Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a

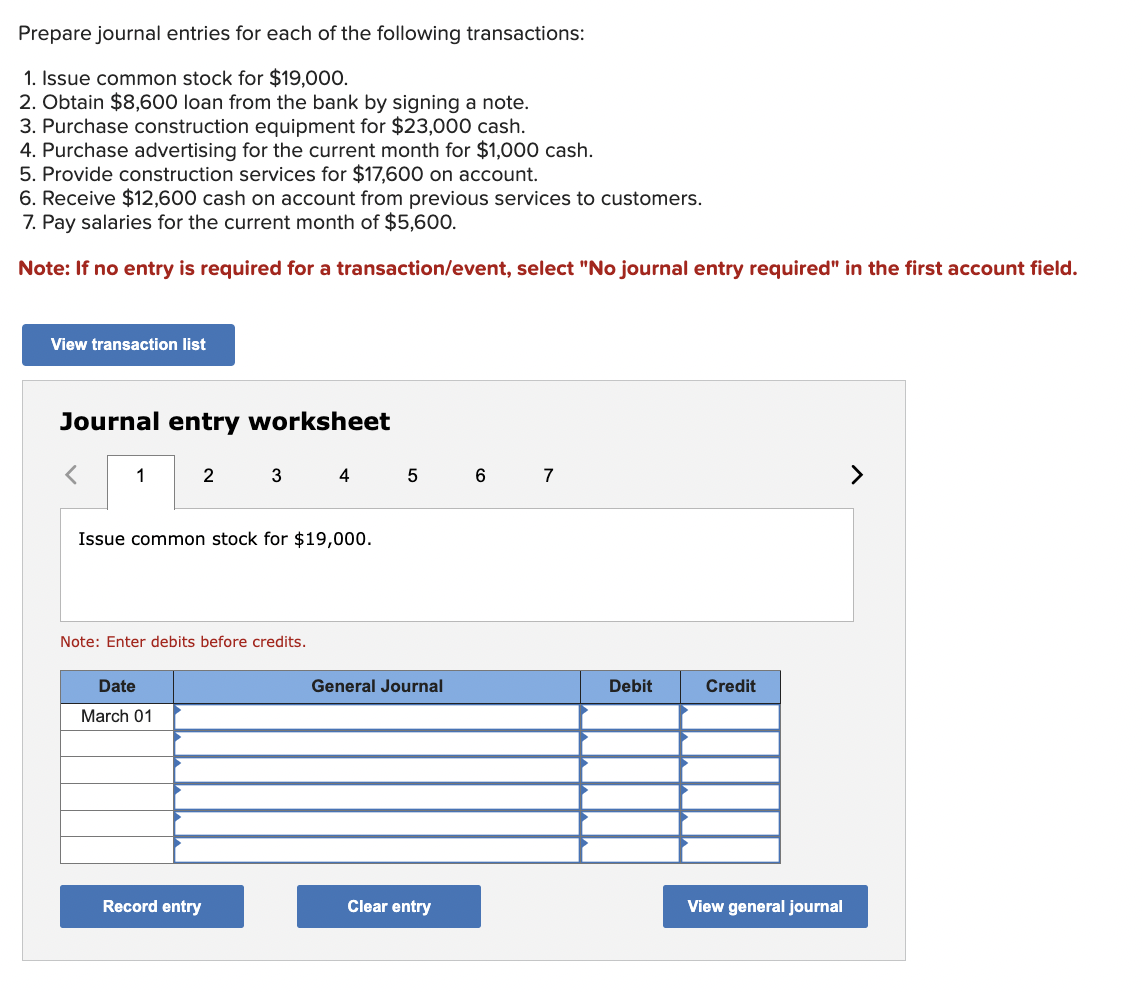

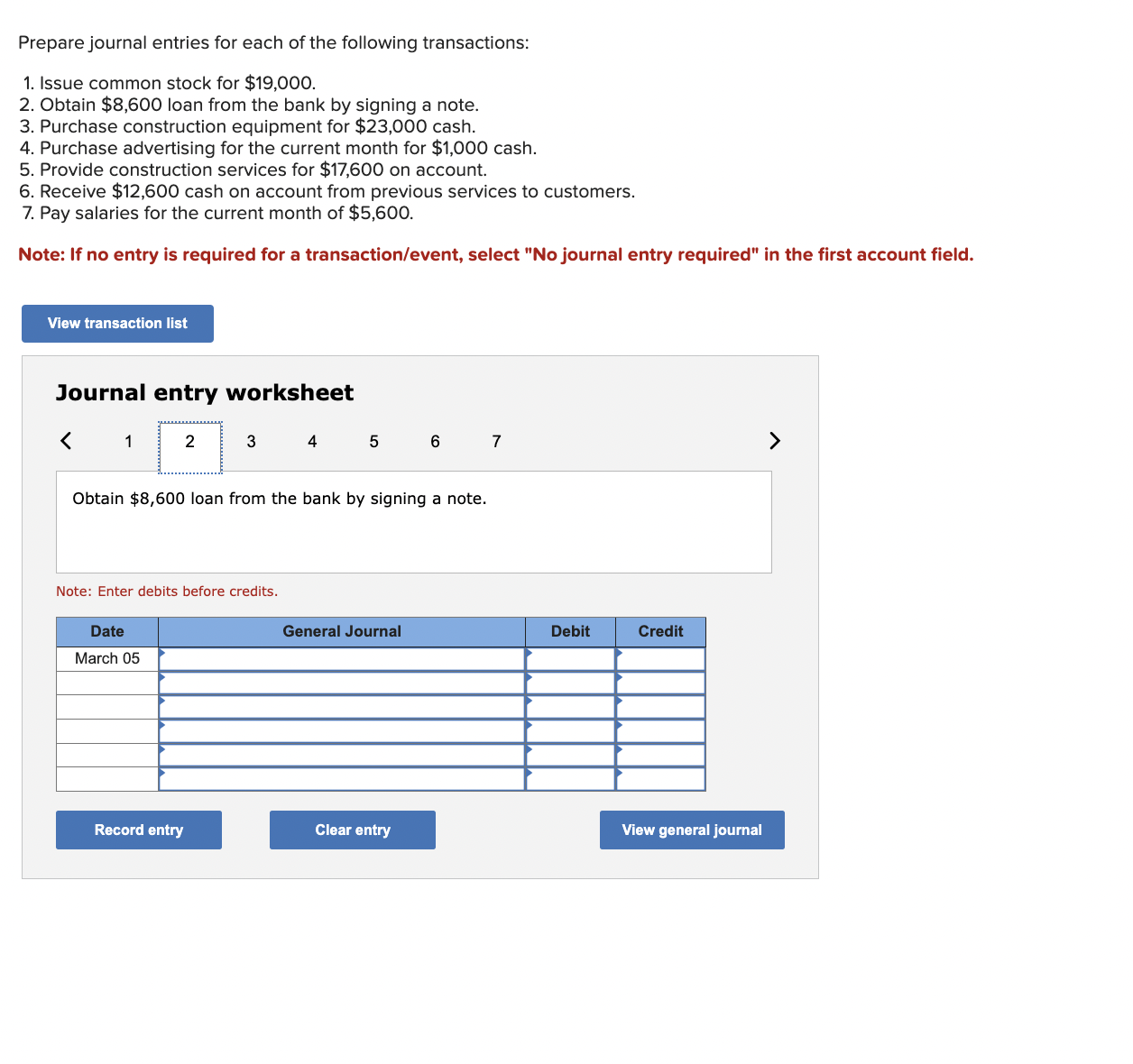

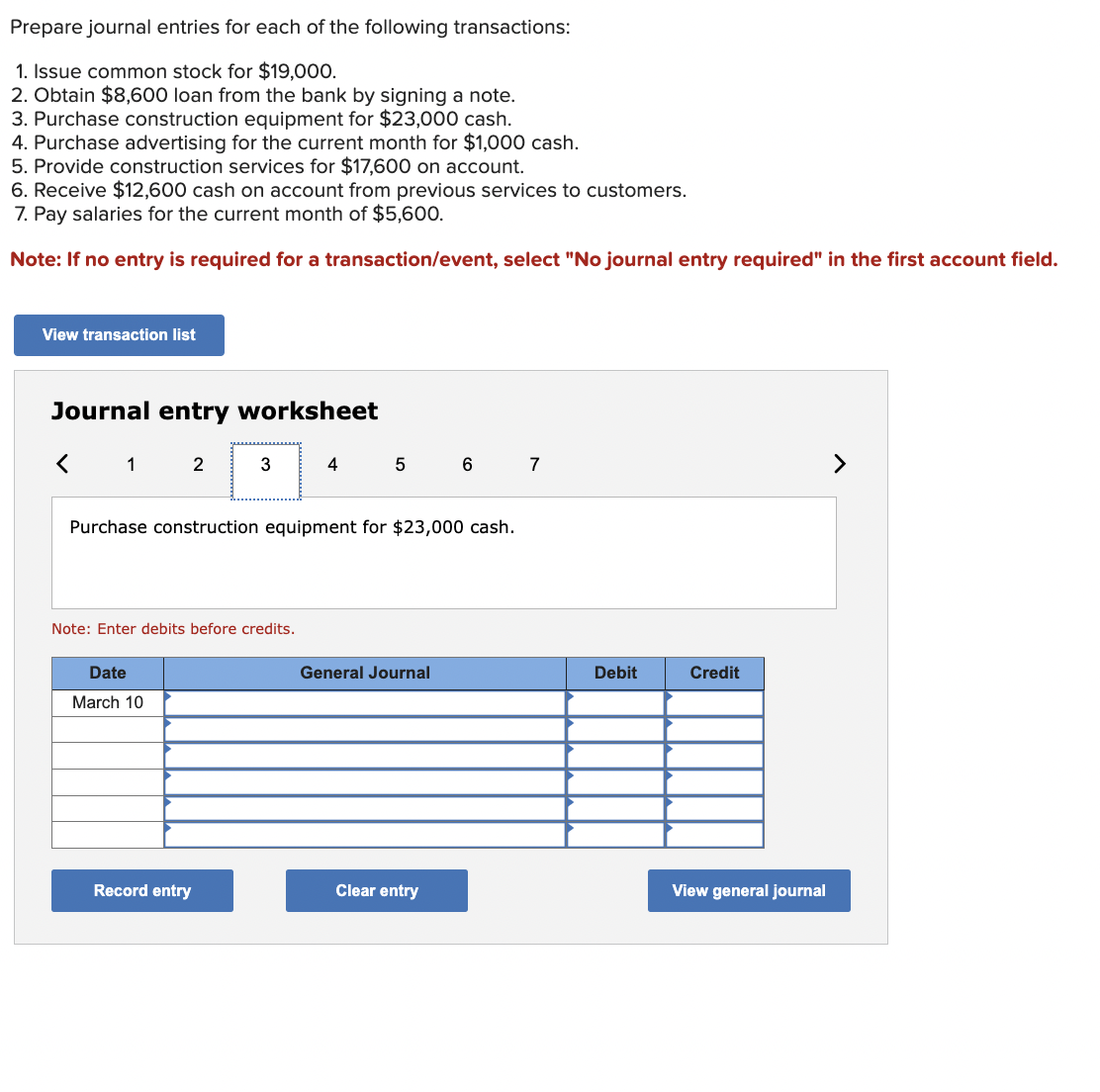

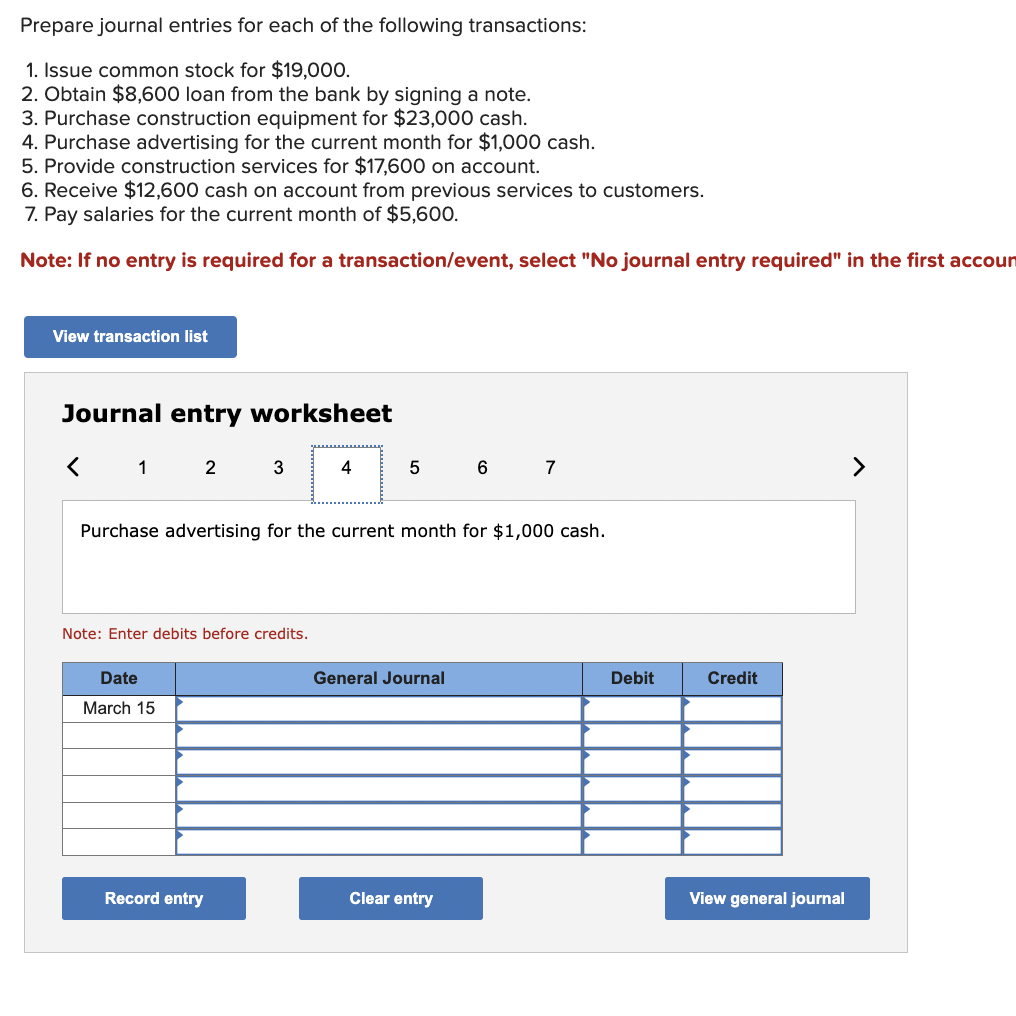

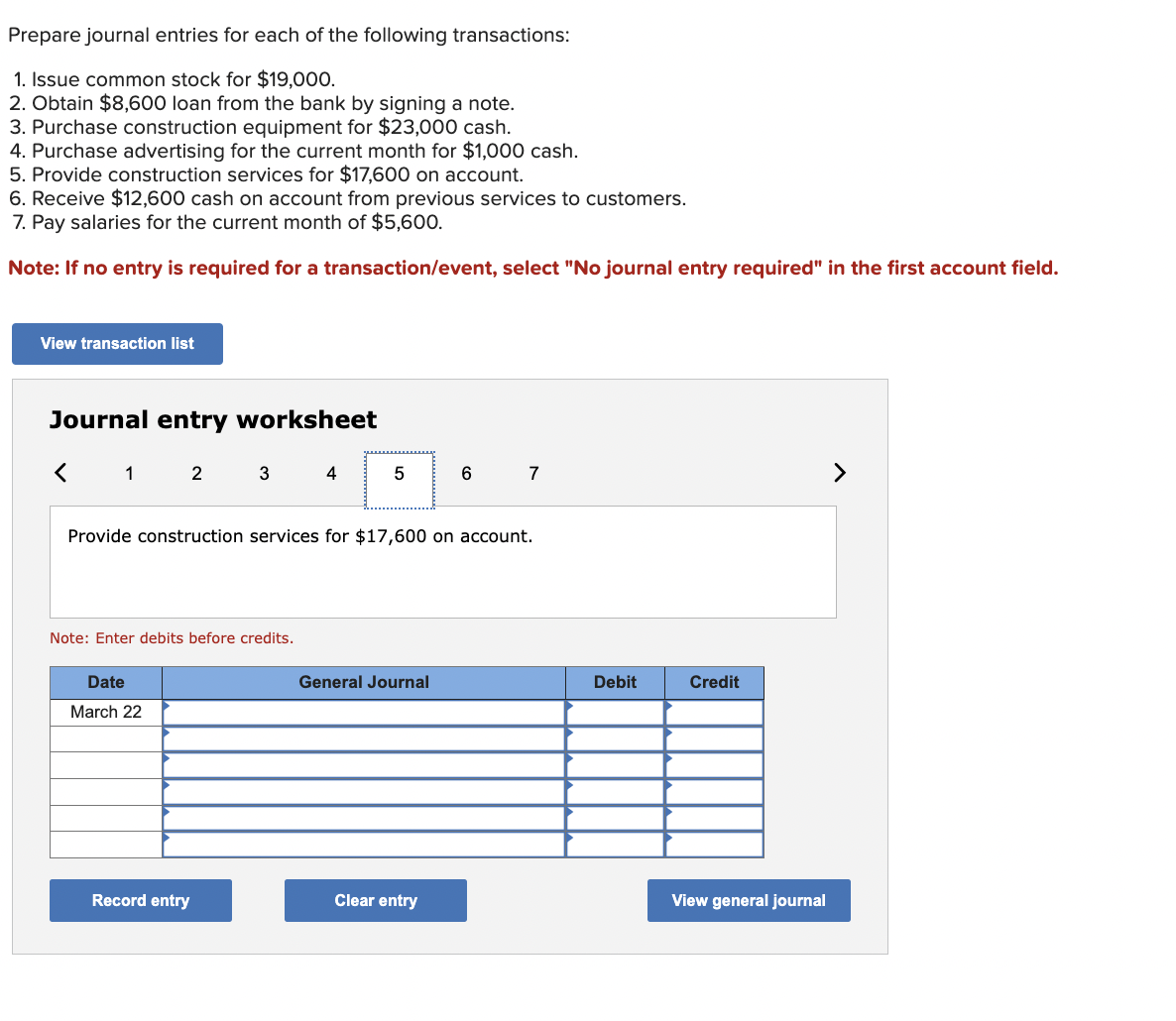

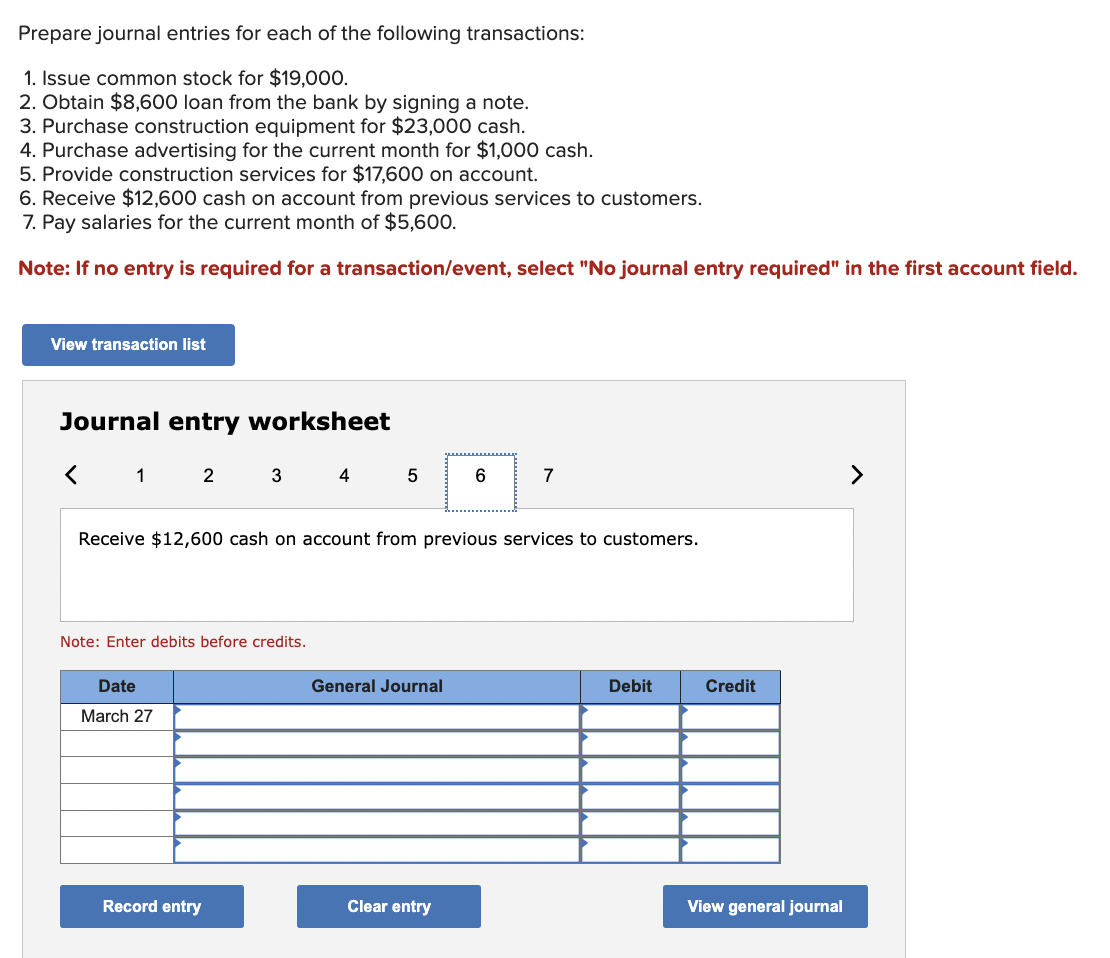

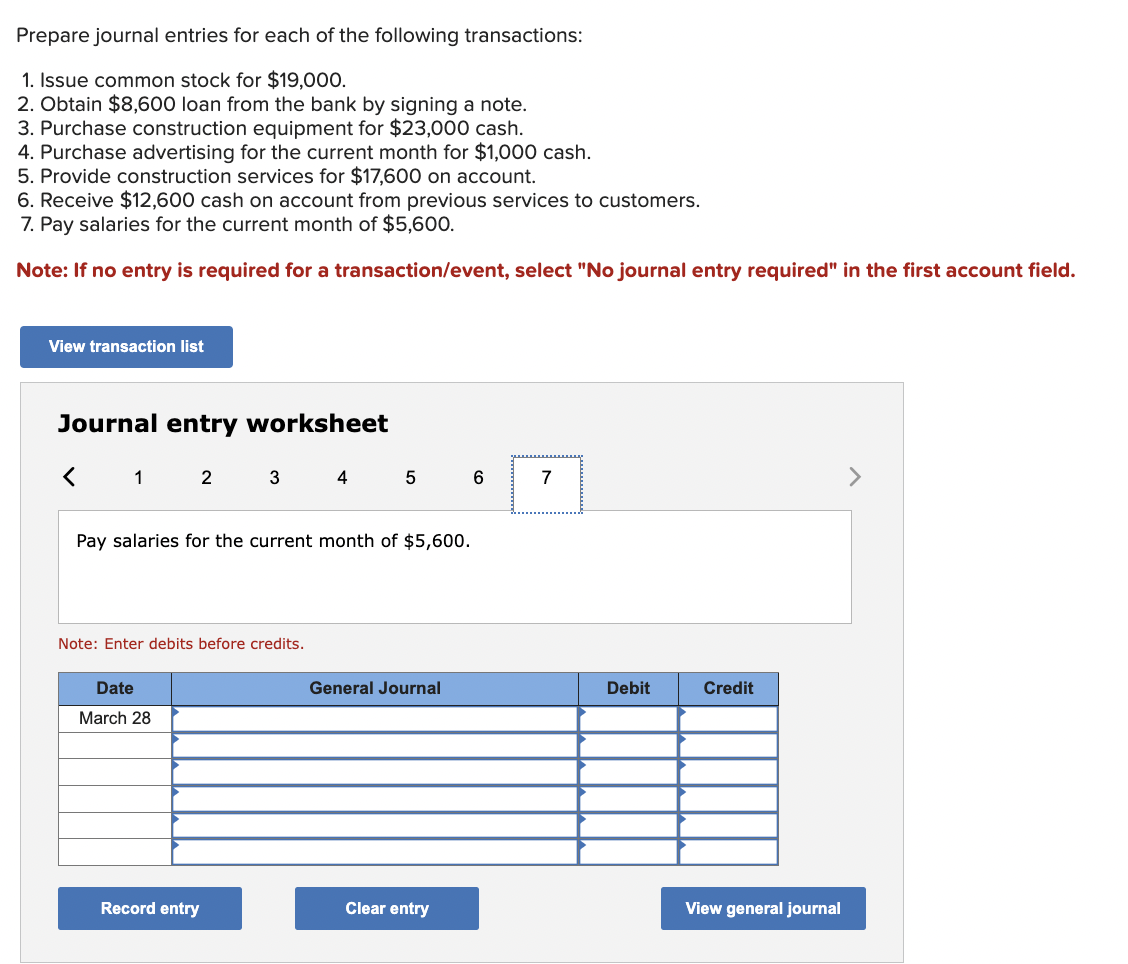

Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 567 Purchase construction equipment for $23,000 cash. Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 7 Provide construction services for $17,600 on account. Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6 . Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first accour Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 4567 Obtain $8,600 loan from the bank by signing a note. Note: Enter debits before credits

Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 567 Purchase construction equipment for $23,000 cash. Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 7 Provide construction services for $17,600 on account. Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6 . Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first accour Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Prepare journal entries for each of the following transactions: 1. Issue common stock for $19,000. 2. Obtain $8,600 loan from the bank by signing a note. 3. Purchase construction equipment for $23,000 cash. 4. Purchase advertising for the current month for $1,000 cash. 5. Provide construction services for $17,600 on account. 6. Receive $12,600 cash on account from previous services to customers. 7. Pay salaries for the current month of $5,600. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 4567 Obtain $8,600 loan from the bank by signing a note. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started