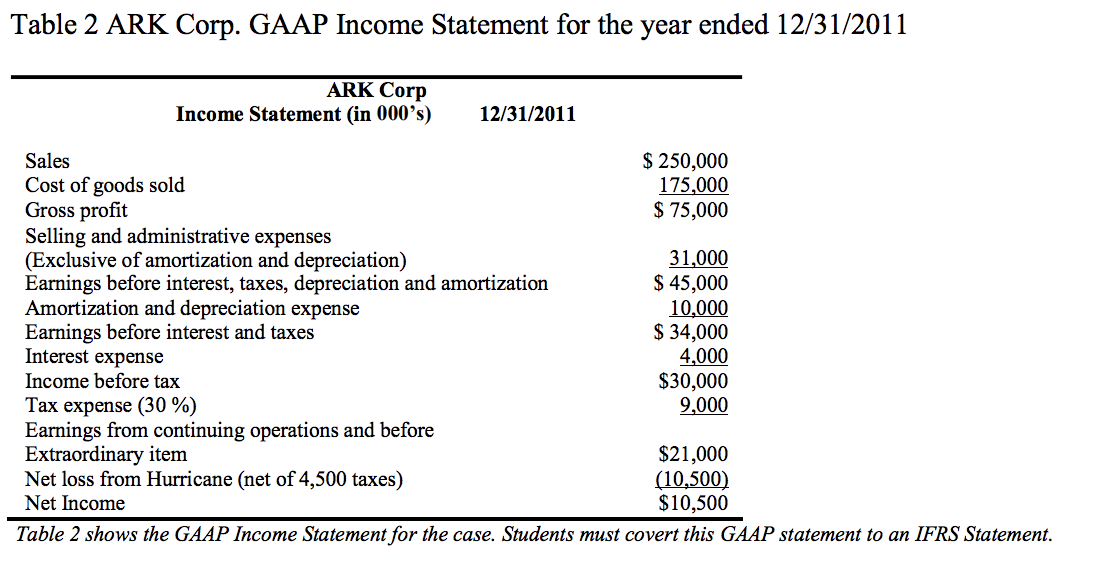

Question

Prepare an income statement under IFRS for year 1. Assume that the net income remains the same under IFRS as it does for GAAP and

Prepare an income statement under IFRS for year 1.

Assume that the net income remains the same under IFRS as it does for GAAP and any difference is reconciled in the tax expense and tax payable accounts.

ADJUSTING ENTRIES YEAR 1 TO CONFORM TO IFRS

1- Dr. Leased Asset-Financing Lease: 26,730

Cr. Minimum Lease Obligation-Financing Lease: 26,730

To record capitalization of the lease

2- Dr. Depreciation Expense: 8,910

Cr. Accumulated Depreciation: 8,910

To record depreciation expense on the capitalized lease

3- Dr. Interest Expense: 1,604

Dr. Minimum Lease Obligation-Financing Lease: 8,396

Cr. Rent expense/Selling and Administrative expense:10,000

To adjust lease from operating to capital/financing

4- Dr. Minimum Lease Obligation-Financing lease: 18,334

Cr. Minimum Lease Obligation-Financing lease -Current liability: 8,900

Cr. Minimum Lease Obligation-Financing lease -Long Term Liability: 9,434

To correctly classify the Minimum Lease Obligation to its liability term components

5- Dr. Selling and Administrative Expense: 15,000

Cr.- Extraordinary Item: 15,000

To reclassify extraordinary item as an operating expense

This is calculated by the extraordinary loss , shown net of taxes of 10,500 divided by 1 less the tax rate of 30 percent, or 0.7, which yields a before tax loss of 15,000.

The reclassification of the extraordinary loss is shown before tax (10,500+ 4,500)

6- Dr. Tax Payable 514

Cr. Tax Expense 514

To reconcile a net income total of $10,500; an amount equal to the GAAP reported total.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started