Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare an Income Statement, Balance sheet, closing journal entries for the year, and adjusted trial balance from the information given above. Brad, the CFO of

Prepare an Income Statement, Balance sheet, closing journal entries for the year, and adjusted trial balance from the information given above.

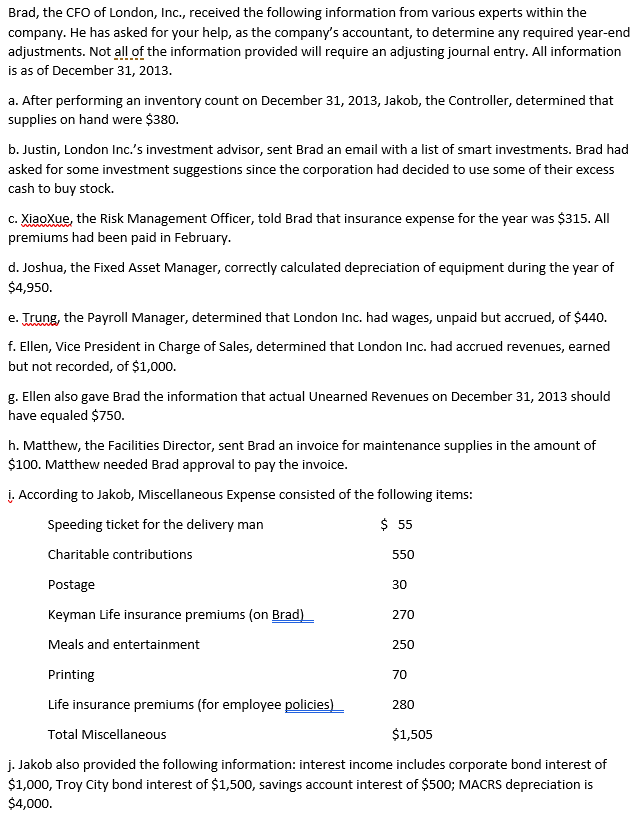

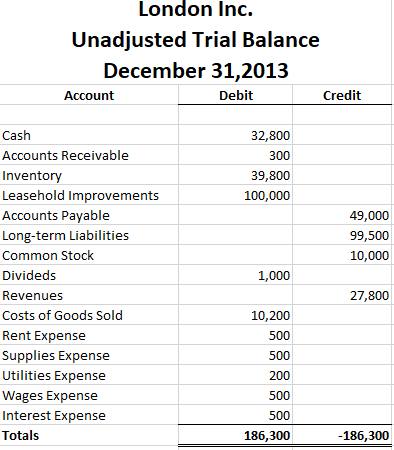

Brad, the CFO of London, Inc., received the following information from various experts within the company. He has asked for your help, as the company's accountant, to determine any required year-end adjustments. Not all of the information provided will require an adjusting journal entry. All information is as of December 31, 2013. a. After performing an inventory count on December 31, 2013, Jakob, the Controller, determined that supplies on hand were $380. b. Justin, London Inc.'s investment advisor, sent Brad an email with a list of smart investments. Brad had asked for some investment suggestions since the corporation had decided to use some of their excess cash to buy stock. c. XiaoXue, the Risk Management Officer, told Brad that insurance expense for the year was $315. All premiums had been paid in February. d. Joshua, the Fixed Asset Manager, correctly calculated depreciation of equipment during the year of $4,950. e. Trung, the Payroll Manager, determined that London Inc. had wages, unpaid but accrued, of $440. f. Ellen, Vice President in Charge of Sales, determined that London Inc. had accrued revenues, earned but not recorded, of $1,000. g. Ellen also gave Brad the information that actual Unearned Revenues on December 31, 2013 should have equaled $750. h. Matthew, the Facilities Director, sent Brad an invoice for maintenance supplies in the amount of $100. Matthew needed Brad approval to pay the invoice. 1. According to Jakob, Miscellaneous Expense consisted of the following items: Speeding ticket for the delivery man $ 55 Charitable contributions Postage Keyman Life insurance premiums (on Brad) Meals and entertainment Printing Life insurance premiums (for employee policies) 280 Total Miscellaneous $1,505 j. Jakob also provided the following information: interest income includes corporate bond interest of $1,000, Troy City bond interest of $1,500, savings account interest of $500; MACRS depreciation is $4,000. London Inc. Unadjusted Trial Balance December 31, 2013 Account Debit Credit 32,800 300 39,800 100,000 49,000 99,500 10,000 1,000 Cash Accounts Receivable Inventory Leasehold Improvements Accounts Payable Long-term Liabilities Common Stock Divideds Revenues Costs of Goods Sold Rent Expense Supplies Expense Utilities Expense Wages Expense Interest Expense Totals 27,800 10,200 500 500 200 500 500 186,300 -186,300 Brad, the CFO of London, Inc., received the following information from various experts within the company. He has asked for your help, as the company's accountant, to determine any required year-end adjustments. Not all of the information provided will require an adjusting journal entry. All information is as of December 31, 2013. a. After performing an inventory count on December 31, 2013, Jakob, the Controller, determined that supplies on hand were $380. b. Justin, London Inc.'s investment advisor, sent Brad an email with a list of smart investments. Brad had asked for some investment suggestions since the corporation had decided to use some of their excess cash to buy stock. c. XiaoXue, the Risk Management Officer, told Brad that insurance expense for the year was $315. All premiums had been paid in February. d. Joshua, the Fixed Asset Manager, correctly calculated depreciation of equipment during the year of $4,950. e. Trung, the Payroll Manager, determined that London Inc. had wages, unpaid but accrued, of $440. f. Ellen, Vice President in Charge of Sales, determined that London Inc. had accrued revenues, earned but not recorded, of $1,000. g. Ellen also gave Brad the information that actual Unearned Revenues on December 31, 2013 should have equaled $750. h. Matthew, the Facilities Director, sent Brad an invoice for maintenance supplies in the amount of $100. Matthew needed Brad approval to pay the invoice. 1. According to Jakob, Miscellaneous Expense consisted of the following items: Speeding ticket for the delivery man $ 55 Charitable contributions Postage Keyman Life insurance premiums (on Brad) Meals and entertainment Printing Life insurance premiums (for employee policies) 280 Total Miscellaneous $1,505 j. Jakob also provided the following information: interest income includes corporate bond interest of $1,000, Troy City bond interest of $1,500, savings account interest of $500; MACRS depreciation is $4,000. London Inc. Unadjusted Trial Balance December 31, 2013 Account Debit Credit 32,800 300 39,800 100,000 49,000 99,500 10,000 1,000 Cash Accounts Receivable Inventory Leasehold Improvements Accounts Payable Long-term Liabilities Common Stock Divideds Revenues Costs of Goods Sold Rent Expense Supplies Expense Utilities Expense Wages Expense Interest Expense Totals 27,800 10,200 500 500 200 500 500 186,300 -186,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started