Answered step by step

Verified Expert Solution

Question

1 Approved Answer

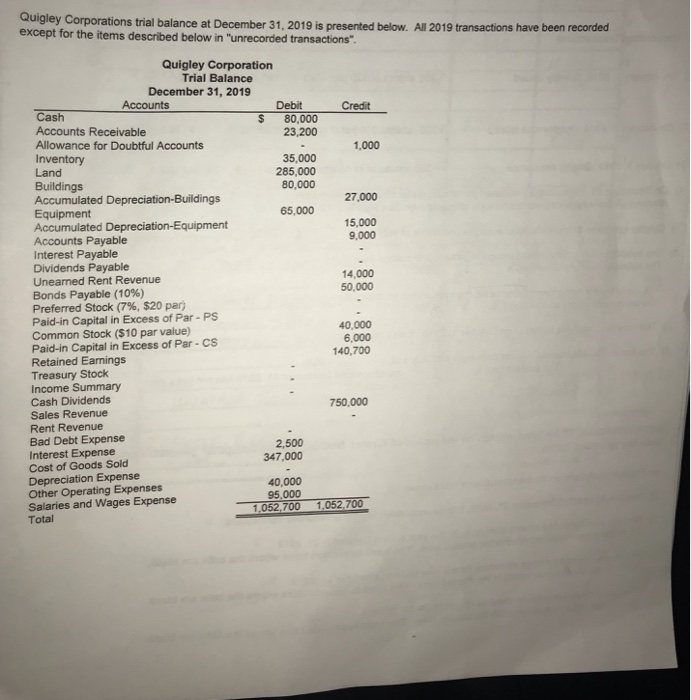

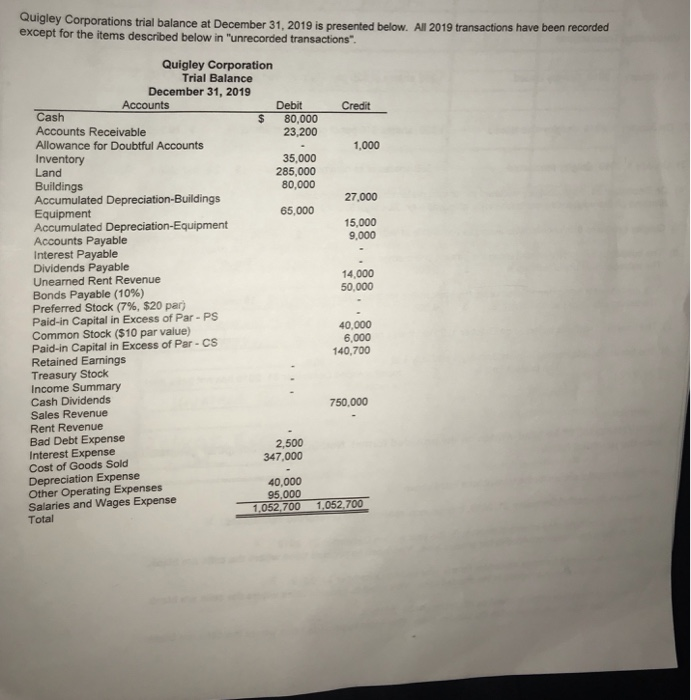

prepare journal entries for transacrions listed above. Quigley except for the items described below in unrecorded transactions Corporations trial balance at December 31, 2019 is

prepare journal entries for transacrions listed above.

Quigley except for the items described below in "unrecorded transactions Corporations trial balance at December 31, 2019 is presented below. All 2019 transactions have been recorded Quigley Corporation Trial Balance December 31, 2019 Accounts Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue Bonds Payable (10%) Preferred Stock (796, $20 par Paid-in Capital in Excess of Par- Ps Common Stock ($10 par value Paid-in Capital in Excess of Par-CS Retained Earnings Treasury Stock Income Summary Cash Dividends Sales Revenue Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses Salaries and Wages Expense Total S 80,000 23,200 1,000 35,000 285,000 80,000 27,000 65,000 15,000 9,000 14,000 50,000 40,000 6,000 140,700 750,000 2,500 347,000 40,000 95,000 1,052,700 1,052,700 Quigley except for the items described below in "unrecorded transactions Corporations trial balance at December 31, 2019 is presented below. All 2019 transactions have been recorded Quigley Corporation Trial Balance December 31, 2019 Accounts Debit Credit Cash S 80,000 23,200 Accounts Receivable Allowance for Doubtful Accounts 1,000 Inventory 35,000 285,000 80,000 Land Buildings Accumulated Depreciation-Buildings 27,000 Equipment 65,000 Accumulated Depreciation-Equipment 15,000 9,000 Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue Bonds Payable (10%) Preferred Stock (796, $20 par) Paid-in Capital in Excess of Par- Ps Common Stock ($10 par value) Paid-in Capital in Excess of Par-CS Retained Earnings Treasury Stock ncome Summary Cash Dividends Sales Revenue Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses 14,000 50,000 40,000 6,000 140,700 750,000 2,500 347,000 40,000 95,000 Salaries and Wages Expense Total 1,052,700 1,052,700 Quigley except for the items described below in "unrecorded transactions Corporations trial balance at December 31, 2019 is presented below. All 2019 transactions have been recorded Quigley Corporation Trial Balance December 31, 2019 Accounts Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue Bonds Payable (10%) Preferred Stock (796, $20 par Paid-in Capital in Excess of Par- Ps Common Stock ($10 par value Paid-in Capital in Excess of Par-CS Retained Earnings Treasury Stock Income Summary Cash Dividends Sales Revenue Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses Salaries and Wages Expense Total S 80,000 23,200 1,000 35,000 285,000 80,000 27,000 65,000 15,000 9,000 14,000 50,000 40,000 6,000 140,700 750,000 2,500 347,000 40,000 95,000 1,052,700 1,052,700 Quigley except for the items described below in "unrecorded transactions Corporations trial balance at December 31, 2019 is presented below. All 2019 transactions have been recorded Quigley Corporation Trial Balance December 31, 2019 Accounts Debit Credit Cash S 80,000 23,200 Accounts Receivable Allowance for Doubtful Accounts 1,000 Inventory 35,000 285,000 80,000 Land Buildings Accumulated Depreciation-Buildings 27,000 Equipment 65,000 Accumulated Depreciation-Equipment 15,000 9,000 Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue Bonds Payable (10%) Preferred Stock (796, $20 par) Paid-in Capital in Excess of Par- Ps Common Stock ($10 par value) Paid-in Capital in Excess of Par-CS Retained Earnings Treasury Stock ncome Summary Cash Dividends Sales Revenue Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses 14,000 50,000 40,000 6,000 140,700 750,000 2,500 347,000 40,000 95,000 Salaries and Wages Expense Total 1,052,700 1,052,700 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started