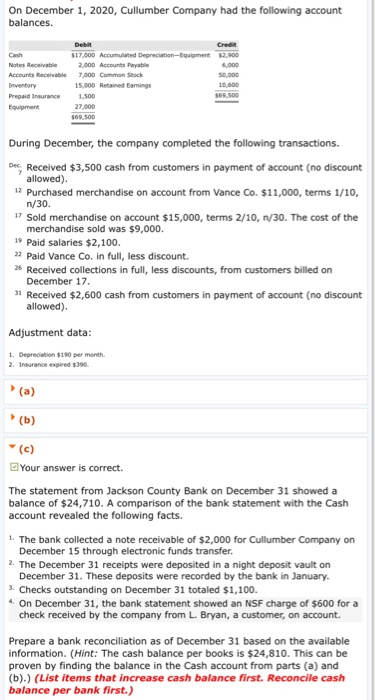

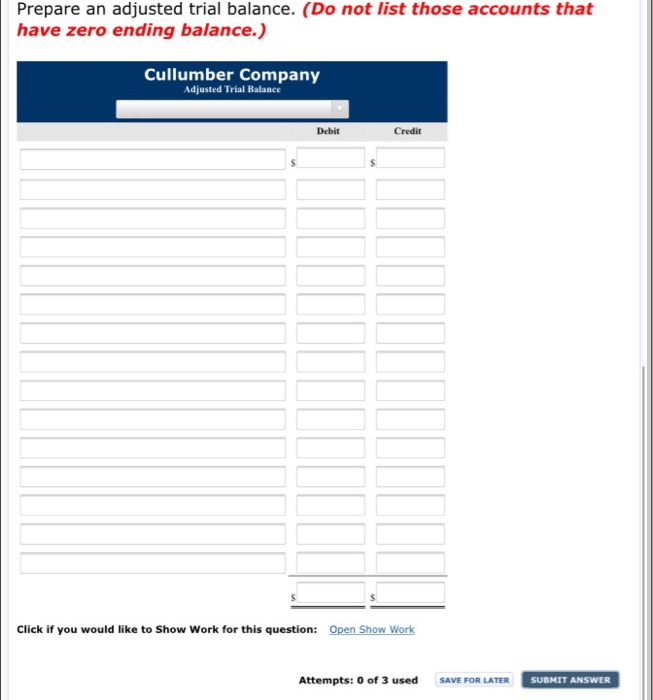

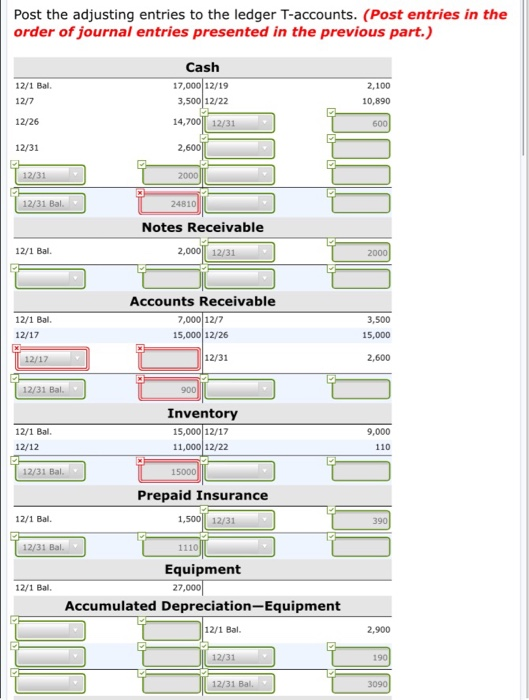

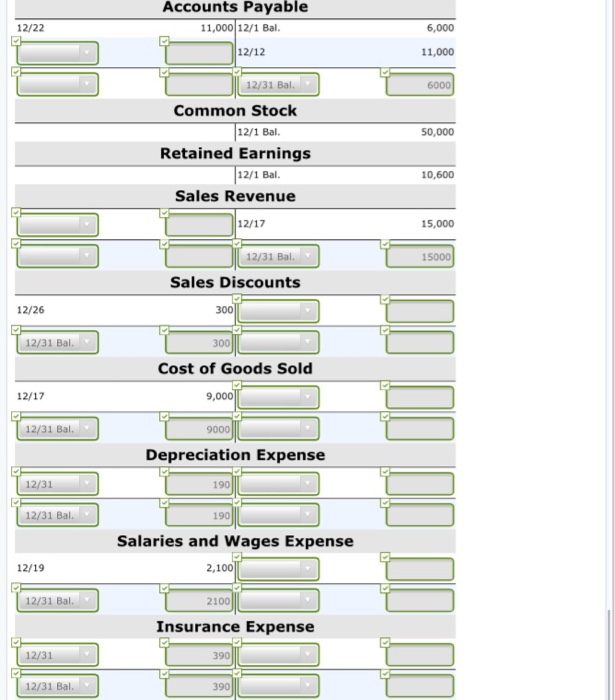

Prepare an adjusted trial balance. (Do not list those accounts that have zero ending balance.) Cullumber Company Adjusted Trial Balance Dcbit Credit Click if you would like to Show Work for this question: Open Show Work Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER Post the adjusting entries to the ledger T-accounts. (Post entries in the order of journal entries presented in the previous part.) 12/1 Bal 2,100 10,890 12/7 12/26 12/31 Cash 17,000 12/19 3,500 12/22 14,700 12/31 2,600 2000 1 24810 Notes Receivable 2,000 12/31 12/31 12/31 Bal. 12/1 Bal 12/1 Bal 12/17 Accounts Receivable 7,000 12/7 15,000 12/26 12/31 3,500 15,000 12/17 2,600 12/31 Bal. 12/1 Bal. 12/12 Inventory 15,000 12/17 11,000 12/22 12/1 Bal 12/31 Bal. T 15000 Prepaid Insurance 1,500 12/31 12/31 Bal. 1 1110 Equipment 27,000 Accumulated Depreciation-Equipment 12/1 Bal. 12/31 2.900 12/31 Bal 12/22 Accounts Payable 11,000 12/1 Bal. 12/12 6,000 11,000 6000 50,000 12/31 Bal. Common Stock 12/1 Bal. Retained Earnings 12/1 Bal. Sales Revenue 12/17 10,600 15,000 15000 12/31 Bal. Sales Discounts 12/26 300 12/31 Bal. 300 Cost of Goods Sold 9,000 12/17 12/31 Bal. 9000 Depreciation Expense 12/31 190 12/31 Bal. 12/19 Salaries and Wages Expense 2,100 T 2100 Insurance Expense 12/31 Bal. 12/31 Bal. Prepare an adjusted trial balance. (Do not list those accounts that have zero ending balance.) Cullumber Company Adjusted Trial Balance Dcbit Credit Click if you would like to Show Work for this question: Open Show Work Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER Post the adjusting entries to the ledger T-accounts. (Post entries in the order of journal entries presented in the previous part.) 12/1 Bal 2,100 10,890 12/7 12/26 12/31 Cash 17,000 12/19 3,500 12/22 14,700 12/31 2,600 2000 1 24810 Notes Receivable 2,000 12/31 12/31 12/31 Bal. 12/1 Bal 12/1 Bal 12/17 Accounts Receivable 7,000 12/7 15,000 12/26 12/31 3,500 15,000 12/17 2,600 12/31 Bal. 12/1 Bal. 12/12 Inventory 15,000 12/17 11,000 12/22 12/1 Bal 12/31 Bal. T 15000 Prepaid Insurance 1,500 12/31 12/31 Bal. 1 1110 Equipment 27,000 Accumulated Depreciation-Equipment 12/1 Bal. 12/31 2.900 12/31 Bal 12/22 Accounts Payable 11,000 12/1 Bal. 12/12 6,000 11,000 6000 50,000 12/31 Bal. Common Stock 12/1 Bal. Retained Earnings 12/1 Bal. Sales Revenue 12/17 10,600 15,000 15000 12/31 Bal. Sales Discounts 12/26 300 12/31 Bal. 300 Cost of Goods Sold 9,000 12/17 12/31 Bal. 9000 Depreciation Expense 12/31 190 12/31 Bal. 12/19 Salaries and Wages Expense 2,100 T 2100 Insurance Expense 12/31 Bal. 12/31 Bal