Answered step by step

Verified Expert Solution

Question

1 Approved Answer

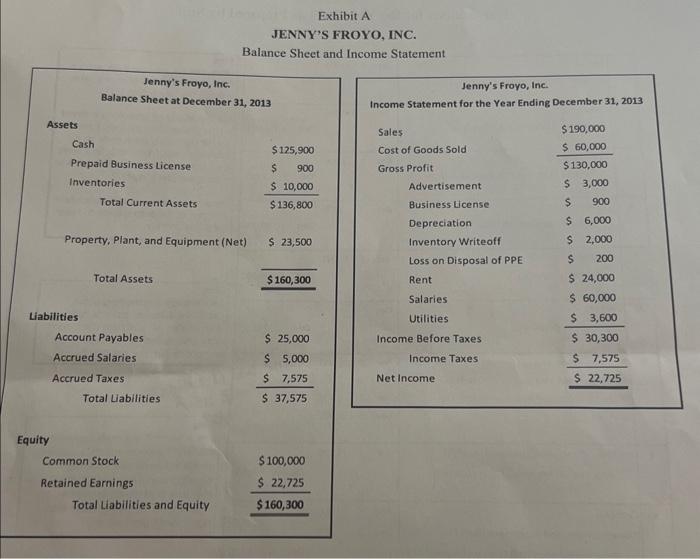

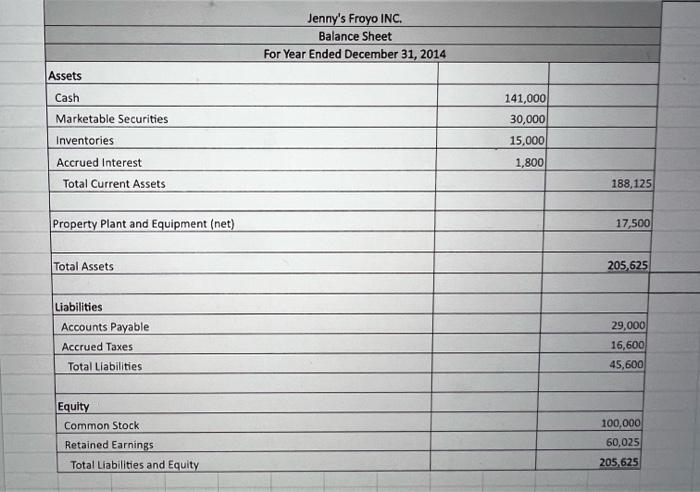

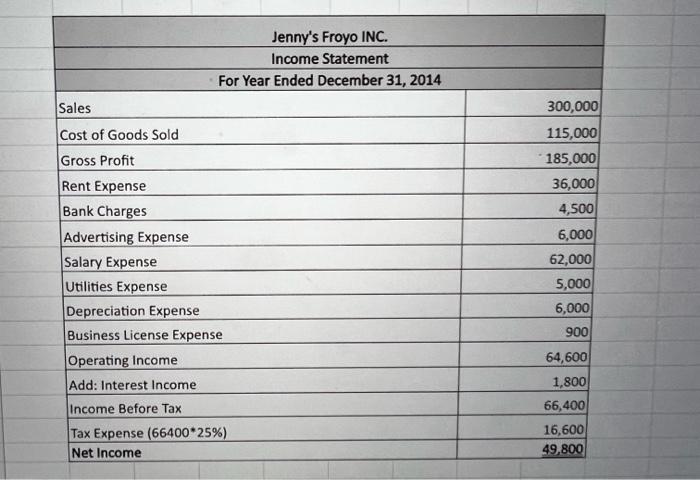

prepare cash flow statement for year 2014 from the following information: A Exhibit A JENNY'S FROYO, INC. Income Statement Jenny's Froyo INC. Balance Sheet For

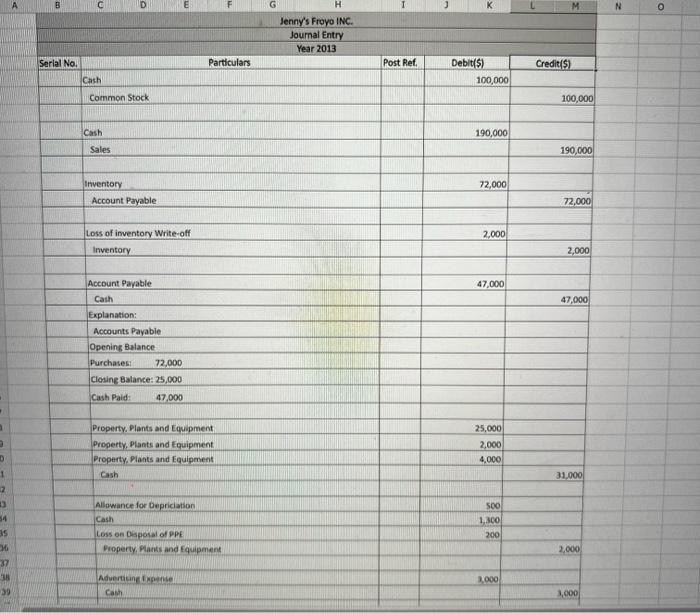

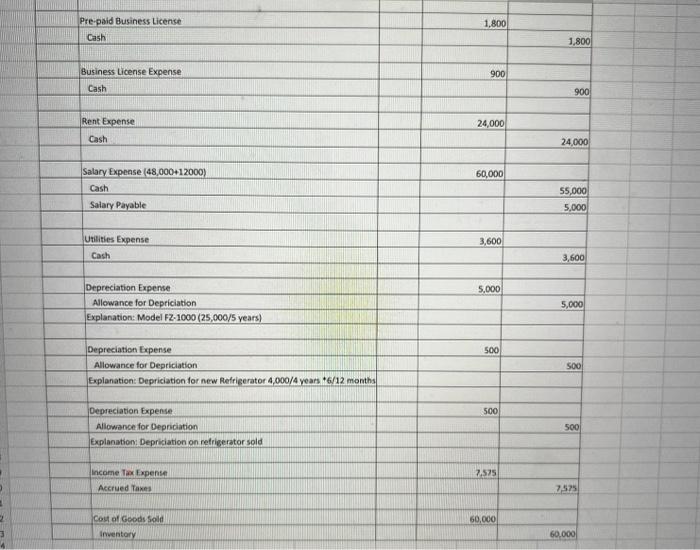

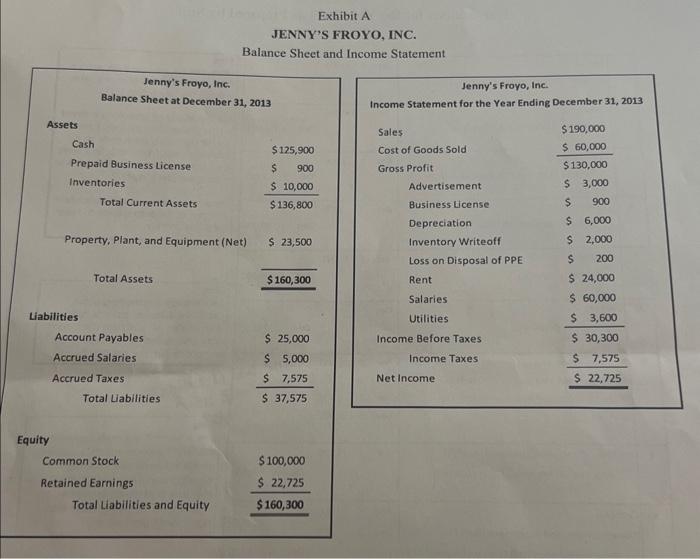

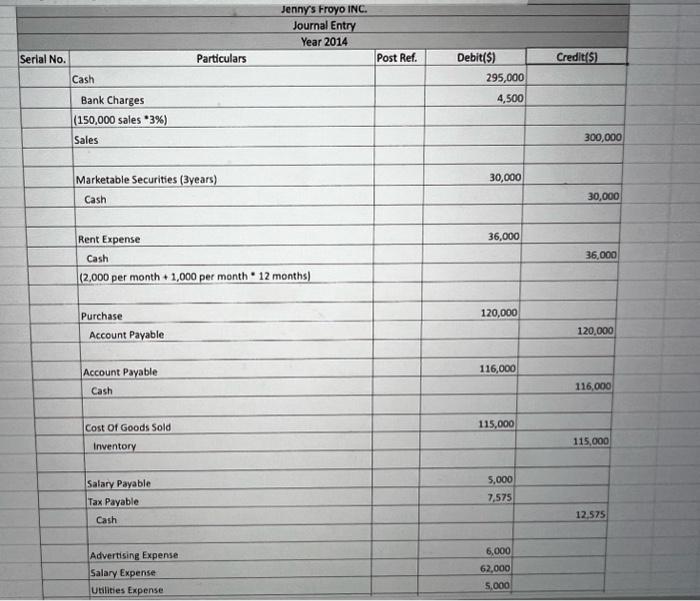

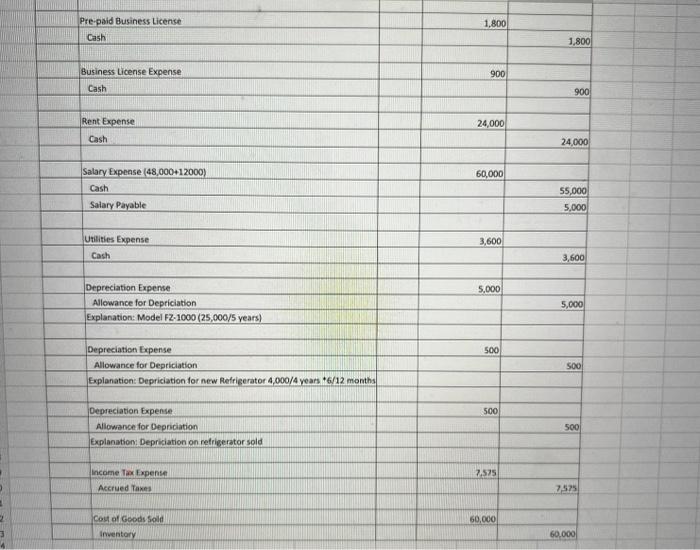

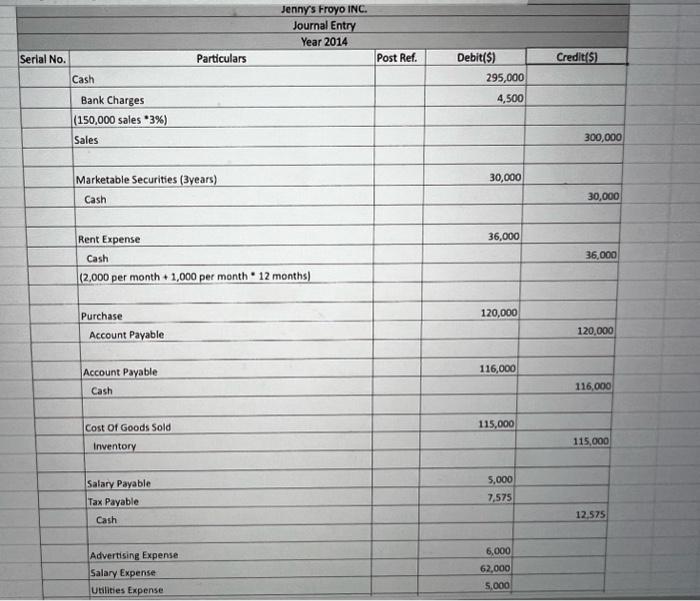

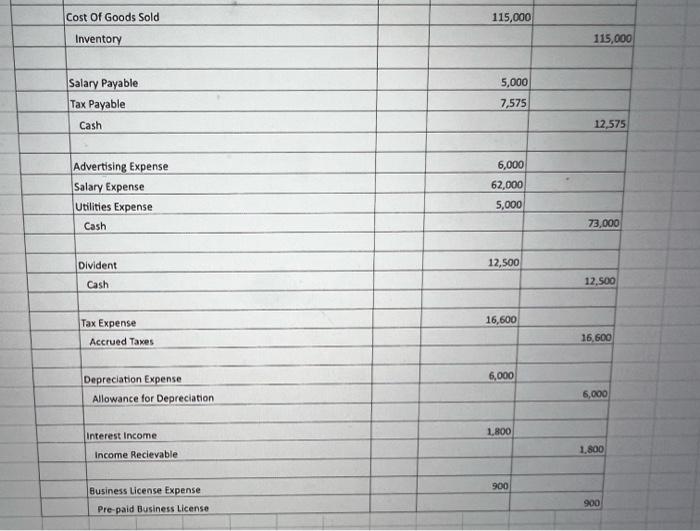

prepare cash flow statement for year 2014 from the following information:

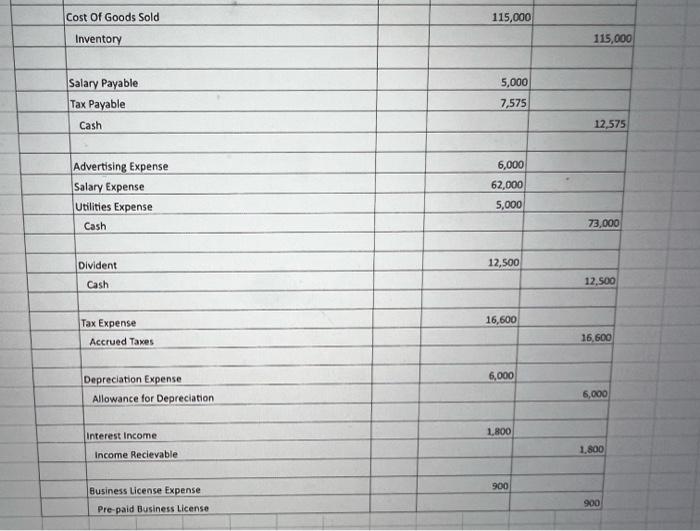

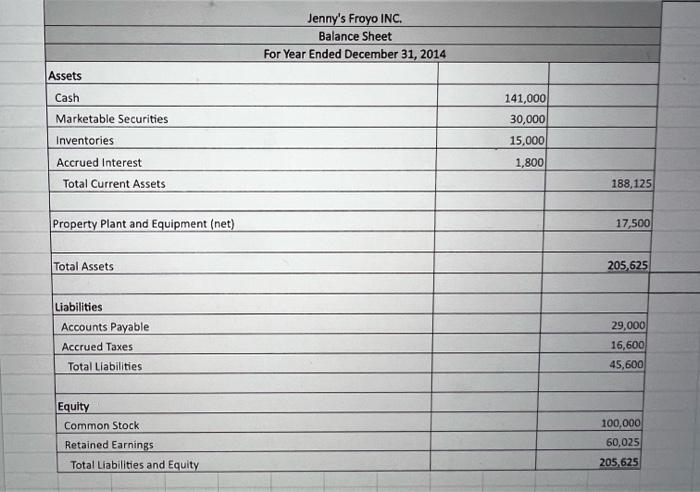

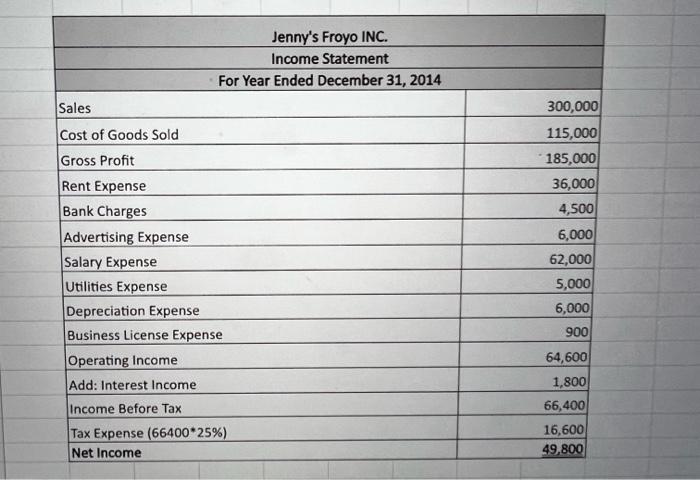

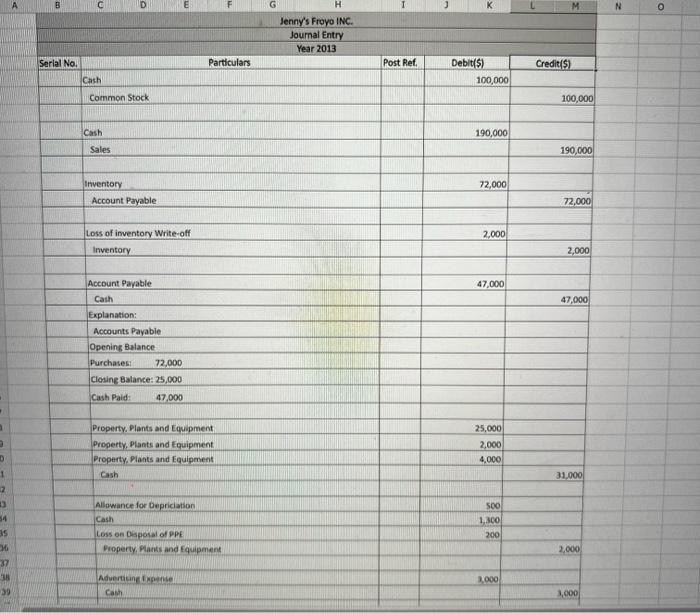

A Exhibit A JENNY'S FROYO, INC. Income Statement Jenny's Froyo INC. Balance Sheet For Year Ended December 31, 2014 Assets Cash Marketable Securities Inventories Accrued Interest Total Current Assets Property Plant and Equipment (net) Total Assets 205,625 Liabilities Accounts Payable Accrued Taxes Total Liabilities Equity Common Stock Retained Earnings Total Liabilities and Equity 205,625 \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Jenny's Froyo INC. } \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline \multicolumn{2}{|c|}{ For Year Ended December 31, 2014 } \\ \hline Sales & 300,000 \\ \hline Cost of Goods Sold & 115,000 \\ \hline Gross Profit & 185,000 \\ \hline Rent Expense & 36,000 \\ \hline Bank Charges & 4,500 \\ \hline Advertising Expense & 6,000 \\ \hline Salary Expense & 62,000 \\ \hline Utilities Expense & 5,000 \\ \hline Depreciation Expense & 6,000 \\ \hline Business License Expense & 900 \\ \hline Operating Income & 64,600 \\ \hline Add: Interest Income & 1,800 \\ \hline Income Before Tax & 66,400 \\ \hline Tax Expense (66400*25\%) & 16,600 \\ \hline Net Income & 49,800 \\ \hline \end{tabular} A Exhibit A JENNY'S FROYO, INC. Income Statement Jenny's Froyo INC. Balance Sheet For Year Ended December 31, 2014 Assets Cash Marketable Securities Inventories Accrued Interest Total Current Assets Property Plant and Equipment (net) Total Assets 205,625 Liabilities Accounts Payable Accrued Taxes Total Liabilities Equity Common Stock Retained Earnings Total Liabilities and Equity 205,625 \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Jenny's Froyo INC. } \\ \hline \multicolumn{2}{|c|}{ Income Statement } \\ \hline \multicolumn{2}{|c|}{ For Year Ended December 31, 2014 } \\ \hline Sales & 300,000 \\ \hline Cost of Goods Sold & 115,000 \\ \hline Gross Profit & 185,000 \\ \hline Rent Expense & 36,000 \\ \hline Bank Charges & 4,500 \\ \hline Advertising Expense & 6,000 \\ \hline Salary Expense & 62,000 \\ \hline Utilities Expense & 5,000 \\ \hline Depreciation Expense & 6,000 \\ \hline Business License Expense & 900 \\ \hline Operating Income & 64,600 \\ \hline Add: Interest Income & 1,800 \\ \hline Income Before Tax & 66,400 \\ \hline Tax Expense (66400*25\%) & 16,600 \\ \hline Net Income & 49,800 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started