Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare Ceylon Ltds Cash Budget for the month of April 2020 only. ( Assume that the company will have a cash balance of 300,000 on

Prepare Ceylon Ltds Cash Budget for the month of April 2020 only. ( Assume that the company will have a cash balance of 300,000 on 1st of April)

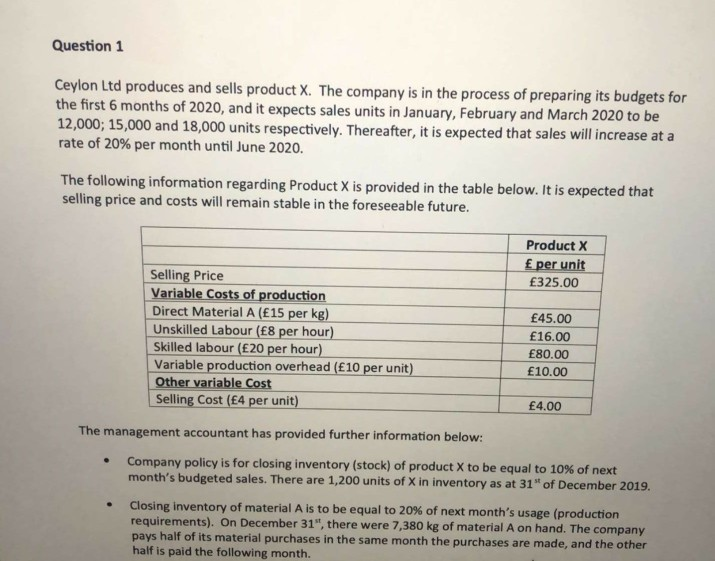

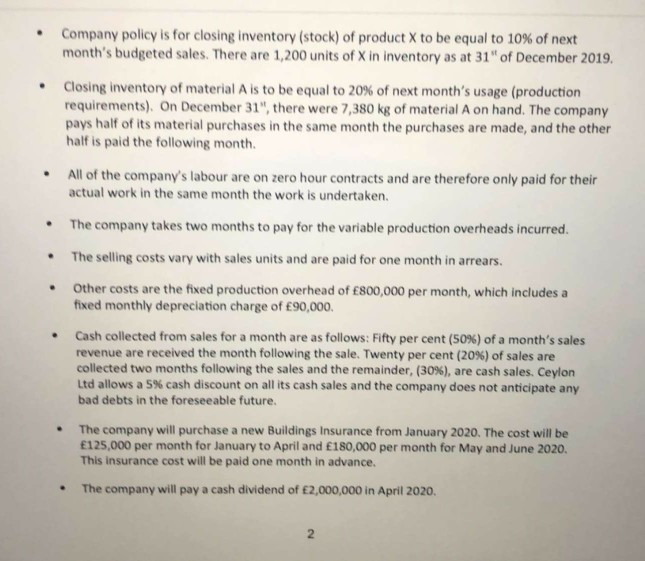

Question 1 Ceylon Ltd produces and sells product X. The company is in the process of preparing its budgets for the first 6 months of 2020, and it expects sales units in January, February and March 2020 to be 12,000; 15,000 and 18,000 units respectively. Thereafter, it is expected that sales will increase at a rate of 20% per month until June 2020. The following information regarding Product X is provided in the table below. It is expected that selling price and costs will remain stable in the foreseeable future. Product X per unit 325.00 Selling Price Variable Costs of production Direct Material A (15 per kg) Unskilled Labour (8 per hour) Skilled labour (20 per hour) Variable production overhead (10 per unit) Other variable Cost Selling Cost (4 per unit) 45.00 16.00 80.00 10.00 4.00 The management accountant has provided further information below: . . Company policy is for closing inventory (stock) of product X to be equal to 10% of next month's budgeted sales. There are 1,200 units of X in inventory as at 31" of December 2019. Closing inventory of material A is to be equal to 20% of next month's usage (production requirements). On December 31", there were 7,380 kg of material A on hand. The company pays half of its material purchases in the same month the purchases are made, and the other half is paid the following month. . . . Company policy is for closing inventory (stock) of product X to be equal to 10% of next month's budgeted sales. There are 1,200 units of Xin inventory as at 31" of December 2019. Closing inventory of material A is to be equal to 20% of next month's usage (production requirements) On December 31", there were 7,380 kg of material A on hand. The company pays half of its material purchases in the same month the purchases are made, and the other half is paid the following month. All of the company's labour are on zero hour contracts and are therefore only paid for their actual work in the same month the work is undertaken. The company takes two months to pay for the variable production overheads incurred. The selling costs vary with sales units and are paid for one month in arrears. Other costs are the fixed production overhead of 800,000 per month, which includes a fixed monthly depreciation charge of 90,000 Cash collected from sales for a month are as follows: Fifty per cent (50%) of a month's sales revenue are received the month following the sale. Twenty per cent (20%) of sales are collected two months following the sales and the remainder, (30%), are cash sales. Ceylon Ltd allows a 5% cash discount on all its cash sales and the company does not anticipate any bad debts in the foreseeable future. The company will purchase a new Buildings Insurance from January 2020. The cost will be 125,000 per month for January to April and 180,000 per month for May and June 2020. This insurance cost will be paid one month in advance. . . The company will pay a cash dividend of 2,000,000 in April 2020, 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started