Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare Form 1040 - Individual Income Tax Return (Form 1040). In addition, complete any required schedules Schedule 1, 2, A, B, etc. Post picture of

Prepare Form 1040 - Individual Income Tax Return (Form 1040). In addition, complete any required schedules Schedule 1, 2, A, B, etc. Post picture of filled out forms.

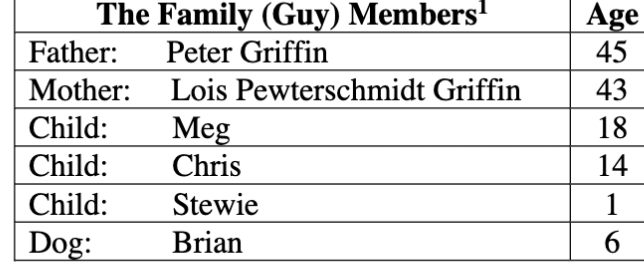

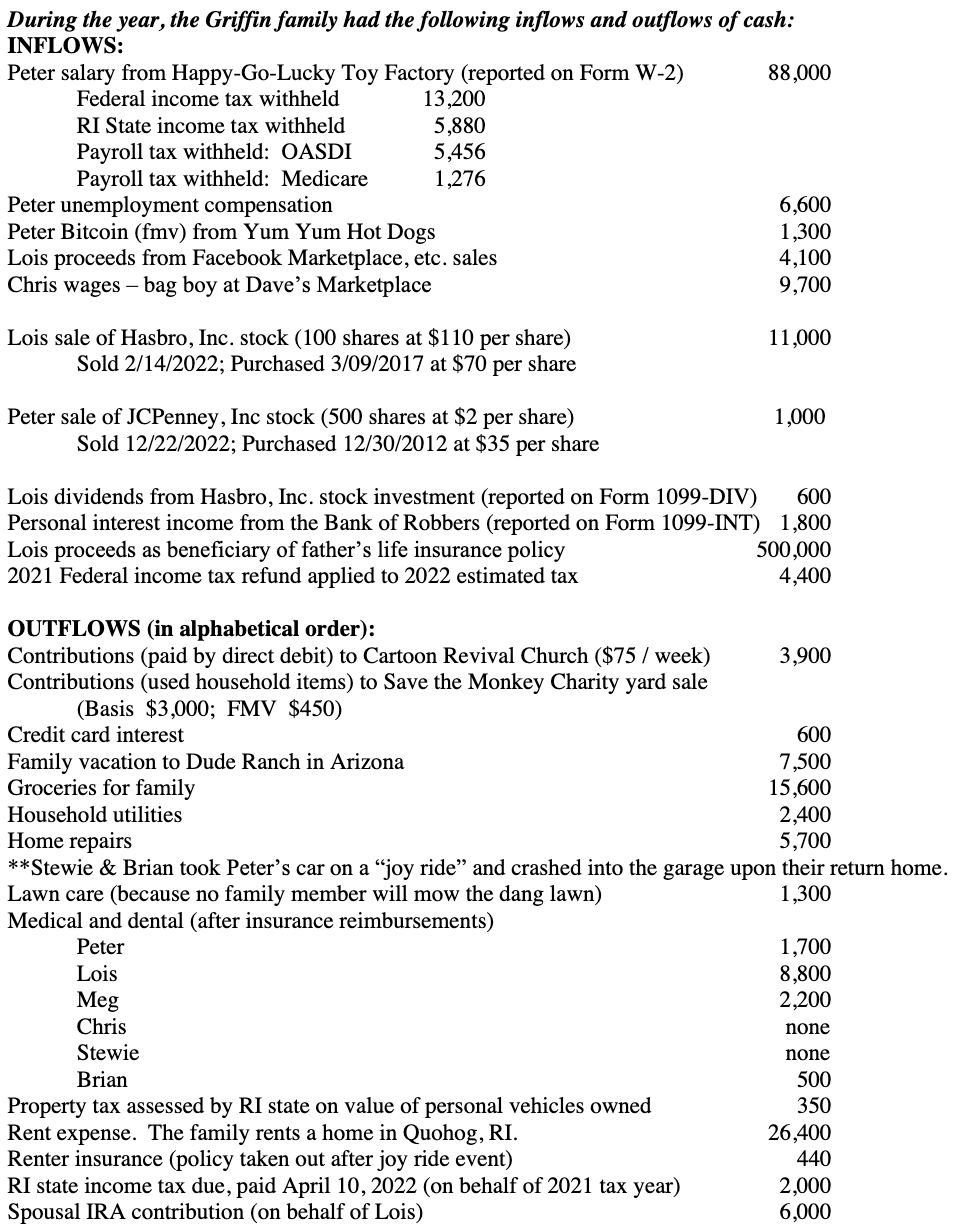

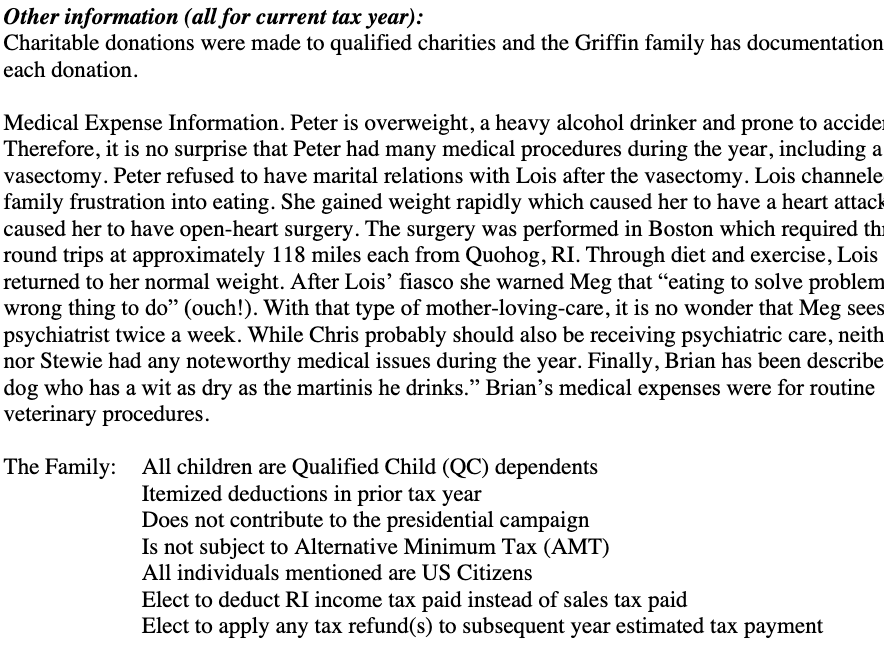

\begin{tabular}{|ll|c|} \multicolumn{2}{|c|}{ The Family (Guy) Members 1} & Age \\ \hline Father: & Peter Griffin & 45 \\ \hline Mother: & Lois Pewterschmidt Griffin & 43 \\ \hline Child: & Meg & 18 \\ \hline Child: & Chris & 14 \\ \hline Child: & Stewie & 1 \\ \hline Dog: & Brian & 6 \\ \hline \end{tabular} Other information (all for current tax year): Charitable donations were made to qualified charities and the Griffin family has documentation each donation. Medical Expense Information. Peter is overweight, a heavy alcohol drinker and prone to accide Therefore, it is no surprise that Peter had many medical procedures during the year, including a vasectomy. Peter refused to have marital relations with Lois after the vasectomy. Lois channele family frustration into eating. She gained weight rapidly which caused her to have a heart attach caused her to have open-heart surgery. The surgery was performed in Boston which required th round trips at approximately 118 miles each from Quohog, RI. Through diet and exercise, Lois returned to her normal weight. After Lois' fiasco she warned Meg that "eating to solve problem wrong thing to do" (ouch!). With that type of mother-loving-care, it is no wonder that Meg sees psychiatrist twice a week. While Chris probably should also be receiving psychiatric care, neith nor Stewie had any noteworthy medical issues during the year. Finally, Brian has been describe dog who has a wit as dry as the martinis he drinks." Brian's medical expenses were for routine veterinary procedures. The Family: All children are Qualified Child (QC) dependents Itemized deductions in prior tax year Does not contribute to the presidential campaign Is not subject to Alternative Minimum Tax (AMT) All individuals mentioned are US Citizens Elect to deduct RI income tax paid instead of sales tax paid Elect to apply any tax refund(s) to subsequent year estimated tax payment During the year, the Griffin family had the following inflows and outflows of cash: INFLOWS: Peter salary from Happy-Go-Lucky Toy Factory (reported on Form W-2) 88,000 Federal income tax withheld RI State income tax withheld Payroll tax withheld: OASDI Payroll tax withheld: Medicare 13,200 5,880 5,456 1,276 Peter unemployment compensation Peter Bitcoin (fmv) from Yum Yum Hot Dogs Lois proceeds from Facebook Marketplace, etc. sales Chris wages - bag boy at Dave's Marketplace Lois sale of Hasbro, Inc. stock (100 shares at $110 per share) 6,600 1,300 4,100 9,700 Sold 2/14/2022; Purchased 3/09/2017 at $70 per share 11,000 Peter sale of JCPenney, Inc stock (500 shares at \$2 per share) 1,000 Sold 12/22/2022; Purchased 12/30/2012 at \$35 per share Lois dividends from Hasbro, Inc. stock investment (reported on Form 1099-DIV) 600 Personal interest income from the Bank of Robbers (reported on Form 1099-INT) 1,800 Lois proceeds as beneficiary of father's life insurance policy 500,000 2021 Federal income tax refund applied to 2022 estimated tax 4,400 OUTFLOWS (in alphabetical order): Contributions (paid by direct debit) to Cartoon Revival Church (\$75 / week) 3,900 Contributions (used household items) to Save the Monkey Charity yard sale (Basis \$3,000; FMV \$450) \begin{tabular}{lr} Credit card interest & 600 \\ Family vacation to Dude Ranch in Arizona & 7,500 \\ Groceries for family & 15,600 \\ Household utilities & 2,400 \\ Home repairs & 5,700 \end{tabular} **Stewie \& Brian took Peter's car on a "joy ride" and crashed into the garage upon their return home. Lawn care (because no family member will mow the dang lawn) 1,300 Medical and dental (after insurance reimbursements) Peter 1,700 Lois 8,800 Meg 2,200 Chris none Stewie none Brian Property tax assessed by RI state on value of personal vehicles owned 500 Rent expense. The family rents a home in Quohog, RI. 350 Renter insurance (policy taken out after joy ride event) RI state income tax due, paid April 10, 2022 (on behalf of 2021 tax year) 26,400 440 Spousal IRA contribution (on behalf of Lois) 2,000 6,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started