Prepare an income statement, balance sheet, and statement of changes in stockholder's equity, analyze results LO 2,3,4. Except as otherwise indicated, assume that all balance sheet items reflets account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year:

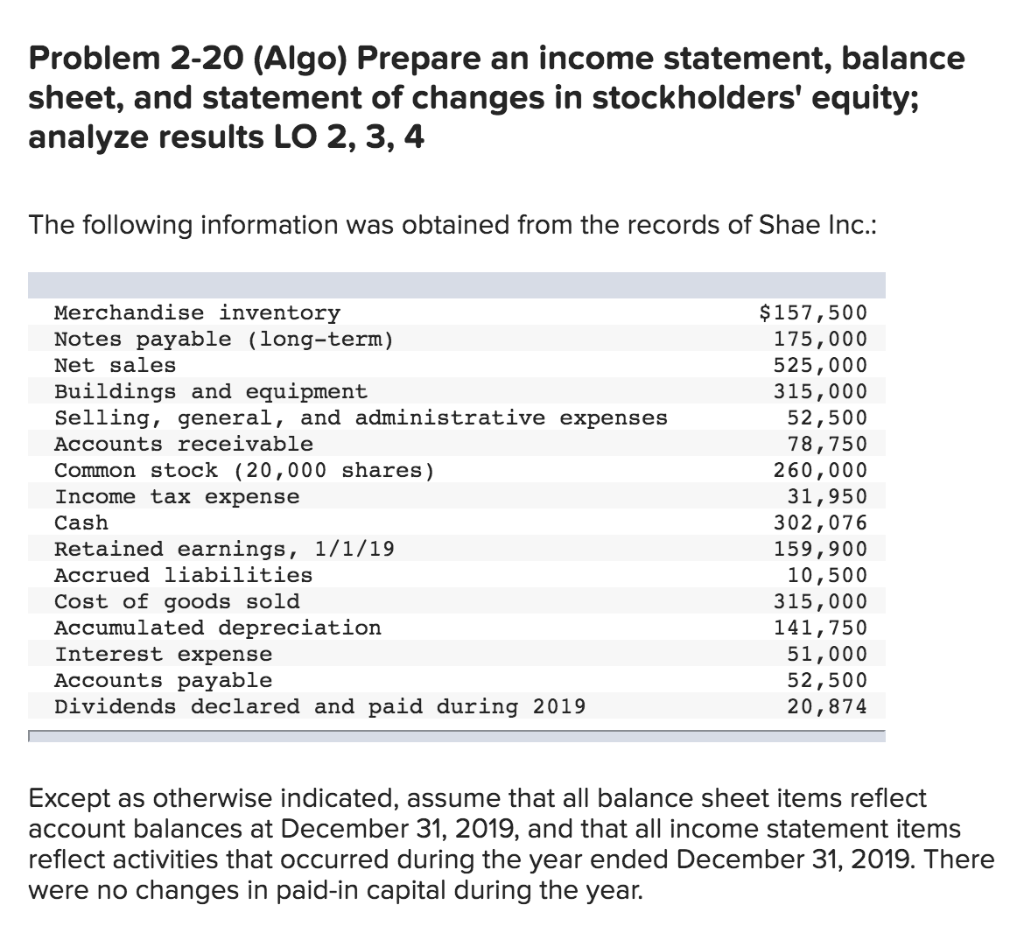

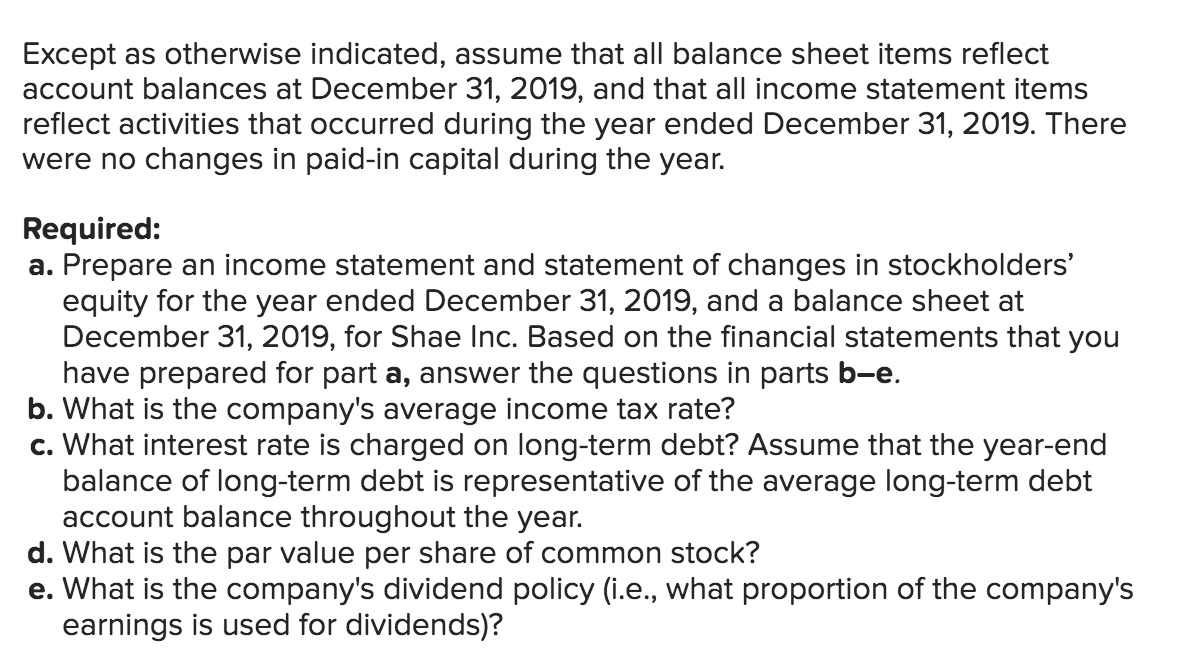

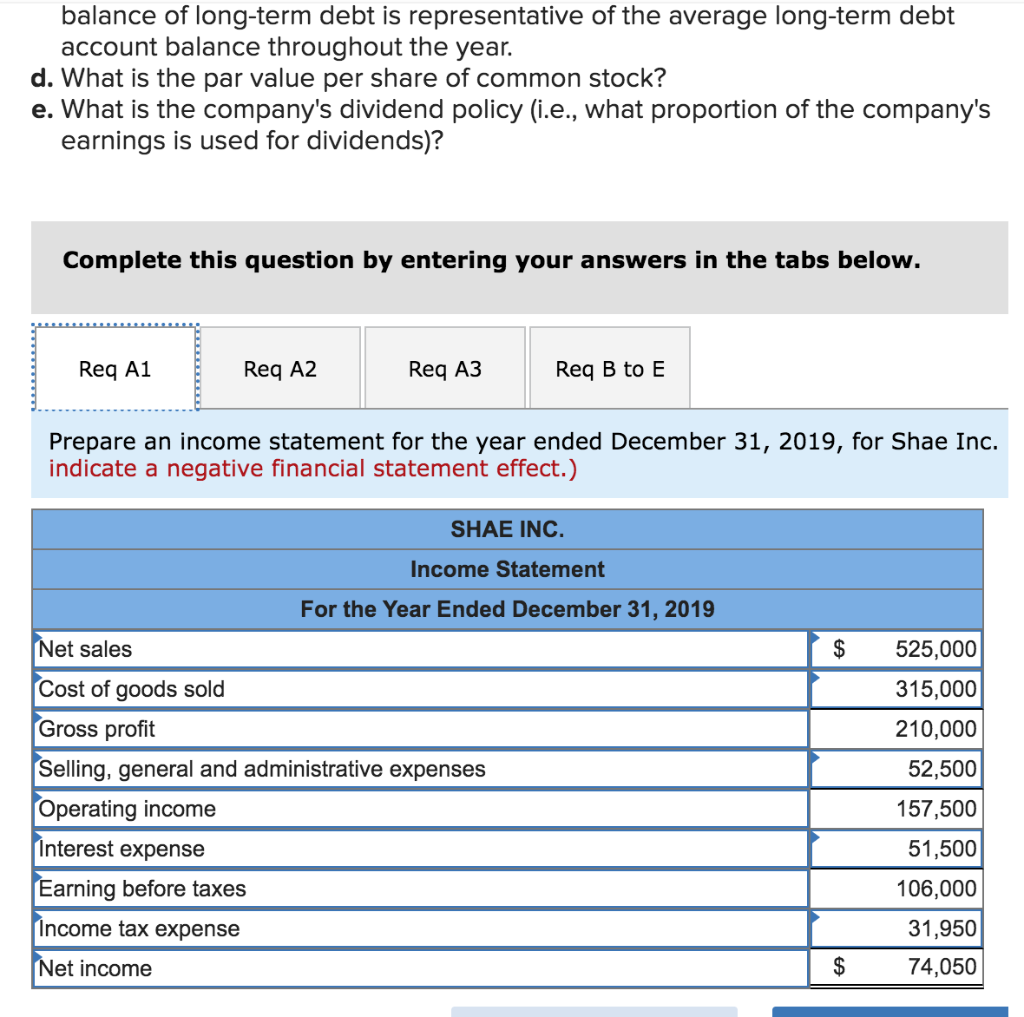

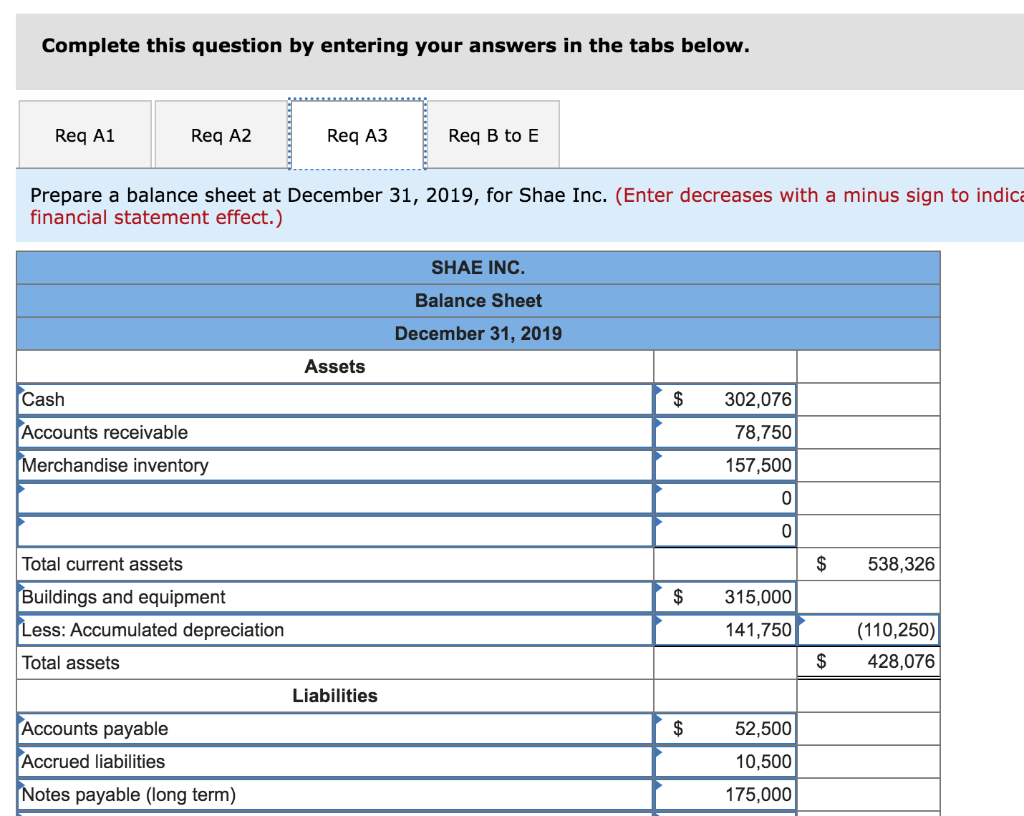

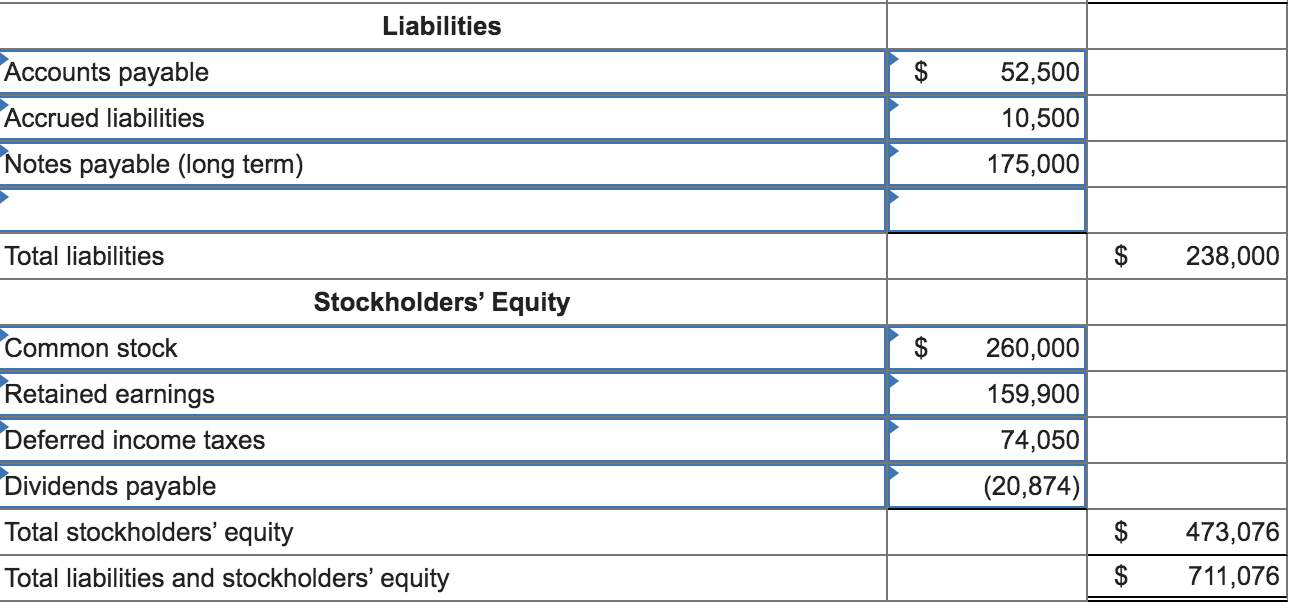

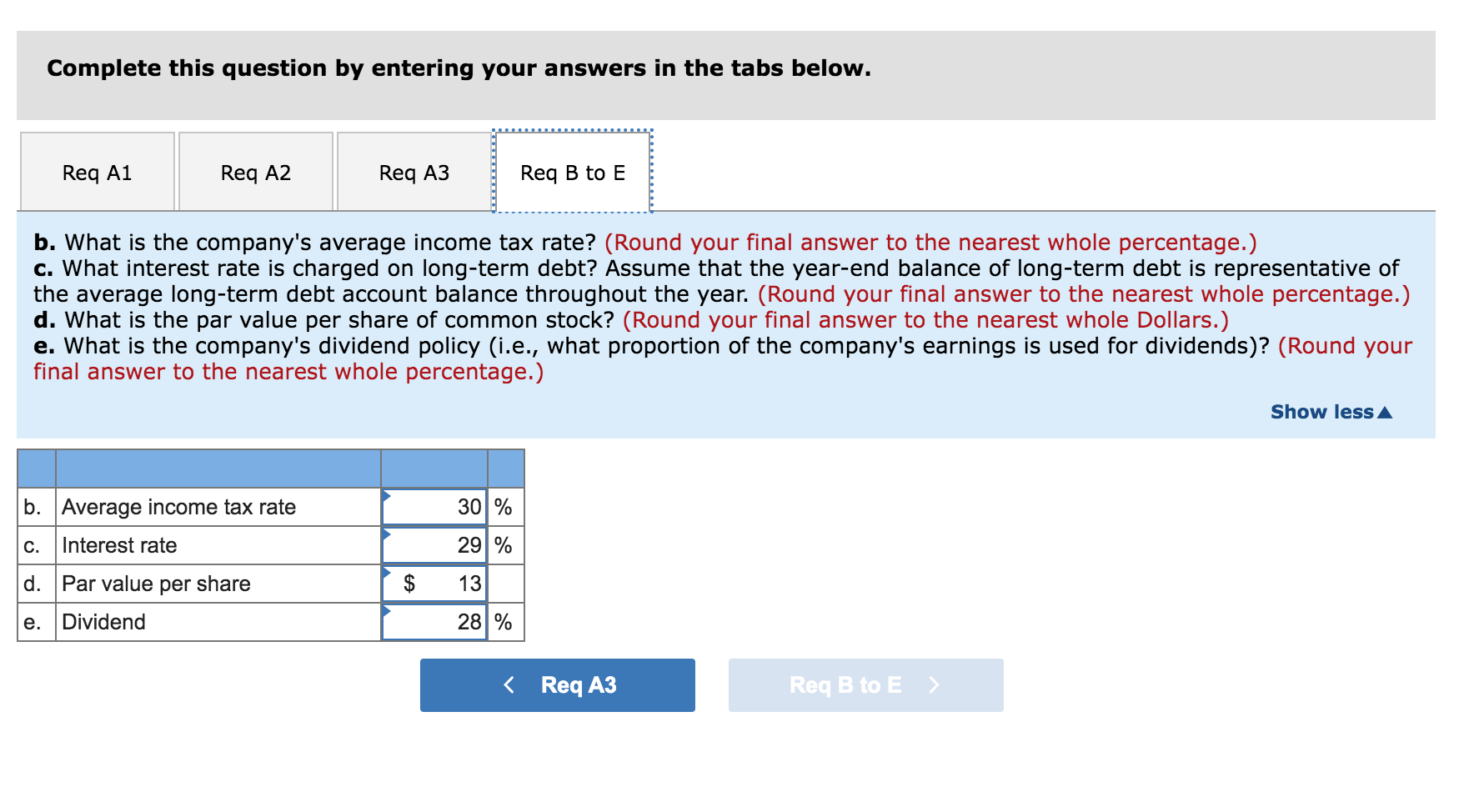

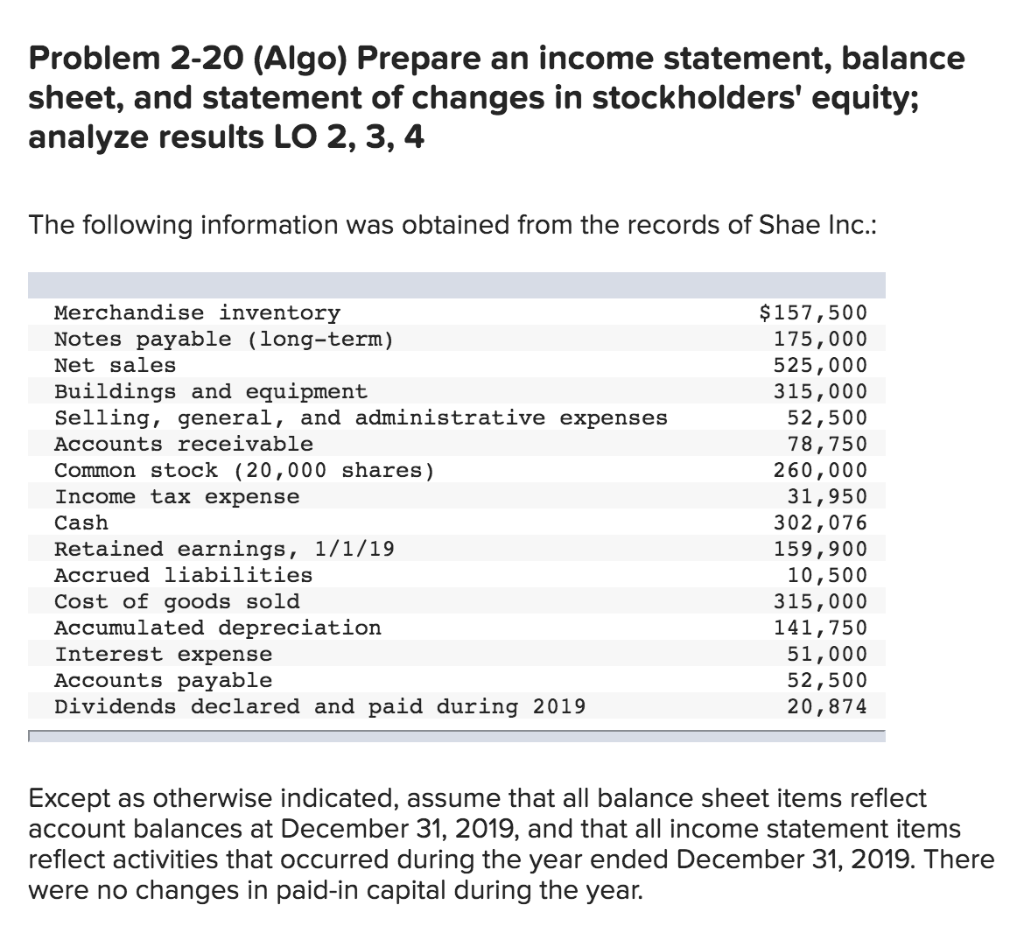

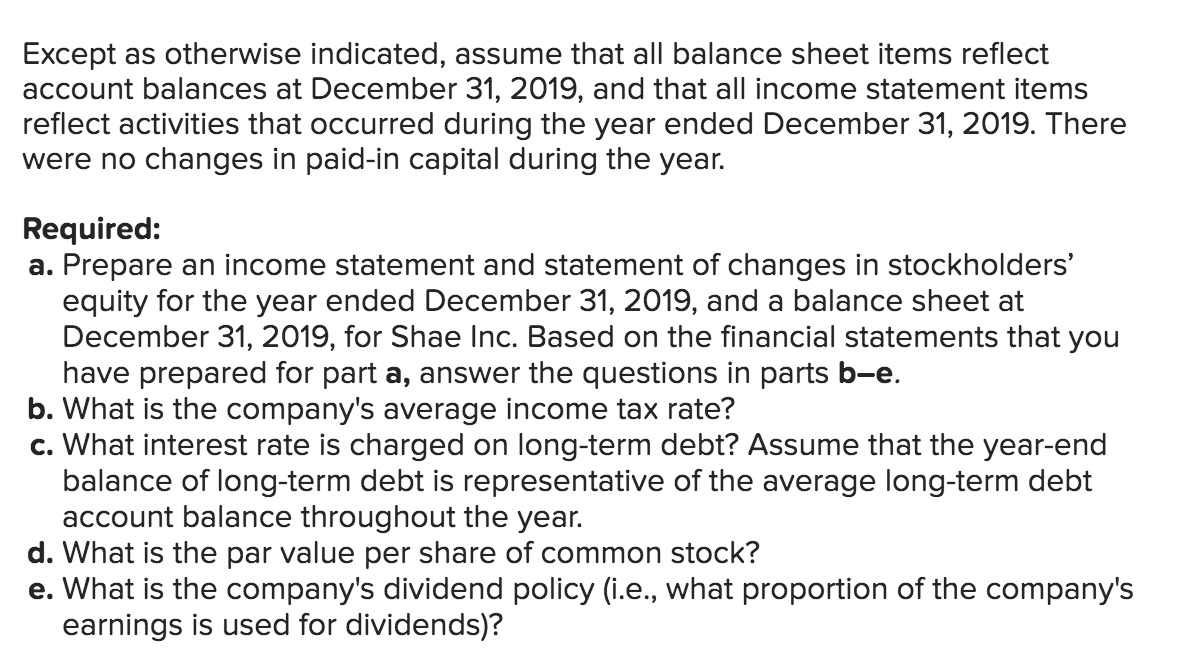

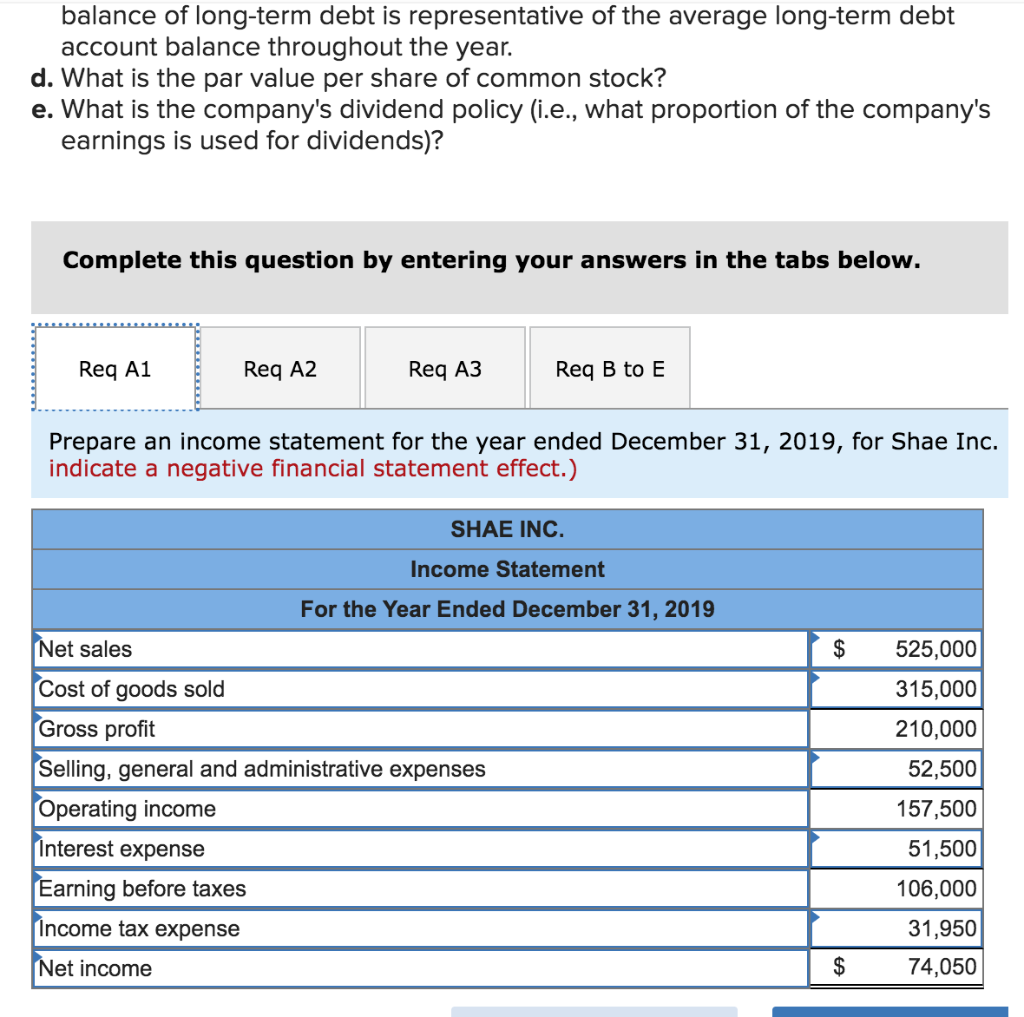

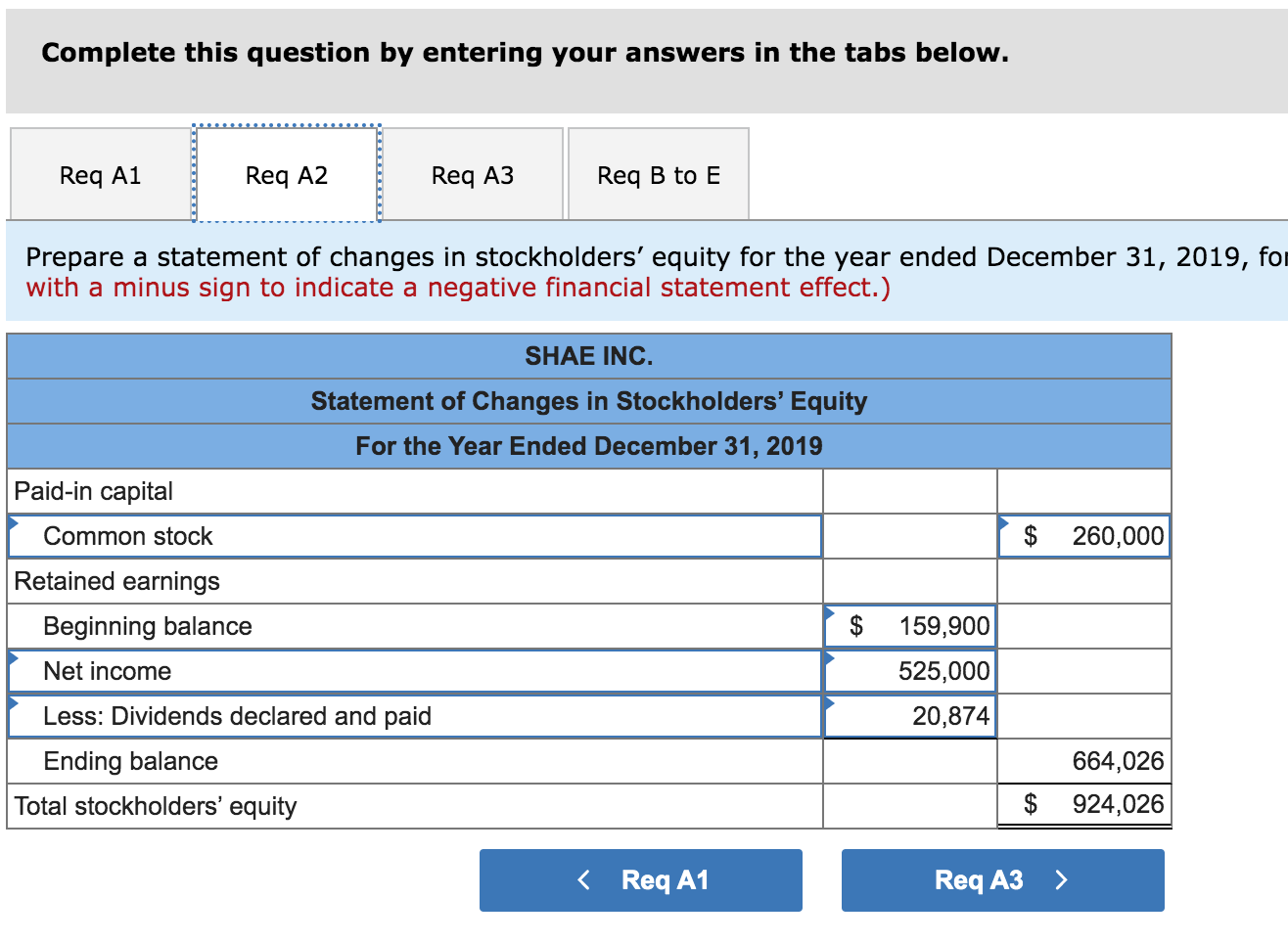

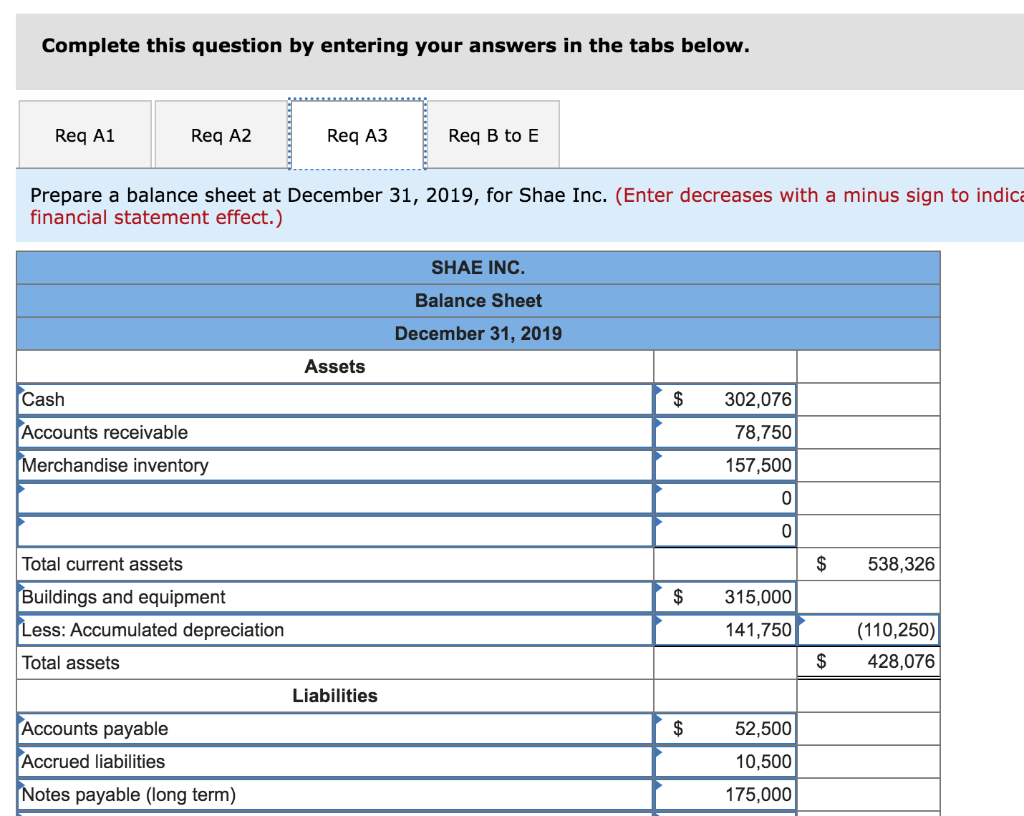

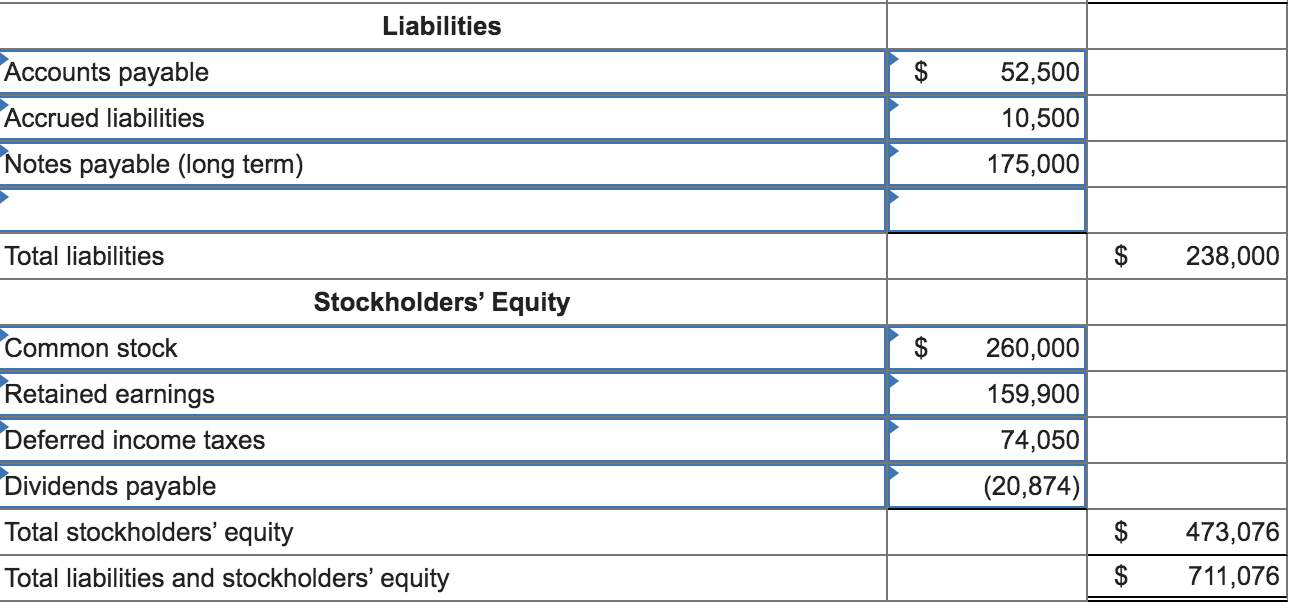

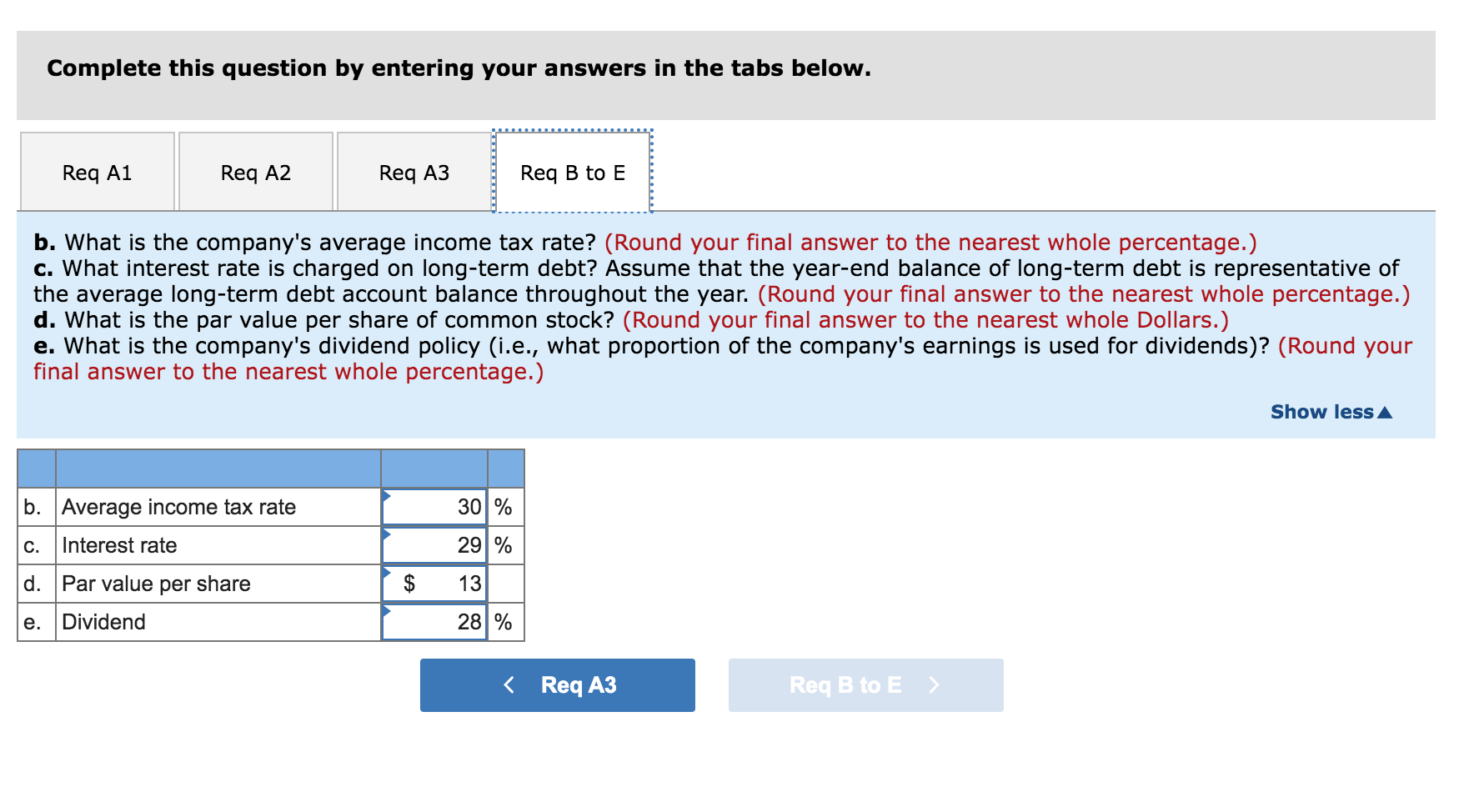

Problem 2-20 (Algo) Prepare an income statement, balance sheet, and statement of changes in stockholders' equity; analyze results LO2,3,4 The following information was obtained from the records of Shae Inc.: Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year. Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year. Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a balance sheet at December 31, 2019, for Shae Inc. Based on the financial statements that you have prepared for part a, answer the questions in parts b-e. b. What is the company's average income tax rate? c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)? balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)? Complete this question by entering your answers in the tabs below. Prepare an income statement for the year ended December 31, 2019, for Shae Inc indicate a negative financial statement effect.) Complete this question by entering your answers in the tabs below. Prepare a statement of changes in stockholders' equity for the year ended December 31, 2019, with a minus sign to indicate a negative financial statement effect.) Complete this question by entering your answers in the tabs below. Prepare a balance sheet at December 31, 2019, for Shae Inc. (Enter decreases with a minus sign to financial statement effect.) Complete this question by entering your answers in the tabs below. b. What is the company's average income tax rate? (Round your final answer to the nearest whole percentage.) c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. (Round your final answer to the nearest whole percentage.) d. What is the par value per share of common stock? (Round your final answer to the nearest whole Dollars.) e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)? (Round your final answer to the nearest whole percentage.)