Answered step by step

Verified Expert Solution

Question

1 Approved Answer

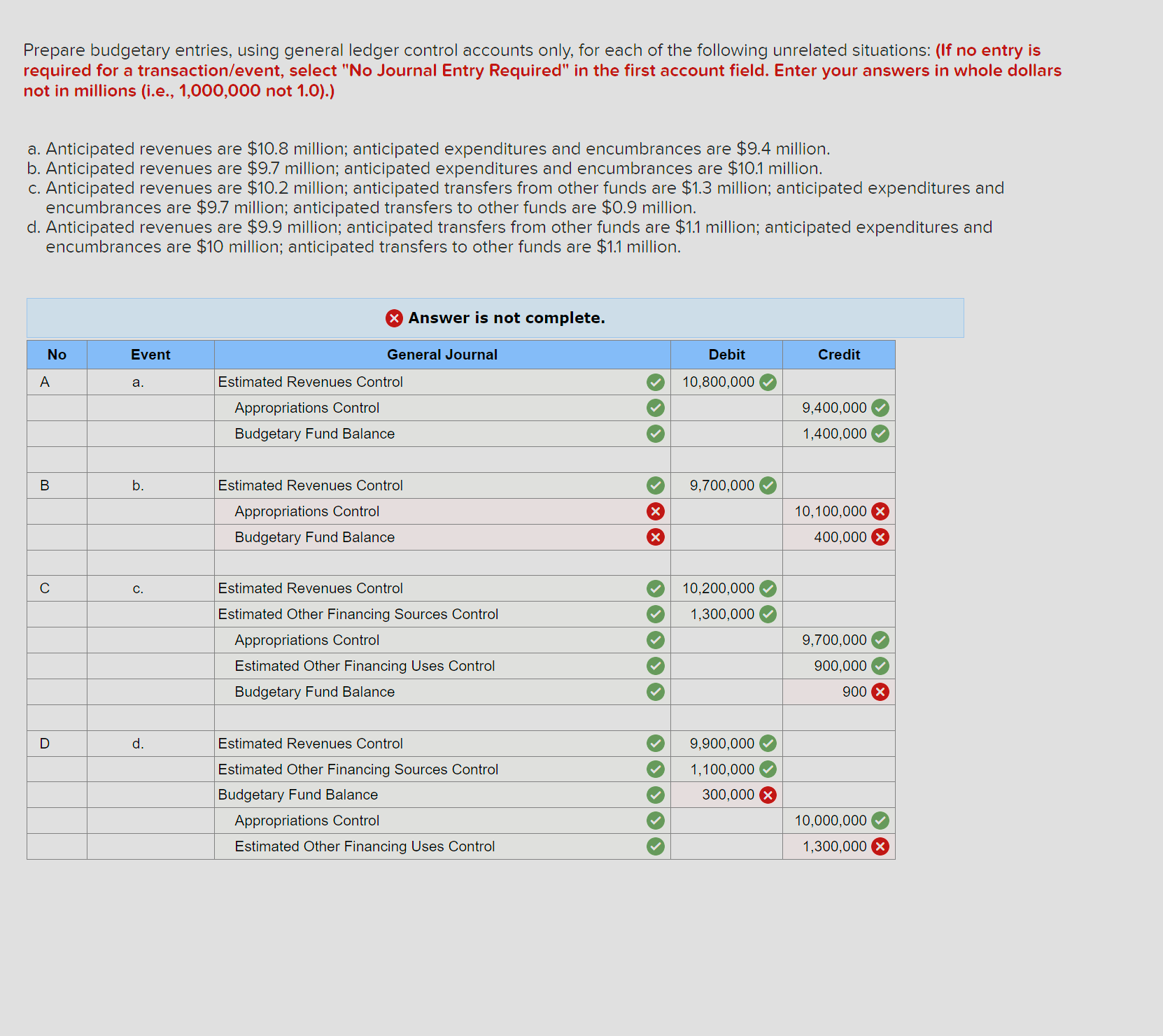

Prepare budgetary entries, using general ledger control accounts only, for each of the following unrelated situations: (If no entry is required for a transaction/event,

Prepare budgetary entries, using general ledger control accounts only, for each of the following unrelated situations: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollars not in millions (i.e., 1,000,000 not 1.0).) a. Anticipated revenues are $10.8 million; anticipated expenditures and encumbrances are $9.4 million. b. Anticipated revenues are $9.7 million; anticipated expenditures and encumbrances are $10.1 million. c. Anticipated revenues are $10.2 million; anticipated transfers from other funds are $1.3 million; anticipated expenditures and encumbrances are $9.7 million; anticipated transfers to other funds are $0.9 million. d. Anticipated revenues are $9.9 million; anticipated transfers from other funds are $1.1 million; anticipated expenditures and encumbrances are $10 million; anticipated transfers to other funds are $1.1 million. A No Answer is not complete. Event General Journal a. Estimated Revenues Control Debit 10,800,000 Credit Appropriations Control Budgetary Fund Balance 9,400,000 1,400,000 B b. Estimated Revenues Control Appropriations Control Budgetary Fund Balance C. Estimated Revenues Control Estimated Other Financing Sources Control Appropriations Control Estimated Other Financing Uses Control Budgetary Fund Balance 9,700,000 10,100,000 400,000 10,200,000 1,300,000 9,700,000 900,000 900 X D d. Estimated Revenues Control 9,900,000 Estimated Other Financing Sources Control 1,100,000 Budgetary Fund Balance 300,000 Appropriations Control Estimated Other Financing Uses Control 10,000,000 1,300,000 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The budgetary entries using general ledger control accounts for each situation are as follows b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started