Prepare Frame-It Companys summary cash budget for 20x1.

What is the quarterly interest payment for 2nd, 3rd, and 4th quarter? I tried (25,000) but it was marked as incorrect.

Cash Balance Beginning?

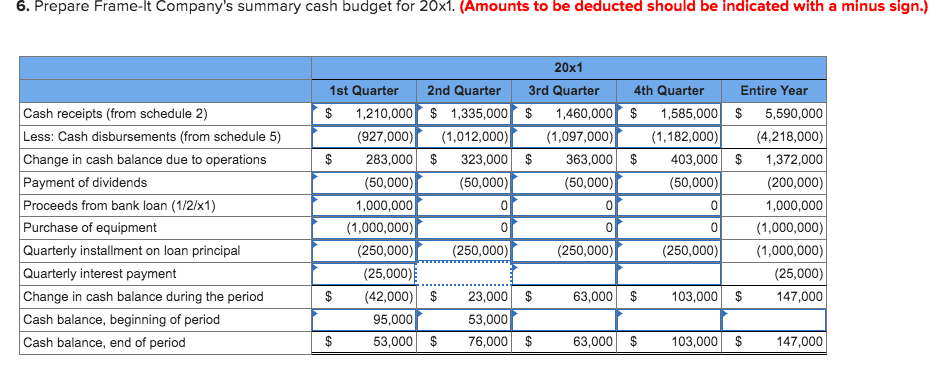

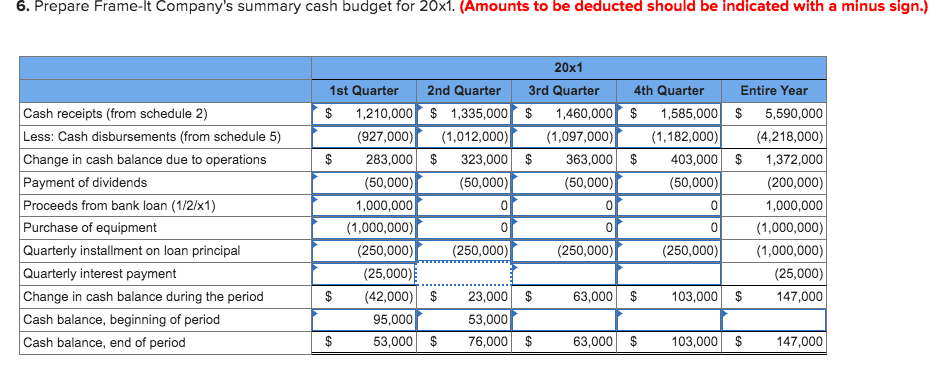

6. Prepare Frame-It Company's summary cash budget for 20x1. (Amounts to be deducted should be indicated with a minus sign.) 2nd Quarter $ 1,335,000 (1,012,000) $ 323,000 (50,000) 0 20x1 3rd Quarter 4th Quarter $ 1,460,000$ 1,585,000 (1,097,000) (1,182,000) $ 363,000 $ 403,000 (50,000)| (50,000) Cash receipts (from schedule 2) Less: Cash disbursements (from schedule 5) Change in cash balance due to operations Payment of dividends Proceeds from bank loan (1/2/x1) Purchase of equipment Quarterly installment on loan principal Quarterly interest payment Change in cash balance during the period Cash balance, beginning of period Cash balance, end of period 1st Quarter $ 1,210,000 (927,000) $ 283,000 (50,000) 1,000,000 (1,000,000) (250,000) (25,000) $ (42,000) 95,000 $ 53,000 Entire Year $ 5,590,000 (4,218,000) $ 1,372,000 (200,000) 1,000,000 (1,000,000) (1,000,000) (25,000) $ 147,000 (250,000) (250,000) (250,000) $ $ 63,000 $ 103,000 23,000 53,000 76,000 $ $ 63,000 $ 103,000 $ 147,000 Jeffrey Vaughn, president of Frame-It Company, was just concluding a budget meeting with his senior staff. It was November of 20x0, and the group was discussing preparation of the firm's master budget for 20x1. "I've decided to go ahead and purchase the industrial robot we've been talking about. We'll make the acquisition on January 2 of next year, and I expect it will take most of the year to train the personnel and reorganize the production process to take full advantage of the new equipment." In response to a question about financing the acquisition, Vaughn replied as follows: "The robot will cost $1,000,000. We'll finance it with a one-year $1,000,000 loan from Shark Bank and Trust Company. I've negotiated a repayment schedule of four equal installments on the last day of each quarter. The interest rate will be 10 percent, and interest payments will be quarterly as well." With that the meeting broke up, and the budget process was on. Frame-It Company is a manufacturer of metal picture frames. The firm's two product lines are designated as S (small frames; 5 x 7 inches) and L (large frames; 8 x 10 inches). The primary raw materials are flexible metal strips and 9-inch by 24-inch glass sheets. Each S frame requires a 2-foot metal strip; an L frame requires a 3-foot strip. Allowing for normal breakage and scrap glass, Frame-It can get either four S frames or two L frames out of a glass sheet. Other raw materials, such as cardboard backing, are insignificant in cost and are treated as indirect materials. Emily Jackson, Frame-It's controller, is in charge of preparing the master budget for 20x1. She has gathered the following information