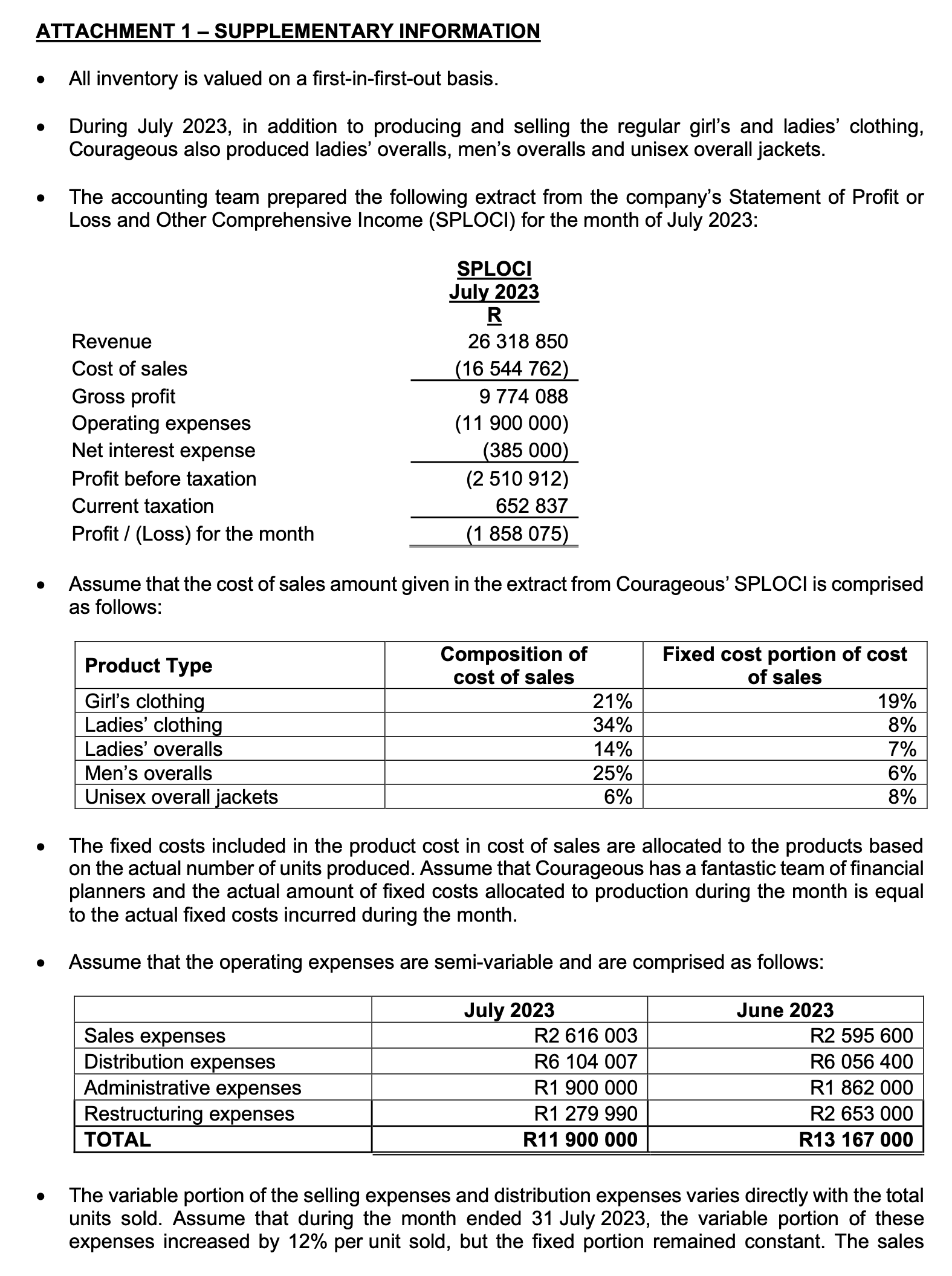

prepare Courageous income statement for the month of July 2023 in the format required to make management accounting decisions for the business.The accounting team has already prepared the Statement of Profit or Loss and Other Comprehensive Income (SPLOCI) for the month. You will be provided with an extract of this SPLOCI, which you will need to refer to when preparing your income statement. I also draw your attention to the information in Attachment 1. Taxation effects will not have any impact on the imminent decisions that need to be made by the management team. Therefore, you should ignore the effect of taxation when preparing your income statement. ATTACHMENT 1 SUPPLEMENTARY INFORMATION

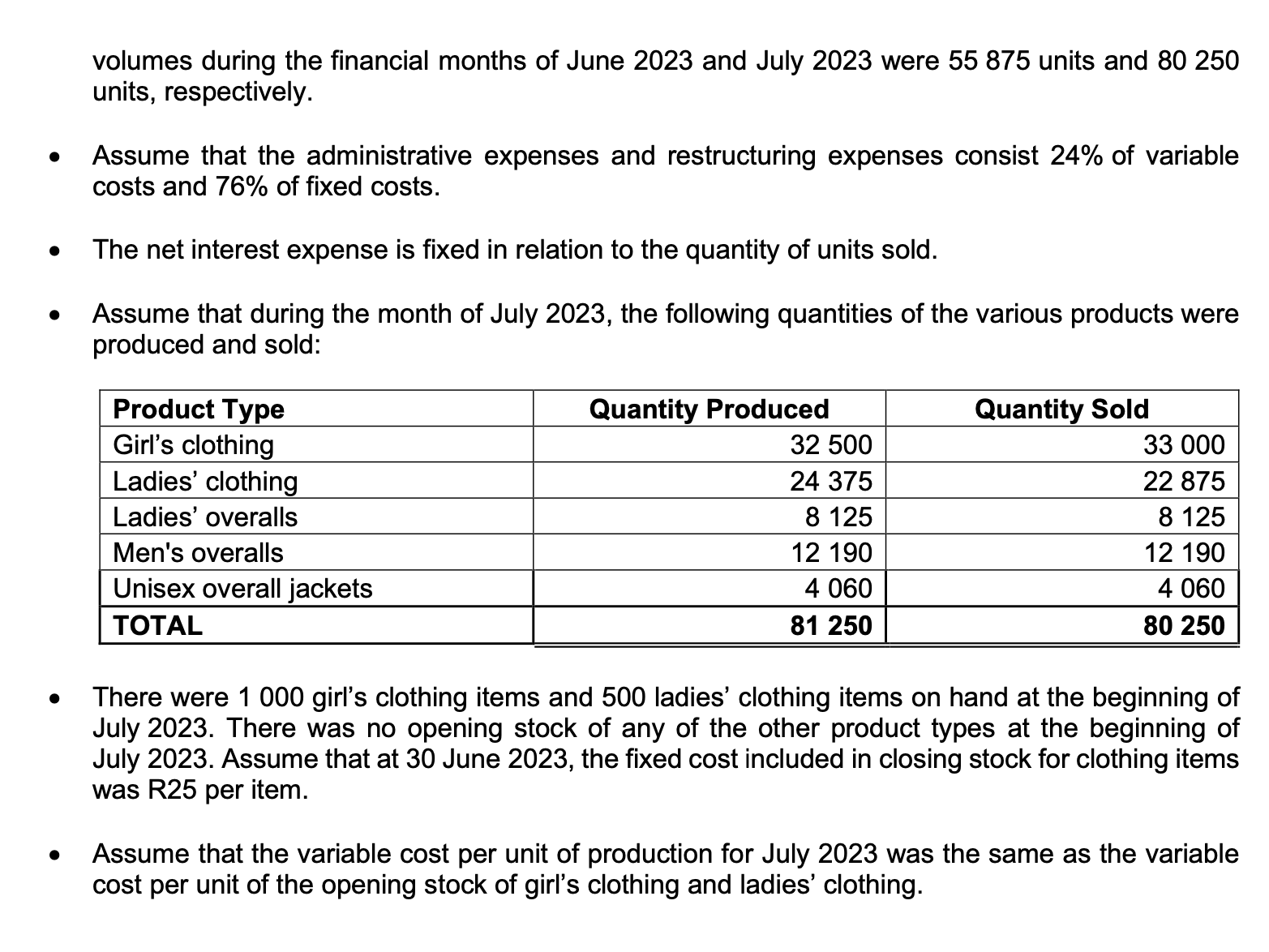

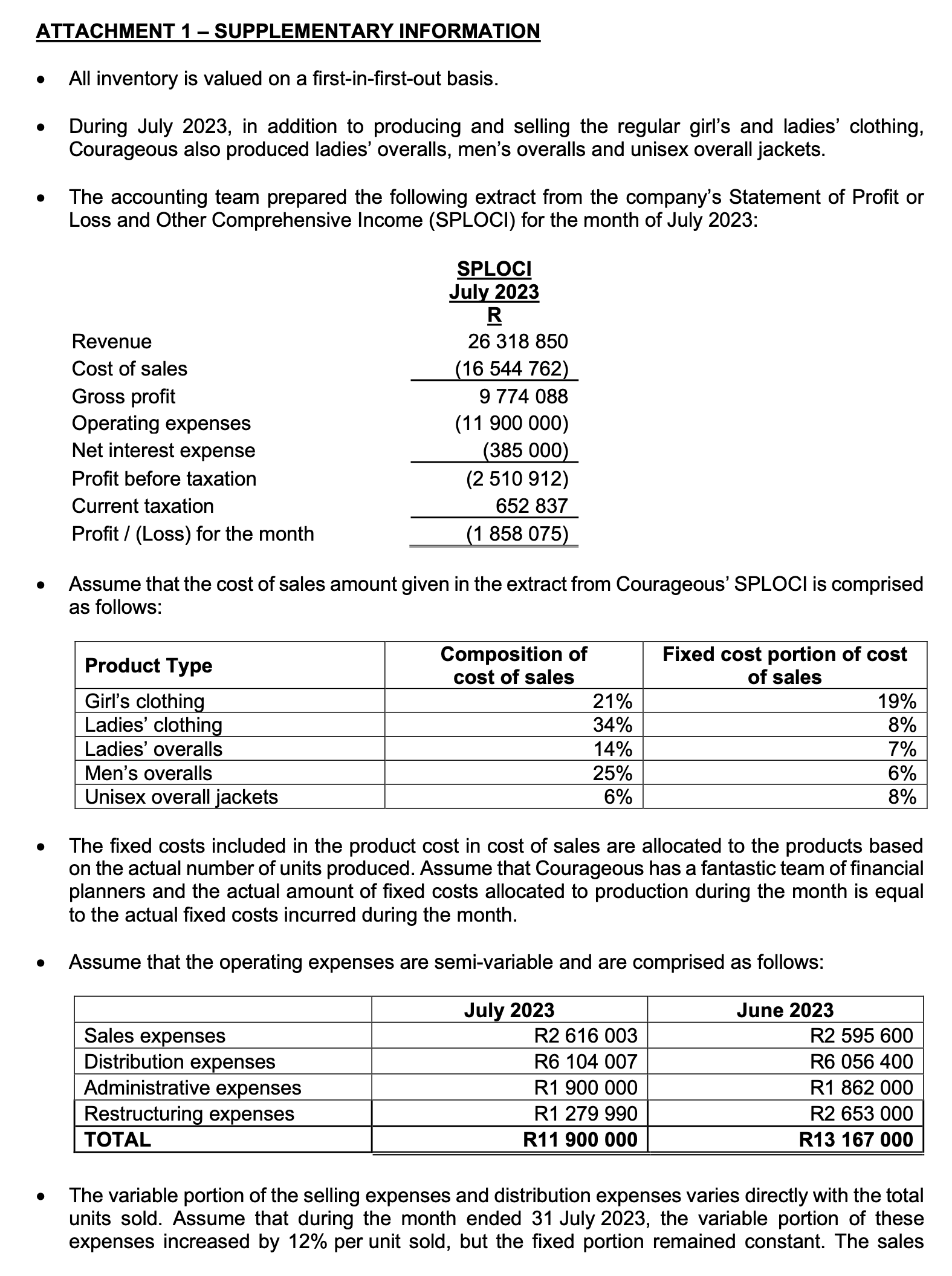

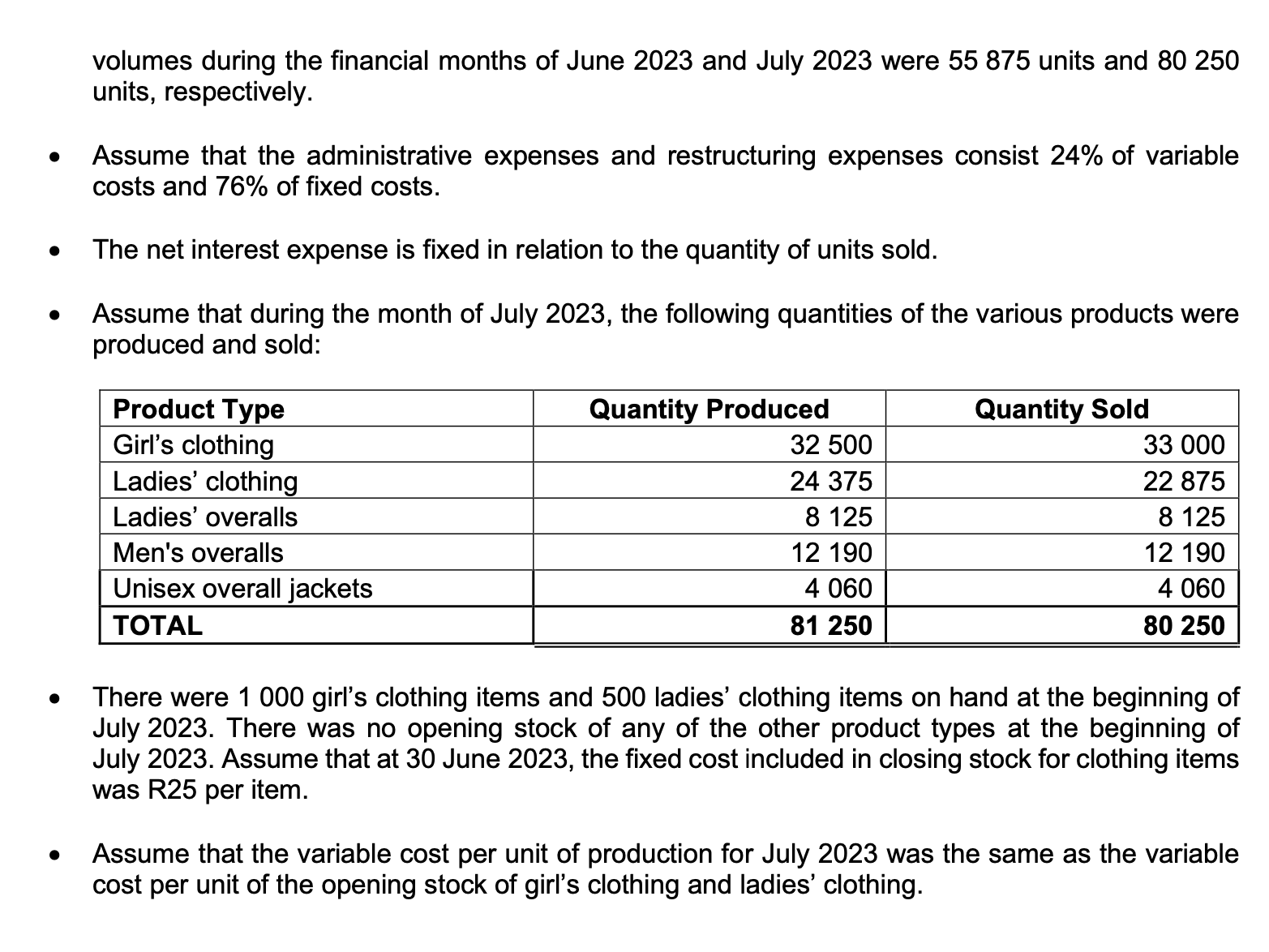

ATTACHMENT 1 - SUPPLEMENTARY INFORMATION - All inventory is valued on a first-in-first-out basis. - During July 2023, in addition to producing and selling the regular girl's and ladies' clothing, Courageous also produced ladies' overalls, men's overalls and unisex overall jackets. - The accounting team prepared the following extract from the company's Statement of Profit or Loss and Other Comprehensive Income (SPLOCI) for the month of July 2023: - Assume that the cost of sales amount given in the extract from Courageous' SPLOCI is comprised as follows: - The fixed costs included in the product cost in cost of sales are allocated to the products based on the actual number of units produced. Assume that Courageous has a fantastic team of financial planners and the actual amount of fixed costs allocated to production during the month is equal to the actual fixed costs incurred during the month. - Assume that the operating expenses are semi-variable and are comprised as follows: - The variable portion of the selling expenses and distribution expenses varies directly with the total units sold. Assume that during the month ended 31 July 2023, the variable portion of these expenses increased by 12% per unit sold, but the fixed portion remained constant. The sales volumes during the financial months of June 2023 and July 2023 were 55875 units and 80250 units, respectively. Assume that the administrative expenses and restructuring expenses consist 24% of variable costs and 76% of fixed costs. The net interest expense is fixed in relation to the quantity of units sold. Assume that during the month of July 2023 , the following quantities of the various products were produced and sold: There were 1000 girl's clothing items and 500 ladies' clothing items on hand at the beginning of July 2023. There was no opening stock of any of the other product types at the beginning of July 2023. Assume that at 30 June 2023, the fixed cost included in closing stock for clothing items was R25 per item. Assume that the variable cost per unit of production for July 2023 was the same as the variable cost per unit of the opening stock of girl's clothing and ladies' clothing. ATTACHMENT 1 - SUPPLEMENTARY INFORMATION - All inventory is valued on a first-in-first-out basis. - During July 2023, in addition to producing and selling the regular girl's and ladies' clothing, Courageous also produced ladies' overalls, men's overalls and unisex overall jackets. - The accounting team prepared the following extract from the company's Statement of Profit or Loss and Other Comprehensive Income (SPLOCI) for the month of July 2023: - Assume that the cost of sales amount given in the extract from Courageous' SPLOCI is comprised as follows: - The fixed costs included in the product cost in cost of sales are allocated to the products based on the actual number of units produced. Assume that Courageous has a fantastic team of financial planners and the actual amount of fixed costs allocated to production during the month is equal to the actual fixed costs incurred during the month. - Assume that the operating expenses are semi-variable and are comprised as follows: - The variable portion of the selling expenses and distribution expenses varies directly with the total units sold. Assume that during the month ended 31 July 2023, the variable portion of these expenses increased by 12% per unit sold, but the fixed portion remained constant. The sales volumes during the financial months of June 2023 and July 2023 were 55875 units and 80250 units, respectively. Assume that the administrative expenses and restructuring expenses consist 24% of variable costs and 76% of fixed costs. The net interest expense is fixed in relation to the quantity of units sold. Assume that during the month of July 2023 , the following quantities of the various products were produced and sold: There were 1000 girl's clothing items and 500 ladies' clothing items on hand at the beginning of July 2023. There was no opening stock of any of the other product types at the beginning of July 2023. Assume that at 30 June 2023, the fixed cost included in closing stock for clothing items was R25 per item. Assume that the variable cost per unit of production for July 2023 was the same as the variable cost per unit of the opening stock of girl's clothing and ladies' clothing