Answered step by step

Verified Expert Solution

Question

1 Approved Answer

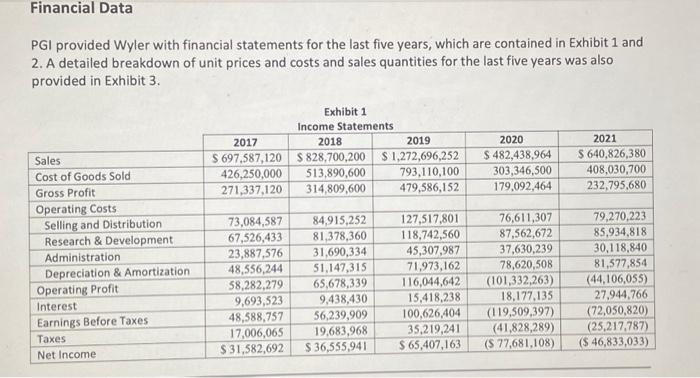

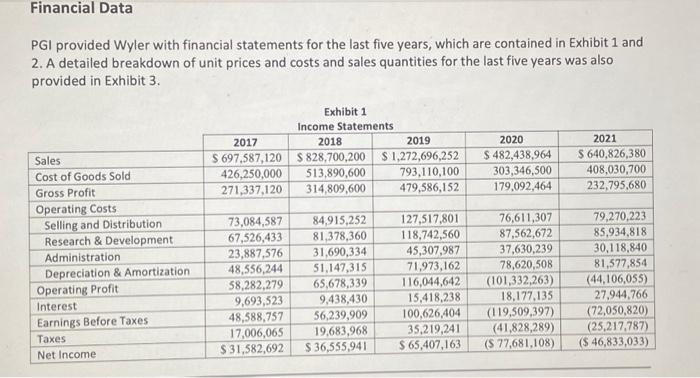

Prepare Cash Flow for 2018, 2019, 2020, 2021 PGI provided Wyler with financial statements for the last five years, which are contained in Exhibit 1

Prepare Cash Flow for 2018, 2019, 2020, 2021

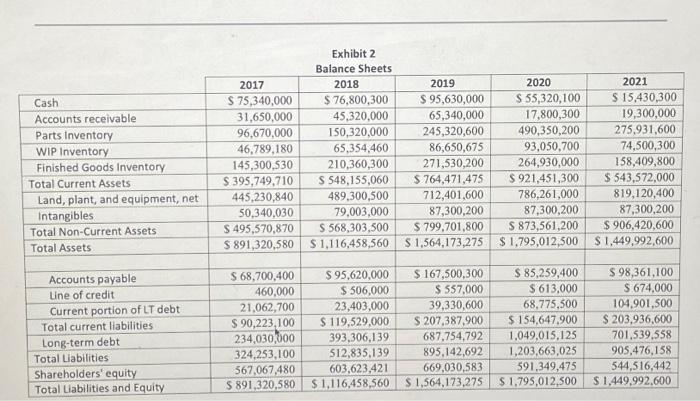

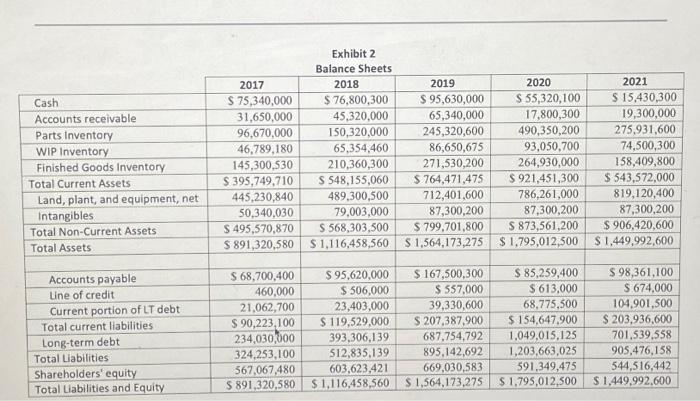

PGI provided Wyler with financial statements for the last five years, which are contained in Exhibit 1 and 2. A detailed breakdown of unit prices and costs and sales quantities for the last five years was also provided in Exhibit 3. Exhibit 2 Balance Sheets \begin{tabular}{|l|r|r|r|r|r|} \cline { 2 - 6 } \multicolumn{1}{c|}{} & \multicolumn{1}{|c|}{2017} & \multicolumn{1}{|c|}{2018} & \multicolumn{1}{c|}{2019} & \multicolumn{1}{c|}{2020} & \multicolumn{1}{c|}{2021} \\ \hline Cash & $75,340,000 & $76,800,300 & $95,630,000 & $55,320,100 & $15,430,300 \\ \hline Accounts receivable & 31,650,000 & 45,320,000 & 65,340,000 & 17,800,300 & 19,300,000 \\ \hline Parts Inventory & 96,670,000 & 150,320,000 & 245,320,600 & 490,350,200 & 275,931,600 \\ \hline WIP Inventory & 46,789,180 & 65,354,460 & 86,650,675 & 93,050,700 & 74,500,300 \\ \hline Finished Goods Inventory & 145,300,530 & 210,360,300 & 271,530,200 & 264,930,000 & 158,409,800 \\ \hline Total Current Assets & $395,749,710 & $548,155,060 & $764,471,475 & $921,451,300 & $543,572,000 \\ \hline Land, plant, and equipment, net & 445,230,840 & 489,300,500 & 712,401,600 & 786,261,000 & 819,120,400 \\ \hline Intangibles & 50,340,030 & 79,003,000 & 87,300,200 & 87,300,200 & 87,300,200 \\ \hline Total Non-Current Assets & $495,570,870 & $568,303,500 & $799,701,800 & $873,561,200 & $906,420,600 \\ \hline Total Assets & $891,320,580 & $1,116,458,560 & $1,564,173,275 & $1,795,012,500 & $1,449,992,600 \\ \hline & & & & & \\ \hline Accounts payable & $68,700,400 & $95,620,000 & $167,500,300 & $85,259,400 & $98,361,100 \\ \hline Line of credit & 460,000 & $506,000 & $557,000 & $613,000 & $674,000 \\ \hline Current portion of LT debt & 21,062,700 & 23,403,000 & 39,330,600 & 68,775,500 & 104,901,500 \\ \hline Total current liabilities & $90,223,100 & $119,529,000 & $207,387,900 & $154,647,900 & $203,936,600 \\ \hline Long-term debt & 234,030,000 & 393,306,139 & 687,754,792 & 1,049,015,125 & 701,539,558 \\ \hline Total Liabilities & 324,253,100 & $12,835,139 & 895,142,692 & 1,203,663,025 & 905,476,158 \\ \hline Shareholders' equity & 567,067,480 & 603,623,421 & 669,030,583 & 591,349,475 & 544,516,442 \\ \hline Total Liabilities and Equity & $891,320,580 & $1,116,458,560 & $1,564,173,275 & $1,795,012,500 & $S1,449,992,600 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started