Question

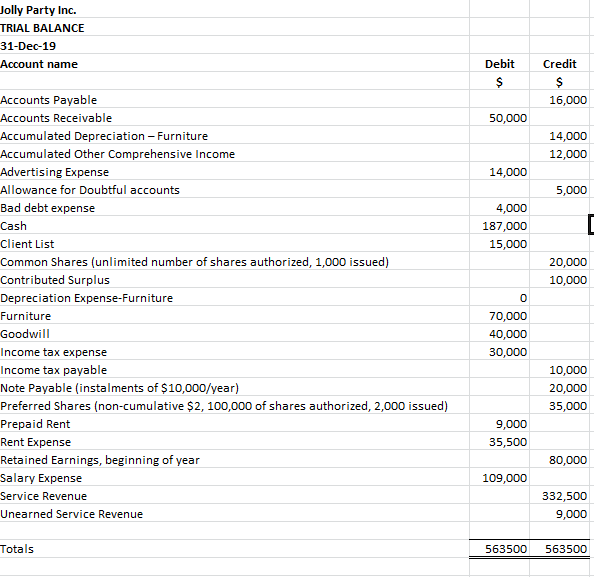

Prepare in proper form a classified Statement of Financial Position as at December 31, 2019 On October 31st, 2019, the company declared $30,000 cash dividends.

Prepare in proper form a classified Statement of Financial Position as at December 31, 2019

On October 31st, 2019, the company declared $30,000 cash dividends. The dividends were paid on February 12, 2020.

On February 15th, 2019, the company declared a 20% common stock dividends when market share price was $30. The shares were distributed on November 15th, 2019 when market share price was $32.

On December 31, 2019, the company declared a two-for-one stock split on common shares.

Client/Customer List was purchased on December 31, 2019. It is expected to have an economic life of 3 years.

The furniture was purchased on Jan 1, 2017. It has a useful life of 10 years, with no expected residual value. Company uses the straight-line depreciation method. No depreciation was recorded for year 2019.

Jolly Party Inc. TRIAL BALANCE 31-Dec-19 Account name Accounts Payable Accounts Receivable Accumulated Depreciation - Furniture Accumulated Other Comprehensive Income Advertising Expense Allowance for Doubtful accounts Bad debt expense Cash Client List Common Shares (unlimited number of shares authorized, 1,000 issued) Contributed Surplus Depreciation Expense-Furniture Furniture Goodwill Income tax expense Income tax payable Note Payable (instalments of $10,000/year) Preferred Shares (non-cumulative $2,100,000 of shares authorized, 2,000 issued) Prepaid Rent Rent Expense Retained Earnings, beginning of year Salary Expense Service Revenue Unearned Service Revenue Totals Debit $ 50,000 14,000 4,000 187,000 15,000 0 70,000 40,000 30,000 9,000 35,500 109,000 563500 Credit $ 16,000 14,000 12,000 5,000 I 20,000 10,000 10,000 20,000 35,000 80,000 332,500 9,000 563500

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

answers Adjusting entries Date Account titles and explanation Debit Credit 2019 Oct 31 Dividends 30000 Dividend payable 30000 Dividend recorded Feb 15 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started