Question

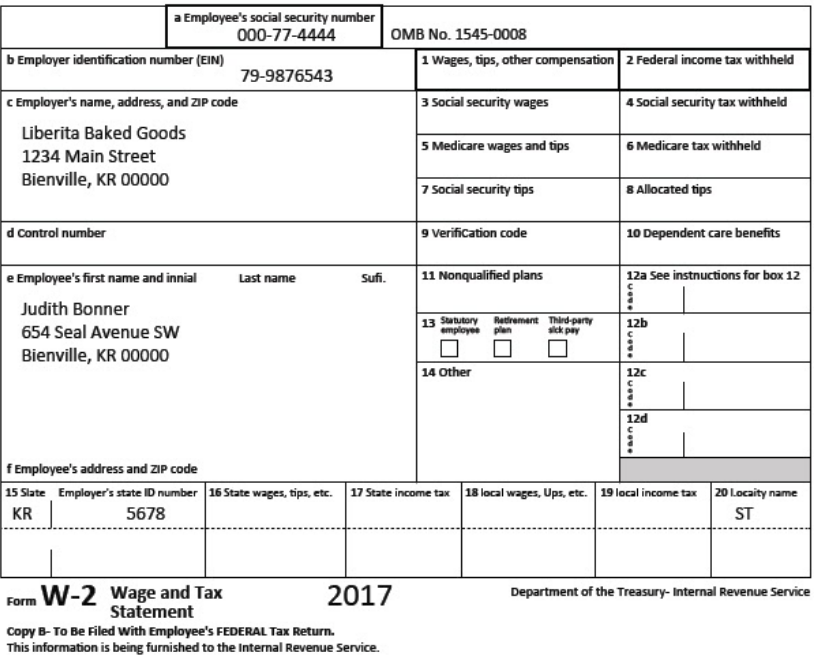

Prepare federal, state, and local payroll reports for a company. Mrs. Samuels, the owner of Liberita Baked Goods, is preparing her company's payroll forms. She

Prepare federal, state, and local payroll reports for a company.

Mrs. Samuels, the owner of Liberita Baked Goods, is preparing her company's payroll forms. She has five employees, whose annual salaries are listed as follows:

- Judith Bonner, general manager: $47,000

- Carol Garrison, cashier: $28,000

- Stewart Martinez, kitchen manager: $42,000

- Nicole Gray, assistant baker: $33,500

- Patrick Woodall, assistant baker: $33,500

These five employees have paid $9,424 in federal income taxes for the entire year.

1. First, Mrs. Samuels will need to fill out the Form 941. Since it is a quarterly form, she is preparing it for the first quarter of the year. So far this year, Mrs. Samuels has paid $6,000 in deposits. Fill out the following Form 941 for Mrs. Samuels's business. Pay close attention to detail and make sure your work is accurate.

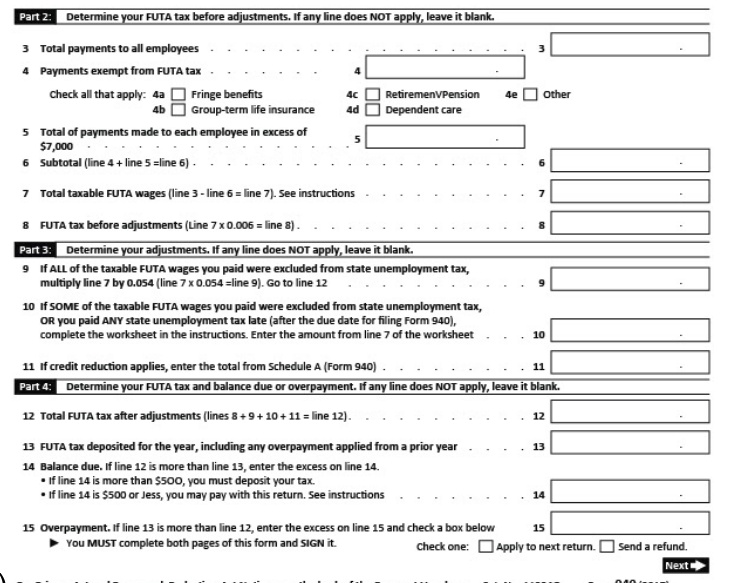

Mrs. Samuels will need to fill out the Form 940 for her employees' unemployment insurance. This is an annual form that only needs to be filled out once a year. No portion of her employees' salaries is exempt from the FUTA tax and that she did not pay any state employment tax. She has deposited $2,100 in FUTA tax so far this year.

Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all employees 4 Payments exempt from FUTA tax check all that apply: 4a 4b Fringe benefits Group-term life insurance 4c 4d 5 Total of payments made to each employee in excess of $7,000 6 Subtotal (line 4+ line 5 =line 6). 7 Total taxable FUTA wages (line 3-line 6= line 7). See instructions RetiremenVPension 4e Dependent care 8 FUTA tax before adjustments (Line 7 x 0.006 = line 8). Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by 0.054 (line 7 x 0.054-line 9). Go to line 12 10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet. 13 FUTA tax deposited for the year, including any overpayment applied from a prior year 14 Balance due. If line 12 is more than line 13, enter the excess on line 14. If line 14 is more than $500, you must deposit your tax. If line 14 is $500 or Jess, you may pay with this return. See instructions Other 15 Overpayment. If line 13 is more than line 12, enter the excess on line 15 and check a box below You MUST complete both pages of this form and SIGN it. 7 10 11 If credit reduction applies, enter the total from Schedule A (Form 940). 11 Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8+9+10+11 = line 12). 12 13 IL 14 15 Check one: Apply to next return. Send a refund. Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to complete the W2 form for Judith Bonner 1 Box 1 Wages tips other compensation E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started