Answered step by step

Verified Expert Solution

Question

1 Approved Answer

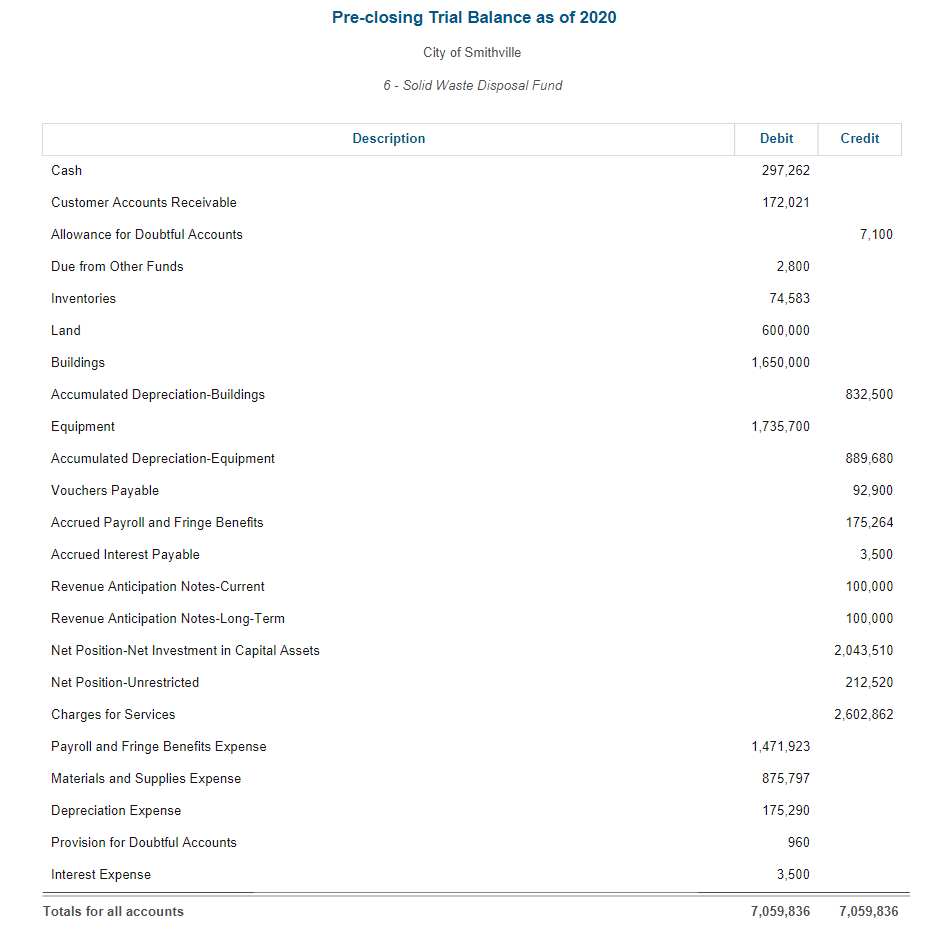

prepare entries to reclassify the two net position accounts , as appropriate. Let me know if additional info is needed (I think the Pre-close TB

prepare entries to reclassify the two net position accounts, as appropriate. Let me know if additional info is needed (I think the Pre-close TB is enough).

Pre-closing Trial Balance as of 2020 City of Smithville 6 - Solid Waste Disposal Fund Description Debit Credit Cash 297,262 Customer Accounts Receivable 172,021 Allowance for Doubtful Accounts 7,100 Due from Other Funds 2,800 Inventories 74,583 Land 600,000 Buildings 1,650,000 Accumulated Depreciation-Buildings 832,500 Equipment 1,735,700 Accumulated Depreciation-Equipment 889,680 Vouchers Payable 92,900 Accrued Payroll and Fringe Benefits 175,264 Accrued Interest Payable 3,500 Revenue Anticipation Notes-Current 100,000 Revenue Anticipation Notes-Long-Term 100,000 Net Position-Net Investment in Capital Assets 2,043,510 212,520 Net Position-Unrestricted Charges for Services 2,602,862 1,471,923 Payroll and Fringe Benefits Expense Materials and Supplies Expense Depreciation Expense 875,797 175,290 Provision for Doubtful Accounts 960 Interest Expense 3,500 Totals for all accounts 7,059,836 7,059,836 Pre-closing Trial Balance as of 2020 City of Smithville 6 - Solid Waste Disposal Fund Description Debit Credit Cash 297,262 Customer Accounts Receivable 172,021 Allowance for Doubtful Accounts 7,100 Due from Other Funds 2,800 Inventories 74,583 Land 600,000 Buildings 1,650,000 Accumulated Depreciation-Buildings 832,500 Equipment 1,735,700 Accumulated Depreciation-Equipment 889,680 Vouchers Payable 92,900 Accrued Payroll and Fringe Benefits 175,264 Accrued Interest Payable 3,500 Revenue Anticipation Notes-Current 100,000 Revenue Anticipation Notes-Long-Term 100,000 Net Position-Net Investment in Capital Assets 2,043,510 212,520 Net Position-Unrestricted Charges for Services 2,602,862 1,471,923 Payroll and Fringe Benefits Expense Materials and Supplies Expense Depreciation Expense 875,797 175,290 Provision for Doubtful Accounts 960 Interest Expense 3,500 Totals for all accounts 7,059,836 7,059,836

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started