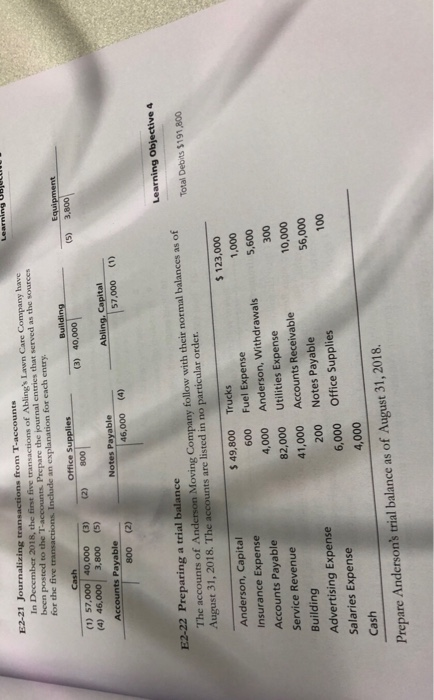

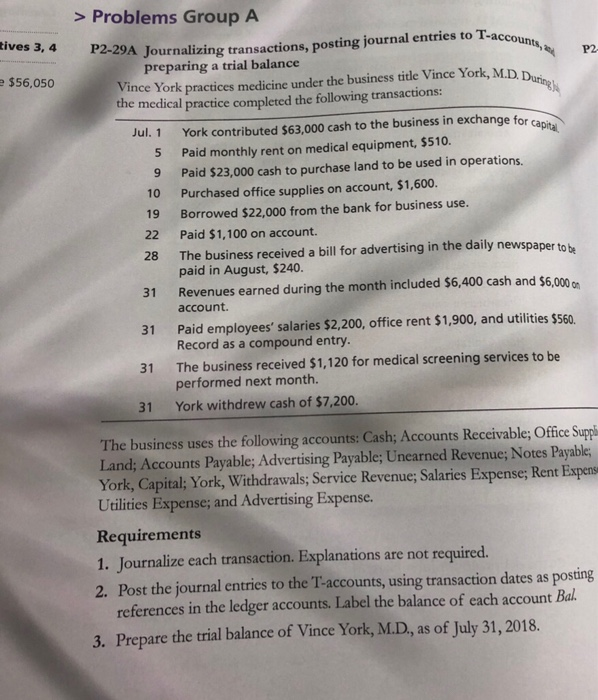

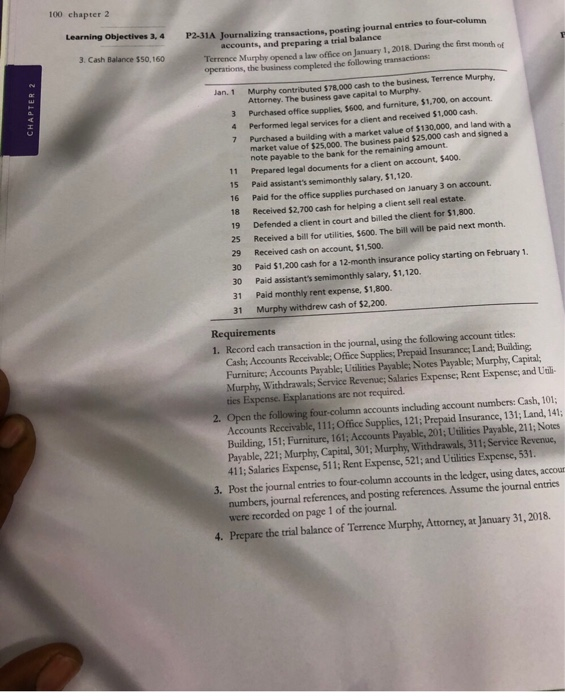

Prepare Anderson's trial balance as of August 31, 2018. 000 Cash Office Supplies 000 Notes Payable Accounts Receivable 000'L Utilities Expense 000'28 Anderson, Withdrawals 000' Fuel Expense 009 008'6 $ Trucks 00L 000'9 Salaries Expense 000'9s Advertising Expense 000 0L Building 000 Service Revenue 009's Accounts Payable 000'L Insurance Expense $ 123,000 Anderson, Capital pro rnaned ou ur pais re siunoode , 810 'Isniny The accounts of Anderson Moving Company follow with their normal balances as of Learning Objective 4 E2-22 Preparing 000'LS 000'9 qeked sazON (L) (z) 008 (s) 000'9 () 000'0 000'Ls () 008'E (S) 000'0 (E) 008 (2) (E) nus pes og uoprurdxa ue apnpu uogpesun ang ap Joy s3oumos ap se pasuas iep somus eunol aup auedaad saunoaoe-I, a os paasod uaaq aey Aueduo ar r uy o suogoesun asg asag p 102 quoac u saunoaoe-L wo suopoesuen upzgeuanof 1z-z Buuea > Problems Group A P2-29A Journalizing transactions, posting journal entries to T-accounts, preparing a trial balance Vince York practices medicine under the business title Vince York, M.D. During) tives 3, 4 P2 e $56,050 the medical practice completed the following transactions: York contributed $63,000 cash to the business in exchange for capital Jul. 1 Paid monthly rent on medical equipment, $510. Paid $23,000 cash to purchase land to be used in operations. Purchased office supplies on account, $1,600. 10 Borrowed $22,000 from the bank for business use. 19 22 Paid $1,100 on account. The business received a bill for advertising in the daily newspaper to b paid in August, $240. Revenues earned during the month included $6,400 cash and $6,000e account. 28 31 Paid employees' salaries $2,200, office rent $1,900, and utilities $560 31 Record as a compound entry The business received $1,120 for medical screening services to be performed next month. 31 York withdrew cash of $7,200. 31 The business uses the following accounts: Cash; Accounts Receivable; Office Suppl Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; York, Capital; York, Withdrawals; Service Revenue; Salaries Expense; Rent Expens Utilities Expense; and Advertising Expense. Requirements 1. Journalize each transaction. Explanations 2. Post the journal entries to the T-accounts, using transaction dates as posting references in the ledger required. are not accounts. Label the balance of each account Bal 3. Prepare the trial balance of Vince York, M.D., as of July 31, 2018. on m 100 chapter 2 Learning Objectives 3, 4 P2-31A Journalizing transactions, posting journal entries to four-column accounts, and preparing a trial balance Terrence Murphy opened a law office on January 1, 2018. During the first month of operations, the business completed the following transactions 3. Cash Balance $50,160 Murphy contributed $78,000 cash to the business, Terrence Murphy Attorney. The business gave capital to Murphy Purchased office supplies, $600, and furniture, $1,700, on account. Jan. 1 Performed legal services for a client and received $1,000 cash. Purchased a building with a market value of $130,000, and land with a market value of $25,000. The business paid $25,000 cash and signed a note payable to the bank for the remaining amount. 4 Prepared legal documents for a client on account, $400. Paid assistant's semimonthly salary, $1,120. Paid for the office supplies purchased on January 3 on account. Received $2,700 cash for helping a client sell real estate. Defended a client in court and billed the client for $1,800. 11 15 16 18 19 Received a bill for utilities, $600. The bill will be paid next month. Received cash on account, $1,500. 25 29 Paid $1,200 cash for a 12-month insurance policy starting on February 1. Paid assistant's semimonthly salary, $1,120. Paid monthly rent expense, $1,800. Murphy withdrew cash of $2,200. 30 31 31 Requirements 1. Record cach transaction in the journal, using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Building Furniture; Accounts Payable; Utilities Payable; Notes Payable; Murphy, Capital; Murphy, Withdrawals; Service Rcvenue; Salaries Expense; Rent Expense; and Utli- ties Expense. Explanations are not required. 2. Open the following four-column accounts including account numbers: Cash, 101; Accounts Receivable, 111; Office Supplies, 121; Prepaid Insurance, 131; Land, 141; Building, 151; Furniture, 161; Accounts Payable, 201; Utilities Payable, 211; Notes Payable, 221; Murphy, Capital, 301; Murphy, Withdrawals, 311; Service Revenuc, 411; Salaries Expense, 511; Rent Expense, 521; and Utilities Expense, 531. 3. Post the journal entries to four-column accounts in the ledger, using dates, accour numbers, journal references, and posting references. Assume the journal entries were recorded on page 1 of the journal. 4. Prepare the trial balance of Terrence Murphy, Attorney, at January 31, 2018. z 3PT