Answered step by step

Verified Expert Solution

Question

1 Approved Answer

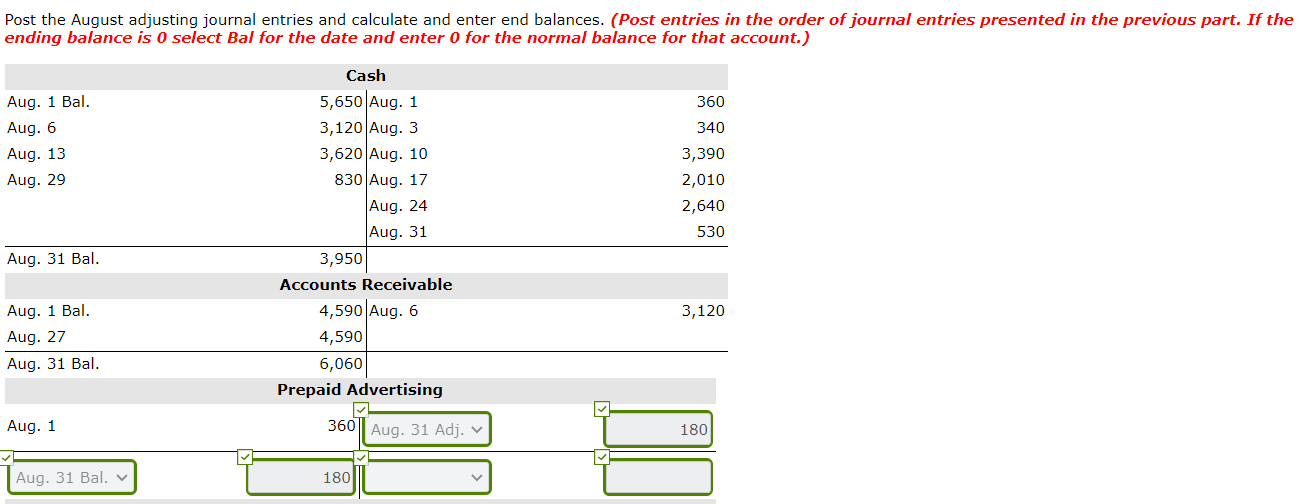

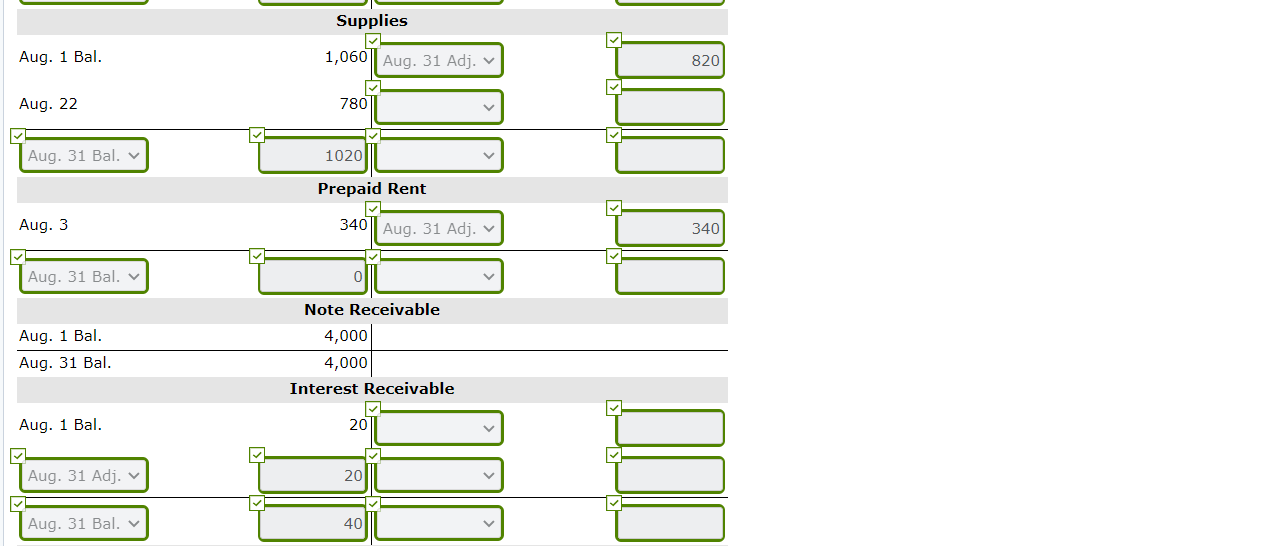

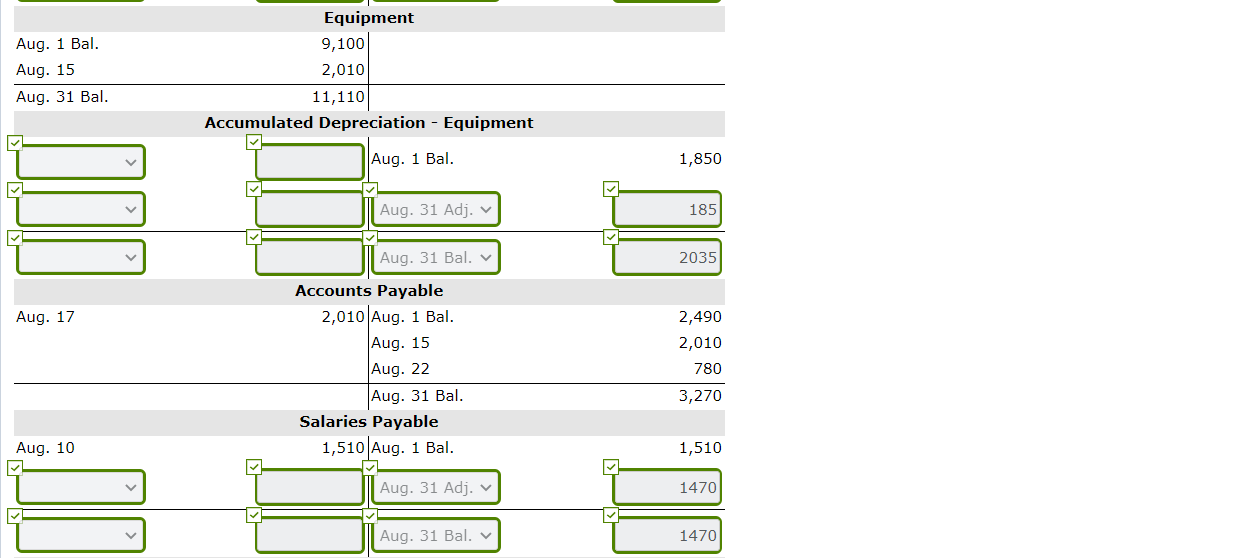

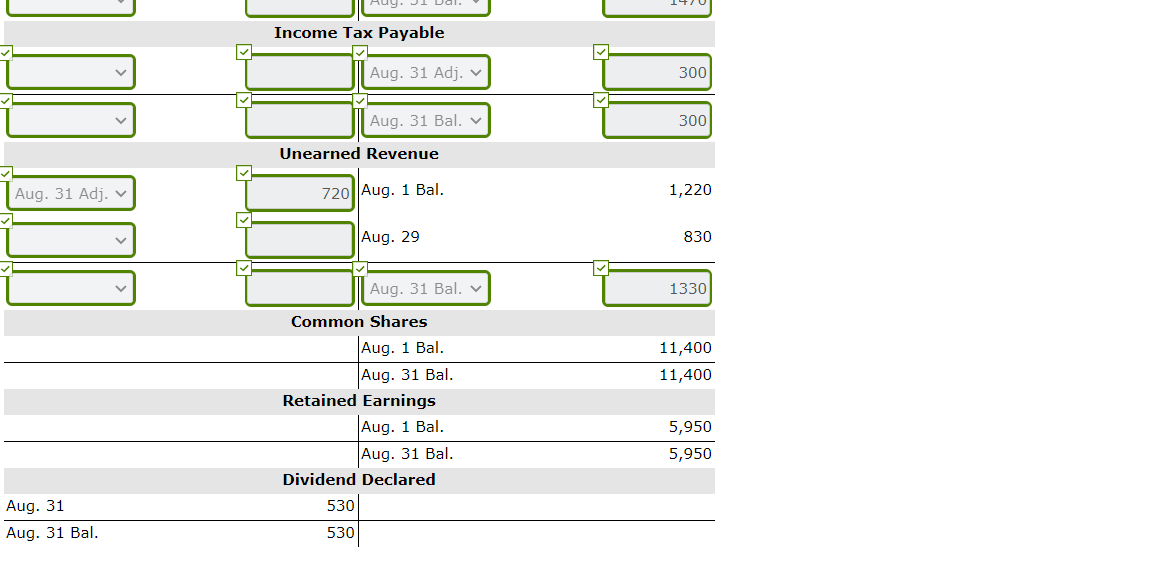

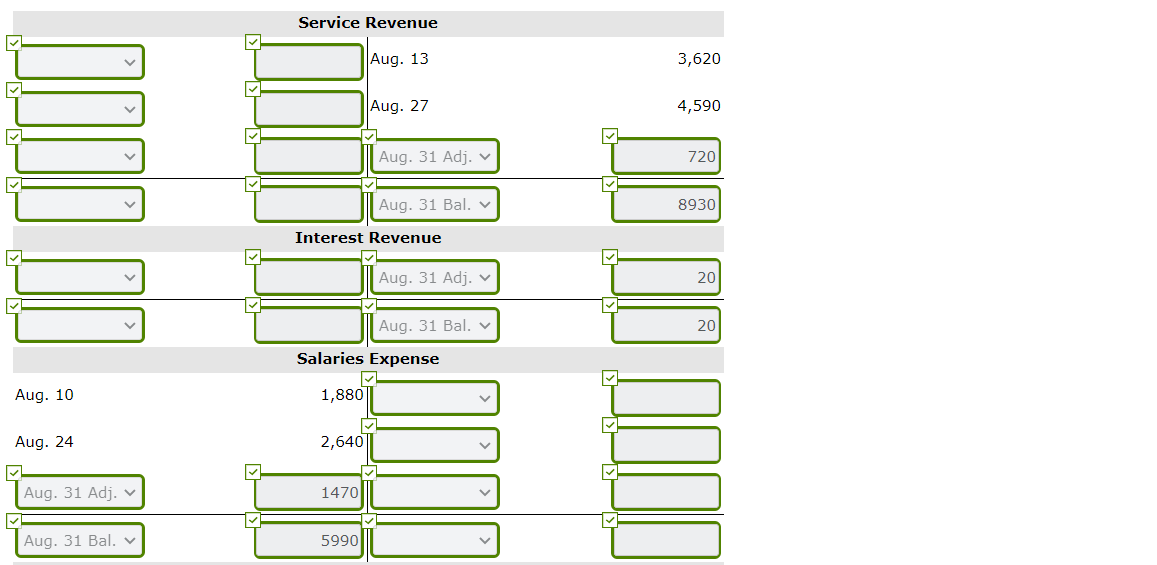

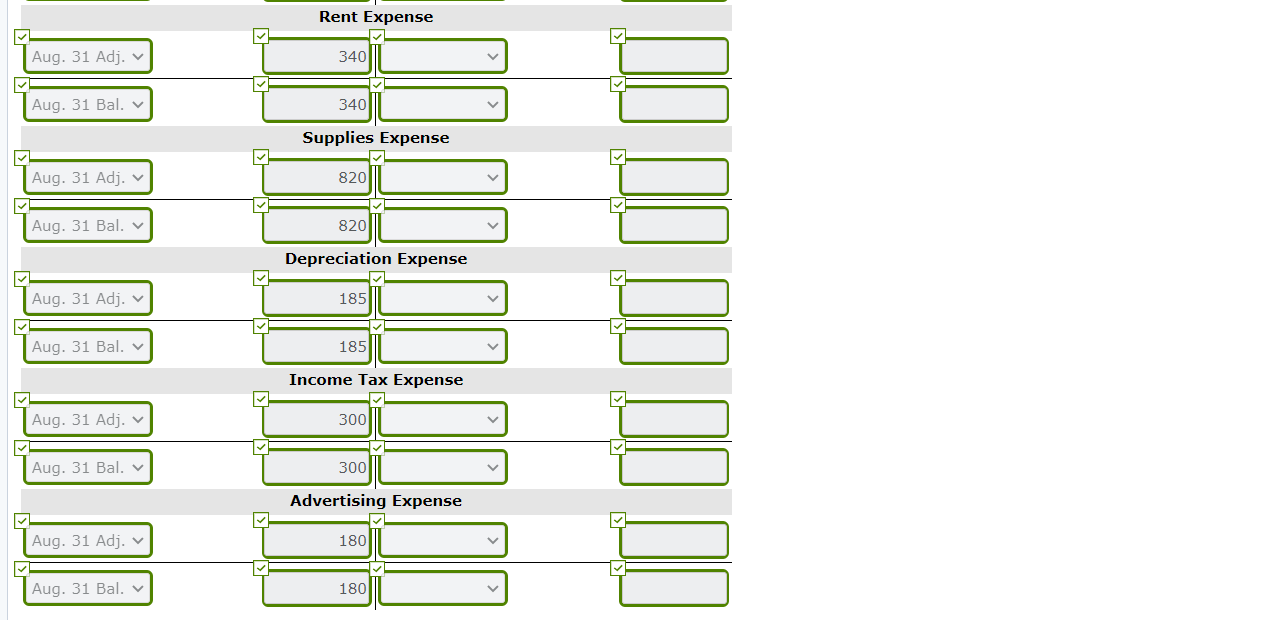

Prepare an adjusted trial balance as at August 31. Post the August adjusting journal entries and calculate and enter end balances. (Post entries in the

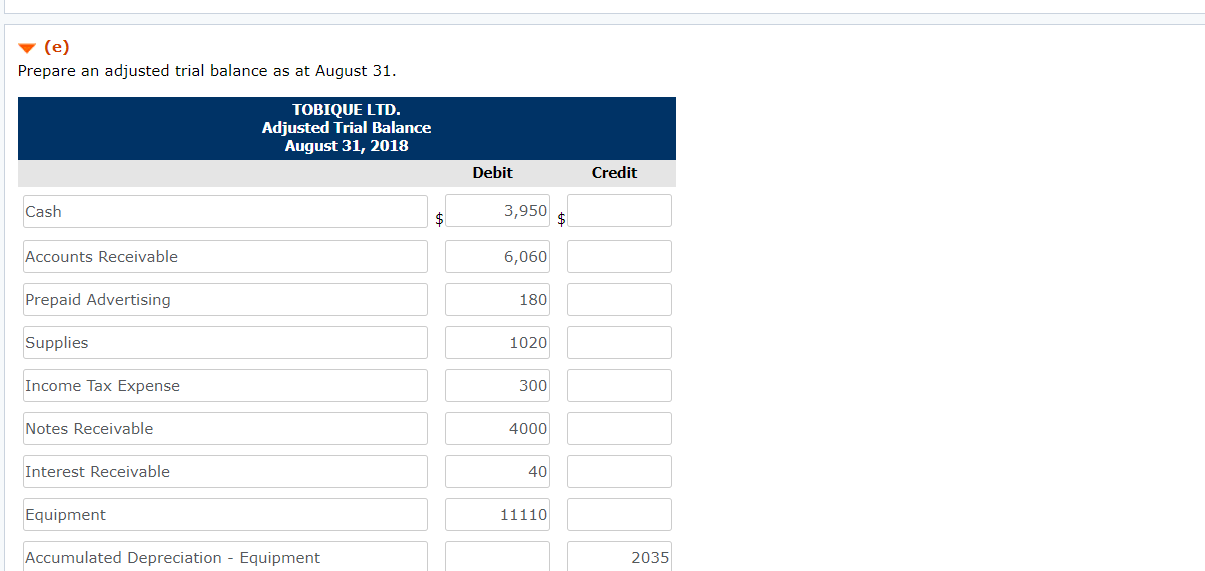

Prepare an adjusted trial balance as at August 31.

Post the August adjusting journal entries and calculate and enter end balances. (Post entries in the order of journal entries presented in the previous part. If the ending balance is 0 select Bal for the date and enter o for the normal balance for that account.) 360 340 Aug. 1 Bal. Aug. 6 Aug. 13 Aug. 29 3,390 2,010 2,640 Cash 5,650 Aug. 1 3,120 Aug. 3 3,620 Aug. 10 830 Aug. 17 Aug. 24 Aug. 31 3,950 Accounts Receivable 4,590 Aug. 6 4,590 6,060 Prepaid Advertising 530 Aug. 31 Bal. 3,120 Aug. 1 Bal. Aug. 27 Aug. 31 Bal. Aug. 1 360 Aug. 31 Adj. 180 Aug. 31 Bal v 1801 Supplies Aug. 1 Bal. 1,060 Aug. 31 Adj. V 820 Aug. 22 780 Aug. 31 Bal. 1020 Prepaid Rent Aug. 3 340|| Aug. 31 Adj. V 340 Aug. 31 Bal. Aug. 1 Bal. Aug. 31 Bal. Note Receivable 4,000 4,000 Interest Receivable Aug. 1 Bal. 201 Aug. 31 Adj. 20 Aug. 31 Bal. 40 Aug. 1 Bal. Aug. 15 Aug. 31 Bal. Equipment 9,100 2,010 11,110 Accumulated Depreciation - Equipment Aug. 1 Bal. 1,850 Aug. 31 Adj. v. 185 1 Aug. 31 Bal. 2035 Aug. 17 Accounts Payable 2,010 Aug. 1 Bal. Aug. 15 Aug. 22 Aug. 31 Bal. Salaries Payable 1,510 Aug. 1 Bal. 2,490 2,010 780 3,270 Aug. 10 1,510 Aug. 31 Adj. v 1470 Aug. 31 Bal. 1470 Income Tax Payable Aug. 31 Adj. 300 Aug. 31 Bal v 300 Unearned Revenue Aug. 31 Adj. 720||Aug. 1 Bal. 1,220 Aug. 29 830 1330 11,400 11,400 Aug. 31 Bal. Common Shares Aug. 1 Bal. Aug. 31 Bal. Retained Earnings Aug. 1 Bal. Aug. 31 Bal. Dividend Declared 530 5,950 5,950 Aug. 31 Aug. 31 Bal. 530 Service Revenue Aug. 13 3,620 Aug. 27 4,590 Aug. 31 Adj. 720 DI DUNI 1 Aug. 31 Bal. 8930 Interest Revenue Aug. 31 Adj. 20 M Aug. 31 Bal. 20 Salaries Expense Aug. 10 1,880 Aug. 24 2,640 Aug. 31 Adj. 14701 Aug. 31 Bal. 5990 Rent Expense Aug. 31 Adj. v 340 Aug. 31 Bal. 340 Supplies Expense Aug. 31 Adj. v 820 Aug. 31 Bal. 820 Depreciation Expense Aug. 31 Adj. v 185 Aug. 31 Bal v 185 Income Tax Expense Aug. 31 Adj. v 3001 Aug. 31 Bal. 300 Advertising Expense IO DI Aug. 31 Adj. 180 Aug. 31 Bal. 180 (e) Prepare an adjusted trial balance as at August 31. TOBIQUE LTD. Adjusted Trial Balance August 31, 2018 Debit Credit Cash 3,950 $ $ Accounts Receivable 6,060 Prepaid Advertising 180 Supplies 1020 Income Tax Expense 300 Notes Receivable 4000 Interest Receivable 40 Equipment 11110 Accumulated Depreciation - Equipment 2035Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started