Answered step by step

Verified Expert Solution

Question

1 Approved Answer

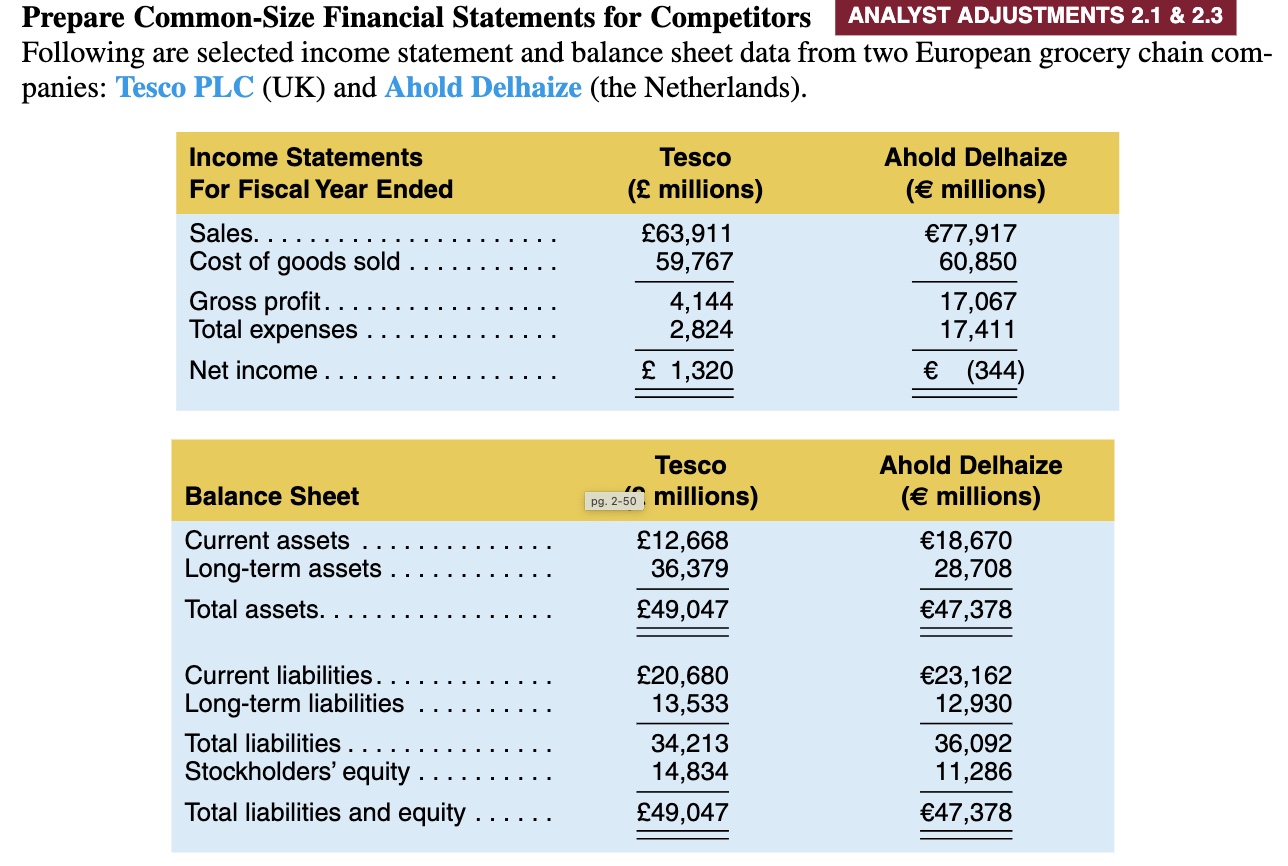

Prepare Common - Size Financial Statements for Competitors ANALYST ADJUSTMENTS 2 . 1 & 2 . 3 Following are selected income statement and balance sheet

Prepare CommonSize Financial Statements for Competitors

ANALYST ADJUSTMENTS &

Following are selected income statement and balance sheet data from two European grocery chain companies: Tesco PLC UK and Ahold Delhaize the Netherlands

tabletableIncome StatementsFor Fiscal Year EndedtableTesco millionstableAhold Delhaize millionstableSalesCost of goods soldtabletabletabletabletableGross profit. Total expensestabletabletableNet income,

tableBalance Sheet,tableTescopg millionstableAhold Delhaize millionsCurrent assets,Longterm assets,Total assets.,Current liabilities.,Longterm liabilities,Total liabilities,Stockholders equity,Total liabilities and equity,

a Prepare a common size income statement. To do this, each income statement amount as a percent of sales. comment on any differences observed between the two companies.

B Prepare a common size balance sheet. to do this, express each balance sheet amount as a percent of total assets. comment on any differences observed between the two companies.

C Which company has chosen to structure itself with a higher proportion of equity and a lower proportion of debt how does this capital structure decision affect our assessment of the relative riskiness of these two companies?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started