Answered step by step

Verified Expert Solution

Question

1 Approved Answer

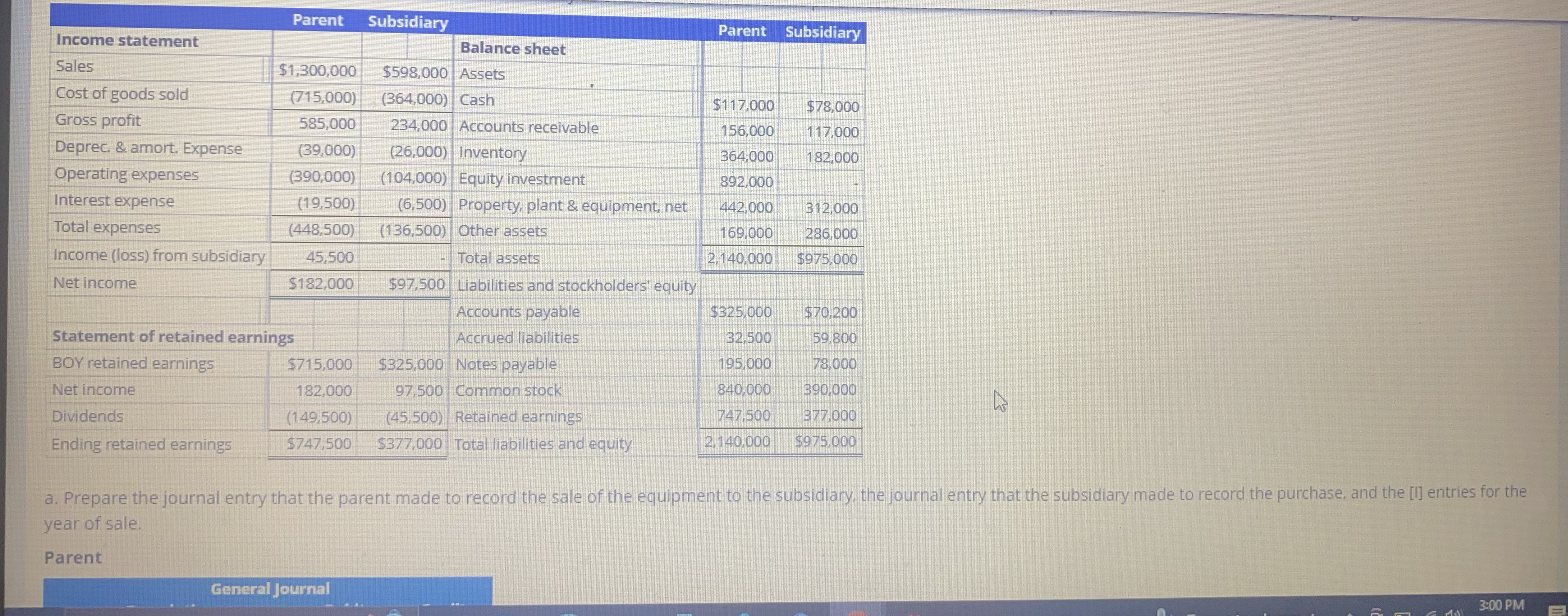

Prepare consolidation spreadsheet for In Assume that a parent company acquired a subsidiary on January 1 , 2 0 1 2 for $ 8 9

Prepare consolidation spreadsheet for In

Assume that a parent company acquired a subsidiary on January for $ The purchase price was $ in excess of the

acquisition date. On the acquisition date, the subsidiary's stockholders equity was comprised of $ of nopar common stock and $ of retained earnings. The Acquisition Accounting

Premium AAP was assigned as follows: an increase of $ in accounts receivable that were entirely collected during the year after acquisition, an increase of $ for property, plant and

equipment that has years of remaining useful life, $ for an unrecorded patent with an year remaining life and $ for goodwill. All amortizable components of the AAP are

amortized using the straightline method.

On January the parent sold Equipment to the subsidiary for a cash price of $ The parent had acquired the equipment at a cost of $ and depreciated the equipment over its

year useful life using the straightline method no salvage value The parent had depreciated the equipment for years at the time of sale. The subsidiary retained the depreciation policy of the

parent and depreciates the equipment over its remaining year useful life.

Following are financial statements of the parent and its subsidiary as of December The parent uses the cost method of preconsolidation investment bookkeeping.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started