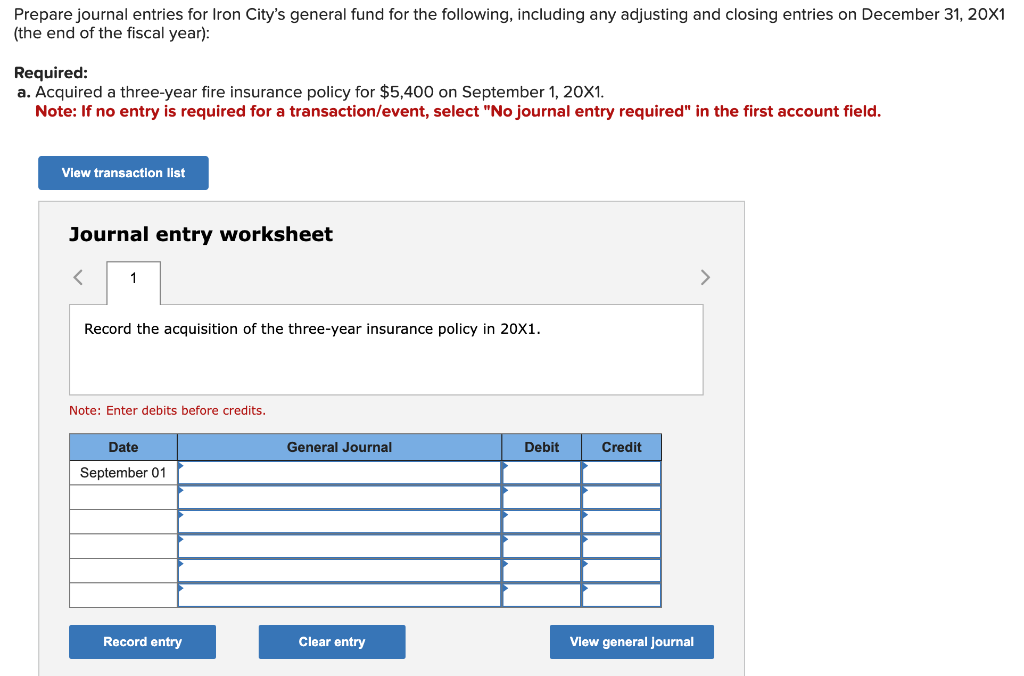

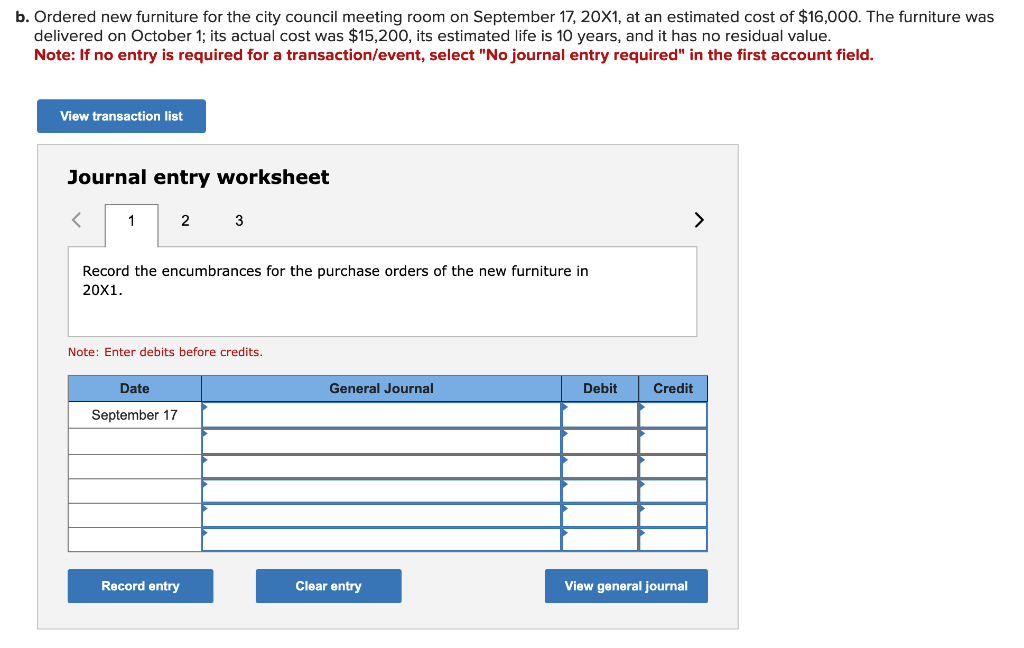

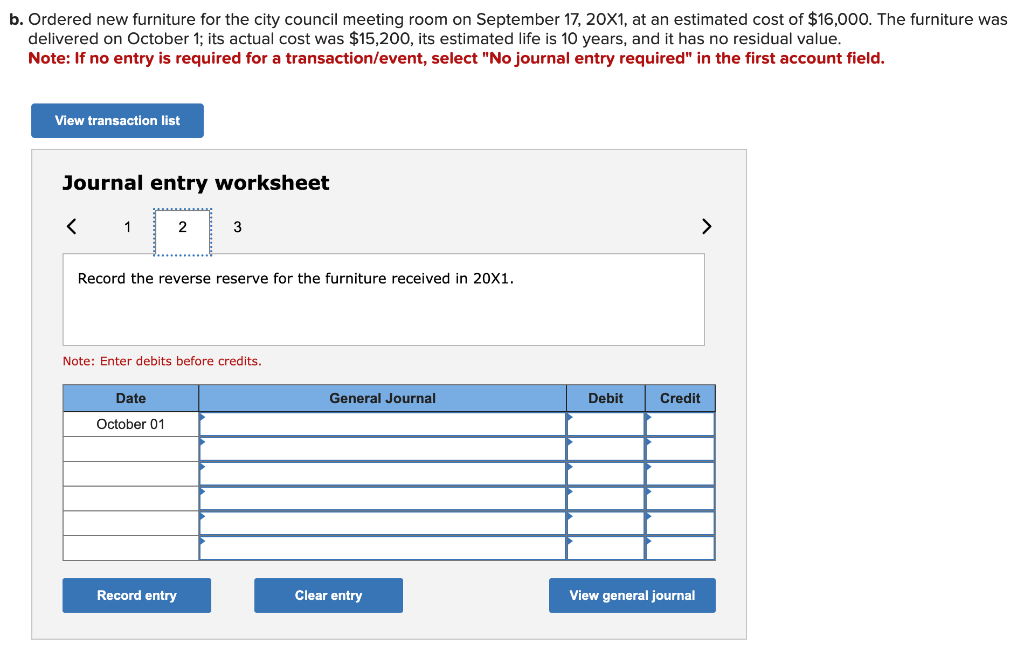

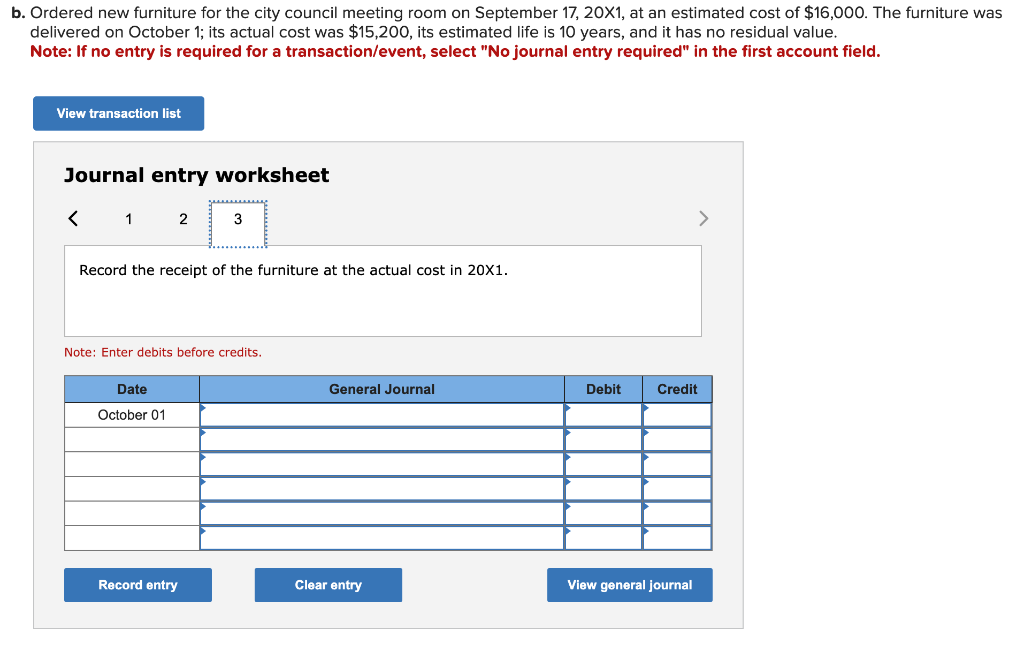

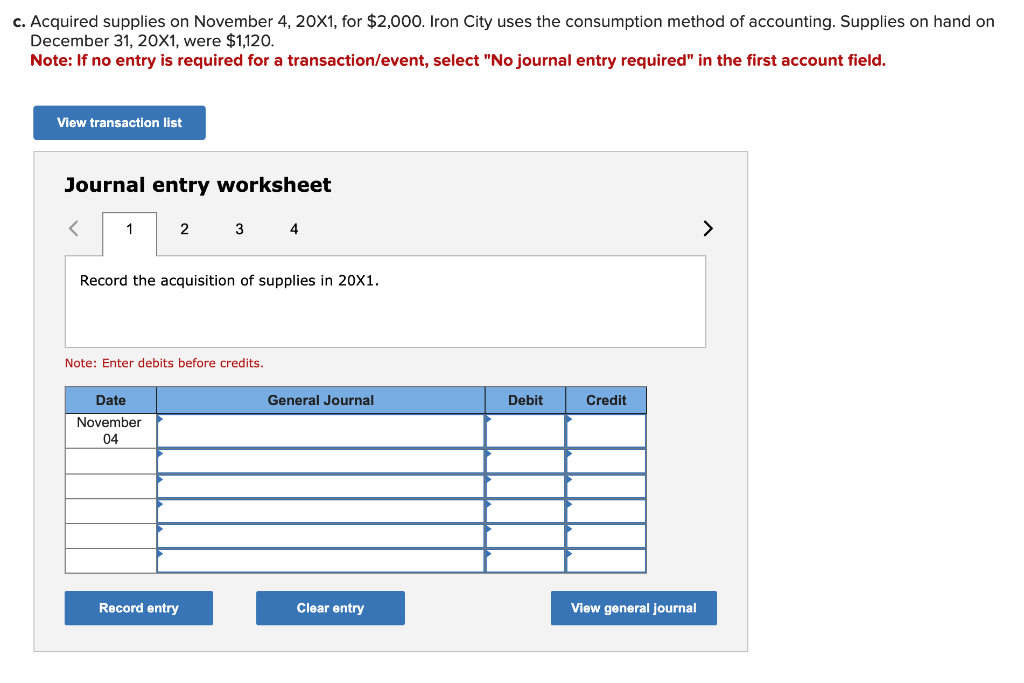

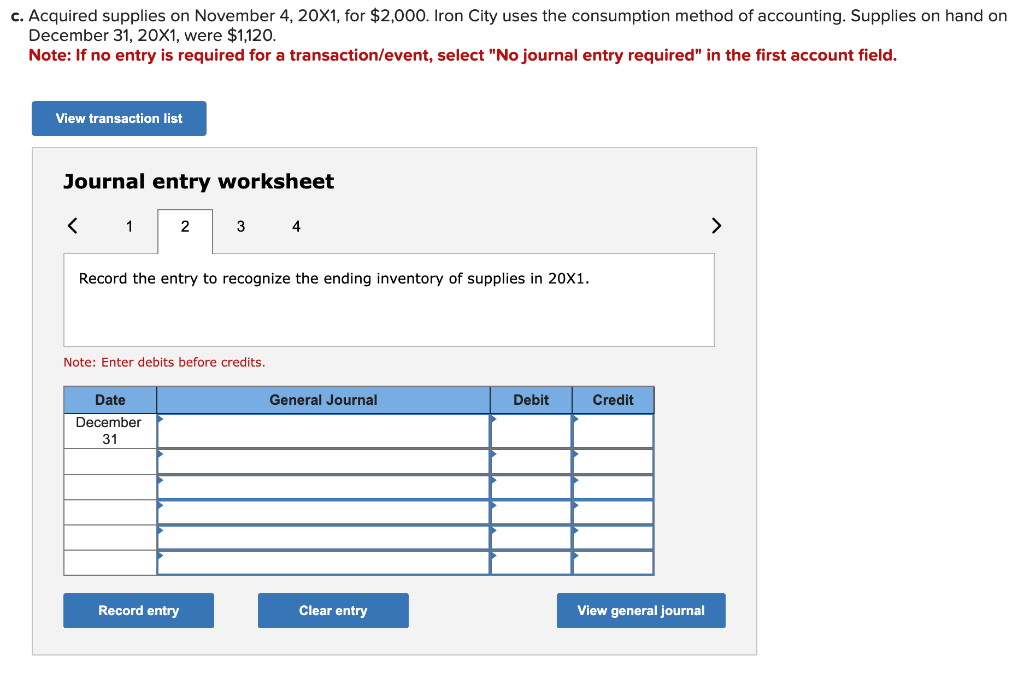

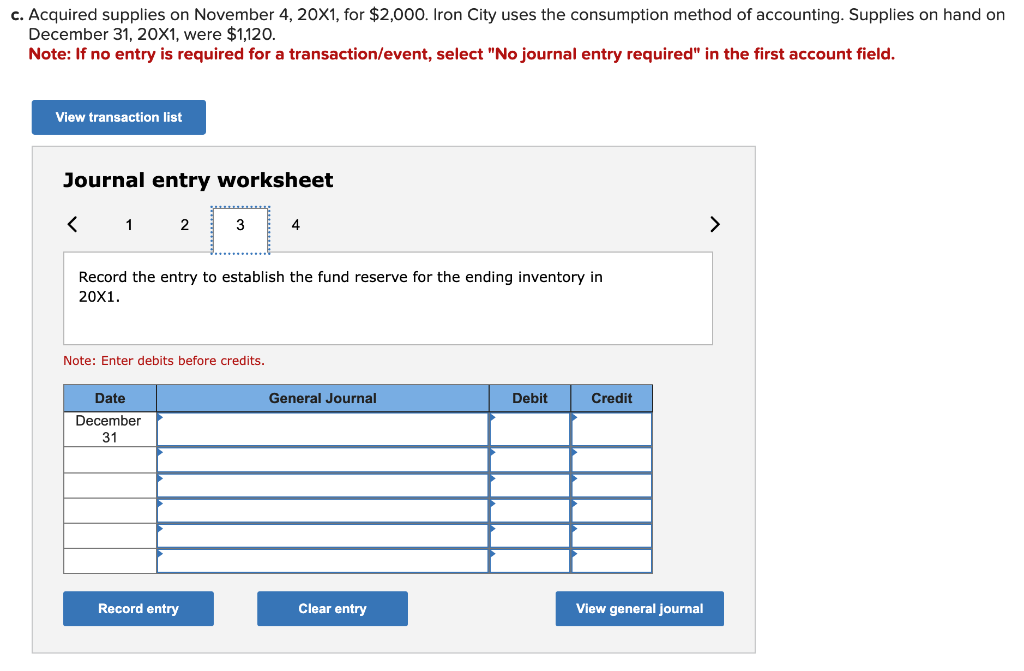

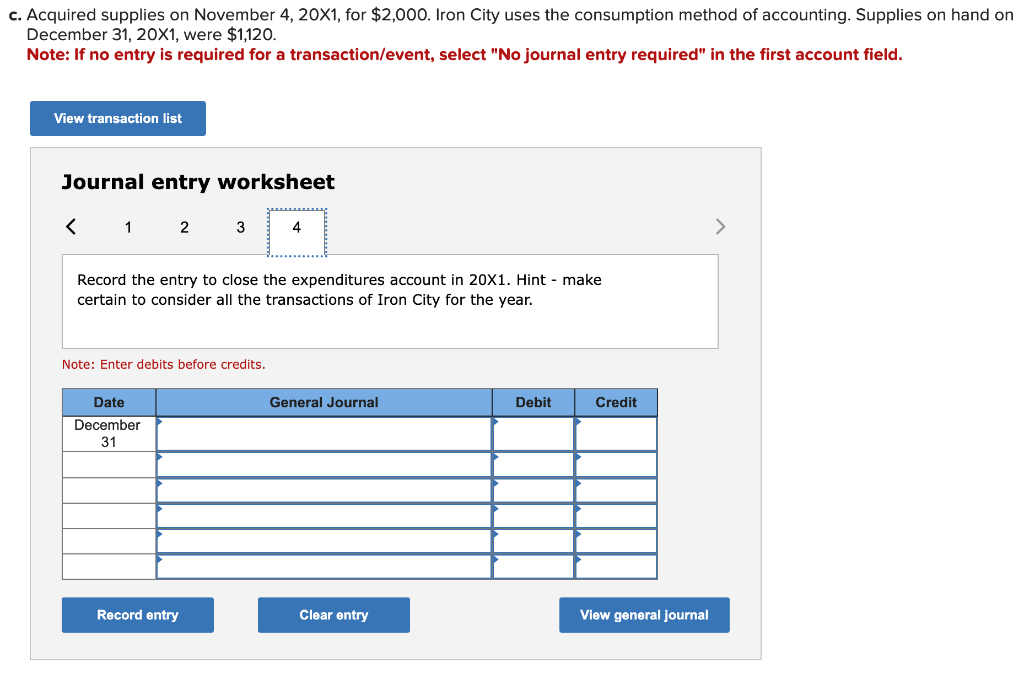

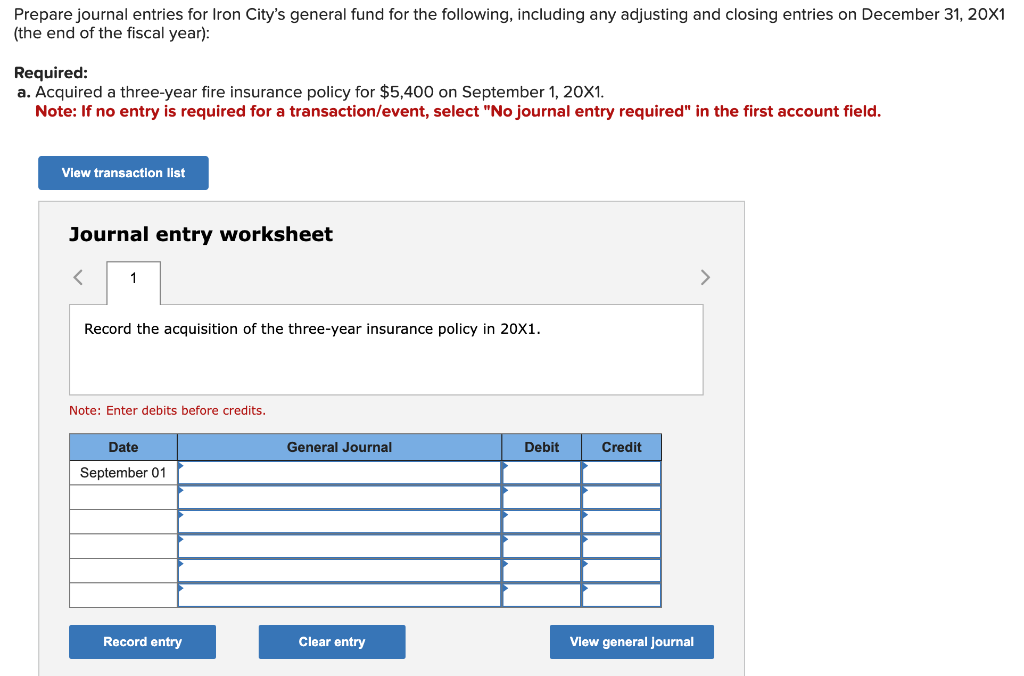

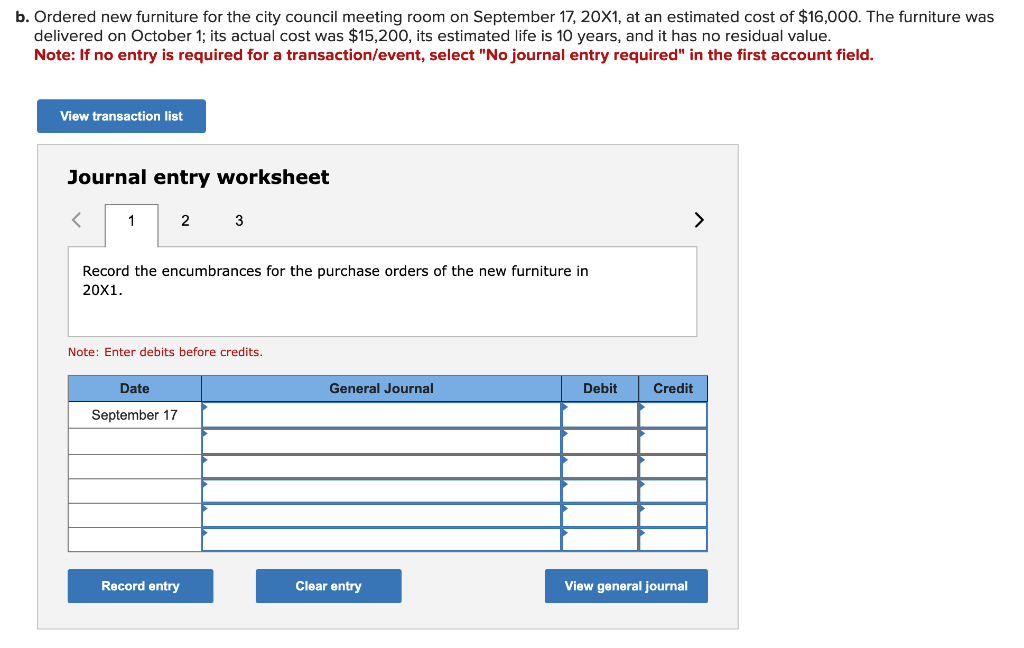

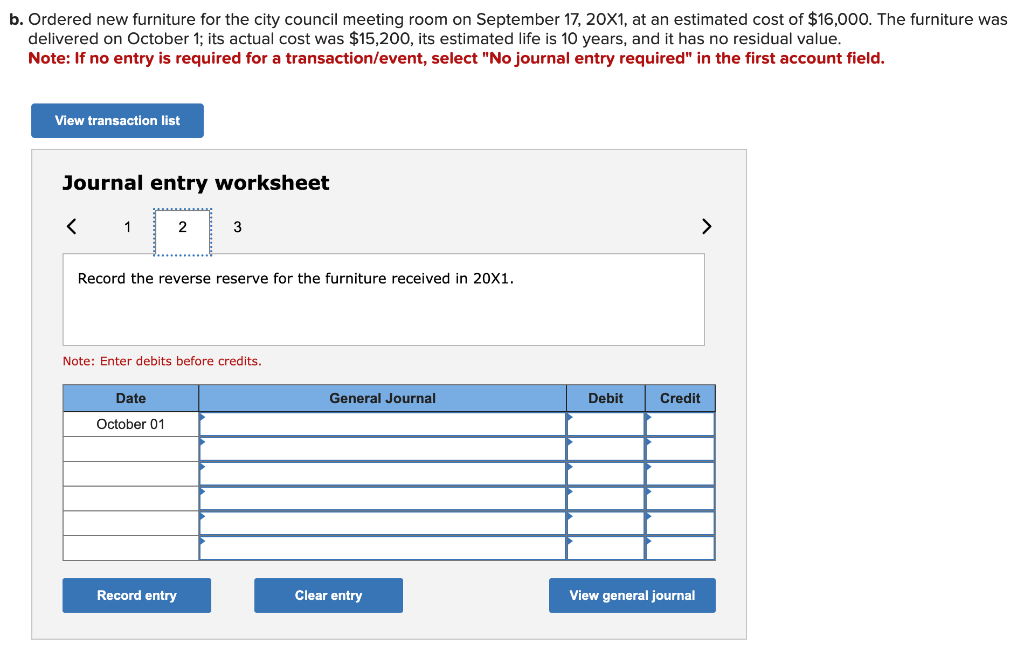

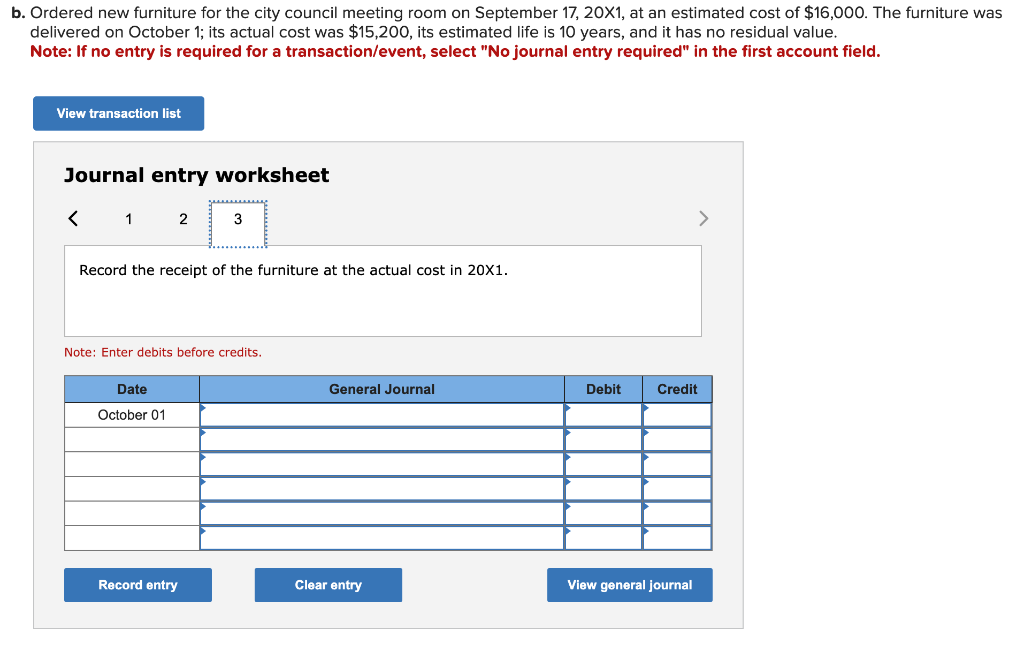

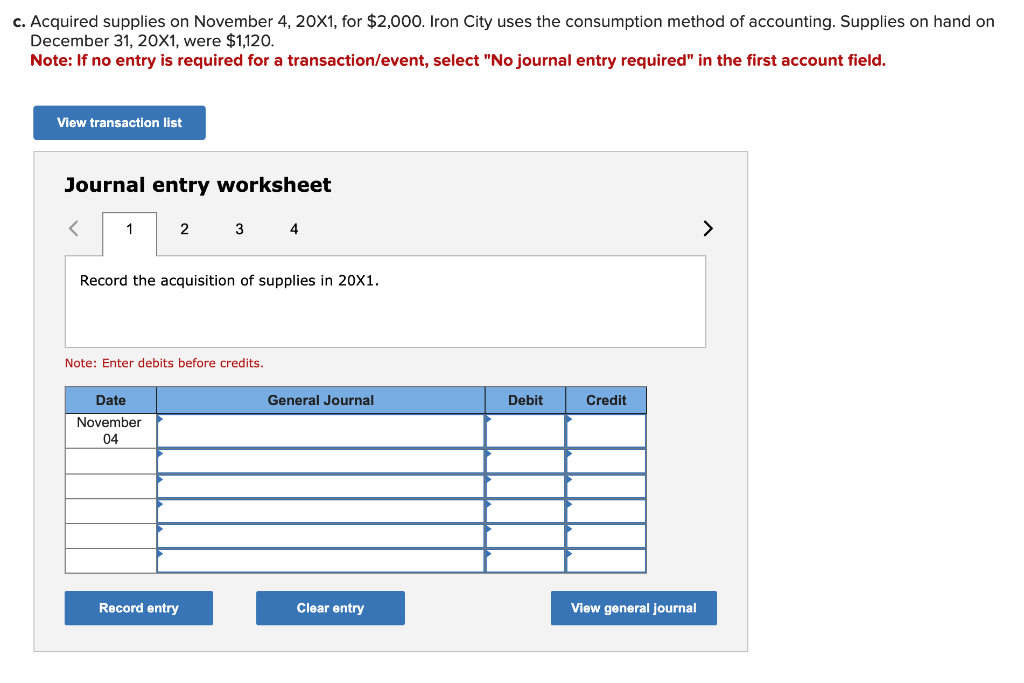

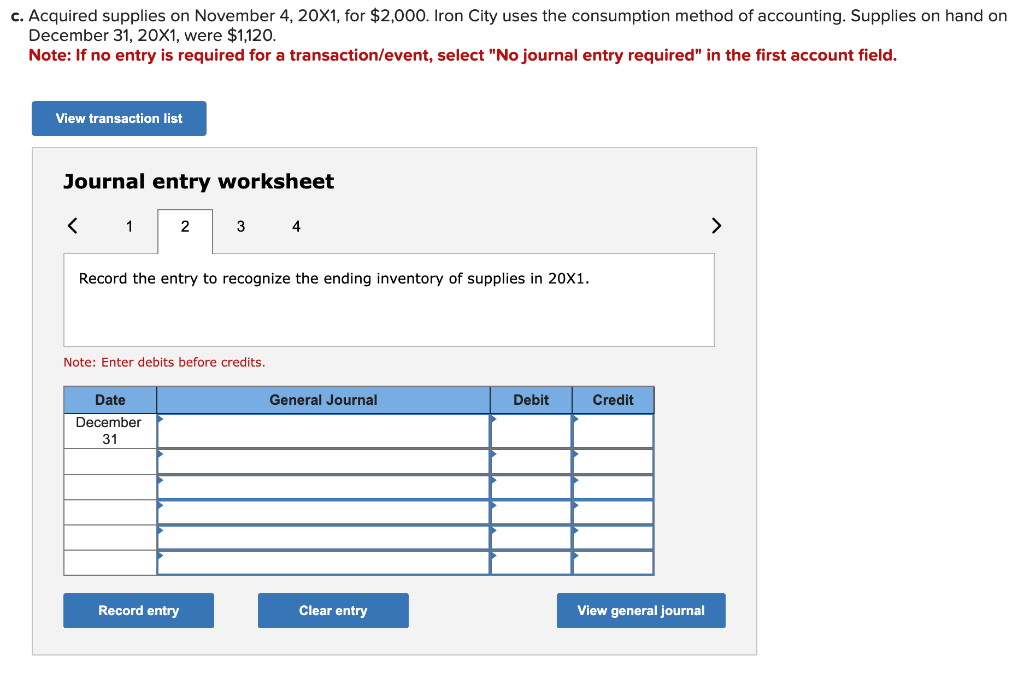

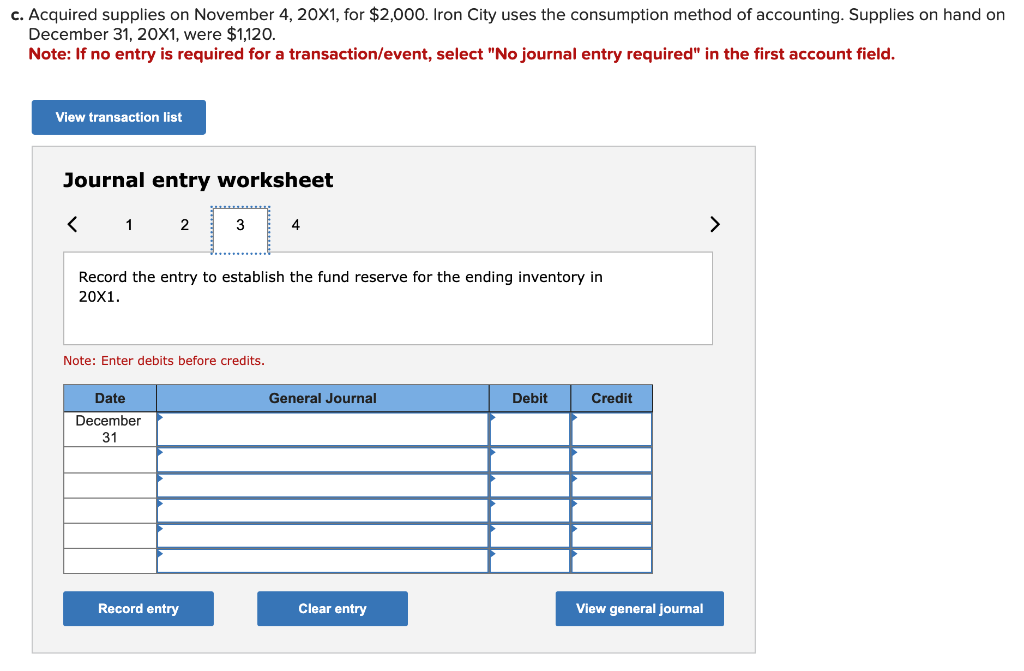

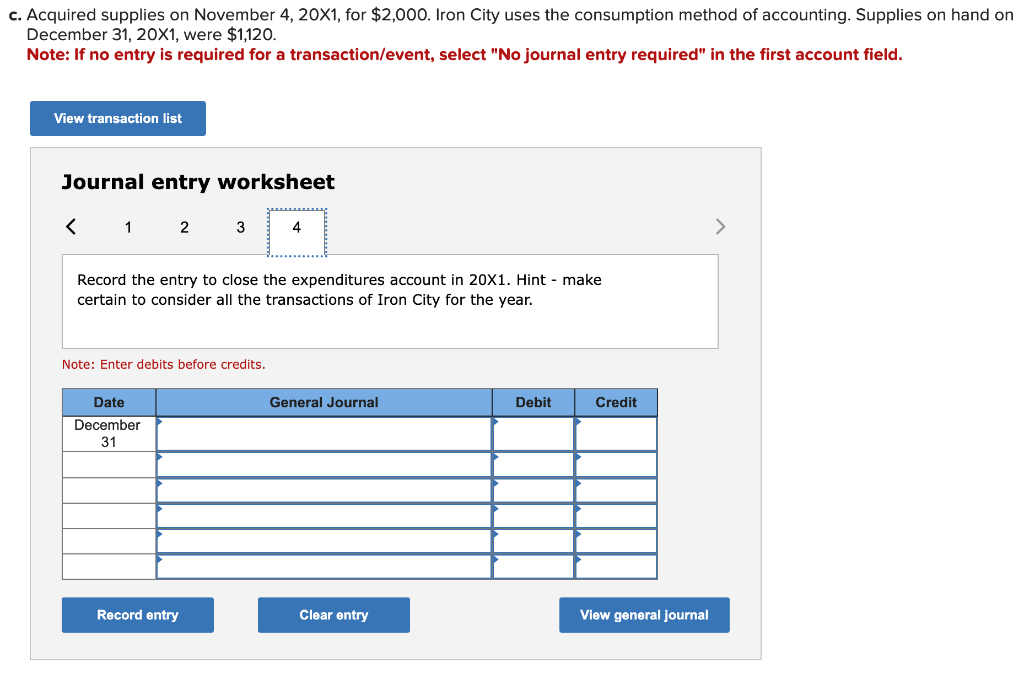

Prepare journal entries for Iron City's general fund for the following, including any adjusting and closing entries on December 31,201 (the end of the fiscal year): Required: a. Acquired a three-year fire insurance policy for $5,400 on September 1,201. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the acquisition of the three-year insurance policy in 20X1. Note: Enter debits before credits. o. Ordered new furniture for the city council meeting room on September 17,201, at an estimated cost of $16,000. The furniture was delivered on October 1 ; its actual cost was $15,200, its estimated life is 10 years, and it has no residual value. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the encumbrances for the purchase orders of the new furniture in 201. Note: Enter debits before credits. . Ordered new furniture for the city council meeting room on September 17,201, at an estimated cost of $16,000. The furniture was delivered on October 1 ; its actual cost was $15,200, its estimated life is 10 years, and it has no residual value. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the reverse reserve for the furniture received in 201. Note: Enter debits before credits. o. Ordered new furniture for the city council meeting room on September 17,201, at an estimated cost of $16,000. The furniture was delivered on October 1 ; its actual cost was $15,200, its estimated life is 10 years, and it has no residual value. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the receipt of the furniture at the actual cost in 201. Note: Enter debits before credits. c. Acquired supplies on November 4,201, for $2,000. Iron City uses the consumption method of accounting. Supplies on hand on December 31, 20X1, were $1,120. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. c. Acquired supplies on November 4,201, for $2,000. Iron City uses the consumption method of accounting. Supplies on hand on December 31, 20X1, were \$1,120. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the entry to recognize the ending inventory of supplies in 201. Note: Enter debits before credits. c. Acquired supplies on November 4,201, for $2,000. Iron City uses the consumption method of accounting. Supplies on hand on December 31,201, were $1,120. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the entry to establish the fund reserve for the ending inventory in 20X1. Note: Enter debits before credits. c. Acquired supplies on November 4,201, for $2,000. Iron City uses the consumption method of accounting. Supplies on hand on December 31,201, were $1,120. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet