Answered step by step

Verified Expert Solution

Question

1 Approved Answer

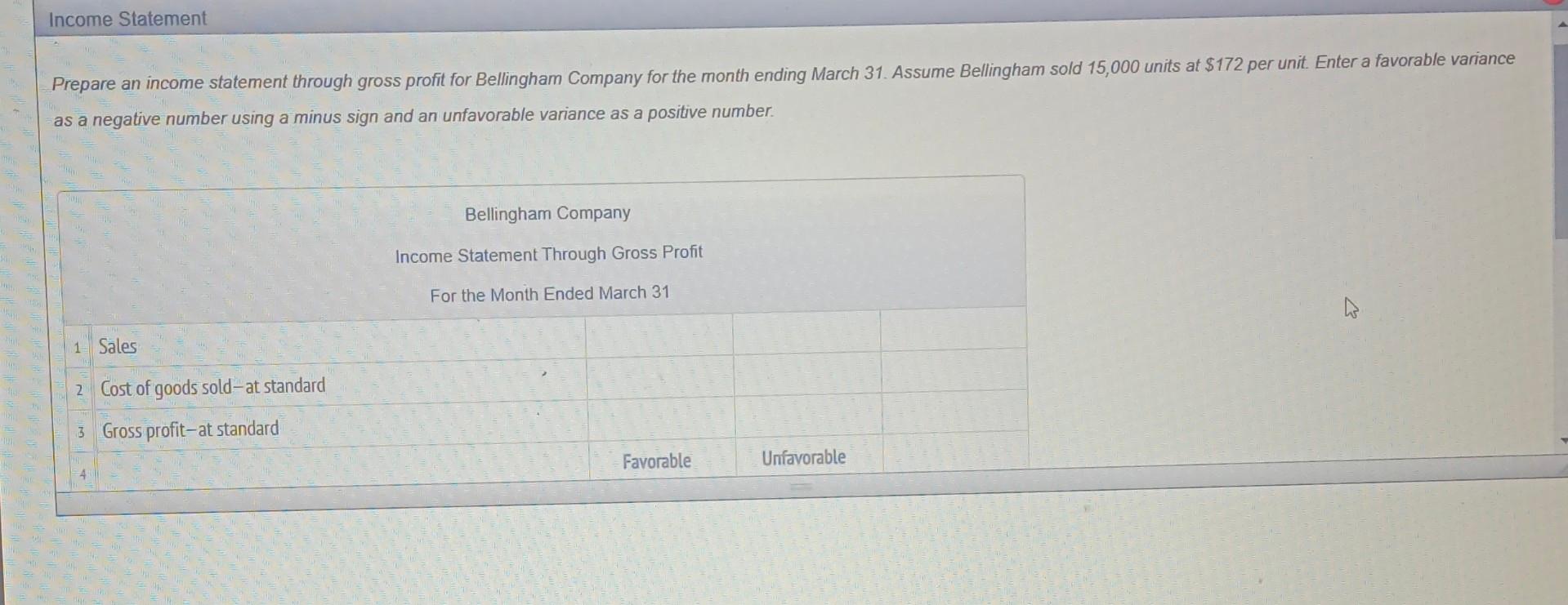

Prepare an income statement through gross profit for Bellingham Company for the month ending March 31. Assume Bellingham sold 15,000 units at $172 per unit.

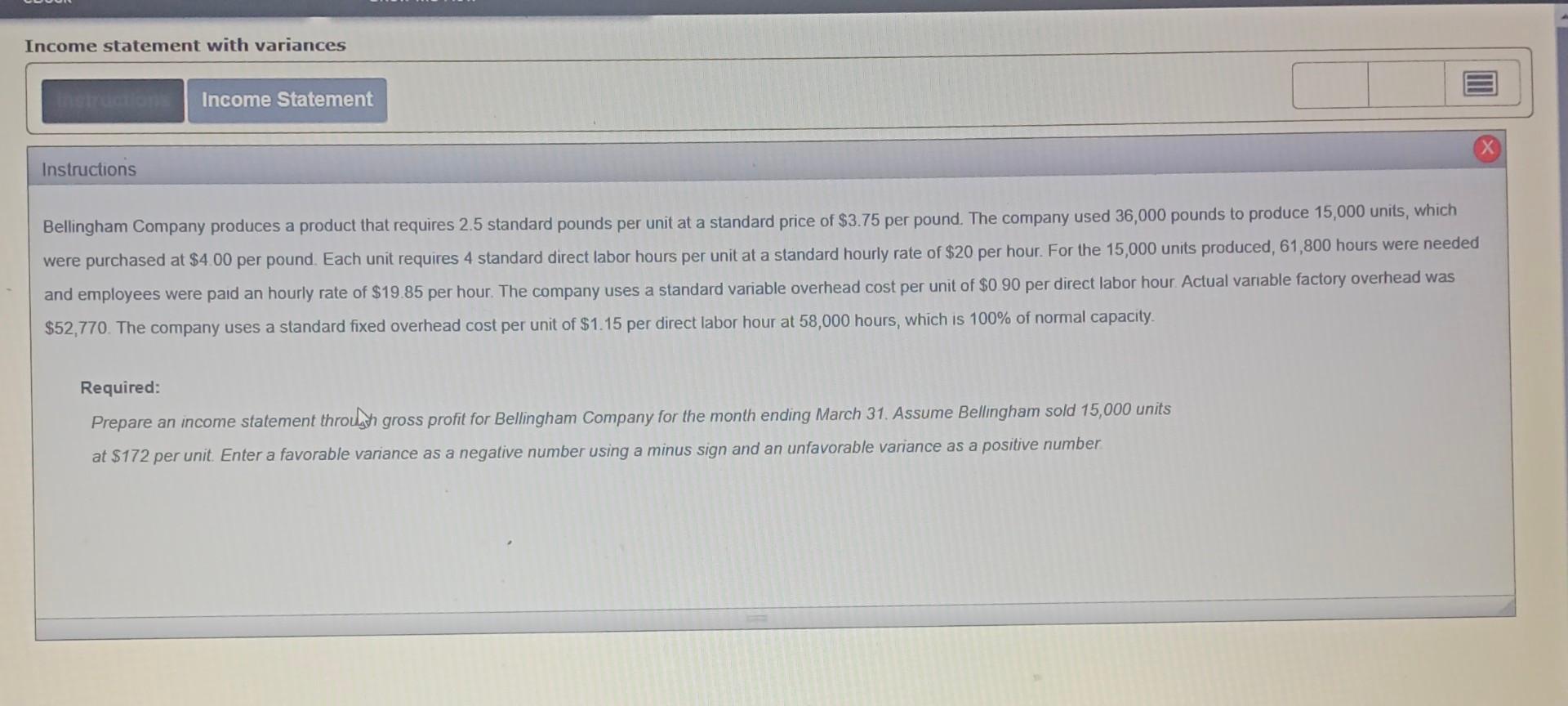

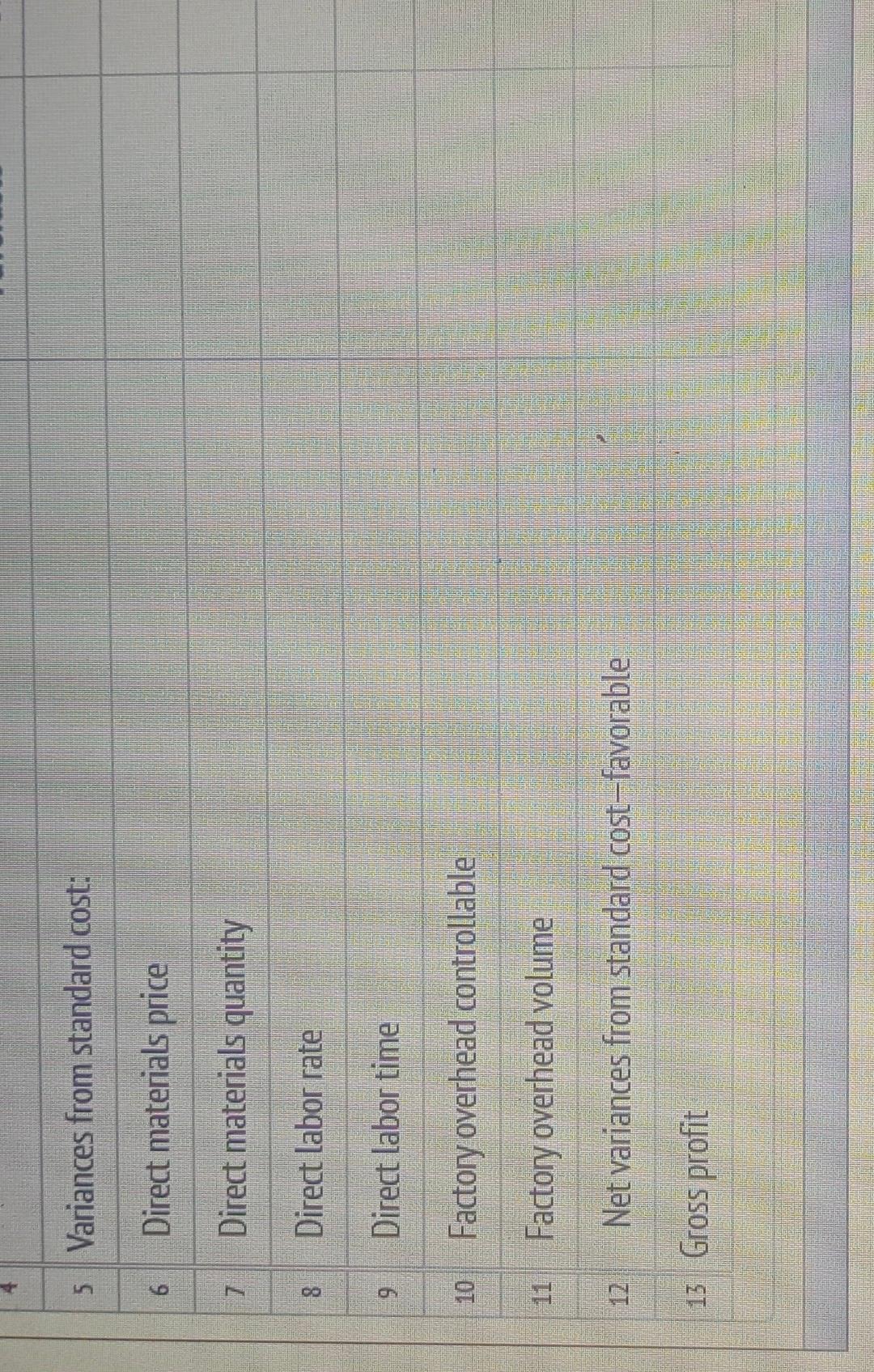

Prepare an income statement through gross profit for Bellingham Company for the month ending March 31. Assume Bellingham sold 15,000 units at $172 per unit. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Income statement with variances Instructions Bellingham Company produces a product that requires 2.5 standard pounds per unit at a standard price of $3.75 per pound. The company used 36,000 pounds to produce 15,000 units, which were purchased at $4.00 per pound. Each unit requires 4 standard direct labor hours per unit at a standard hourly rate of $20 per hour. For the 15,000 units produced, 61,800 hours were needed and employees were paid an hourly rate of $19.85 per hour. The company uses a standard variable overhead cost per unit of $090 per direct labor hour. Actual variable factory overhead was $52,770. The company uses a standard fixed overhead cost per unit of $1.15 per direct labor hour at 58,000 hours, which is 100% of normal capacity. Required: Prepare an income statement througth gross profit for Bellingham Company for the month ending March 31. Assume Bellingham sold 15,000 units at $172 per unit. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number 5 Variances from standard cost: 6 Direct materials price 7 Direct materials quantity 8 Direct labor rate 9 Direct labor time 10 Factory overhead controllable 11 Factory overhead volume 12 Net variances from standard cost-favorable 13 Gross profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started