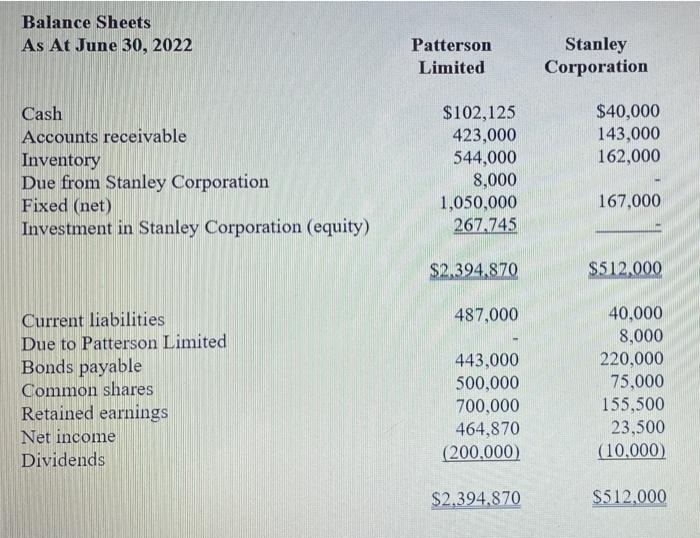

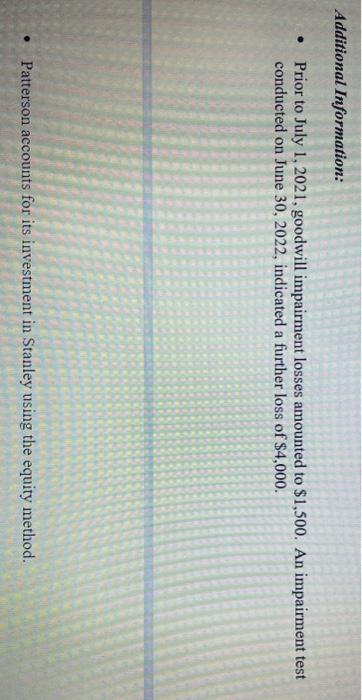

On July 1, 2019 Patterson Limited bought 80% of Stanley Corporation for $200,000. On that date, Stanley had common stock of $75,000 and retained earnings of $60,000. At acquisition, all assets had fair values equal to book values except for the following: Building - The building owned by Stanley had a fair market value of $198,000 and was carried on the books of the company for a net book value of $166,000. The estimated useful life of the building at July 1, 2019 was 10 years. Inventory - Inventory was booked at $60,000 but had a fair market value of $45,000. This inventory was all sold by June 30, 2020. Accounts receivable - Accounts receivable had a fair value of $30,000 more than book value at July 1, 2019. These receivables were all collected by June 30, 2020. . a Intangible assets - Intangible assets not carried on the books of Stanley had a fair market value at the acquisition date of $34.250. The estimated remaining useful life was 20 years. . Bond payable- Bonds payable on the books for $60,000 had a fair market value of $80,000. The maturity date for the bonds was June 30, 2023. It is now June 30, 2022 and you are preparing the consolidated financial statements for Patterson Limited. The individual financial statements are as follows: Income Statements For the Year ended June 30, 2022 Patterson Limited Stanley Corporation $308,000 Sales Investment income (equity method) $2,065,200 15,670 $2,080,870 $308,000 Cost of goods sold Depreciation Interest Other 1,234.000 227,000 72.000 83,000 1.616,000 220,000 12.000 34.500 18.000 284,500 Net income S464.870 $23.500 Balance Sheets As At June 30, 2022 Patterson Limited Stanley Corporation $40,000 143,000 162,000 Cash Accounts receivable Inventory Due from Stanley Corporation Fixed (net) Investment in Stanley Corporation (equity) $102,125 423,000 544,000 8,000 1,050,000 267.745 167,000 $2.394,870 $512.000 487,000 Current liabilities Due to Patterson Limited Bonds payable Common shares Retained earnings Net income Dividends 443,000 500,000 700,000 464,870 (200,000) 40,000 8,000 220,000 75,000 155,500 23,500 (10.000) $2.394,870 $512.000 Additional Information: . Prior to July 1, 2021, goodwill impairment losses amounted to $1,500. An impairment test conducted on June 30, 2022, indicated a further loss of $4,000. Patterson accounts for its investment in Stanley using the equity method. Prepare all the required journal entries to affect the consolidation of Patterson Limited and Stanley Corporation at June 30, 2022. (34 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started