Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparing Financial Statements and Closing Entries Beneish Corporation has the following account balances at December 31, the end of its fiscal year. Credit Cash

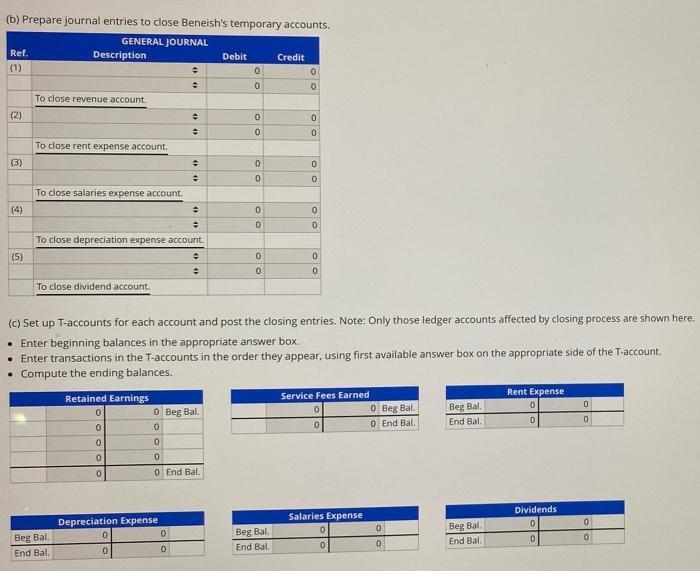

Preparing Financial Statements and Closing Entries Beneish Corporation has the following account balances at December 31, the end of its fiscal year. Credit Cash Accounts receivable Equipment Accumulated depreciation Notes payable Common stock Retained earnings Dividends Service fees earned Rent expense Salaries expense Depreciation expense Totals Debit $ 2,000 3,250 39,000 4,000 $7,000 5,000 21,500 10,300 35,500 9,000 18,550 3,500 $79,300 $79,300 (b) Prepare journal entries to close Beneish's temporary accounts. GENERAL JOURNAL Ref. (2) (3) (4) (5) Description To close revenue account. To close rent expense account. To close salaries expense account. To close dividend account. Beg Bal. End Bal. To close depreciation expense account. Retained Earnings 0 0 0 0 0 : 0 0 Depreciation Expense + 0 0 + 0 Beg Bal. 0 0 0 0 End Bal Debit 0 0 0 0 0 0 0 0 0 0 (c) Set up T-accounts for each account and post the closing entries. Note: Only those ledger accounts affected by closing process are shown here. Enter beginning balances in the appropriate answer box. answer box on the appropriate side of the T-account. Enter transactions in the T-accounts in the order they appear, using first available Compute the ending balances. . Credit Beg Bal. End Bal. 0 0 0 0 0 0 0 0 0 0 Service Fees Earned 0 0 Salaries Expense 0 0 0 Beg Bal. 0 End Bal 0 Beg Bal. End Bal. Beg Bal. End Bal. Rent Expense 0 0 Dividends 0 0 0 0 0

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement for the year ending December 31 Revenue 35500 Rent 9000 Salaries 18550 Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started