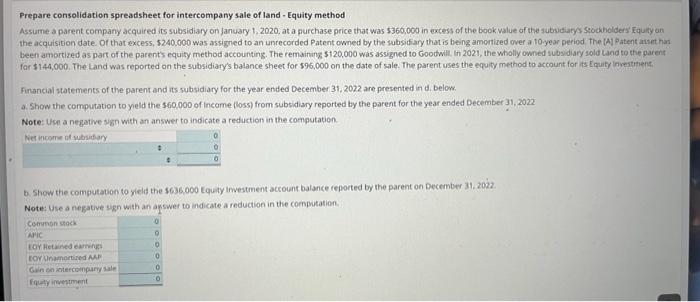

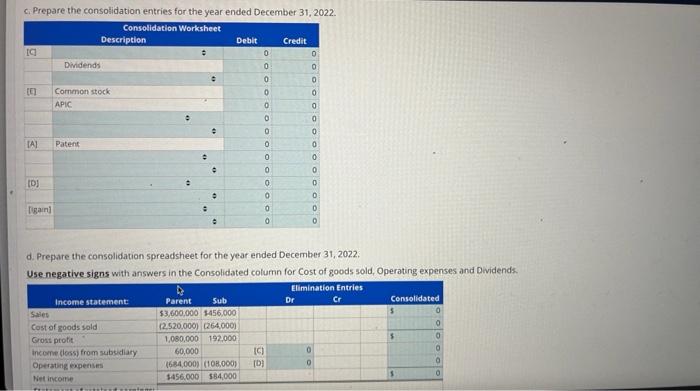

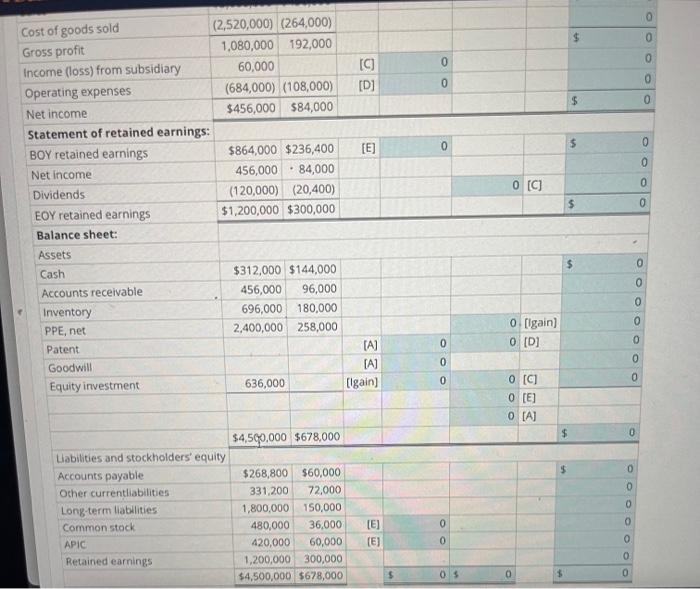

Prepare consolidation spreadsheet for intercompany sale of land-Equity method Assume a parent company acquired its subsidiafy on janvary 1,2020, at a purchase price that was 5360,000 in excess of the bookvalue of the subsidiatys scocheiders' Equify on the acquisition date. Of that excess, 5240.000 was assigned to an unrecorded Patent owned by the subsiffary that is being amortized over a toyear period the (A) Patent attet has been amortized as part of the parent's equity method accounting. The remaining $120,000 was assigned to Goodwill, in 2021 , the wholly owned subsidiary sold tand to the parent far $144,000. The Land was reported on the subsidiary's balance sheet for 596,000 on the date of sale. The parent uses the equity method to account for its Equity investimenti. Financial statements of the parent and its subsidiary for the year ended December 31,2022 are presented in di. below. a. Show the computation to yeld the 560,000 of income (loss) from subsidiary reported by the parent for the year ended December 31, 2022 Note: Use a negative sign with an answer to indicate a reduction in the computation. 6. Show the computation to yield the 3636,000 cquity imestment account balance reported by the parent on December 31.2022. Note: USe a negative sign with an asswer to indicate a reduction in the computation. c. Prepare the consolidation entries for the year ended December 31, 2022 . d. Prephare the consolidation spreadsheet for the year ended December 31, 2022. Use negative signs with answers in the Consolidated column for Cost of goods sold, Operating expenses and Dividends. Prepare consolidation spreadsheet for intercompany sale of land-Equity method Assume a parent company acquired its subsidiafy on janvary 1,2020, at a purchase price that was 5360,000 in excess of the bookvalue of the subsidiatys scocheiders' Equify on the acquisition date. Of that excess, 5240.000 was assigned to an unrecorded Patent owned by the subsiffary that is being amortized over a toyear period the (A) Patent attet has been amortized as part of the parent's equity method accounting. The remaining $120,000 was assigned to Goodwill, in 2021 , the wholly owned subsidiary sold tand to the parent far $144,000. The Land was reported on the subsidiary's balance sheet for 596,000 on the date of sale. The parent uses the equity method to account for its Equity investimenti. Financial statements of the parent and its subsidiary for the year ended December 31,2022 are presented in di. below. a. Show the computation to yeld the 560,000 of income (loss) from subsidiary reported by the parent for the year ended December 31, 2022 Note: Use a negative sign with an answer to indicate a reduction in the computation. 6. Show the computation to yield the 3636,000 cquity imestment account balance reported by the parent on December 31.2022. Note: USe a negative sign with an asswer to indicate a reduction in the computation. c. Prepare the consolidation entries for the year ended December 31, 2022 . d. Prephare the consolidation spreadsheet for the year ended December 31, 2022. Use negative signs with answers in the Consolidated column for Cost of goods sold, Operating expenses and Dividends