Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare an income statement, a statement of owner's equity, and a balance sheet for fiscal year 2020. The statements should reflect all the adjustments

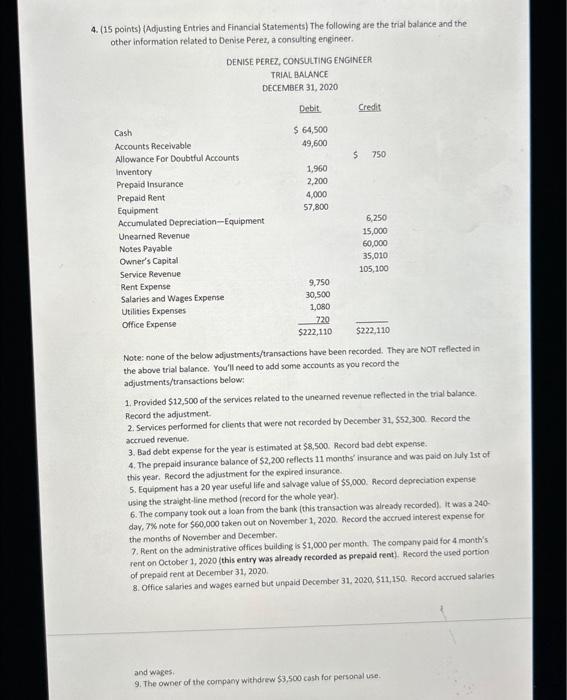

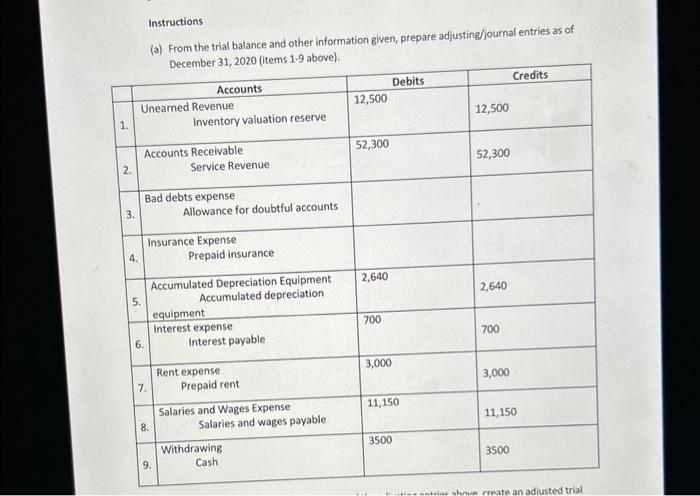

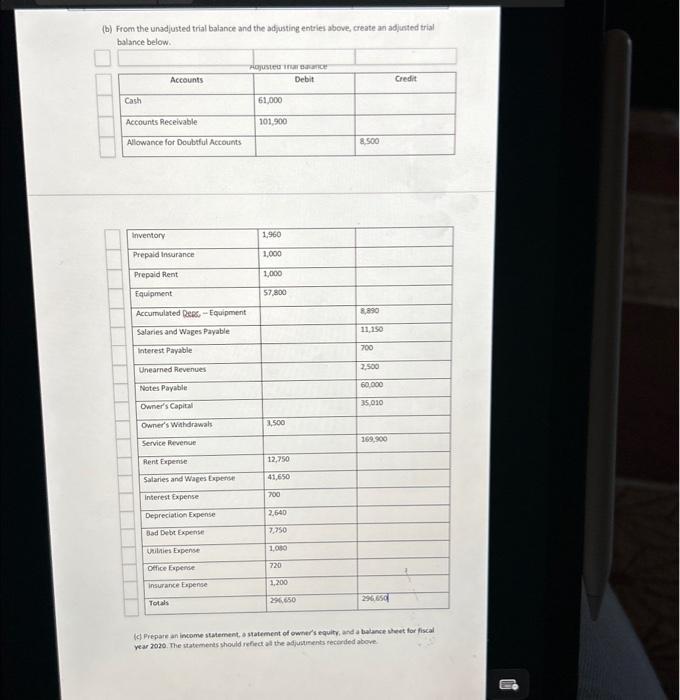

Prepare an income statement, a statement of owner's equity, and a balance sheet for fiscal year 2020. The statements should reflect all the adjustments recorded above. 4. (15 points) (Adjusting Entries and Financial Statements) The following are the trial balance and the other information related to Denise Perez, a consulting engineer. DENISE PEREZ, CONSULTING ENGINEER TRIAL BALANCE DECEMBER 31, 2020 Debit $ 64,500 49,600 Cash Accounts Receivable Allowance For Doubtful Accounts Inventory Prepaid Insurance Prepaid Rent Equipment. Accumulated Depreciation-Equipment Unearned Revenue Notes Payable Owner's Capital Service Revenue Rent Expense Salaries and Wages Expense Utilities Expenses Office Expense 1,960 2,200 4,000 57,800 9,750 30,500 1,080 720 $222,110 Credit $ 750 6,250 15,000 60,000 35,010 105,100 $222,110 Note: none of the below adjustments/transactions have been recorded. They are NOT reflected in the above trial balance. You'll need to add some accounts as you record the adjustments/transactions below: 1. Provided $12,500 of the services related to the unearned revenue reflected in the trial balance. Record the adjustment. 2. Services performed for clients that were not recorded by December 31, $52,300. Record the accrued revenue. 3. Bad debt expense for the year is estimated at $8,500. Record bad debt expense. 4. The prepaid insurance balance of $2,200 reflects 11 months' insurance and was paid on July 1st of this year. Record the adjustment for the expired insurance. 5. Equipment has a 20 year useful life and salvage value of $5,000. Record depreciation expense using the straight-line method (record for the whole year). 6. The company took out a loan from the bank (this transaction was already recorded). It was a 240- day, 7% note for $60,000 taken out on November 1, 2020. Record the accrued interest expense for the months of November and December. 7. Rent on the administrative offices building is $1,000 per month. The company paid for 4 month's rent on October 1, 2020 (this entry was already recorded as prepaid rent). Record the used portion of prepaid rent at December 31, 2020. 8. Office salaries and wages earned but unpaid December 31, 2020, $11,150. Record accrued salaries and wages. 9. The owner of the company withdrew $3,500 cash for personal use. 1. 2. 3. 4. 5. Instructions (a) From the trial balance and other information given, prepare adjusting/journal entries as of December 31, 2020 (items 1-9 above). Unearned Revenue 6. Accounts Receivable 7. Accounts Inventory valuation reserve Bad debts expense 8. Service Revenue 9. Insurance Expense Allowance for doubtful accounts Prepaid insurance Accumulated Depreciation Equipment Accumulated depreciation equipment Interest expense Interest payable Rent expense Prepaid rent Salaries and Wages Expense Salaries and wages payable Withdrawing Cash 12,500 52,300 2,640 700 3,000 Debits 11,150 3500 12,500 52,300 2,640 700 3,000 Credits 11,150 3500 ingatia shrue rreate an adjusted trial (b) From the unadjusted trial balance and the adjusting entries above, create an adjusted trial balance below. Cash Accounts Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Prepaid Rent Equipment Accumulated De-Equipment Salaries and Wages Payable Interest Payable Unearned Revenues Notes Payable Owner's Capital Owner's Withdrawals Service Revenue Rent Expense Salaries and Wages Expense Interest Expense Depreciation Expense Bad Debt Expense Utilities Expense Office Expense insurance Expense Totals Hajusteu na maance Debit 61,000 101,900 1,960 1,000 1,000 57,800 3,500 12,750 41,650 700 2,640 7,750 1,000 720 1,200 296,650 8,500 8,890 11,150 700 2,500 60,000 35,010 169,900 296.650 Credit (c) Prepare an income statement, a statement of owner's equity, and a balance sheet for fiscal year 2020. The statements should reflect all e adjustments recorded above

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Denise Perez Consulting Engineer Income Statement For the Year Ended December 31 2020 Service Revenu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started