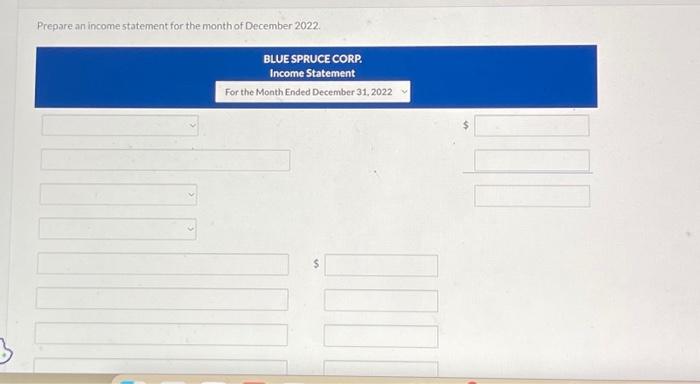

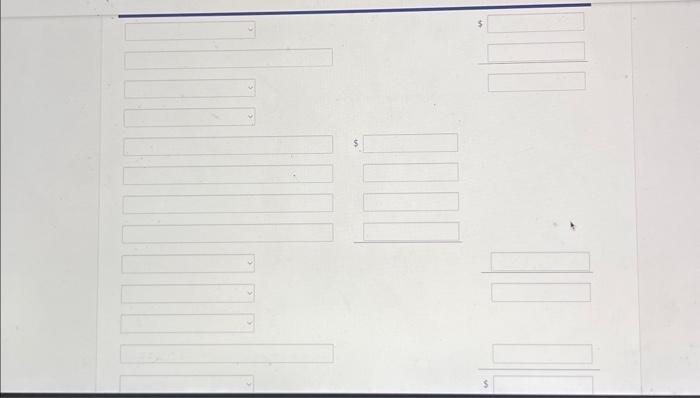

Prepare an income statement for the month of December 2022. BLUE SPRUCE CORP. Income Statement For the Month Ended December 31, 2022 LA

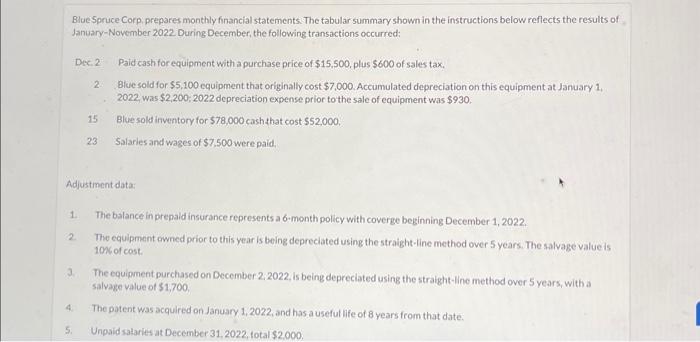

Prepare an income statement for the month of December 2022. Blue Spruce Corp, prepares monthly financial statements. The tabular summary shown in the instructions below reflects the results of January-November 2022 During December, the following transactions occurred: Dec. 2 Paid cash for equipment with a purchase price of $15,500, plus $600 of sales tax. 2. Bive sold for $5,100 equipment that originally cost $7,000. Accumulated depreciation on this equipment at January 1. 2022 , was $2,200;2022 depreciation expense prior to the sale of equipment was $930. 15 Blue sold inventory for $78,000 cash shat cost $52,000, 23 Salaries and wages of $7,500 were paid. Adjustiment data: 1. The balance in prepaid insurance represents a 6 -month policy with coverge beginning December 1,2022. 2. The equipment owned prior to this year is being depreciated using the straight-line method over 5 years. The salvage value is 100 of cost. 3. The equipment purchased on December 2, 2022, is being depreciated using the straight-line method over 5 years, with a salvage value of $1,700, 4. The patent was acquired on January 1,2022, and has a useful life of 8 years from that date. 5. Unpaid salaries at December 31,2022 , total $2.000. Prepare an income statement for the month of December 2022. Blue Spruce Corp, prepares monthly financial statements. The tabular summary shown in the instructions below reflects the results of January-November 2022 During December, the following transactions occurred: Dec. 2 Paid cash for equipment with a purchase price of $15,500, plus $600 of sales tax. 2. Bive sold for $5,100 equipment that originally cost $7,000. Accumulated depreciation on this equipment at January 1. 2022 , was $2,200;2022 depreciation expense prior to the sale of equipment was $930. 15 Blue sold inventory for $78,000 cash shat cost $52,000, 23 Salaries and wages of $7,500 were paid. Adjustiment data: 1. The balance in prepaid insurance represents a 6 -month policy with coverge beginning December 1,2022. 2. The equipment owned prior to this year is being depreciated using the straight-line method over 5 years. The salvage value is 100 of cost. 3. The equipment purchased on December 2, 2022, is being depreciated using the straight-line method over 5 years, with a salvage value of $1,700, 4. The patent was acquired on January 1,2022, and has a useful life of 8 years from that date. 5. Unpaid salaries at December 31,2022 , total $2.000