Answered step by step

Verified Expert Solution

Question

1 Approved Answer

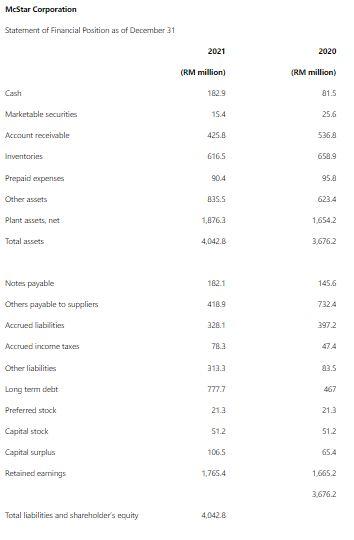

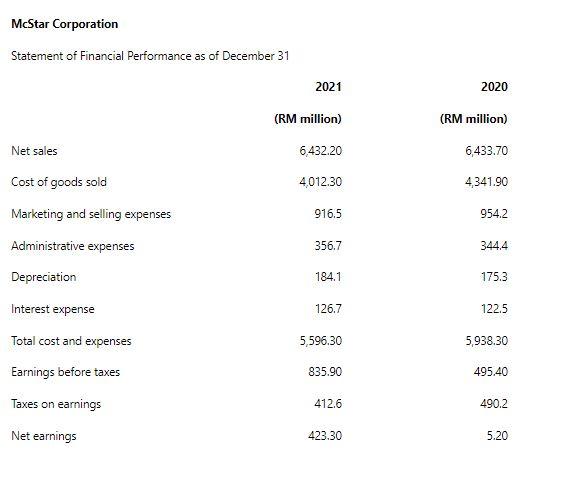

Prepare and analyze the statement of cash flows for McStar Corporation for the year 2021. McStar Corporation Statement of Financial Position as of December 31

Prepare and analyze the statement of cash flows for McStar Corporation for the year 2021.

McStar Corporation Statement of Financial Position as of December 31 2021 2020 (RM million) (RM million) Cash 182.9 81.5 Marketable securities 15.4 25.6 Account receivable 425.6 536.8 Inventories 616.5 658.9 Prepaid expenses 90.4 95.a Other assets Bass 623.4 Plant assets, net 1,876.a 1.654.2 Total assets 4,042.8 3,676.2 Nates payable 182.1 145.6 Others payable to suppliers 418.9 732.4 Accrued liabilities 228.1 3972 Accrued income taxes 78.3 47.4 Other liabilities 31.3 23.5 Long term debat 7777 467 Preferred stock 21.3 213 Capital stock 512 51.2 Capital surplus 106.5 654 Retained earnings 1,765.4 1,6652 3.676.2 Total liabilities and shareholder's mouity 4,042.8 McStar Corporation Statement of Financial Performance as of December 31 2021 2020 (RM million) (RM million) 6,432.20 6,433.70 Net sales Cost of goods sold 4012.30 4341.90 916.5 954.2 Marketing and selling expenses Administrative expenses 356.7 344,4 Depreciation 184.1 175.3 126.7 122.5 Interest expense Total cost and expenses Earnings before taxes 5,596.30 5,938.30 835.90 495.40 Taxes on earnings 412.6 490.2 Net earnings 423.30 5.20 McStar Corporation Statement of Financial Position as of December 31 2021 2020 (RM million) (RM million) Cash 182.9 81.5 Marketable securities 15.4 25.6 Account receivable 425.6 536.8 Inventories 616.5 658.9 Prepaid expenses 90.4 95.a Other assets Bass 623.4 Plant assets, net 1,876.a 1.654.2 Total assets 4,042.8 3,676.2 Nates payable 182.1 145.6 Others payable to suppliers 418.9 732.4 Accrued liabilities 228.1 3972 Accrued income taxes 78.3 47.4 Other liabilities 31.3 23.5 Long term debat 7777 467 Preferred stock 21.3 213 Capital stock 512 51.2 Capital surplus 106.5 654 Retained earnings 1,765.4 1,6652 3.676.2 Total liabilities and shareholder's mouity 4,042.8 McStar Corporation Statement of Financial Performance as of December 31 2021 2020 (RM million) (RM million) 6,432.20 6,433.70 Net sales Cost of goods sold 4012.30 4341.90 916.5 954.2 Marketing and selling expenses Administrative expenses 356.7 344,4 Depreciation 184.1 175.3 126.7 122.5 Interest expense Total cost and expenses Earnings before taxes 5,596.30 5,938.30 835.90 495.40 Taxes on earnings 412.6 490.2 Net earnings 423.30 5.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started