Answered step by step

Verified Expert Solution

Question

1 Approved Answer

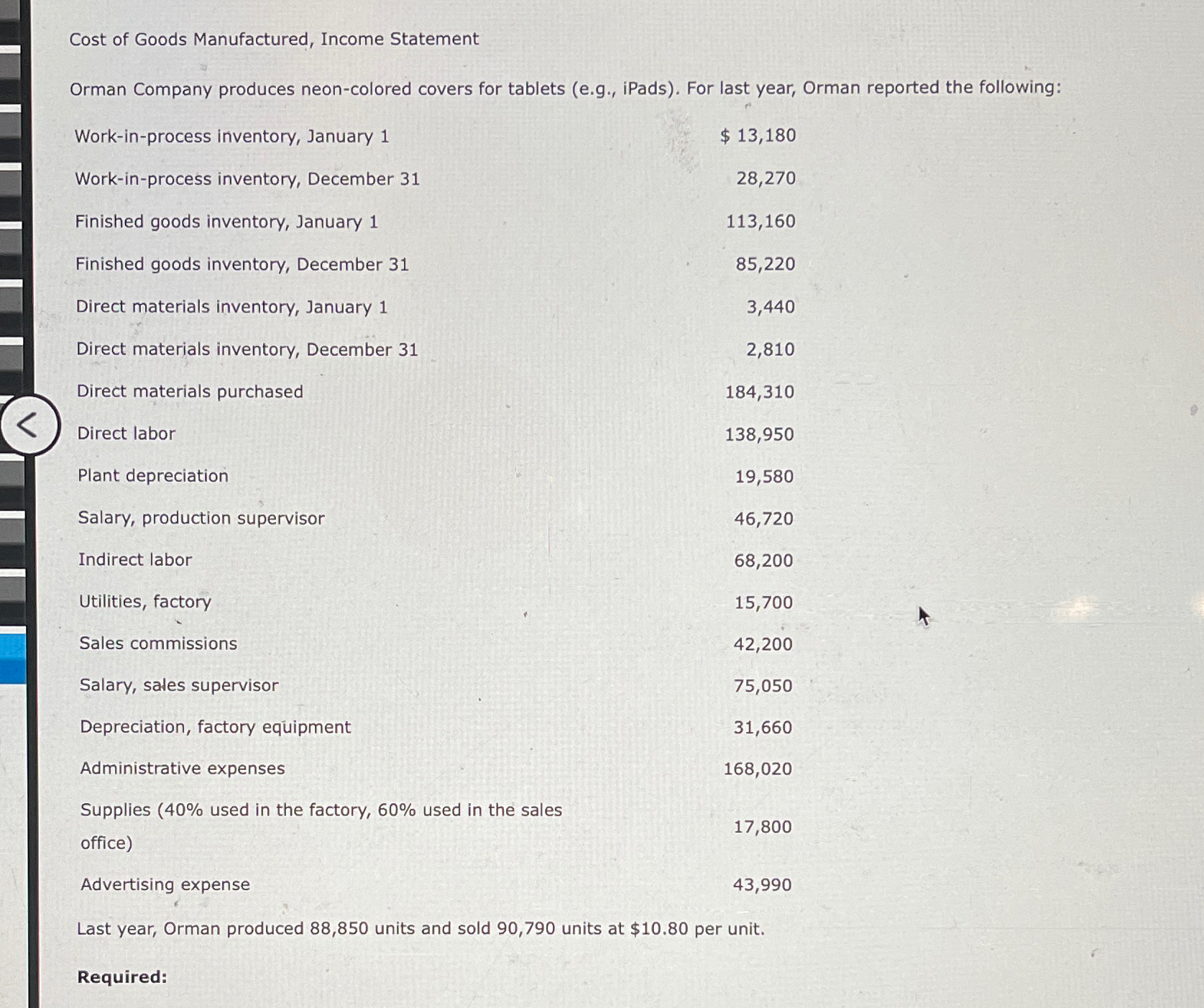

Prepare an absorption - costing income statement. Cost of Goods Manufactured, Income Statement Orman Company produces neon-colored covers for tablets (e.g., iPads). For last year,

Prepare an absorptioncosting income statement.

Cost of Goods Manufactured, Income Statement Orman Company produces neon-colored covers for tablets (e.g., iPads). For last year, Orman reported the following: Work-in-process inventory, January 1 Work-in-process inventory, December 31 Finished goods inventory, January 1 $ 13,180 28,270 113,160 Finished goods inventory, December 31 85,220 Direct materials inventory, January 1 3,440 Direct materials inventory, December 31 2,810 Direct materials purchased 184,310 < Direct labor 138,950 Plant depreciation Salary, production supervisor Indirect labor Utilities, factory Sales commissions 19,580 46,720 68,200 15,700 42,200 Salary, sales supervisor 75,050 Depreciation, factory equipment 31,660 Administrative expenses 168,020 Supplies (40% used in the factory, 60% used in the sales 17,800 office) Advertising expense 43,990 Last year, Orman produced 88,850 units and sold 90,790 units at $10.80 per unit. Required:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare the Cost of Goods Manufactured COGM Income Statement for Orman Company we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started