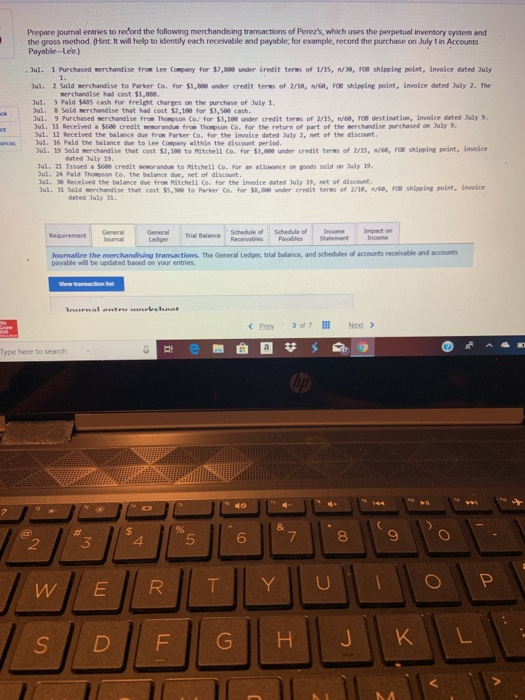

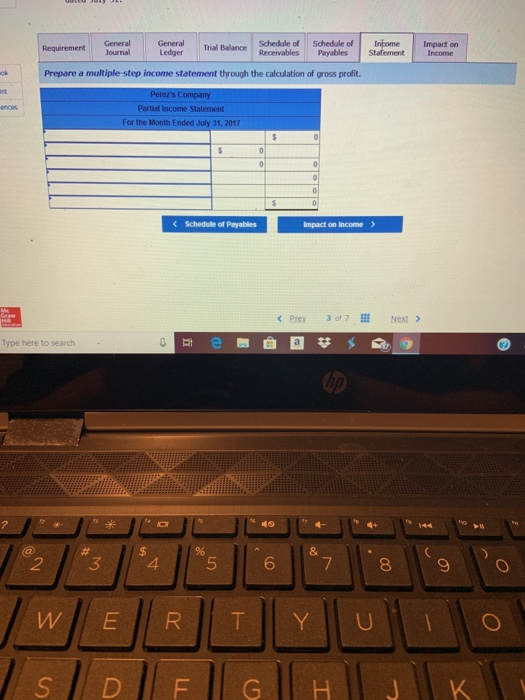

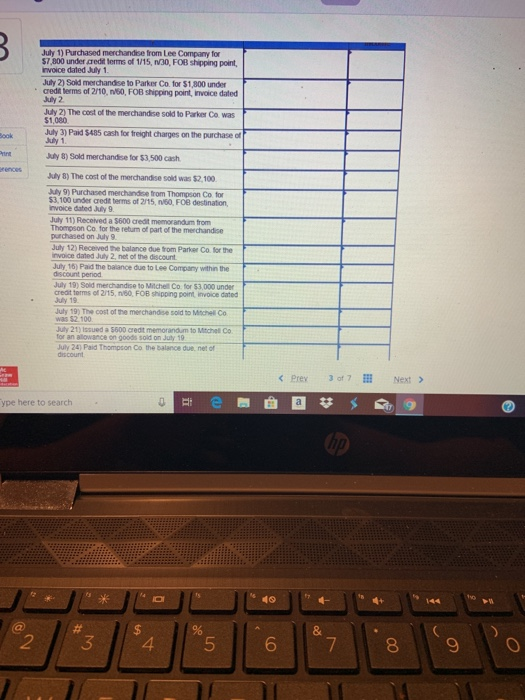

Prepare joumal entries to redord the following merchandising transactions of Perez's, which uses the perpetual inventory system and the gross method. (Hint: It will help to identily each receivable and payable, for example, record the purchase on July 1 in Accounts Payable-Lee) . Jul. 1 Purchased ierchandise fro" Lee Copa y for S7,800 under iredit teres of 1/15, n/H, FOB shipping point, invoice dated July Ju1. 2 Sold-erchandise to Parker Co. for S1,uner credit teres of 2/10, nia, Fce shipping point, imoicedated July 2. The nerchandise had cost 51, ul. 3 Paid 5485 cash for frelght charges on the purchase of July 1. ul. 8 Sold merchandise that had cest $2,18e for 3,500 cash. u1. 9 Purchased merchandise froe Thonpson Co- for 3,100 under credit teres of 2/5, n/e, FOB dest ination, invoice dated July 9 ul. 11 Received a $688 credit memorandun from Thonpson Co. for the return of part of the serchandise purchased on July 9 l. 12 Received the balance due from Parker Co. for the imvoice dated July 2, net of the discount. ences Jul. 16 Pald the balance due to Lee Company within the discount perlod Jul. 19 Sold serchandise that cost $1,10e to Mitchell Co. for S3,we under credit terms of 2/15m/ae, Foe shipping point, invoice dated July 19 ui. 21 Issued a $6ee creait memor andun to Mitchell Co. for an allowance on goods sold on July 19 Sul. 24 Paid Thonpson Co. the balance due, net of aiscount. ul. 30 Recelved the balance due from Mitchell Co. for the invoice dated July 19, net of discount Jul 31 Sald merchandise that cost ss,y00 to Parker Co. for SA00 undr eredit teris of 2ne. neo, fce sklaping pelet, l-ace dated July 31 lncome Impact on Requirement Gneral General Ledger Tl Bance Schedule of Journalize the merchandising transactions. The General Ledgec trial bulance, and schedules of accounts receivable and accounts payable will be updated based on your entries C Prey 3 of7 Next > Type here to search 8 6 8 9 3 5 S D FGJ K Impact on RequirementJournal Trial Balance Schedule of Schedule of Receivables Payables Statement Income Prepare a multiple-step income statement through the calculation of gross profit. Partial Income Statement For the Month Ended July 31, 2017 C Schedule of Payabiles mpact on Income> Type here to search 49 2 3 4 5 6 SIDFGHJK July 1) Purchased merchandise from Lee Company for $7,800 under credat terms of 1/15, v/30, FOB shipping point rvoice dated July 1 July 2) Sold merchandise to Parker Co for $1,800 under credt terms of 2/10, n/60, FOB shipping point, invoice dated July 2 July 2) The cost of the merchandise sold to Parker Co was 51,080 July 3) Paid $485 cash for freight charges on the purchase of ook July 8) Sold merchandise for $3,500 cash July 8) The cost of the merchandise sold was $2,100 July 9) Purchased merchandise from Thompson Co. for ea 53,100 under credit terms of 2/15, n/60, FOB destination, nvoice dated July 9 July 11) Received a $600 credit memorandum from Thompson Co for the return of part of the merchandice purchased on July 9 July 12) Received the balance due from Parker Co. for the nvoice dated July 2 net of the discount July 16) Paid the baiance due to Lee Company within the discount period July 19) Sold merchandise to Mitchell Co for $3,000 under credit torms of 2/15, n60, FOB shipping point invoice dated .July 19 July 19) The cost of the merchandse sold to Mitchell Co was $2 100 July 21) Issued a $600 credit memorandum to Mitchell Co for an allowance on goods sold on July 19 uly 24) Paid Thompson Co the balance due.net of ype here to search 2 3 45 67 9