Answered step by step

Verified Expert Solution

Question

1 Approved Answer

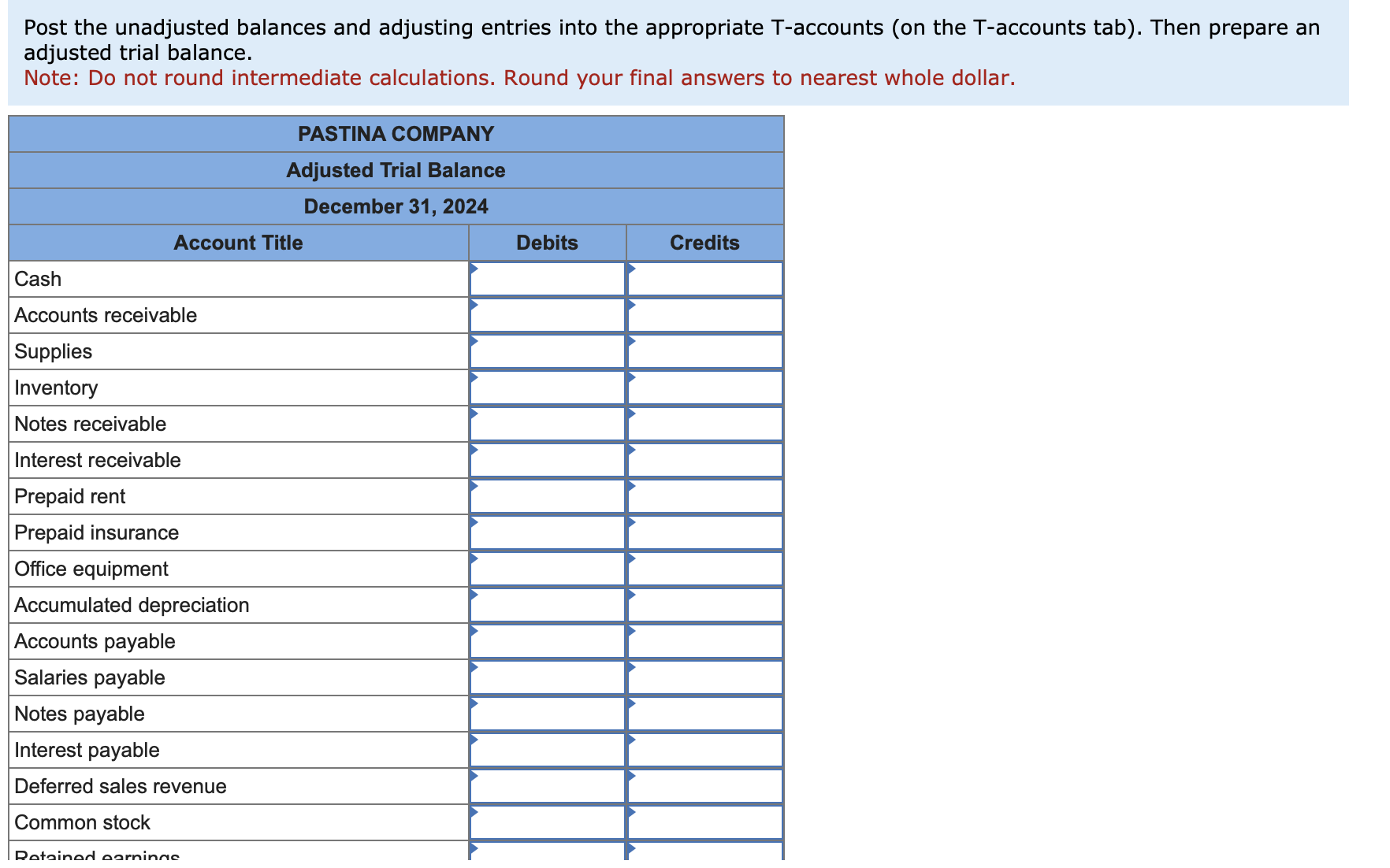

Prepare an income statement for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $5,400 in

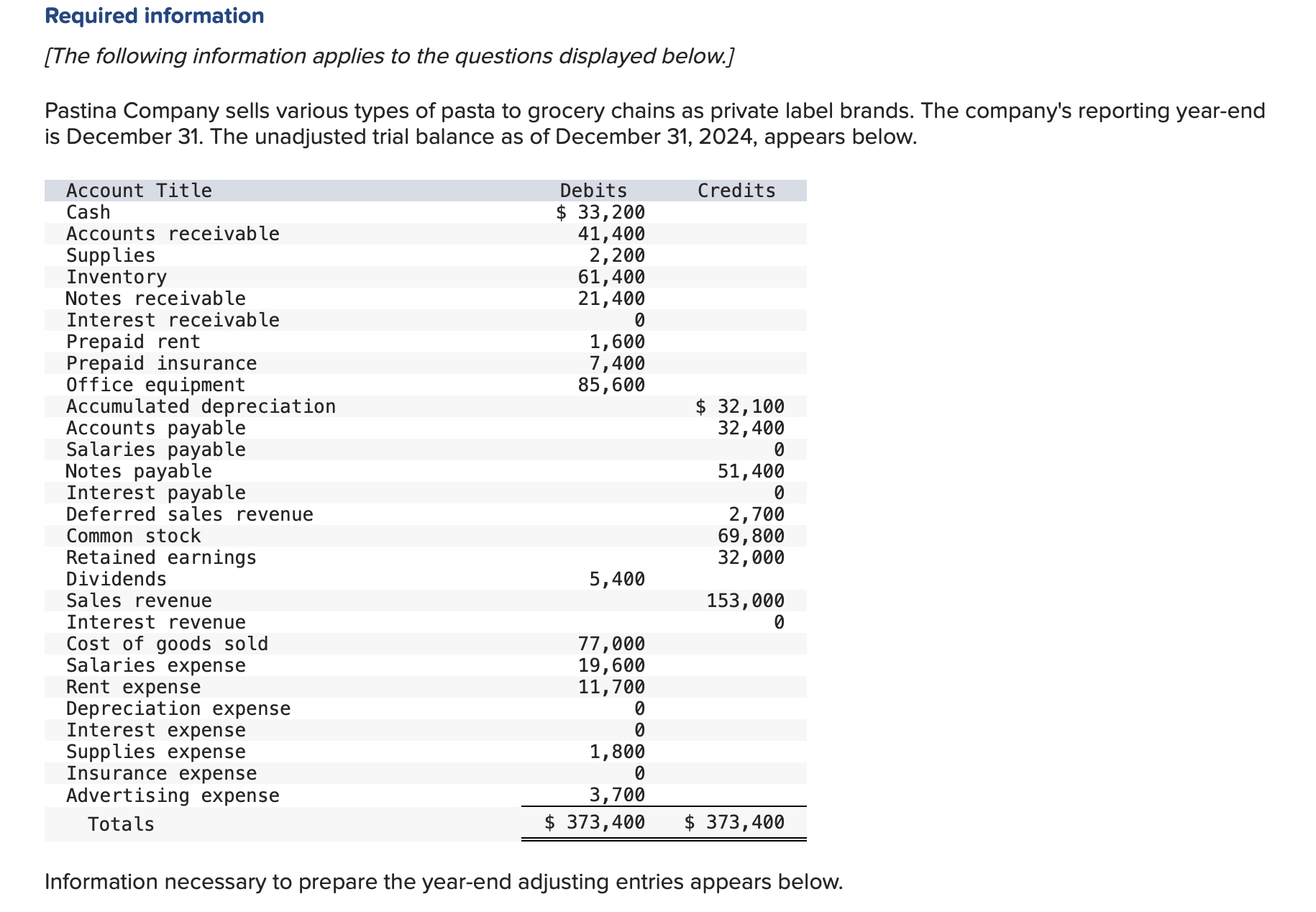

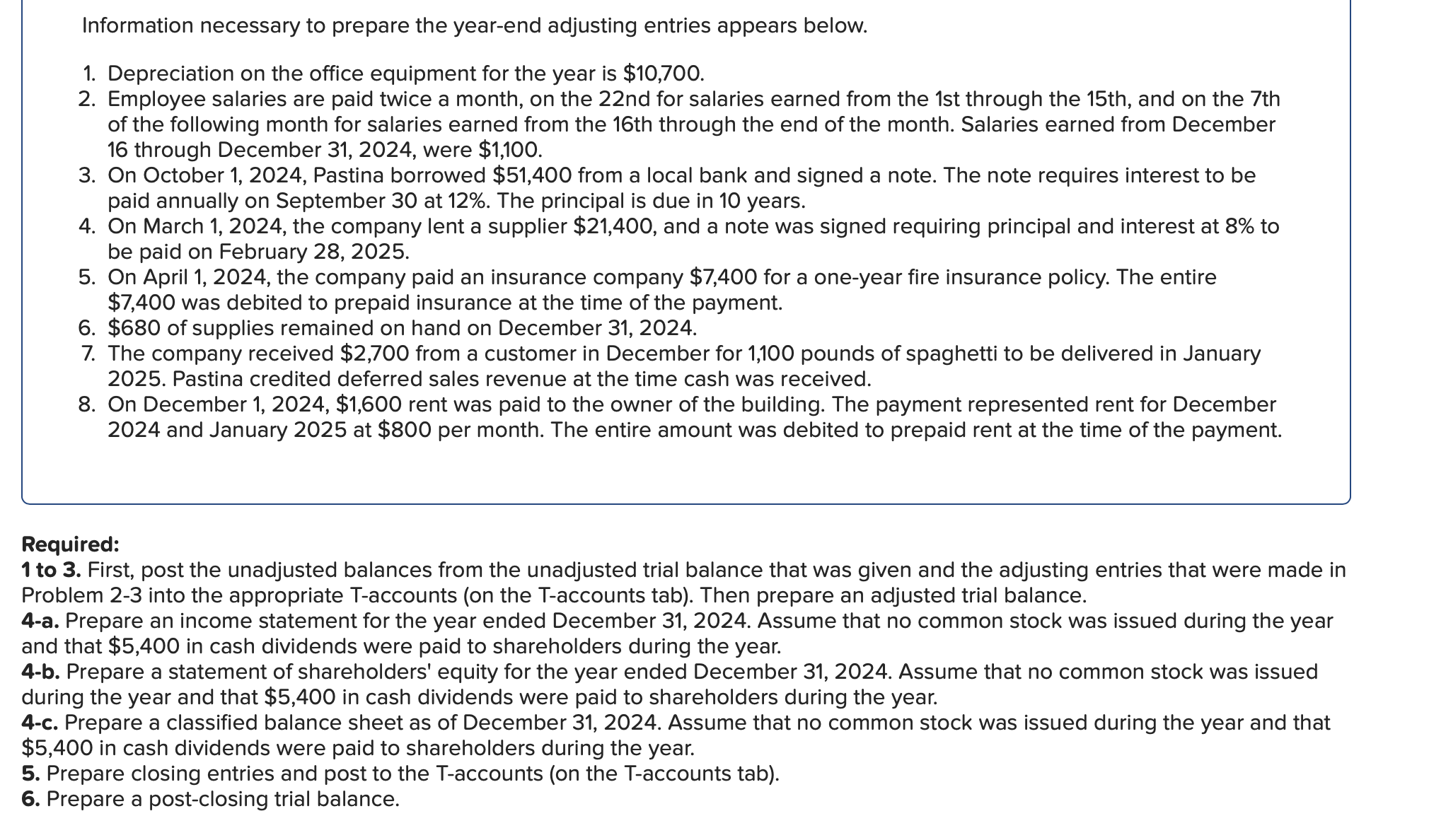

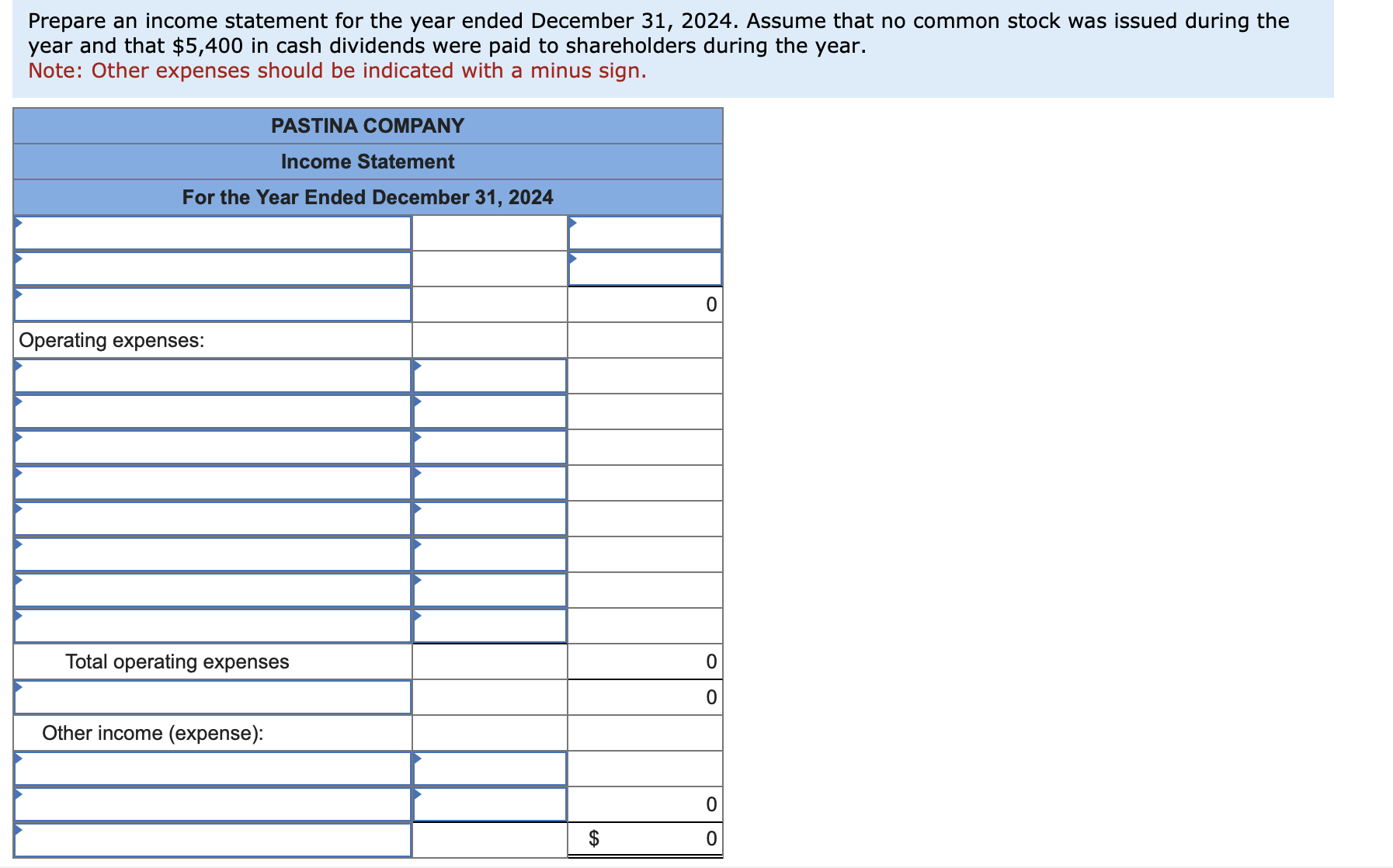

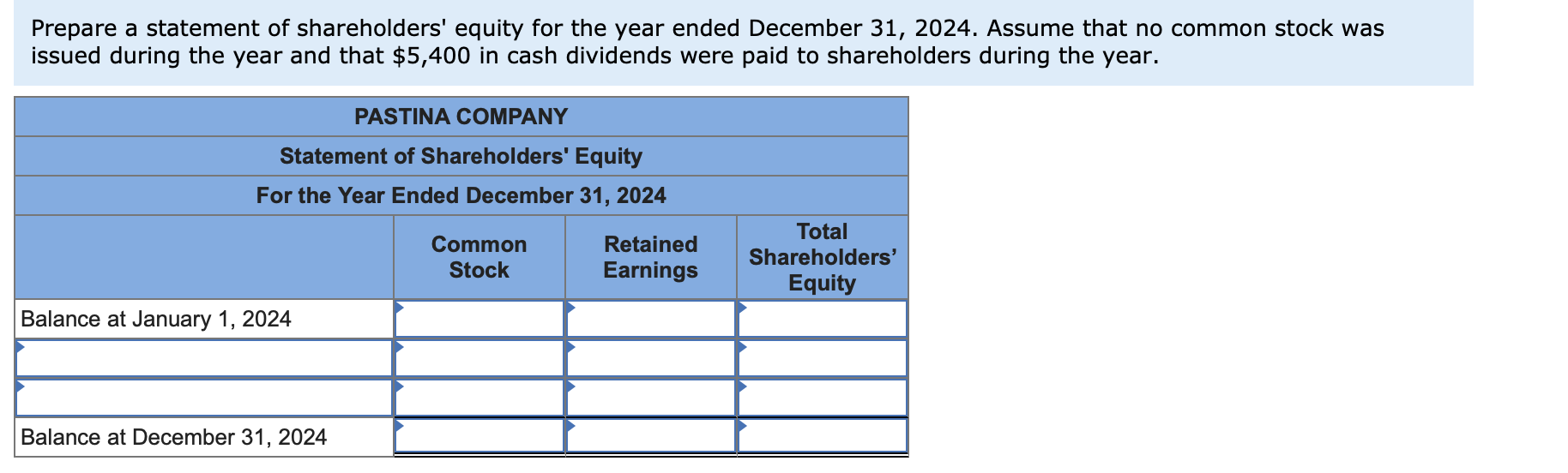

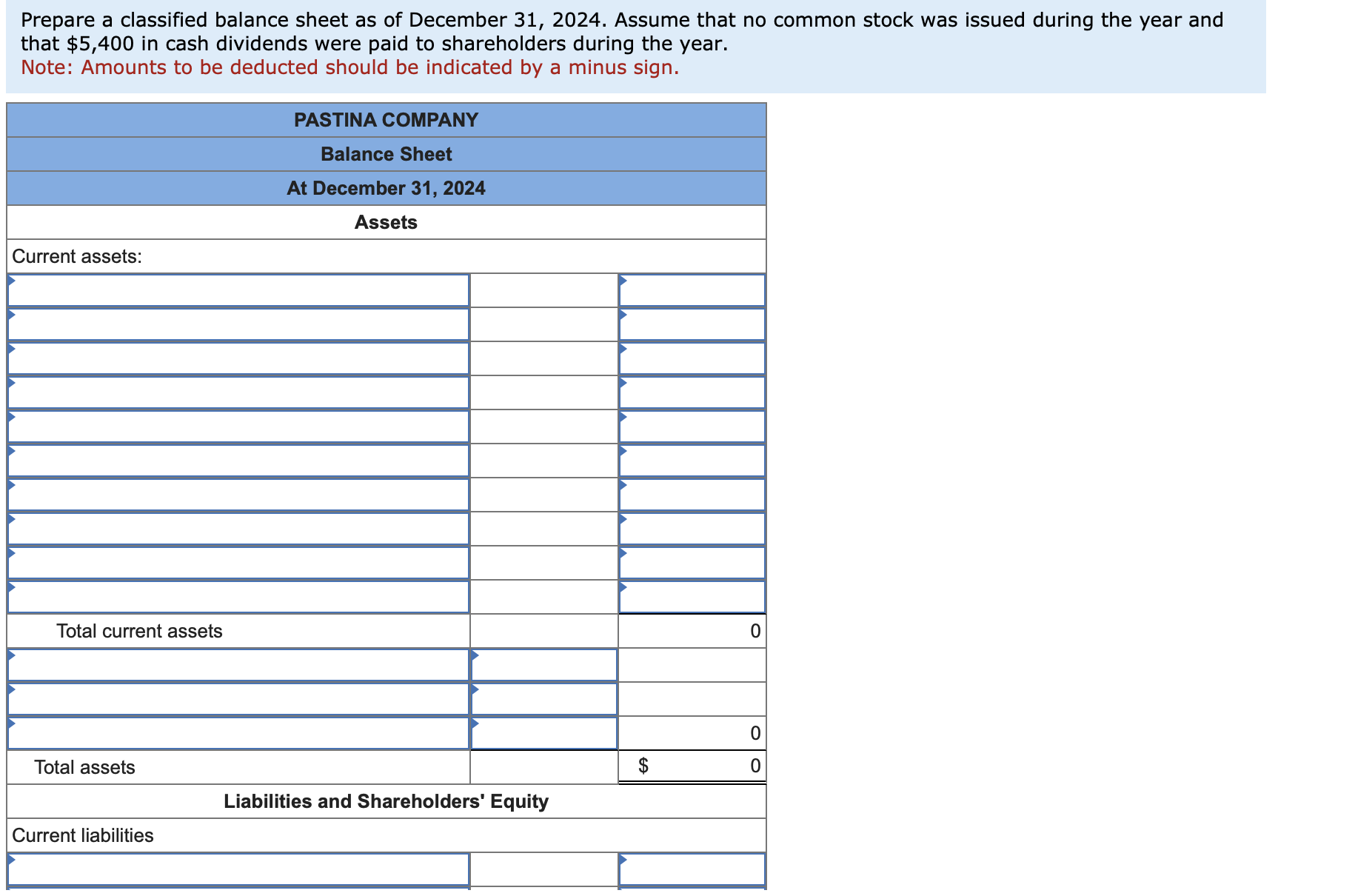

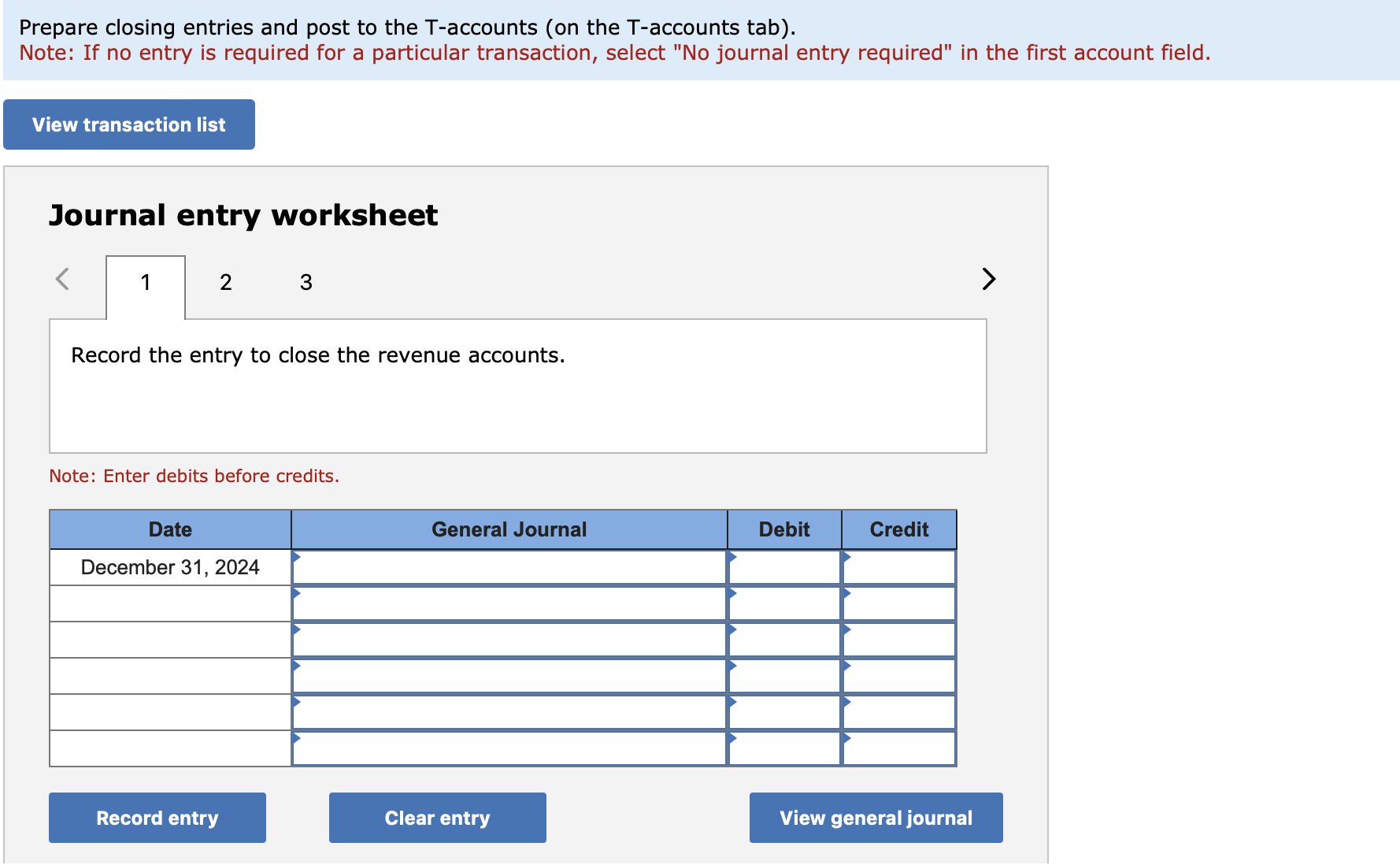

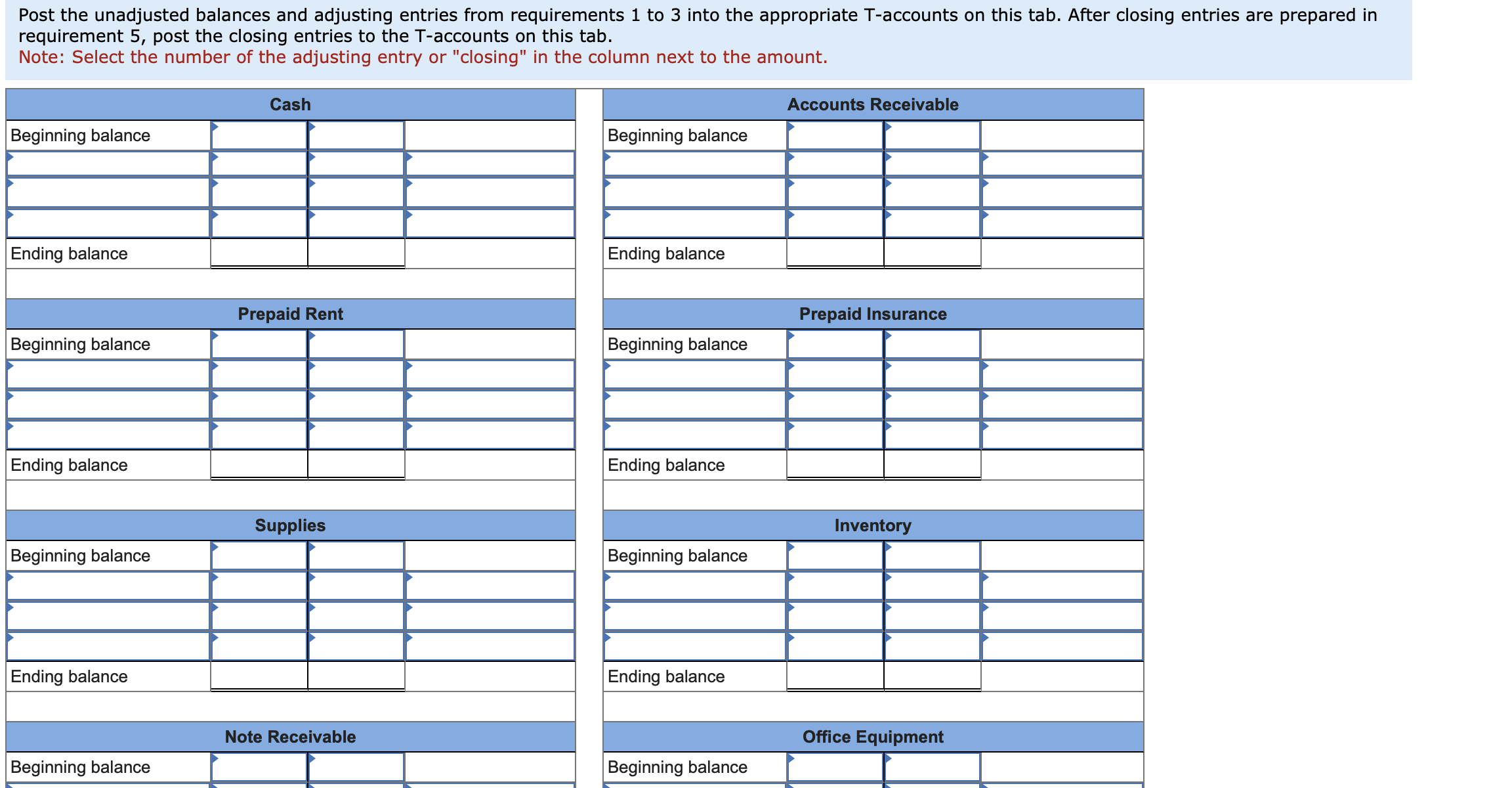

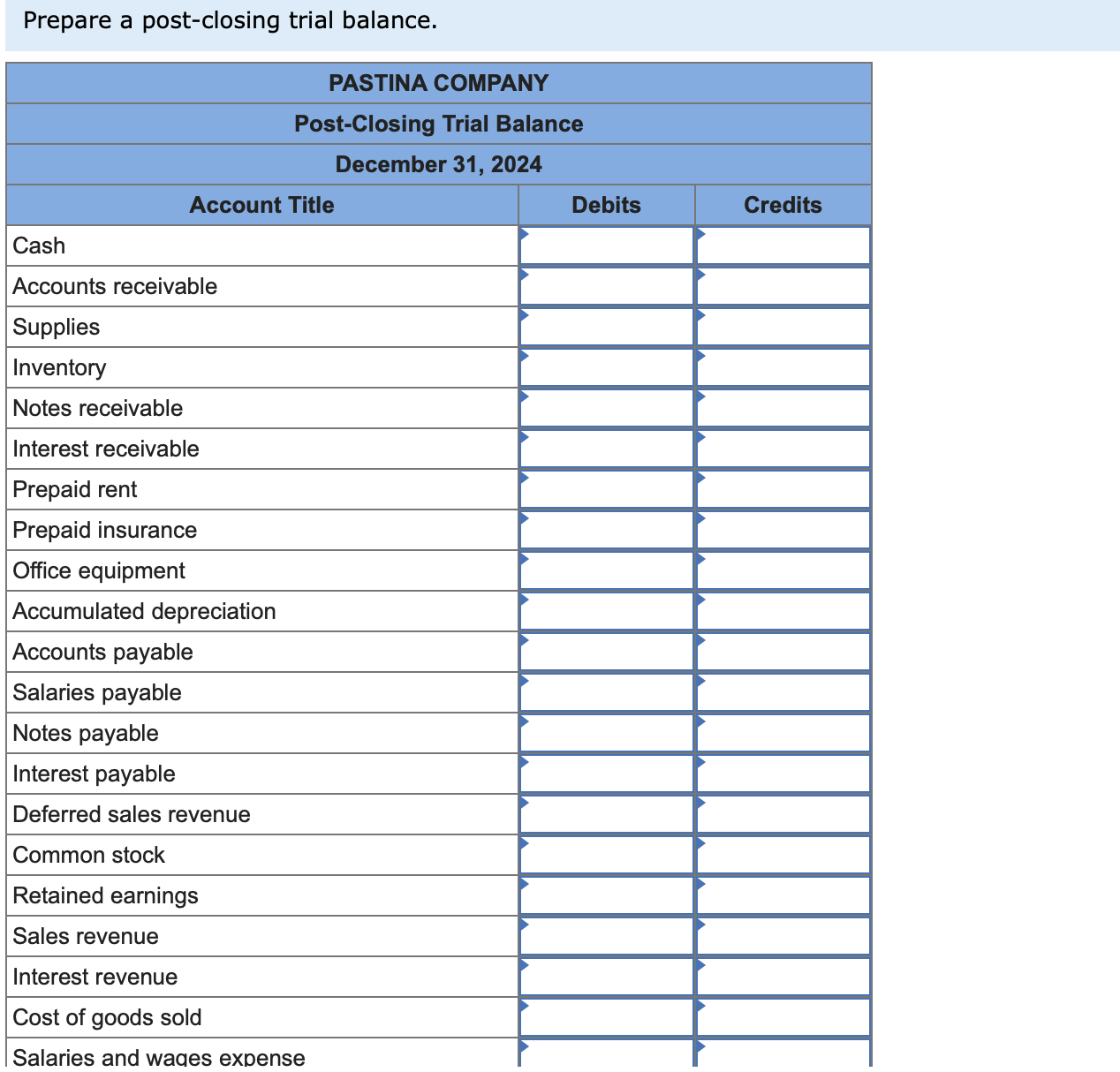

Prepare an income statement for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. Note: Other expenses should be indicated with a minus sign. Prepare a statement of shareholders' equity for the year ended December 31,2024 . Assume that no common stock was ssued during the year and that $5,400 in cash dividends were paid to shareholders during the year. Required information [The following information applies to the questions displayed below.] Pastina Company sells various types of pasta to grocery chains as private label brands. The company's reporting year-end is December 31. The unadjusted trial balance as of December 31, 2024, appears below. Information necessary to prepare the year-end adjusting entries appears below. Post the unadjusted balances and adjusting entries into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. Note: Do not round intermediate calculations. Round vour final answers to nearest whole dollar. Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5 , post the closing entries to the T-accounts on this tab. Note: Select the number of the adjusting entry or "closing" in the column next to the amount. Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare a classified balance sheet as of December 31,2024 . Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. Note: Amounts to be deducted should be indicated by a minus sign. Prepare a post-closing trial balance. Information necessary to prepare the year-end adjusting entries appears below. 1. Depreciation on the office equipment for the year is $10,700. 2. Employee salaries are paid twice a month, on the 22nd for salaries earned from the 1 st through the 15th, and on the 7 th of the following month for salaries earned from the 16th through the end of the month. Salaries earned from December 16 through December 31, 2024, were \$1,100. 3. On October 1, 2024, Pastina borrowed $51,400 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years. 4. On March 1,2024 , the company lent a supplier $21,400, and a note was signed requiring principal and interest at 8% to be paid on February 28, 2025. 5. On April 1, 2024, the company paid an insurance company $7,400 for a one-year fire insurance policy. The entire $7,400 was debited to prepaid insurance at the time of the payment. 6. $680 of supplies remained on hand on December 31, 2024. 7. The company received $2,700 from a customer in December for 1,100 pounds of spaghetti to be delivered in January 2025. Pastina credited deferred sales revenue at the time cash was received. 8. On December 1, 2024, $1,600 rent was paid to the owner of the building. The payment represented rent for December 2024 and January 2025 at $800 per month. The entire amount was debited to prepaid rent at the time of the payment. Required: 1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in Problem 2-3 into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. 4-a. Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. 4-b. Prepare a statement of shareholders' equity for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. 4-c. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. 5. Prepare closing entries and post to the T-accounts (on the T-accounts tab). 6. Prepare a post-closing trial balance

Prepare an income statement for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. Note: Other expenses should be indicated with a minus sign. Prepare a statement of shareholders' equity for the year ended December 31,2024 . Assume that no common stock was ssued during the year and that $5,400 in cash dividends were paid to shareholders during the year. Required information [The following information applies to the questions displayed below.] Pastina Company sells various types of pasta to grocery chains as private label brands. The company's reporting year-end is December 31. The unadjusted trial balance as of December 31, 2024, appears below. Information necessary to prepare the year-end adjusting entries appears below. Post the unadjusted balances and adjusting entries into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. Note: Do not round intermediate calculations. Round vour final answers to nearest whole dollar. Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5 , post the closing entries to the T-accounts on this tab. Note: Select the number of the adjusting entry or "closing" in the column next to the amount. Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare a classified balance sheet as of December 31,2024 . Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. Note: Amounts to be deducted should be indicated by a minus sign. Prepare a post-closing trial balance. Information necessary to prepare the year-end adjusting entries appears below. 1. Depreciation on the office equipment for the year is $10,700. 2. Employee salaries are paid twice a month, on the 22nd for salaries earned from the 1 st through the 15th, and on the 7 th of the following month for salaries earned from the 16th through the end of the month. Salaries earned from December 16 through December 31, 2024, were \$1,100. 3. On October 1, 2024, Pastina borrowed $51,400 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years. 4. On March 1,2024 , the company lent a supplier $21,400, and a note was signed requiring principal and interest at 8% to be paid on February 28, 2025. 5. On April 1, 2024, the company paid an insurance company $7,400 for a one-year fire insurance policy. The entire $7,400 was debited to prepaid insurance at the time of the payment. 6. $680 of supplies remained on hand on December 31, 2024. 7. The company received $2,700 from a customer in December for 1,100 pounds of spaghetti to be delivered in January 2025. Pastina credited deferred sales revenue at the time cash was received. 8. On December 1, 2024, $1,600 rent was paid to the owner of the building. The payment represented rent for December 2024 and January 2025 at $800 per month. The entire amount was debited to prepaid rent at the time of the payment. Required: 1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in Problem 2-3 into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. 4-a. Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. 4-b. Prepare a statement of shareholders' equity for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. 4-c. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $5,400 in cash dividends were paid to shareholders during the year. 5. Prepare closing entries and post to the T-accounts (on the T-accounts tab). 6. Prepare a post-closing trial balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started