Question

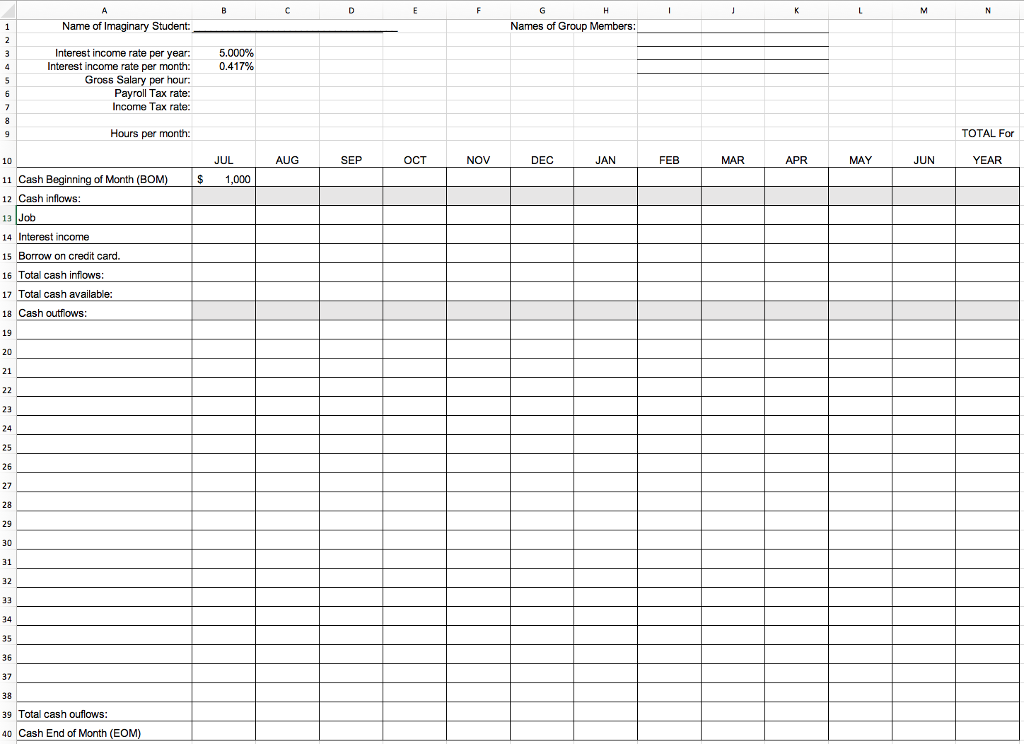

Prepare an annual (fiscal year from July to June) budget for an imaginary college student. The student will work full time (160 hours per month)

Prepare an annual (fiscal year from July to June) budget for an imaginary college student. The student will work full time (160 hours per month) during July, August & September. The student can work half time (80 hours per month) during the other 9 months of the school year.

The student will have $1,000 in cash in the bank on July 1 and earns interest on the cash balance at 5% per year. Interest income should be calculated each month by taking the monthly interest rate and multiplying it by the beginning of month cash balance.

The student has a credit card with a $5,000 line of credit. Interest expense on the unpaid balance is 20% per year and must be paid monthly. I recommend NOT using your credit card to smooth out the cash flowsthe interest rate is too expensive. (Just like real life.) The cash balance cannot go negative so increase your hourly wage rate if you start to run out of money.

Plot in the expenses that will be incurred during the year. Include all expenses you can imagine including payroll taxes, income taxes, tuition and books, food, rent, travel, transportation, insurance, fun, clothes, phone, utilities, etc. Calculate the hourly rate that must be earned to live for the year. Calculate annual totals and the final cash balance on June 30. This worksheet should be built so that you can easily change the hourly wage rate...and then the whole worksheet will recalculate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started