Prepare Journal Entries

On January 1, 2021, you purchased 25% of the outstanding common stock of Tiny Company for $6,700 in cash and plan to exercise significant influence over Tiny. On the acquisition date, Tiny's merchandise had a book value of $800 higher than its market value (FIFO system) and their patent had a book value of $1,000 lower than its market value (with a five-year remaining lite). On December 1, 2021, you received $75 of cash dividends from Tiny. On December 31, 2021, Tiny Company reported $2,000 of net income for the ENTIRE year and your shares of Tiny Company had a market value of $7,000.

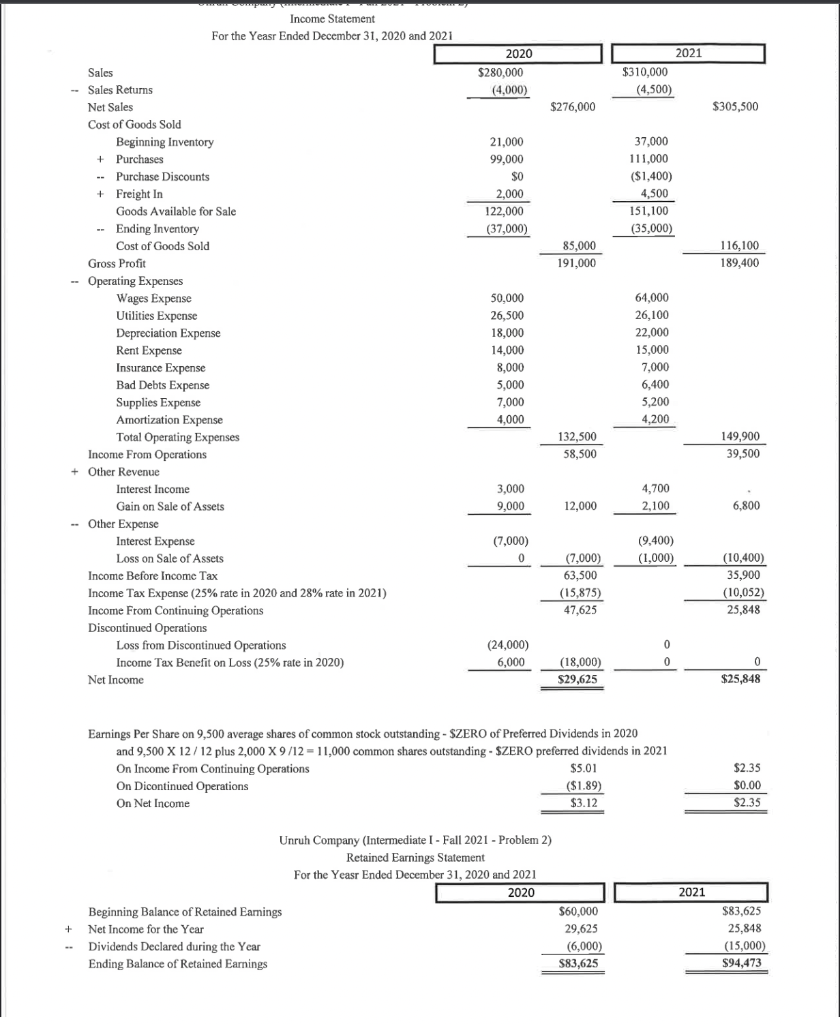

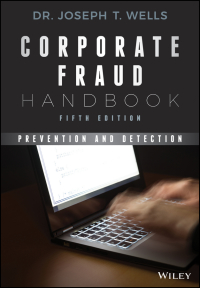

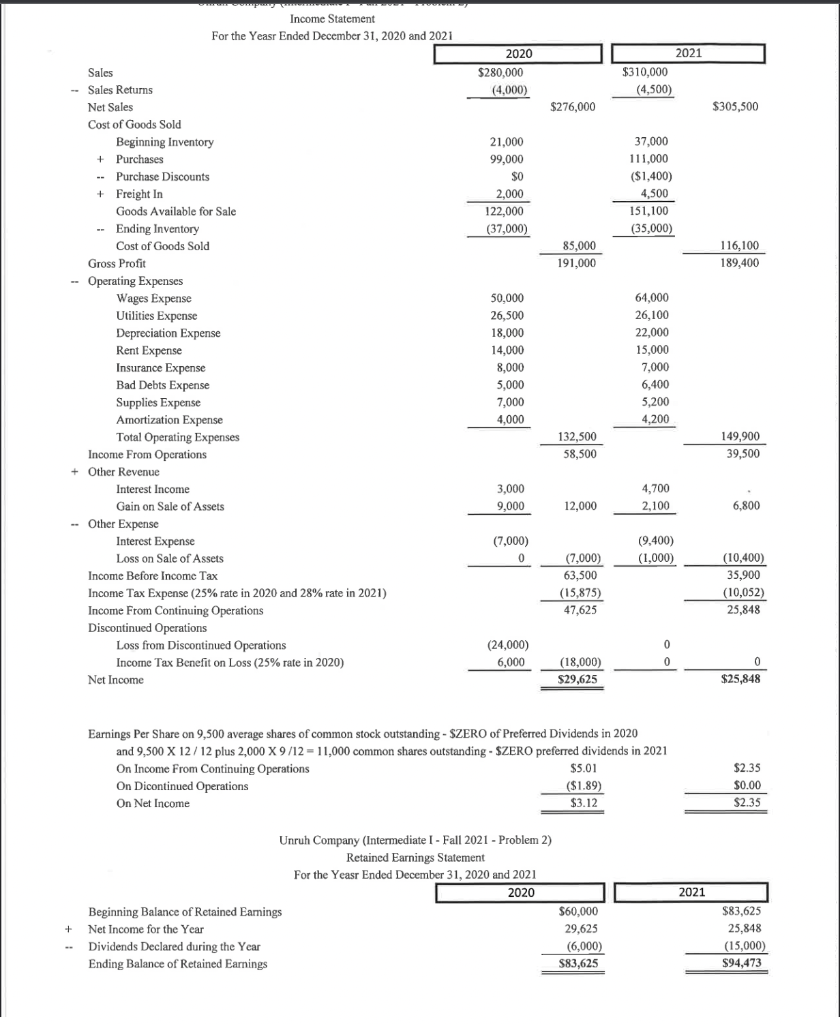

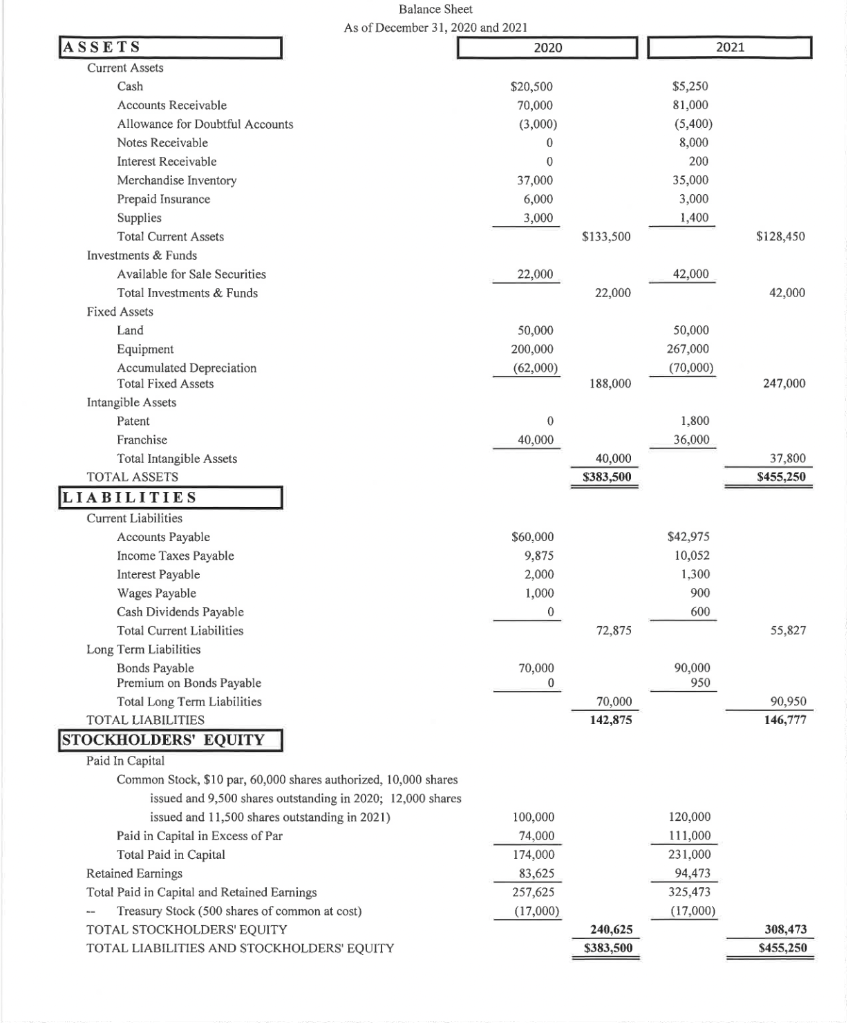

Income Statement For the Yeasr Ended December 31, 2020 and 2021 2020 $280,000 (4,000) 2021 $310,000 (4,500) $305,500 $276,000 $ 21,000 99,000 $0 2,000 122,000 (37,000) 37,000 111,000 ($1,400) 4,500 151,100 (35,000) 85,000 191,000 116,100 189,400 Sales -- Sales Returns Net Sales Cost of Goods Sold Beginning Inventory + Purchases - Purchase Discounts + Freight In Goods Available for Sale -- Ending Inventory Cost of Goods Sold Gross Profit -- Operating Expenses Wages Expense Utilities Expense Depreciation Expense Rent Expense Insurance Expense Bad Debts Expense Supplies Expense Amortization Expense Total Operating Expenses Income From Operations + Other Revenue Interest Income Gain on Sale of Assets - Other Expense Interest Expense Loss on Sale of Assets Income Before Income Tax Income Tax Expense (25% rate in 2020 and 28% rate in 2021) Income From Continuing Operations Discontinued Operations Loss from Discontinued Operations Income Tax Benefit on Loss (25% rate in 2020) Net Income 50.000 26,500 18,000 14,000 8,000 5,000 7,000 4,000 64,000 26,100 22,000 15,000 7,000 6,400 5,200 4,200 132,500 58,500 149,900 39,500 3,000 9,000 4,700 2,100 12,000 6,800 (7,000) (9.400) (1,000) 0 (7,000) 63,500 (15,875) 47,625 (10,400) 35,900 (10,052) 25,848 (24,000) 6,000 0 0 (18,000) $29,625 0 $25,848 Earnings Per Share on 9,500 average shares of common stock outstanding - SZERO of Preferred Dividends in 2020 and 9,500 X 12/12 plus 2,000 X 9/12 = 11,000 common shares outstanding - SZERO preferred dividends in 2021 On Income From Continuing Operations $5.01 $ On Dicontinued Operations ($1.89) ( On Net Income $3.12 $2.35 $0.00 $2.35 2021 Unruh Company (Intermediate I - Fall 2021 - Problem 2) Retained Earnings Statement For the Yeasr Ended December 31, 2020 and 2021 2020 Beginning Balance of Retained Earnings + Net Income for the Year Dividends Declared during the Year Ending Balance of Retained Earnings $60.000 29,625 (6,000) $83,625 $83,625 25,848 (15,000) $94,473 $ 2021 $5,250 81,000 (5,400) 8,000 200 35,000 3,000 1,400 $133,500 $128,450 42,000 22,000 42,000 50,000 267,000 (70,000) 188,000 247,000 0 1,800 36,000 37.800 Balance Sheet As of December 31, 2020 and 2021 ASSETS 2020 Current Assets Cash $20,500 Accounts Receivable 70,000 Allowance for Doubtful Accounts (3.000) Notes Receivable 0 0 Interest Receivable 0 Merchandise Inventory 37,000 Prepaid Insurance 6,000 Supplies 3,000 Total Current Assets Investments & Funds & Available for Sale Securities 22,000 Total Investments & Funds Fixed Assets Land 50,000 Equipment 200,000 Accumulated Depreciation (62,000) Total Fixed Assets Intangible Assets Patent Franchise 40,000 Total Intangible Assets TOTAL ASSETS LIABILITIES Current Liabilities Accounts Payable $60,000 $ Income Taxes Payable 9,875 Interest Payable 2,000 Wages Payable 1,000 Cash Dividends Payable 0 Total Current Liabilities Long Term Liabilities Bonds Payable 70,000 Premium on Bonds Payable 0 Total Long Term Liabilities TOTAL LIABILITIES STOCKHOLDERS' EQUITY Paid In Capital Common Stock, $10 par, 60,000 shares authorized, 10,000 shares issued and 9,500 shares outstanding in 2020; 12,000 shares issued and 11,500 shares outstanding in 2021) ) 100,000 Paid in Capital in Excess of Par 74,000 Total Paid in Capital 174,000 Retained Earnings 83,625 Total Paid in Capital and Retained Earnings 257,625 - Treasury Stock (500 shares of common at cost) (17,000) TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 40,000 $383,500 $455,250 $42,975 10,052 1,300 900 600 72,875 55,827 90,000 950 90,950 70,000 142,875 146,777 120,000 111,000 231,000 94,473 325,473 (17,000) 240,625 $383,500 308,473 $455,250