Answered step by step

Verified Expert Solution

Question

1 Approved Answer

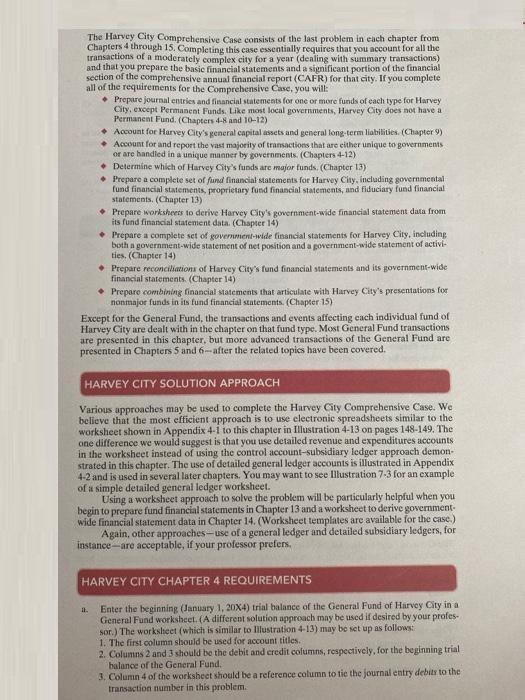

The Harvey City Comprehensive Case consists of the last problem in each chapter from Chapters 4 through 15. Completing this case essentially requires that

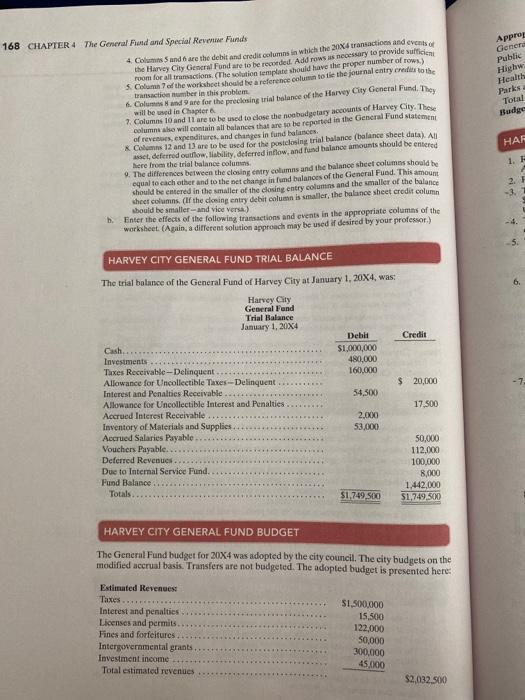

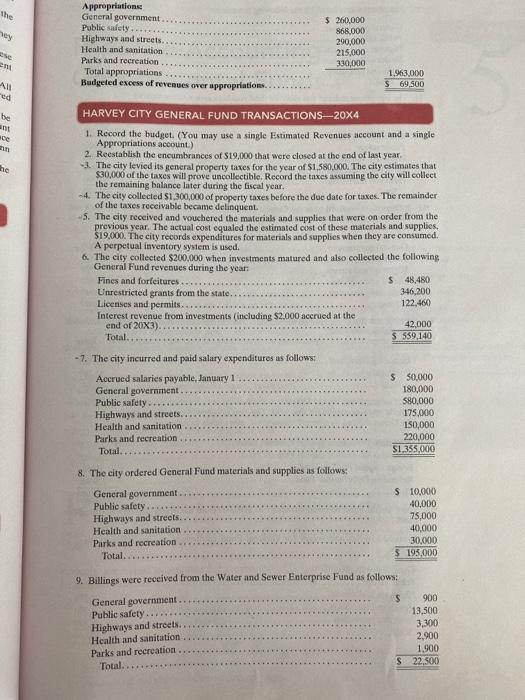

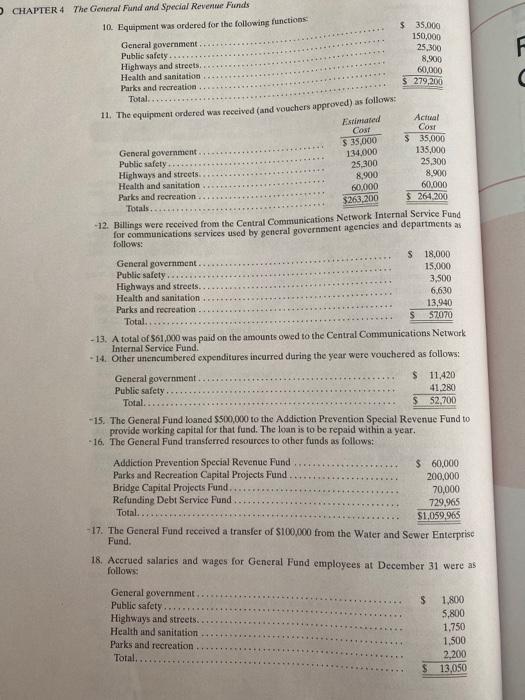

The Harvey City Comprehensive Case consists of the last problem in each chapter from Chapters 4 through 15. Completing this case essentially requires that you account for all the transactions of a moderately complex city for a year (dealing with summary transactions) and that you prepare the basic financial statements and a significant portion of the financial section of the comprehensive annual financial report (CAFR) for that city. If you complete all of the requirements for the Comprehensive Case, you will: Prepare journal entries and financial statements for one or more funds of each type for Harvey City, except Permanent Funds. Like most local governments, Harvey City does not have a Permanent Fund. (Chapters 4-8 and 10-12) * Account for Harvey City's general capital assets and general long-term liabilities. (Chapter 9) Account for and report the vast majority of transactions that are either unique to governments or are handled in a unique manner by governments. (Chapters 4-12) Determine which of Harvey City's funds are major funds. (Chapter 13) Prepare a complete set of fund financial statements for Harvey City, including governmental fund financial statements, proprietary fund financial statements, and fiduciary fund financial. statements. (Chapter 13) Prepare worksheets to derive Harvey City's government-wide financial statement data from its fund financial statement data. (Chapter 14) Prepare a complete set of government-wide financial statements for Harvey City, including both a government-wide statement of net position and a government-wide statement of activi- ties. (Chapter 14) it. Prepare reconciliations of Harvey City's fund financial statements and its government-wide financial statements. (Chapter 14) Prepare combining financial statements that articulate with Harvey City's presentations for nonmajor funds in its fund financial statements. (Chapter 15) Except for the General Fund, the transactions and events affecting each individual fund of Harvey City are dealt with in the chapter on that fund type. Most General Fund transactions are presented in this chapter, but more advanced transactions of the General Fund are presented in Chapters 5 and 6-after the related topics have been covered. HARVEY CITY SOLUTION APPROACH Various approaches may be used to complete the Harvey City Comprehensive Case. We believe that the most efficient approach is to use electronic spreadsheets similar to the worksheet shown in Appendix 4-1 to this chapter in Illustration 4-13 on pages 148-149. The one difference we would suggest is that you use detailed revenue and expenditures accounts in the worksheet instead of using the control account-subsidiary ledger approach demon- strated in this chapter. The use of detailed general ledger accounts is illustrated in Appendix 4-2 and is used in several later chapters. You may want to see Illustration 7-3 for an example: of a simple detailed general ledger worksheet. Using a worksheet approach to solve the problem will be particularly helpful when you begin to prepare fund financial statements in Chapter 13 and a worksheet to derive government- wide financial statement data in Chapter 14. (Worksheet templates are available for the case.) Again, other approaches-use of a general ledger and detailed subsidiary ledgers, for instance are acceptable, if your professor prefers. HARVEY CITY CHAPTER 4 REQUIREMENTS Enter the beginning (January 1, 20X4) trial balance of the General Fund of Harvey City in a General Fund worksheet. (A different solution approach may be used if desired by your profes sor.) The worksheet (which is similar to Illustration 4-13) may be set up as follows: 1. The first column should be used for account titles. 2. Columns 2 and 3 should be the debit and credit columns, respectively, for the beginning trial balance of the General Fund. 3. Column 4 of the worksheet should be a reference column to tie the journal entry debits to the transaction number in this problem. 168 CHAPTER 4 The General Fund and Special Revenue Funds b. 4 Columns 5 and are the debit and credit columns in which the 2004 transactions and events of the Harvey City General Fund are to be recorded. Add rows as necessary to provide sufficient room for all transactions. (The solution template should have the proper number of rows) 5 Column 7 of the worksheet should be a reference column to tie the journal entry credits to the transaction number in this problem. 6 Columns 8 and 9 are for the preclosing trial balance of the Harvey City General Fund. They will be used in Chapter 6 7. Columns 10 and 11 are to be used to close the noabudgetary accounts of Harvey City. These columns also will contain all balances that are to be reported in the General Fund statement of revenues, expenditures, and changes in fund balances. & Columns 12 and 13 are to be used for the postclosing trial balance (balance sheet data). All asset, deferred outflow, liability, deferred inflow, and fund balance amounts should be entered here from the trial balance columns. 9. The differences between the closing entry columns and the balance sheet columns should be equal to each other and to the net change in fund balances of the General Fund. This amount should be entered in the smaller of the closing entry columns and the smaller of the balance sheet columns. (If the closing entry debit column is smaller, the balance sheet credit column should be smaller-and vice versa) Enter the effects of the following transactions and events in the appropriate columns of the worksheet. (Again, a different solution approach may be used if desired by your professor.) HARVEY CITY GENERAL FUND TRIAL BALANCE The trial balance of the General Fund of Harvey City at January 1, 20X4, was: Harvey City General Fund Trial Balance January 1, 20X4 Cash. Investments Taxes Receivable-Delinquent Allowance for Uncollectible Taxes-Delinquent Interest and Penalties Receivable Allowance for Uncollectible Interest and Penalties Accrued Interest Receivable Inventory of Materials and Supplies.. Accrued Salaries Payable.. Vouchers Payable.. Deferred Revenues. Due to Internal Service Fund. Fund Balance Totals. Debit $1,000,000 480,000 160,000 Estimated Revenues: Taxes.... Interest and penalties Licenses and permits. Fines and forfeitures, Intergovernmental grants. Investment income Total estimated revenues 54,500 2,000 53,000 $1,749,500 Credit $1,500,000 15,500 122,000 50,000 300,000 45,000 $ 20,000 17,500 50,000 112,000 100,000 8,000 HARVEY CITY GENERAL FUND BUDGET The General Fund budget for 20X4 was adopted by the city council. The city budgets on the modified accrual basis. Transfers are not budgeted. The adopted budget is presented here: 1,442,000 $1,749,500 $2,032.500 Approp Genera Public Highw Health Parks a Total Budges HAR 1. R 2. F the hey esc 201 All red be ant ace he Appropriations: General government. Public safety. Highways and streets. Health and sanitation Parks and recreation Total appropriations Budgeted excess of revenues over appropriations.. $ 260,000 868,000 290,000 215,000 330,000 HARVEY CITY GENERAL FUND TRANSACTIONS-20X4 1. Record the budget. (You may use a single Estimated Revenues account and a single Appropriations account.) 2. Reestablish the encumbrances of $19,000 that were closed at the end of last year. -3. The city levied its general property taxes for the year of $1,580,000. The city estimates that $30,000 of the taxes will prove uncollectible. Record the taxes assuming the city will collect the remaining balance later during the fiscal year. -4. The city collected $1,300,000 of property taxes before the due date for taxes. The remainder of the taxes receivable became delinquent. Fines and forfeitures. Unrestricted grants from the state.. 1,963,000 $ 69,500 -5. The city received and vouchered the materials and supplies that were on order from the previous year. The actual cost equaled the estimated cost of these materials and supplies. $19,000. The city records expenditures for materials and supplies when they are consumed. A perpetual inventory system is used. 6. The city collected $200,000 when investments matured and also collected the following General Fund revenues during the year: Licenses and permits. Interest revenue from investments (including $2,000 accrued at the end of 20X3). Total.. -7. The city incurred and paid salary expenditures as follows: Accrued salaries payable, January 1 General government. Public safety.. Highways and streets... Health and sanitation Parks and recreation Total..... 8. The city ordered General Fund materials and supplies as follows: General government.. Public safety.. Highways and streets. Health and sanitation Parks and recreation Total.. $ 48,480 346,200 122,460 42,000 $ 559,140 $ 50,000 180,000 580,000 175,000 150,000 220,000 $1,355,000 $ 10,000 40,000 75,000 40,000 30,000 $ 195,000 9. Billings were received from the Water and Sewer Enterprise Fund as follows: General government. Public safety. Highways and streets.. Health and sanitation Parks and recreation. Total... 900 13,500 3,300 2,900 1,900 S 22,500 $ O CHAPTER 4 The General Fund and Special Revenue Funds 10. Equipment was ordered for the following functions: General government Public safety. Highways and streets. Health and sanitation Parks and recreation Total... 11. The equipment ordered was received (and vouchers approved) as follows: Estimated Cost General government. Public safety Highways and streets.. Health and sanitation Parks and recreation. Totals... General government. Public safety.. Highways and streets.. Health and sanitation Parks and recreation Total... General government. Public safety.. $ 35,000 134,000 25,300 8,900 60,000 $263,200 $ 35,000 150,000 25,300 8,900 60,000 $ 279,200 -12. Billings were received from the Central Communications Network Internal Service Fund for communications services used by general government agencies and departments as follows: Addiction Prevention Special Revenue Fund Parks and Recreation Capital Projects Fund Bridge Capital Projects Fund... Refunding Debt Service Fund Total.... Actual Cost $ 35,000 135,000 25,300 8,900 60,000 $ 264,200 General government. Public safety Highways and streets. Health and sanitation Parks and recreation Total... -13. A total of $61,000 was paid on the amounts owed to the Central Communications Network Internal Service Fund. -14. Other unencumbered expenditures incurred during the year were vouchered as follows: $ $ 18,000 15,000 3,500 6,630 13,940 $7,070 $ Total.... -15. The General Fund loaned $500,000 to the Addiction Prevention Special Revenue Fund to provide working capital for that fund. The loan is to be repaid within a year. -16. The General Fund transferred resources to other funds as follows: 11,420 41,280 $ 52,700 $ 60,000 200,000 70,000 729,965 $1,059,965 -17. The General Fund received a transfer of $100,000 from the Water and Sewer Enterprise Fund. 18. Accrued salaries and wages for General Fund employees at December 31 were as follows: S 1,800 5,800 1,750 1,500 2,200 $ 13,050 F C

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 To maintain full and systamatic records of business transaction To ascertain profit or loss of the business To depict financial position of tge business To provide accounting information to the inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started