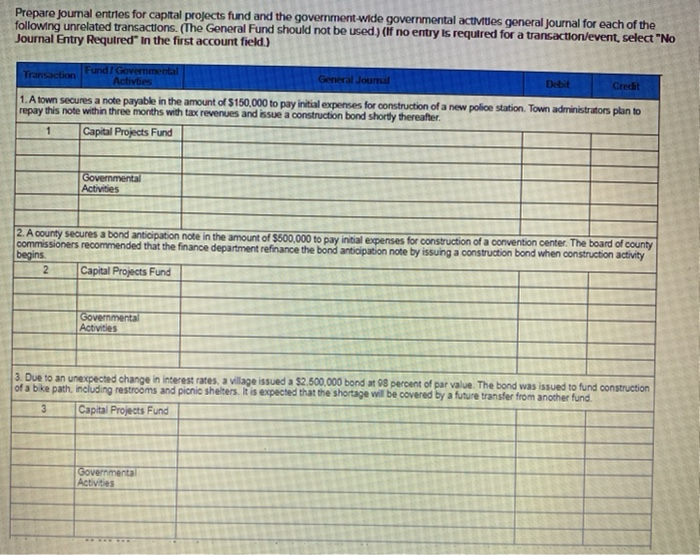

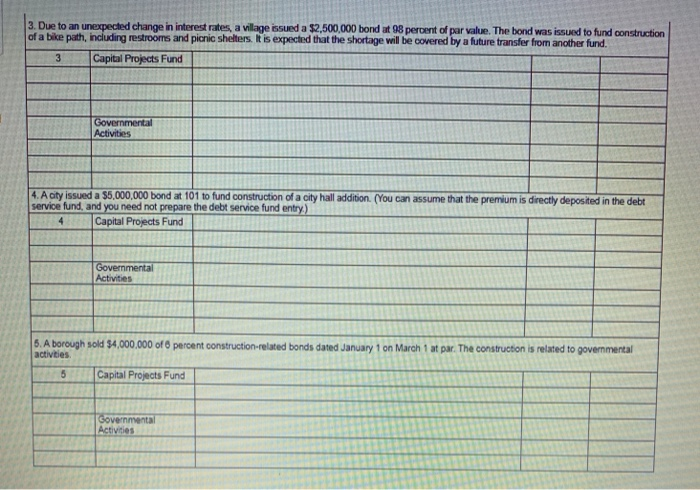

Prepare journal entries for capital projects fund and the government-wide governmental activities general Journal for each of the following unrelated transactions. (The General Fund should not be used) (if no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) Transaction Fund Governmental Activies General Journal Debit Creat 1. A town secures a note payable in the amount of $150,000 to pay initial expenses for construction of a new police station. Town administrators plan to repay this note within three months with tax revenues and issue a construction bond shortly thereafter. 1 Capital Projects Fund Governmental Activities 2. A county secures a bond anticipation note in the amount of $500,000 to pay initial expenses for construction of a convention center. The board of county commissioners recommended that the finance department refinance the bond anticipation note by issuing a construction bond when construction activity begins. 2 Capital Projects Fund Governmental Activities 3. Due to an unexpected change in interest rates, a village issued a $2.500.000 bond at 98 percent of par value. The bond was issued to fund construction of a bike path, including restrooms and picnic shelters. It is expected that the shortage will be covered by a future transfer from another fund. 3 Capital Projects Fund Governmental Activities 3. Due to an unexpected change in interest rates, a village issued a $2,500,000 bond at 98 percent of par value. The bond was issued to fund construction of a bike path, including restrooms and picnic shelters. It is expected that the shortage will be covered by a future transfer from another fund. 3 Capital Projects Fund Governmental Activities 4. A city issued a $5,000,000 bond at 101 to fund construction of a city hall addition. (You can assume that the premium is directly deposited in the debt service fund, and you need not prepare the debt service fund entry) Capital Projects Fund Governmental Activities 6. A borough sold $4,000,000 of 6 percent construction-related bonds dated January 1 on March 1 at par. The construction is related to governmental activities 5 Capital Projects Fund Governmental Activities