Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare comparative income statement for the years 2017-2018 and 2018-2019 and interpret the same. Mr. Baha Mohammed Al Lawati, Director of Al Hassan Engineering Company

Prepare comparative income statement for the years 2017-2018 and 2018-2019 and interpret the same.

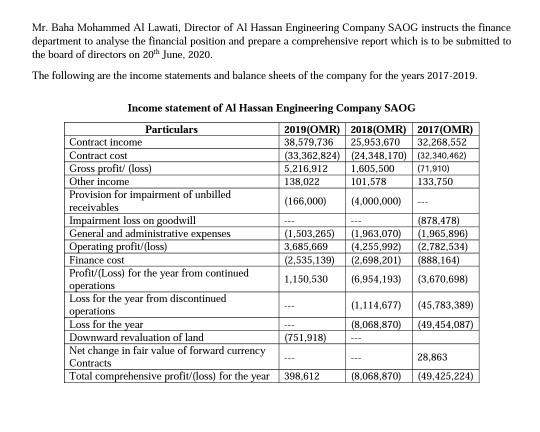

Mr. Baha Mohammed Al Lawati, Director of Al Hassan Engineering Company SAOG instructs the finance department to analyse the financial position and prepare a comprehensive report which is to be submitted to the board of directors on 20th June, 2020. The following are the income statements and balance sheets of the company for the years 2017-2019. Income statement of Al Hassan Engineering Company SAOG Particulars 2019(OMR) 2018(OMR) 2017(OMR) Contract income 38,579,736 25,953,670 32,268,552 Contract cost (33,362,824) (24,348.170) (32,340.462) Gross profit/ (loss) 5,216,912 1,605,500 (71,910) Other income 138,022 101,578 133,750 Provision for impairment of unbilled (166,000) receivables (4,000,000) Impairment loss on goodwill (878.478) General and administrative expenses (1,503,265) (1.963,070) (1.965,896) Operating profit/(loss) 3,685,669 (4.255,992) (2.782,534) Finance cost (2,535,139) (2,698,201) (888.164) Profit (Loss) for the year from continued 1,150,530 (6.954,193) (3,670,698) operations Loss for the year from discontinued operations (1,114,677) (45,783,389) Loss for the year (8,068,870) (49,454,087) Downward revaluation of land (751,918) Net change in fair value of forward currency 28,863 Contracts Total comprehensive profit/(loss) for the year 398,612 (8,068,870) (49,425,224)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started