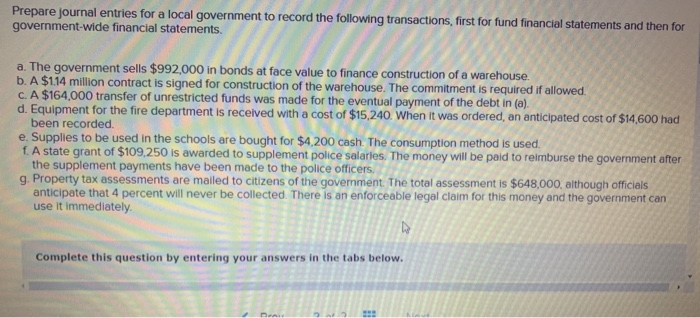

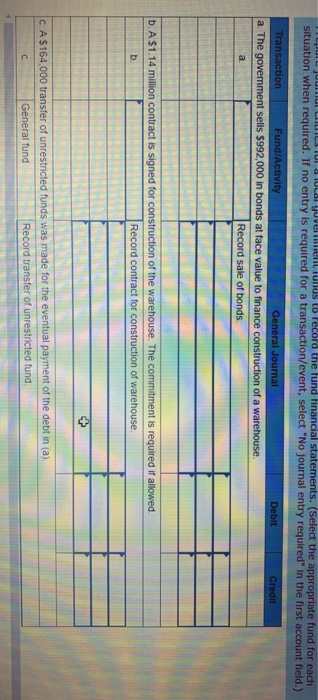

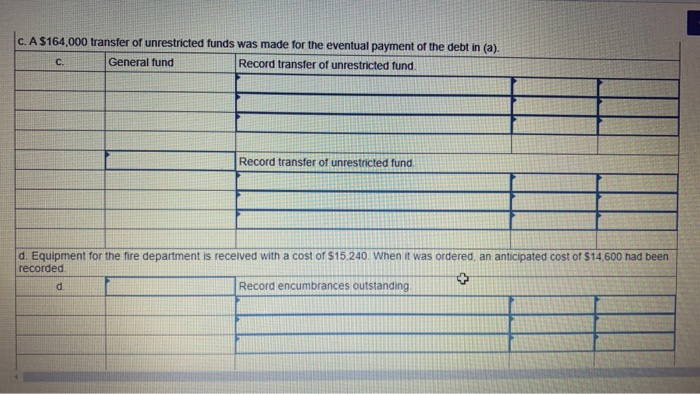

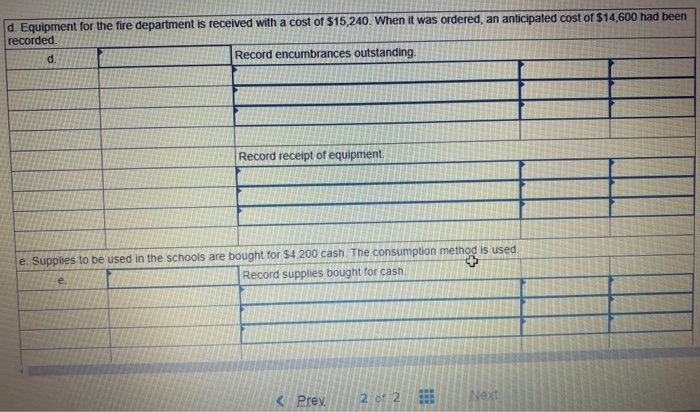

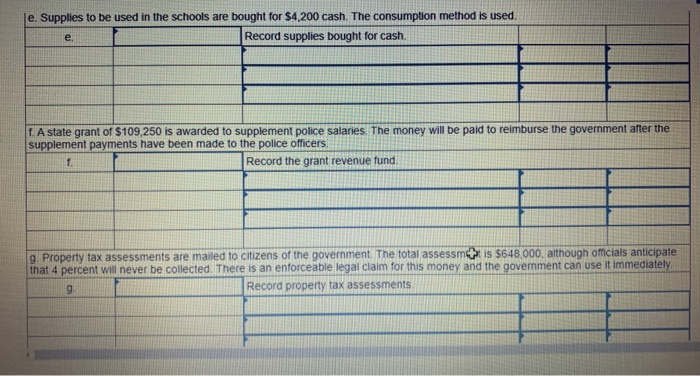

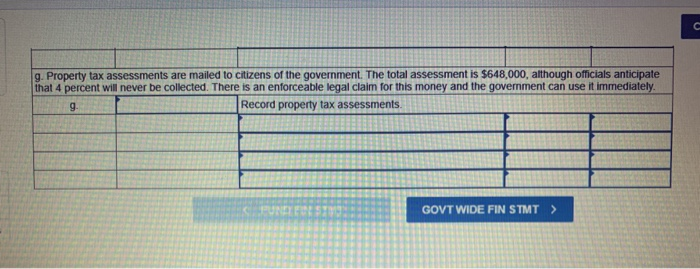

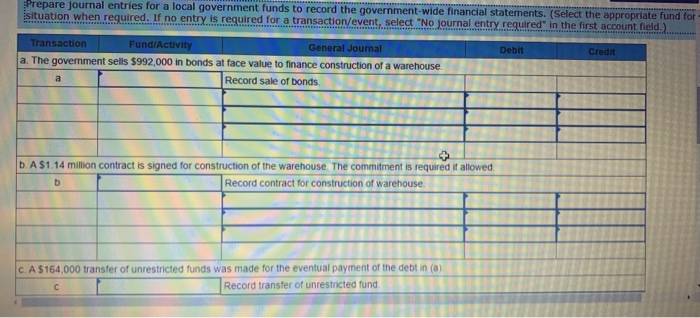

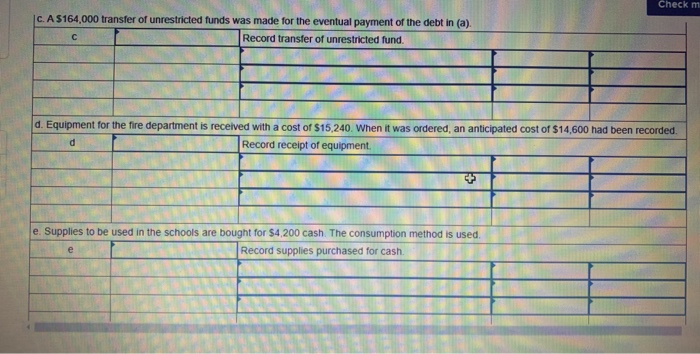

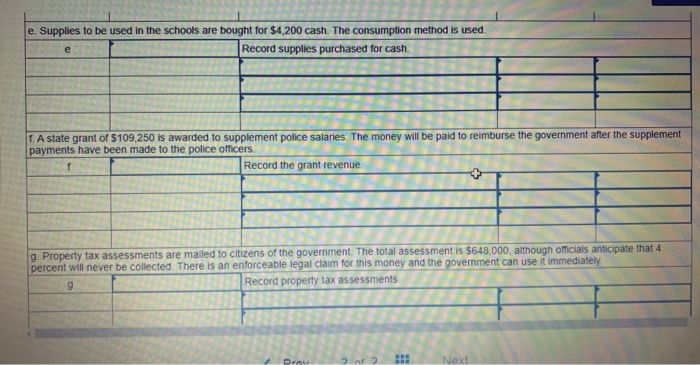

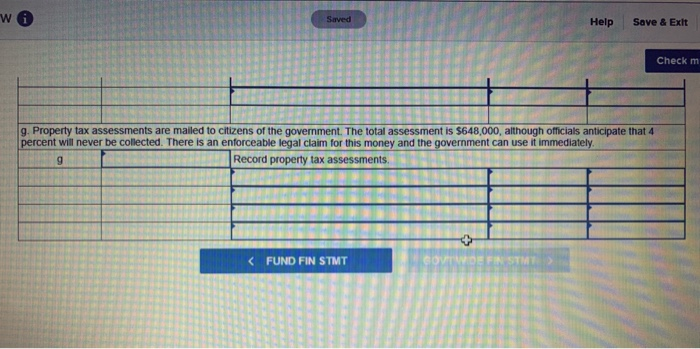

Prepare journal entries for a local government to record the following transactions, first for fund financial statements and then for government-wide financial statements. a. The government sells $992,000 in bonds at face value to finance construction of a warehouse. b. A $1.14 million contract is signed for construction of the warehouse. The commitment is required if allowed. C. A $164,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a). d. Equipment for the fire department is received with a cost of $15,240. When it was ordered, an anticipated cost of $14,600 had been recorded. e. Supplies to be used in the schools are bought for $4,200 cash. The consumption method is used. LA state grant of $109,250 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers. g. Property tax assessments are mailed to citizens of the government. The total assessment is $648,000, although officials anticipate that 4 percent will never be collected. There is an enforceable legal claim for this money and the government can use it immediately. Complete this question by entering your answers in the tabs below. W W T or the fund financial statements. (Select the appropriate fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required in the first account field. Debit Credit Transaction Fund/Activity General Journal a. The government sells $992,000 in bonds at face value to finance construction of a warehouse. a Record sale of bonds b. A $1.14 million contract is signed for construction of the warehouse. The commitment is required if allowed Record contract for construction of warehouse C. A $164,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a) General fund Record transfer of unrestricted fund C. A $164,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a). General fund Record transfer of unrestricted fund. Record transfer of unrestricted fund. d. Equipment for the fire department is received with a cost of $15.240. When it was ordered, an anticipated cost of $14,600 had been recorded Record encumbrances outstanding d. Equipment for the fire department is received with a cost of $15,240. When it was ordered, an anticipated cost of $14,600 had been recorded. Record encumbrances outstanding. Record receipt of equipment le Supplies to be used in the schools are bought for $4,200 cash. The consumption method is used, Record supplies bought for cash Prey. e. Supplies to be used in the schools are bought for $4,200 cash. The consumption method is used. Record supplies bought for cash. f. A state grant of $109,250 is awarded to supplement police salaries The money will be paid to reimburse the government after the supplement payments have been made to the police officers. Record the grant revenue fund. g. Property tax assessments are mailed to citizens of the government. The total assessm is $648,000, although ocials anticipate that 4 percent will never be collected. There is an enforceable legal claim for this money and the government can use it immediately Record property tax assessments 9. Property tax assessments are mailed to citizens of the government. The total assessment is $648,000, although officials anticipate that 4 percent will never be collected. There is an enforceable legal claim for this money and the government can use it immediately BREDA Record property tax assessments. GOVT WIDE FIN STMT > Prepare fournal entries for a local government funds to record the government-wide financial statements. (Select the appropriate fund for situation when required. If no entry is required for a transaction/event, select "No journal entry required in the first account field Debit Transaction Fund/Activity General Journal a The government sells $992,000 in bonds at face value to finance construction of a warehouse. Record sale of bonds b. A $1.14 million contract is signed for construction of the warehouse. The commitment is required if allowed Record contract for construction of warehouse C. A $164,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a) Record transfer of unrestricted fund C. A 5164,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a). c Record transfer of unrestricted fund. 3111 / d. Equipment for the fire department is received with a cost of $15,240. When it was ordered, an anticipated cost of $14,600 had been recorded. Record receipt of equipment 3 e Supplies to be used in the schools are bought for 54,200 cash. The consumption method is used Record supplies purchased for cash e. Supplies to be used in the schools are bought for $4,200 cash. The consumption method is used Record supplies purchased for cash. TY TE 1. A state grant of $109,250 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers Record the grant revenue de atrocor g. Property tax assessments are mailed to citizens of the government. The total assessment is $648.000. although officials anticipate that 4 percent will never be collected. There is an enforceable legal claim for this money and the government can use it immediately Record property tax assessments WA 2 Help Save & Exit Check m 9. Property tax assessments are mailed to citizens of the government. The total assessment is $648,000, although officials anticipate that 4 percent will never be collected. There is an enforceable legal claim for this money and the government can use it immediately. Record property tax assessments. _ _