Answered step by step

Verified Expert Solution

Question

1 Approved Answer

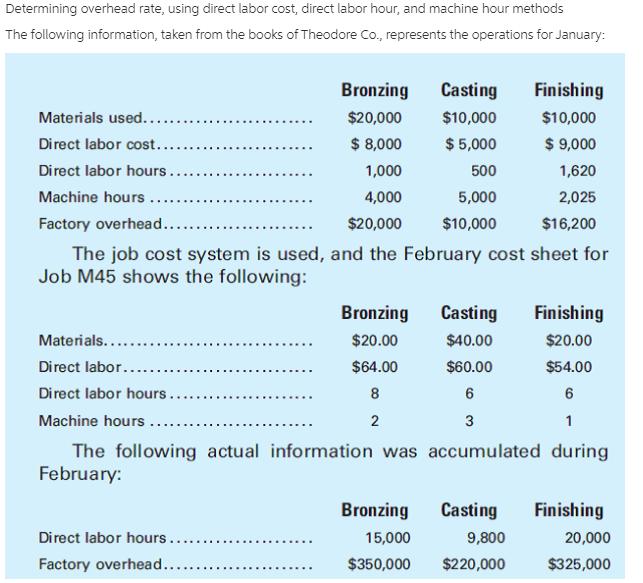

Determining overhead rate, using direct labor cost, direct labor hour, and machine hour methods The following information, taken from the books of Theodore Co.,

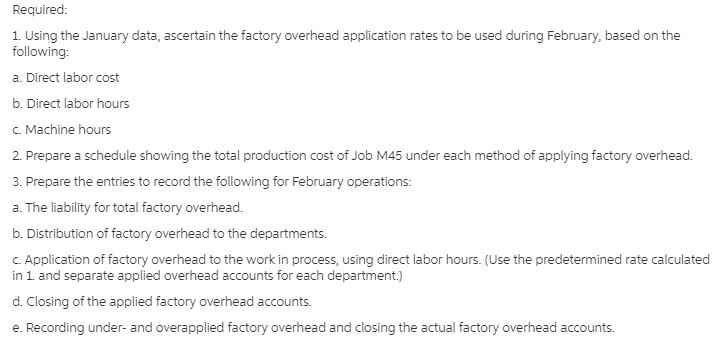

Determining overhead rate, using direct labor cost, direct labor hour, and machine hour methods The following information, taken from the books of Theodore Co., represents the operations for January: Bronzing Casting Finishing Materials used...... $20,000 $10,000 $10,000 Direct labor cost.. $ 8,000 $ 5,000 $ 9,000 Direct labor hours... 1,000 500 1,620 Machine hours ... 4,000 5,000 2,025 Factory overhead..... $20,000 $10,000 $16,200 The job cost system is used, and the February cost sheet for Job M45 shows the following: Bronzing Casting Finishing Materials..... $20.00 $40.00 $20.00 Di rect labor...... $64.00 $60.00 $54.00 Direct labor hours... 8 Machine hours.. 2 3 1 .... The following actual information was accumulated during February: Bronzing Casting Finishing Direct labor hours.... 15,000 9,800 20,000 Factory overhead... $350,000 $220,000 $325,000 Required: 1. Using the January data, ascertain the factory overhead application rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours C. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. C. Application of factory overhead to the work in process, using direct labor hours. (Use the predetermined rate calculated in 1. and separate applied overhead accounts for each department.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started