Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare in excel sheet propotion of ABL= 0.31 B. Calculate price per share assuming that 10 Million shares are outstanding using free cash flow (FCF)

prepare in excel sheet

propotion of ABL= 0.31

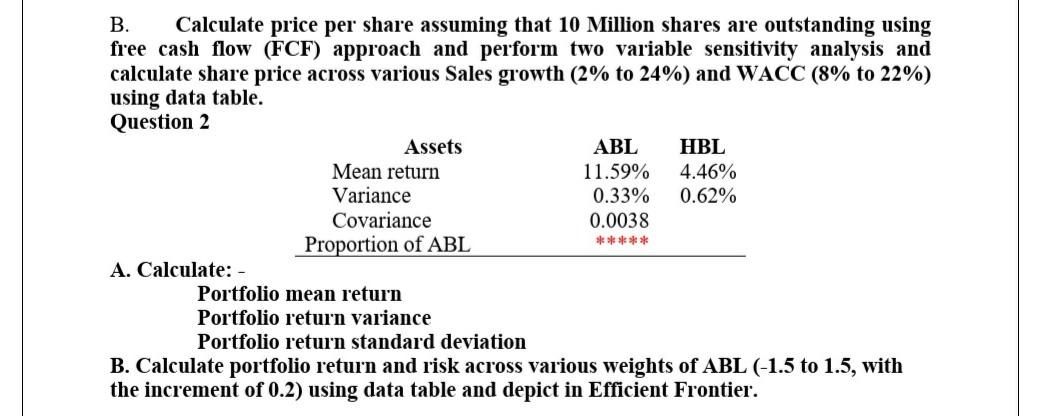

B. Calculate price per share assuming that 10 Million shares are outstanding using free cash flow (FCF) approach and perform two variable sensitivity analysis and calculate share price across various Sales growth (2% to 24%) and WACC (8% to 22%) using data table. Question 2 Assets ABL HBL Mean return 11.59% 4.46% Variance 0.33% 0.62% Covariance 0.0038 Proportion of ABL A. Calculate: Portfolio mean return Portfolio return variance Portfolio return standard deviation B. Calculate portfolio return and risk across various weights of ABL (-1.5 to 1.5, with the increment of 0.2) using data table and depict in Efficient Frontier. ***** B. Calculate price per share assuming that 10 Million shares are outstanding using free cash flow (FCF) approach and perform two variable sensitivity analysis and calculate share price across various Sales growth (2% to 24%) and WACC (8% to 22%) using data table. Question 2 Assets ABL HBL Mean return 11.59% 4.46% Variance 0.33% 0.62% Covariance 0.0038 Proportion of ABL A. Calculate: Portfolio mean return Portfolio return variance Portfolio return standard deviation B. Calculate portfolio return and risk across various weights of ABL (-1.5 to 1.5, with the increment of 0.2) using data table and depict in Efficient Frontier. *****Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started