Answered step by step

Verified Expert Solution

Question

1 Approved Answer

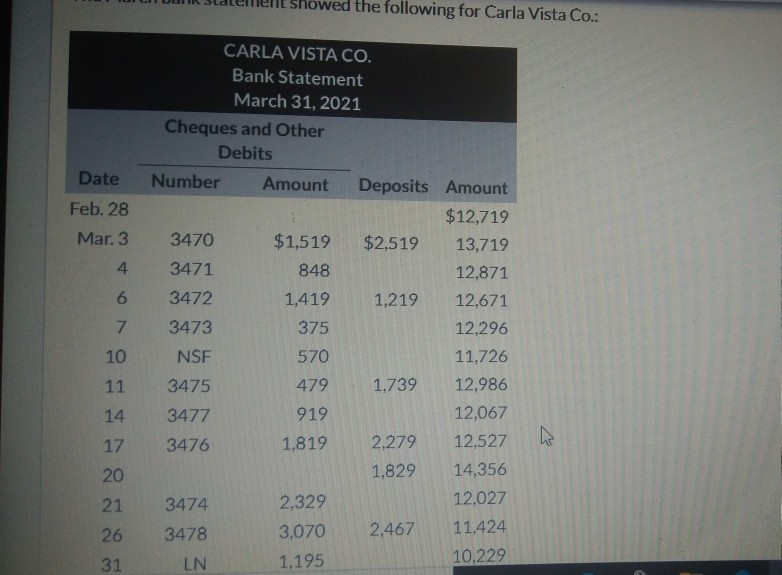

Prepare bank reconciliation showed the following for Carla Vista Co.: Date Feb. 28 Mar. 3 4 6 CARLA VISTA CO. Bank Statement March 31, 2021

Prepare bank reconciliation

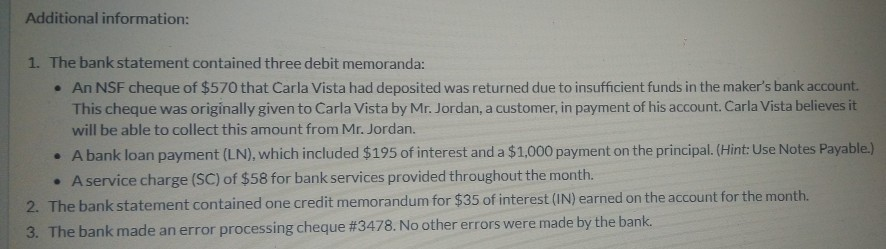

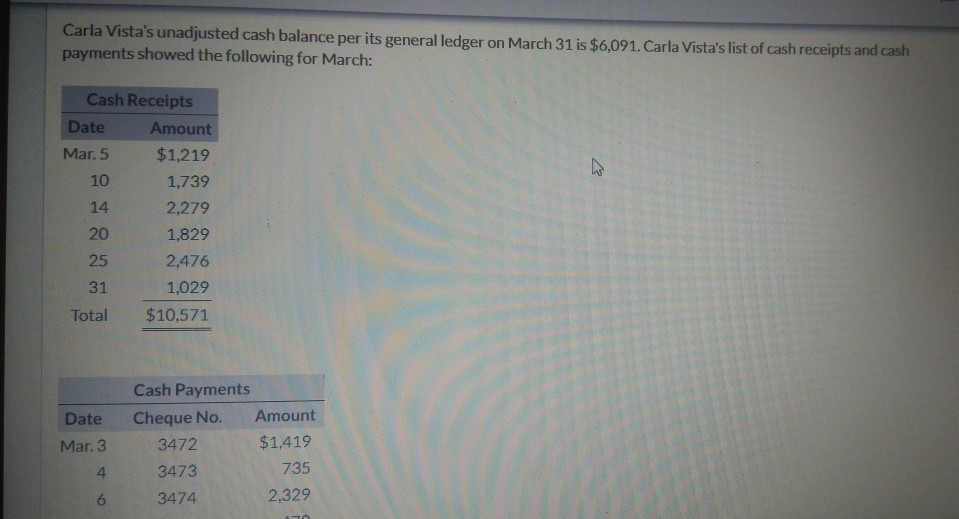

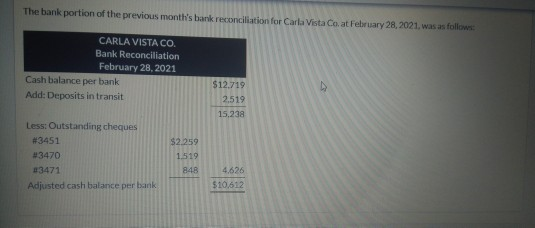

showed the following for Carla Vista Co.: Date Feb. 28 Mar. 3 4 6 CARLA VISTA CO. Bank Statement March 31, 2021 Cheques and Other Debits Number Amount Deposits Amount $12,719 3470 $1,519 $2,519 13,719 3471 848 12,871 3472 1,419 1,219 12,671 3473 375 12,296 NSF 570 11.726 3475 479 1,739 12,986 3477 919 12,067 3476 1,819 2,279 12,527 1,829 14,356 3474 2.329 12.027 3478 3,070 2,467 11.424 LN 1,195 10,229 7 10 11 14 ho 17 20 21 26 31 Additional information: 1. The bank statement contained three debit memoranda: An NSF cheque of $570 that Carla Vista had deposited was returned due to insufficient funds in the maker's bank account. This cheque was originally given to Carla Vista by Mr. Jordan, a customer, in payment of his account. Carla Vista believes it will be able to collect this amount from Mr. Jordan. A bank loan payment (LN), which included $195 of interest and a $1,000 payment on the principal. (Hint: Use Notes Payable.) A service charge (SC) of $58 for bank services provided throughout the month. 2. The bank statement contained one credit memorandum for $35 of interest (IN) earned on the account for the month. 3. The bank made an error processing cheque #3478. No other errors were made by the bank. Carla Vista's unadjusted cash balance per its general ledger on March 31 is $6,091. Carla Vista's list of cash receipts and cash payments showed the following for March: 10 Cash Receipts Date Amount Mar. 5 $1,219 1,739 14 2,279 20 1,829 25 2,476 31 1,029 Total $10.571 Date Mar. 3 Cash Payments Cheque No. Amount 3472 $1.419 3473 735 3474 2.329 4 6 The bank portion of the previous month's bank reconciliation for Carla Vista Coat February 28, 2021, was as follows: CARLA VISTA CO Bank Reconciliation February 28, 2021 Cash balance per bank Add: Deposits in transit $12.719 2,519 15.238 Less: Outstanding cheques #3451 #3470 23471 Adjusted cash balance per bank $2259 1.519 848 4.626 $10.612 showed the following for Carla Vista Co.: Date Feb. 28 Mar. 3 4 6 CARLA VISTA CO. Bank Statement March 31, 2021 Cheques and Other Debits Number Amount Deposits Amount $12,719 3470 $1,519 $2,519 13,719 3471 848 12,871 3472 1,419 1,219 12,671 3473 375 12,296 NSF 570 11.726 3475 479 1,739 12,986 3477 919 12,067 3476 1,819 2,279 12,527 1,829 14,356 3474 2.329 12.027 3478 3,070 2,467 11.424 LN 1,195 10,229 7 10 11 14 ho 17 20 21 26 31 Additional information: 1. The bank statement contained three debit memoranda: An NSF cheque of $570 that Carla Vista had deposited was returned due to insufficient funds in the maker's bank account. This cheque was originally given to Carla Vista by Mr. Jordan, a customer, in payment of his account. Carla Vista believes it will be able to collect this amount from Mr. Jordan. A bank loan payment (LN), which included $195 of interest and a $1,000 payment on the principal. (Hint: Use Notes Payable.) A service charge (SC) of $58 for bank services provided throughout the month. 2. The bank statement contained one credit memorandum for $35 of interest (IN) earned on the account for the month. 3. The bank made an error processing cheque #3478. No other errors were made by the bank. Carla Vista's unadjusted cash balance per its general ledger on March 31 is $6,091. Carla Vista's list of cash receipts and cash payments showed the following for March: 10 Cash Receipts Date Amount Mar. 5 $1,219 1,739 14 2,279 20 1,829 25 2,476 31 1,029 Total $10.571 Date Mar. 3 Cash Payments Cheque No. Amount 3472 $1.419 3473 735 3474 2.329 4 6 The bank portion of the previous month's bank reconciliation for Carla Vista Coat February 28, 2021, was as follows: CARLA VISTA CO Bank Reconciliation February 28, 2021 Cash balance per bank Add: Deposits in transit $12.719 2,519 15.238 Less: Outstanding cheques #3451 #3470 23471 Adjusted cash balance per bank $2259 1.519 848 4.626 $10.612

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started